July 1, 2025

2 Odd Ways Bitcoin Benefits from a Faltering Dollar

Dear Subscriber,

|

| By Bob Czeschin |

Once almost universally seen by investors as the No. 1 safe haven in times of geopolitical upheaval, the U.S. dollar has fallen on hard times.

Hot, shooting wars are metastasizing across the globe.

Russia, Israel and now possibly Iran all have nuclear weapons. And Russia and Iran said they might use them.

War is a great destroyer of paper currencies. So, in less extraordinary times, vast waves of risk-averse capital would have come flooding into the dollar (and U.S. Treasurys) like a tsunami.

But not in 2025 …

DXY is a weighted USD exchange rate against a basket of currencies: the Euro, Yen, Pound, Canadian Dollar, Swedish Krona and the Swiss Franc.

Source: marketwatch.com.

Click here to see full-sized image.

Far from getting a lift from investment inflows, the dollar has been going down.

All year long.

That’s likely because the once-venerable greenback is approaching the end of its run as a world reserve currency.

(I discussed the average lifespan of reserve currencies in a prior Weiss Crypto Daily update.)

Here, my focus is on how the …

Dollar’s Dimming Makes Room for Gold to Shine

Roughly 200 central banks (sovereign wealth funds and royal families) keep their Treasurys in custody at the New York Federal Reserve.

However, these holdings have fallen $48 billion since late March.

On top of that, foreign participation in the Fed’s reverse repurchase facility — for which they receive Treasurys as collateral — has also dropped $15 billion.

Where are the proceeds from these liquidations going?

Increasingly, into gold.

Last year alone, central banks bought 1,045 metric tons of gold, according to the World Gold Council (WGC).

It was the third year in a row total purchases eclipsed 1,000 tons. A big jump up from the 400- to 500-ton average over the preceding decade.

Moreover, this trend shows no sign of slowing. According to WGC’s annual 2025 survey of Global Central Banks …

- 95% expect to buy even more gold over the next 12 months. And …

- 73% say they will likely hold moderately or significantly fewer U.S. dollars — over the next five years.

This outlook is very bullish for Bitcoin (BTC, “A-”) in two striking ways.

1. It brings the tough-talking, Jerome Powell Fed a lot closer to another epic round of money printing.

Annual U.S. government spending exceeds income by about $2 trillion. To cover that shortfall, Washington has to borrow a whopping $5.5 billion a day. (Weekends and holidays included!)

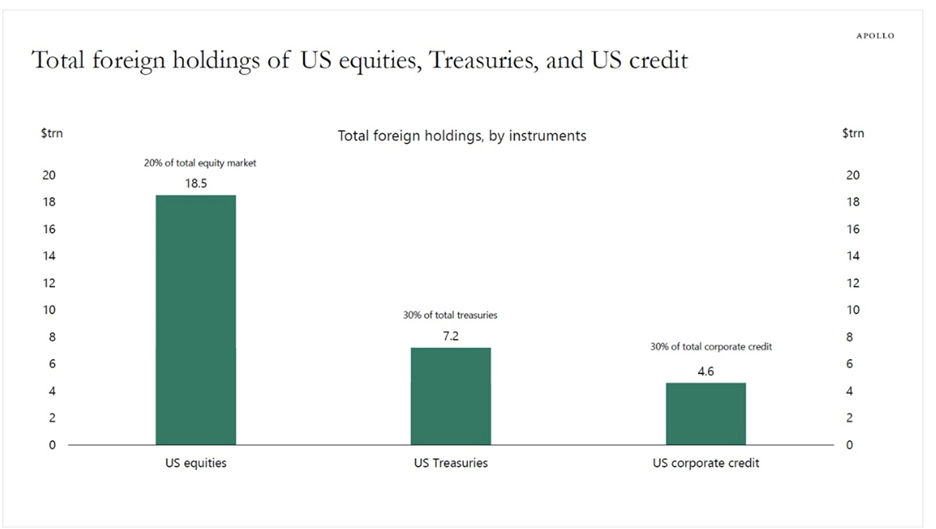

But foreign buyers — who account for about 30% of the U.S. Treasury market — are starting to walk away.

Source: Federal Reserve, MacroBond, Apollo Chief Economist.

Click here to see full-sized image.

Which means very soon, the Fed will face a stark choice:

Watch the bond market seize up, as burgeoning supply overwhelms diminishing demand …

Or print enough dollars to buy however many Treasurys it needs to preserve an orderly market.

Backed up against a wall … of course, Powell will print. Tough talk on inflation notwithstanding, no battle plan — however loudly proclaimed — survives first contact with enemy intact.

All this is wildly bullish for gold … and Bitcoin. That’s because …

2. As the digital revolution matures, Bitcoin is going to grab a big chunk of gold’s growing market cap.

Whenever a good or service transitions from an old analog version to digital, adoption and usage typically skyrockets.

Historical examples of this abound. Among the most notable:

-

Film versus Digital Photos. 85 billion photos were shot in the year 2000 — the high-water mark for film photography. Then came digital cameras and later, smartphones.

By 2015, two trillion digital photos were being shared on social media alone. More in one year … than in the entire history of film.

-

Blockbuster versus Netflix. In 2004, Blockbuster Entertainment had 9,000 shops renting videotapes, revenues of $5.9 billion and a market cap of $5 billion.

Then came Netflix, the digital version of watching movies at home. Netflix revenues today run $40 billion. And its market cap ($533 billion) … is nearly 100x Blockbuster’s best.

What fuels the extraordinary growth of digitized solutions is not mysterious.

By slashing costs, widening distribution and increasing convenience, going digital dramatically lowers the barrier of entry for new users.

And that’s what we’ll likely see with Bitcoin and gold.

One of the most compelling narratives in crypto today is Bitcoin as a digital version of gold.

Because of the hard ceiling on the number of coins that can ever be created, BTC delivers a store-of-value benefit similar to gold. But at much lower cost.

Bitcoin is altogether easier to buy, cheaper to hold and far more convenient to conceal and transport.

So, as the digital revolution bears fruit, the number of Bitcoin owners will surely dwarf the number owing gold today.

In other words, not only is Bitcoin likely to cannibalize a major chunk of gold’s market. It’s also set to expand usage and multiply market size.

Just like digital photography and Netflix.

At current prices, the world’s gold is worth about $17 trillion.

How much of that can we reasonably expect Bitcoin to cannibalize as the digitization megatrend rolls on?

Well, grabbing just 11% of gold’s current market would double Bitcoin’s market cap to make it a $200,000 coin.

What if it eventually gobbled up half of the gold market?

It may sound like a crazy notion. But given Bitcoin’s manifest advantages, it may not be so far-fetched.

If BTC did manage to grab 50% of gold’s current market, that would lift its market cap from about $2 trillion to $8.5 trillion.

Which implies a $450,000 coin price.

But even this is a decidedly conservative reckoning.

That’s because it entirely neglects any future appreciation in gold prices stemming from central bank buying.

Or any Netflix-style multiplication of future market size.

For long-term investors, Bitcoin’s current price below its all-time high could be considered a prime buying opportunity.

But it’s not the only one …

Dollar’s Weakness Reveals a Unique Bonus Opportunity

While banks may be selling their Treasurys, there’s a new category of buyers willing to take their place …

Stablecoin issuers!

That’s because those Treasury notes act as a reserve to fully back the coins pegged 1-to-1 to the U.S. dollar.

But did you know stablecoins can be used as more than just digital dollars? In fact, they can help you unlock profits that were previously only available to banks.

We’re talking yield opportunities that generate APYs of 12.4%, 13.8% and 15.4%.

All with little risk to your principle thanks to stablecoins.

And you can go for even higher returns with other crypto assets.

How high?

Well, our DeFi expert Marija Matić has been able to target yields of 361% … 912% … and even 1,168%.

And the average APY across all these opportunities: a whopping 184%!

That’s …

- 30x greater than a 10-year Treasury …

- 145x greater than the average corporate dividend …

- And over 18,000x greater than some savings accounts.

These opportunities are too good to ignore.

That’s why, on Monday, July 7 at 2 p.m. Eastern, we’re hosting a special event, Profit Like a Bank.

In it, we’ll reveal how this strategy works … and how you can access the sort of rewards TradFi still keeps under lock and key.

It’s completely free to attend. Just be sure to save your seat by clicking here.

Best,

Bob Czeschin