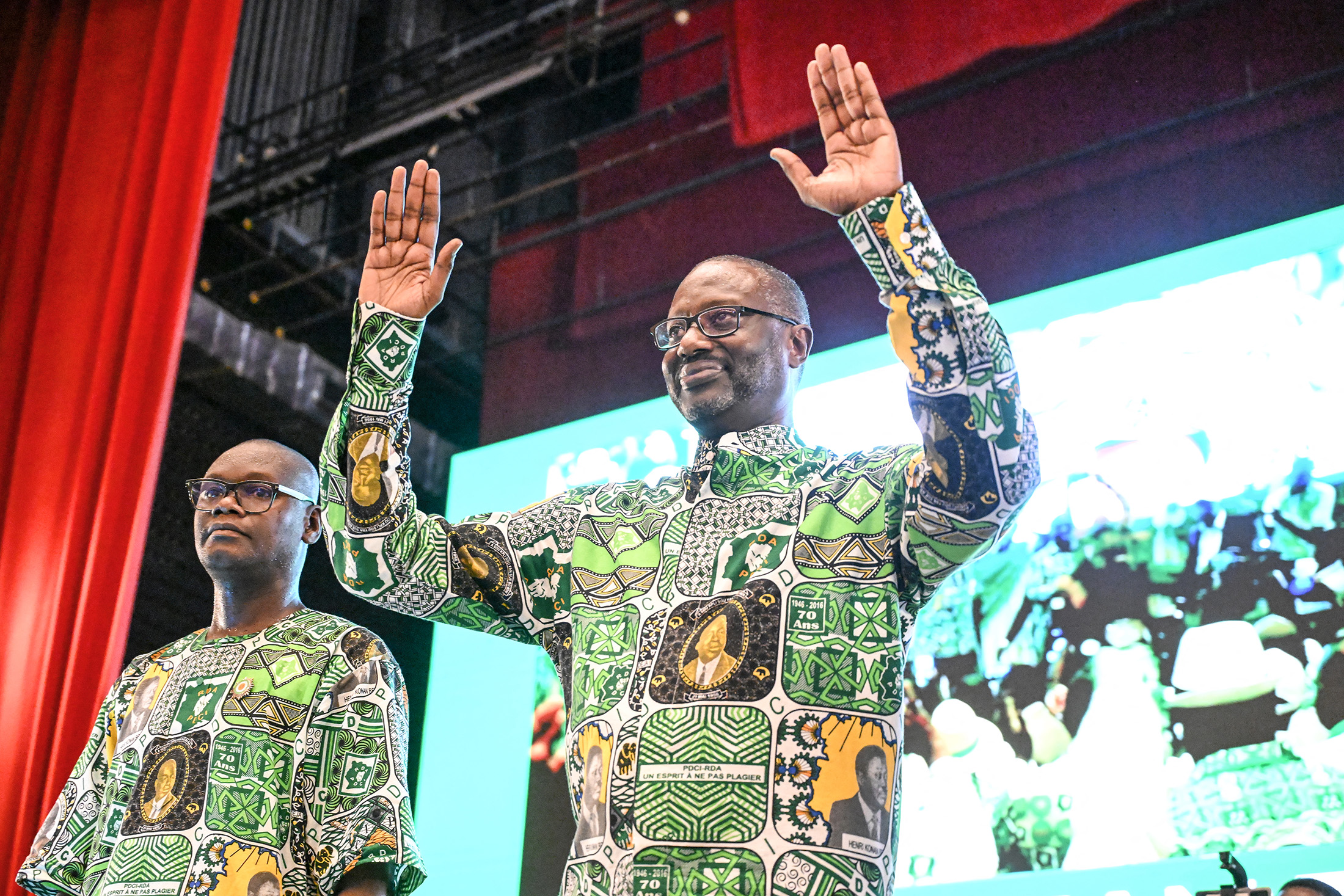

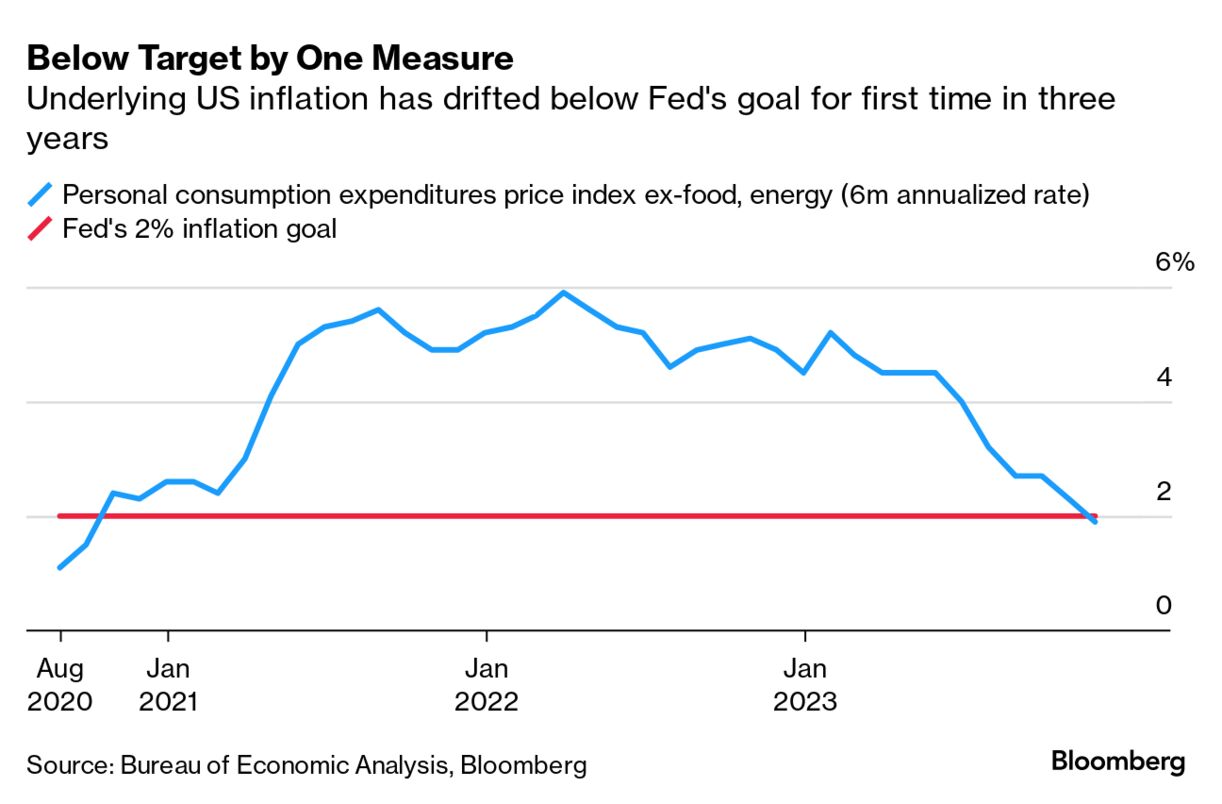

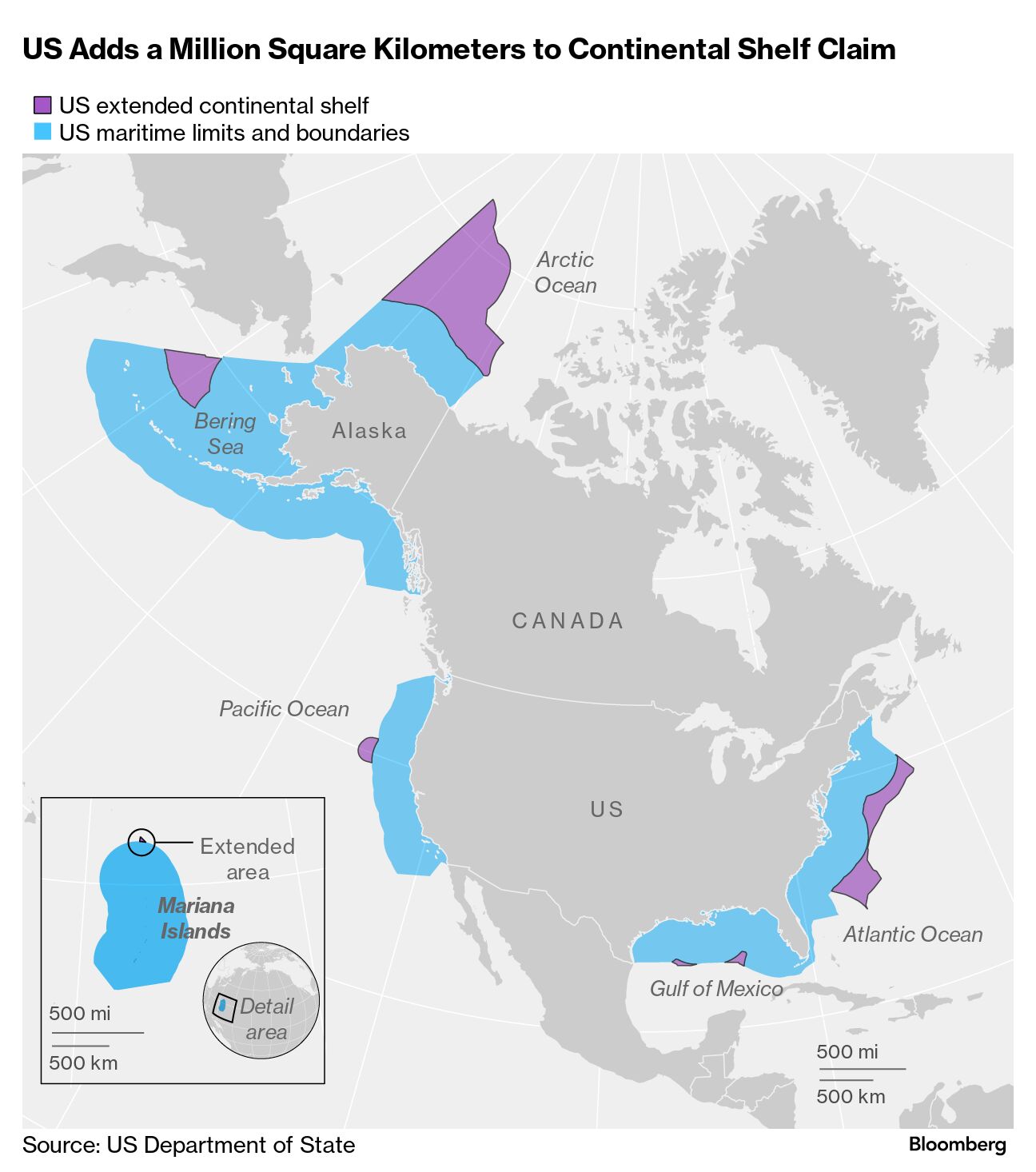

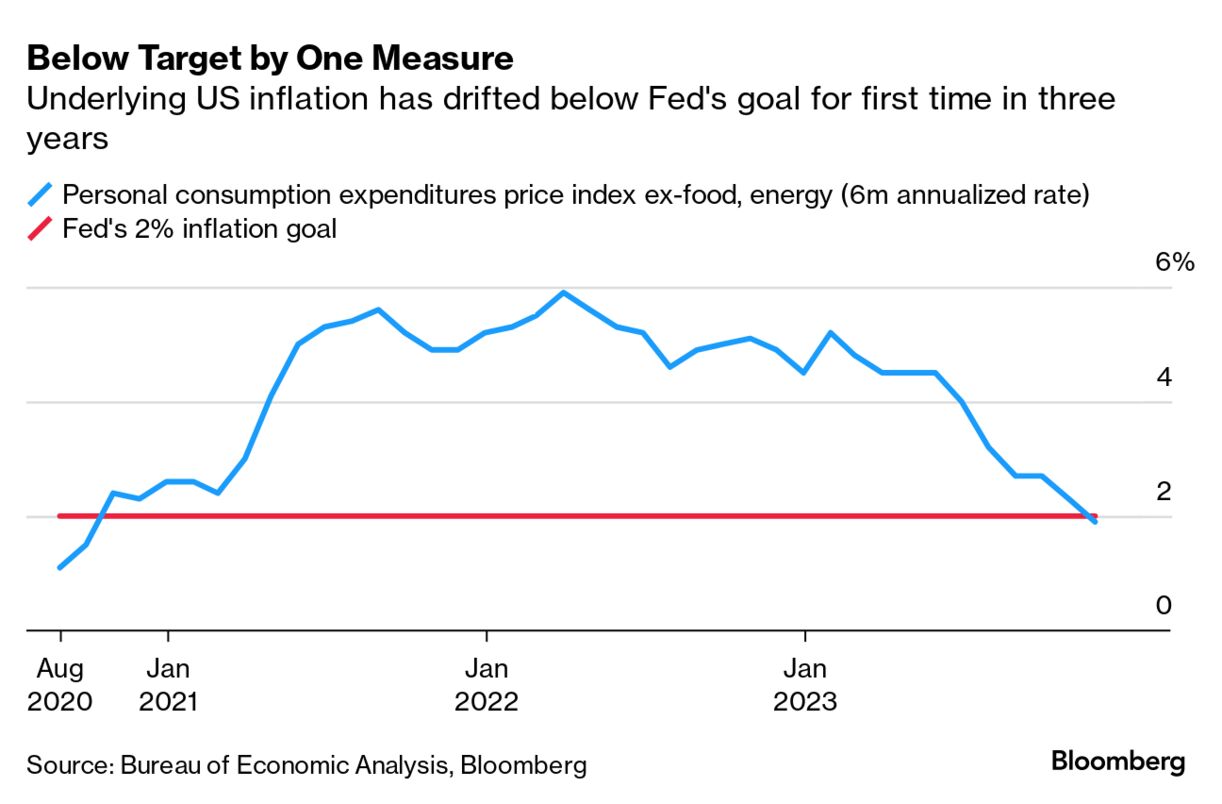

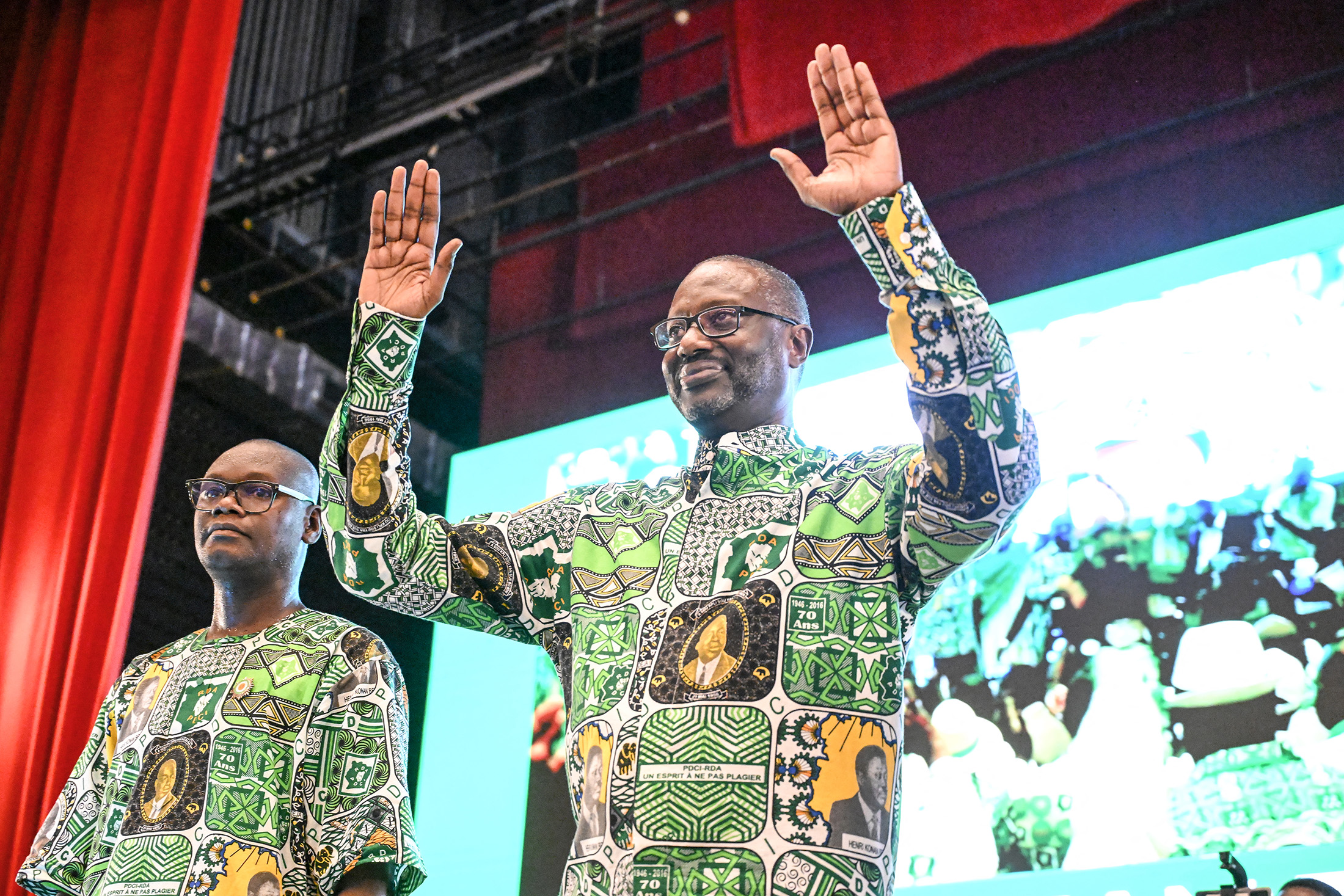

| In the 11 weeks since Hamas attacked southern Israel in a surprise incursion, killing 1,200 Israelis and kidnapping hundreds more, authorities there said, Israel’s military has laid waste to much of the Gaza Strip. More than 20,000 Palestinians have been killed—mostly women and children—in the impoverished, densely packed area of the Occupied Territories, local health officials there said. The number of dead is equivalent to 1 out of every 100 people living in Gaza before the war. Almost 2 million Palestinians have been forced to flee their homes, the United Nations has reported, and new reporting by the New York Times alleges Israel bombed areas where it told Palestinians to seek safety, using 2,000 pound bombs. On Friday, the United Nations Security Council passed a resolution calling for increasing the flow of aid into Gaza, but stopped short of demanding a cease-fire. The US and Russia abstained. —David E. Rovella The US Federal Reserve’s preferred gauge of underlying inflation barely rose in November and even fell below policymakers’ 2% target by one measure, auguring a successful soft landing by Fed Chair Jerome Powell while reinforcing the central bank’s pivot toward interest-rate cuts next year. Consumers remained optimistic that inflation will improve in the final December reading from the University of Michigan, also out Friday, contributing to a robust rebound in sentiment. However, US new-home sales unexpectedly slumped in November, suggesting a bumpy road to recovery for the housing market.  American consumers continued to splurge in 2023, boosting the economy with revenge travel and expensive restaurant meals. But a lot of it was funded with debt. Credit card balances in the US increased by about 4.7% to $48 billion in the third quarter alone, pushing the total to $1.08 trillion. It’s the highest total in data going back to 2003. The bills are mounting at time when the average annual percentage rate, or APR, has soared north of 20% to the highest on record. The US Supreme Court handed a victory to Donald Trump in the first of a series of expected high court rulings in the coming months that may affect the course of the 2024 election. The court, controlled by a Republican-appointed supermajority that includes three Trump picks, refused to hear arguments on whether Trump—a criminal defendant in four felony prosecutions—has immunity for any criminal conduct while he was president. The trial court judge in Trump’s federal prosecution for subverting the 2020 election rejected the Republican’s immunity claim, writing that his “four-year service as Commander in Chief did not bestow on him the divine right of kings to evade the criminal accountability that governs his fellow citizens.” Trump appealed to the US Court of Appeals in Washington, which is hearing the case on an expedited basis. Should the three-judge appeals panel rule against Trump, the normal appellate rules would give him 45 days to seek rehearing from a larger panel of judges and 90 days to request Supreme Court review. Trump has repeatedly sought to delay all of his prosecutions to beyond the 2024 election. If he wins and takes office in January 2025, Trump could shut down the two federal cases or pardon himself. State prosecutions would remain be unaffected. The Biden administration has vastly extended US claims to sovereignty over the ocean floor by an area twice the size of California, securing rights to potentially resource-rich seabeds at a time when Washington is ramping up efforts to safeguard supplies of minerals key to future technologies. The so-called Extended Continental Shelf covers about 386,100 square miles (1 million square km), predominantly in the Arctic and Bering Sea, an area of increasing strategic importance where Canada and Russia also have claims. The US has also declared the shelf’s boundaries in the Atlantic, Pacific and Gulf of Mexico. OpenAI is said to be in early discussions to raise a fresh round of funding at a valuation at or above $100 billion, a deal that would cement the ChatGPT maker as one of the world’s most valuable startups, behind only Elon Musk’s Space Exploration Technologies Corp. Handpicking sectors, sheltering in trendy options strategies, going all-in on dividends—none of it has worked as well this year as simply owning the S&P 500. As 2023 winds down, investors are taking the year’s keep-it-simple lesson to heart. They’ve been pouring money into plain-vanilla stock funds, with equity exchange-traded funds taking in almost $69 billion so far in December, the best month of inflows in two years. It’s a testament to what’s worked time and again—buying and holding the benchmark gauge, which is hovering near new highs. Tidjane Thiam’s bid to lead Ivory Coast’s opposition in presidential elections is facing a critical test. The former Credit Suisse chief executive officer is vying to head the Democratic Party of Ivory Coast, which ruled the West African nation for decades after independence in 1960 but has been out of power since 1999. If he succeeds, the 61-year-old banker has a good chance of being its candidate in the 2025 polls.  Tidjane Thiam greets supporters at a campaign meeting in Yamoussoukro, Ivory Coast, on Dec. 9. Source: AFP Hedge fund traders were among those who snapped up luxury London homes in multimillion-dollar deals this year, as the ultra-rich shrugged off the UK’s broader housing woes. Citadel trader Adam Frame, whose company outperformed many of its peers in 2023, purchased a mansion overlooking Primrose Hill for £42.9 million ($54 million) in June. A few months earlier, Olivier Meyohas, director of a Blackstone Inc. unit that invests client money in hedge funds, bought a £24.7 million semi-detached house near Chelsea. Here’s who else is buying.  The Mayfair district of London Photographer: Chris Ratcliffe/Bloomberg The Evening Briefing will return on Tuesday, Dec. 26. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |