This week we continue our conversation about strengthening US and Western resiliency.

Last Tuesday we covered uranium, the key input for nuclear power generation, which we buy primarily from Russia, Kazakhstan, and Uzbekistan. Today, we’re talking about rare earth elements…

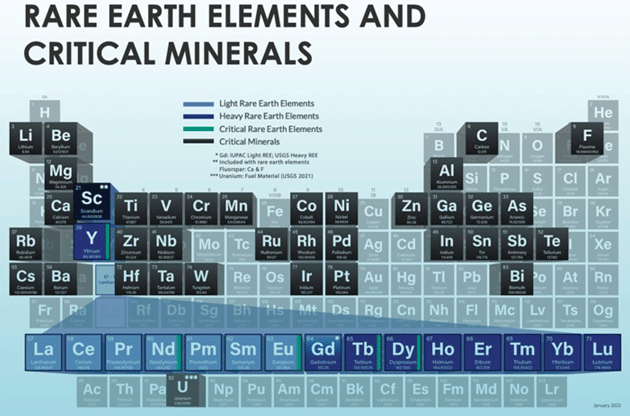

Rare earth elements are a critical input to all kinds of products, including batteries, glass, specialty alloys, high-strength magnets, lasers… the list goes on.

You’ll find rare earth elements in your car (in your catalytic converter or your electric vehicle’s battery), your cell phone, medical equipment, nuclear reactors, and sophisticated military equipment, including missiles, planes, submarines, and radar systems.

Rare earths, which are far from rare, include 17 metallic elements. Of these, five are particularly critical to national security: yttrium, neodymium, europium, terbium, and dysprosium.

Source: National Energy Technology Laboratory (Click to enlarge)

Access to these elements, and their refining, is clearly a matter of national security and resilience.

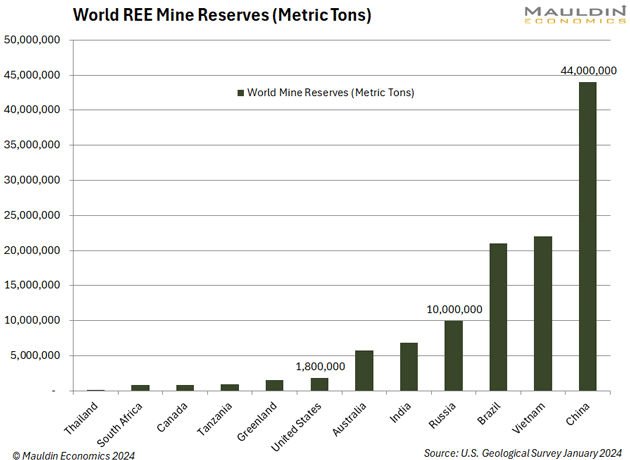

China controls roughly 60% of global rare earth mining and 85% of global rare earth processing capacity. It has far greater rare earth mine reserves than any other nation.

This wasn’t always the case. In 1993, the US accounted for 33% of global rare earth production, and China was only slightly ahead, with 38%.

The US sat back while China made a massive push, increasing rare earth production by an average of 40% per year from 1978 to 1995. This allowed it to ramp up rare earth exports throughout the 1990s, leading us to the predicament we’re in now.

The problem isn’t limited to mining and processing. China has taken over every step in rare earth supply chains, including production of rare earth magnets, where it dominates 90%+ of the market. This puts the US—and virtually every other nation—in a tight spot, as MP Materials CEO James Litinsky summed up at a JPMorgan conference:

We could have all the rare earths in the world in the US or in the Western world or anywhere, but if you can't make the end product, the magnet that is for the use case, then ultimately, you're supply chain reliant on a single source in China.

We got here in part by letting China acquire foreign competitors like Magnequench, which makes neodymium magnets. Magnequench began as part of General Motors (GM). The company was once based in Indiana. Then the federal government signed off on a deal that allowed China to buy the company and move it to China.

When the last US-based Magnequench plant closed, Peter Visclosky, then a Congressman from Indiana correctly observed: “We’re handing over to the Chinese both our defense technology and our jobs.” Today we are much more aware of the vulnerability.

Building Mine-to-Magnet Capacity

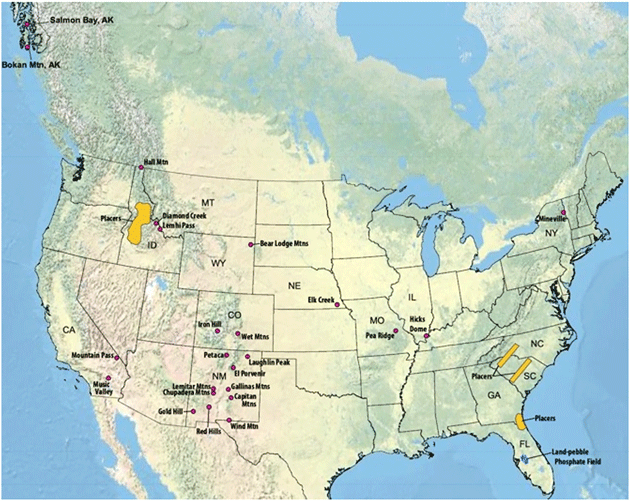

Scarcity is not the issue here. As of 2023, the US Geological Survey pinned US measured and indicated resources of rare earths at 3.6 million metric tons, with another 14 million metric tons in Canada. So, there’s plenty of room to do more.

Primary US REE Districts; Source: US Geological Survey (Click to enlarge)

The Department of Defense agrees. It’s working to bring rare earth mining, processing, and magnet manufacturing to the US.

Since 2020, the DoD has awarded $439+ million to set up domestic “mine-to-magnet” supply chains. Funding is going to companies like Noveon Magnetics and MP Materials to build rare earth magnet manufacturing facilities, and to Lynas USA, which received $288 million to build out additional domestic production capacity by 2026.

A bill introduced last year to provide additional tax credits for rare earth magnet manufacturing has bipartisan sponsorship. But even without that, things appear to be moving forward. Danielle Miller, acting deputy assistant secretary of defense for industrial base resilience at the DoD has said, "We are on track to meet our goal of a sustainable, mine-to-magnet supply chain capable of supporting all US defense requirements by 2027."

Time will tell if they stay on track—and if domestic production expands enough to meet commercial demand, which is largely driven by EVs. In the meantime, there will be investable opportunities as the US builds out its mine-to-magnet supply chain. More to come.

Thanks for reading.