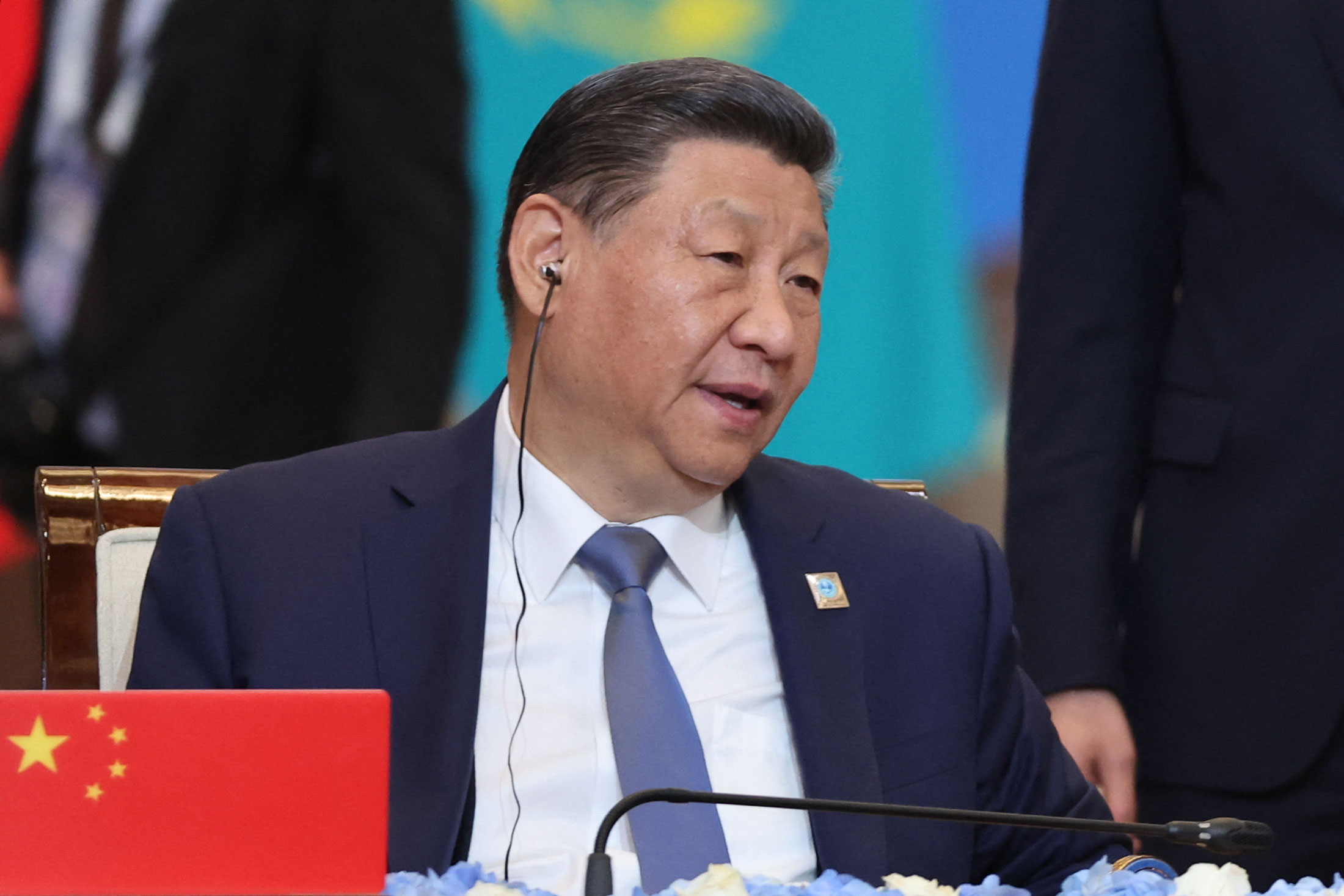

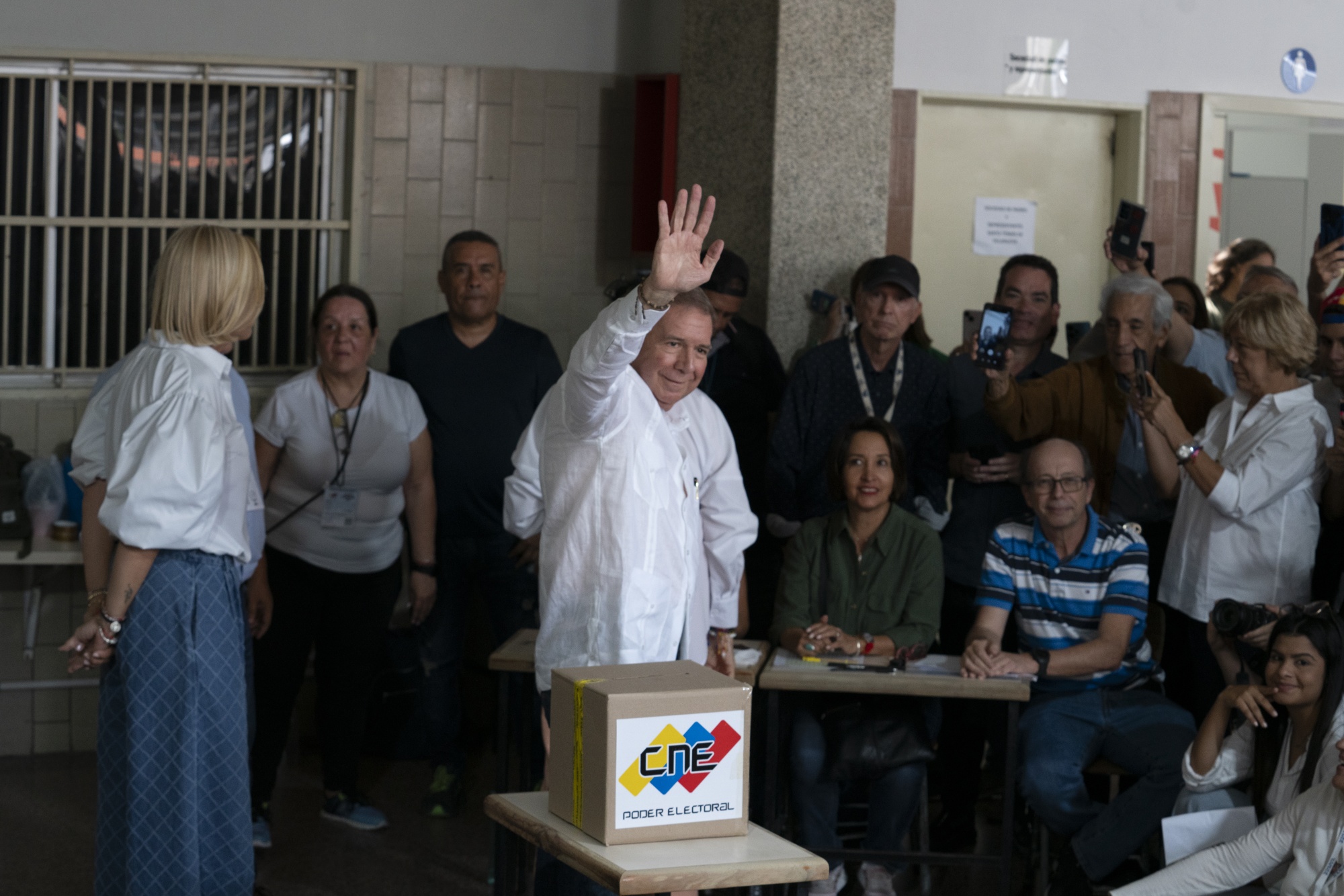

| Dear Evening Briefing readers: Our email domain is changing, which means the briefing will arrive in your mailbox from a different address, noreply@news.bloomberg.com. Please update your contacts to ensure you continue to receive it—see the bottom of this newsletter for details. The violent Wall Street rotation from Big Tech plunged the Nasdaq 100 Index into correction territory, wiping out more than $2 trillion in value in just over three weeks as traders unwound bets that had been minting money for over a year. The index closed down 2.4% on Friday, taking its loss since early July to more than 10%. That means it has passed the threshold that meets the definition of a correction. But it’s still up nearly 10% for the year. So there’s that. —David E. Rovella Cassandras seldom get opportunities to be right about two disasters. Even the original Cassandra scored no notable victories after predicting the fall of Troy. But as Mark Gongloff writes in Bloomberg Opinion, when a seer who successfully called one catastrophe warns of another coming, you might want to listen. Years ahead of the financial crisis, David Burt saw trouble brewing in subprime mortgages and started betting on a crisis, winning himself a cameo in The Big Short in addition to lots of money. Now Burt runs DeltaTerra Capital, a research firm he founded to warn investors about the next housing crisis. This one, he warns, will be caused by climate change, and it could cost more than a $1 trillion. China’s central bank proclaimed that the country’s lenders have to do more to foster the real economy, part of its latest effort to reignite the country’s flagging consumption. The People’s Bank of China plans to shift the financial sector’s focus to benefiting people’s livelihoods and boosting consumption over the coming months, the bank said Friday. The language echoes a call by the Politburo, the 24-member decision-making body led by Xi Jinping, earlier this week.  Xi Jinping Photographer: Sergei Savostyanov/Getty Images US hiring slowed markedly in July and the unemployment rate rose to an almost three-year high, putting the Federal Reserve solidly on a path to cutting interest rates in September as it seeks to stick its soft landing. Friday’s figures cap off a week of disappointing data that heighten concerns of a more abrupt downshift, and perhaps challenge Fed Chair Jerome Powell’s characterization of the slowdown in the job market as “gradual.” However, some aspects of the report may have been distorted by Hurricane Beryl—which hit Texas in the week the survey data were collected—and may rebound in August. Off to the races. The big bats on Wall Street are all swinging for half-point rate cuts now that more data shows the US employment picture cooling. Economists at Bank of America, Barclays, Citigroup, Goldman Sachs and JPMorgan have revamped their forecasts for US monetary policy. All are calling for earlier, bigger or more interest-rate cuts. Citigroup economists said they expect half-point rate cuts in September and November and a quarter-point cut in December, having previously predicted quarter-point cuts at all three meetings. As Venezuela emerged from the deepest economic slump in modern history, its authoritarian president, Nicolas Maduro, seemed willing to take his chances on a new, open election. A credible opposition candidate, Edmundo Gonzalez, was allowed to run, as Maduro sought to convince the international community that he was respecting democratic principles. The rest, as we know, didn’t quite work out. Maduro declared himself the victor, but the opposition released detailed results from a majority of polling stations indicating Gonzalez took nearly 70% of the vote, nearly twice Maduro’s share. Now, with Maduro cracking down on the opposition and demonstrators—with at least 11 killed—here’s what may come next.  Edmundo Gonzalez, Venezuela’s opposition candidate, waves after casting his ballot during the presidential election in Caracas on July 28. Photographer: Andrea Hernandez Briceno/Bloomberg Fossil fuel giant Chevron has been based in California since the days of kerosene lamps. But now this OG of Big Oil is moving headquarters to Texas after years of fighting Sacramento over regulations aimed at, well, slowing the global warming caused mostly by the fossil fuel industry. The move announced Friday will end the company’s 145 years of being based in the most populous US state. Chevron already had slashed new investments in California refining, citing “adversarial” government policies in a state that has some of the most stringent environmental rules in the US. A single arched concrete block juts out of a field in Senegal where R&B singer Akon first laid the foundation stone for his $6 billion metropolis. The West African nation granted the artist 136 acres of land on its Atlantic Coast in 2020 to build his Akon City—envisioned as a real-life Wakanda, the fictional country from Marvel Studios’ Black Panther films. Complete with condominiums, amusement parks and a seaside resort in gravity-defying skyscrapers rising above the rural landscape, Akon City would run on solar power and his Akoin cryptocurrency, the American-Senegalese singer said during a flashy presentation in Senegal’s capital, Dakar. Today, however, goats and cows graze the deserted pasture, and authorities are growing increasingly impatient.  A digital rendering of Akon City. Source: Hussein Bakri/BAD Consultant/Semer Group Meta Platforms is said to be offering Hollywood celebrities millions of dollars for the right to record and use their voices for artificial intelligence projects. The company is apparently talking with Judi Dench, Awkwafina and Keegan-Michael Key. Meta is racing to close deals so it has time to develop a suite of AI tools for unveiling at its Connect 2024 event in September. While it’s not entirely clear how Meta will be using the voices, it has discussed a chatbot that could serve as a digital assistant, à la Apple’s Siri—or even as a friend.  Keegan-Michael Key Photographer: Eva Marie Uzcategui/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |