| 4 Signs That the Lights May Be About to Go Out in the Housing Market Discover the 4 distinct warning signs that a new American housing bubble is on the rise—one you can profit from handsomely if you play your cards right... Dear Fellow Investor, The American dream means different things to different people. For my immigrant parents, it was to send their three children to college (and they managed to do it, too). For most people, one of the things that’s essential to the American dream—or so we’ve been brainwashed to believe for generations—is to own their own home. However, a growing number of Americans can’t afford to buy a house today. In fact, the current rate of homeownership is near 1993 levels...

But wait a minute—how can that be when unemployment is at only 4.9%, the lowest level since 2008, wage growth is at a six-year high, and the US economy is happily buzzing along? Well, things aren’t always the way they seem... The Awful Truth in a Few Numbers Let me introduce myself. I’m Tony Sagami, editor of the Rational Bear alert service here at Mauldin Economics. And I’m telling you, in contrast to what you read in the mainstream media, right now there’s a lot to be bearish about when it comes to the US economy. Oh, I know, that’s not what you keep hearing from the government talking heads, who claim that everything in the American economic landscape is rainbows and unicorns. But if there’s one thing I’m well known for, it’s to tell it like it is. I don’t usually mince my words when I see BS... and I won’t let you fall for the pig-with-lipstick figures the government trots out every month either. Before I tell you more about the housing bubble I see coming, here are some numbers that, in a nutshell, tell the story about why you should be wary of all the economic euphoria:

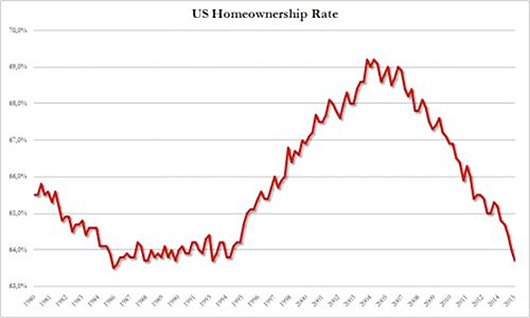

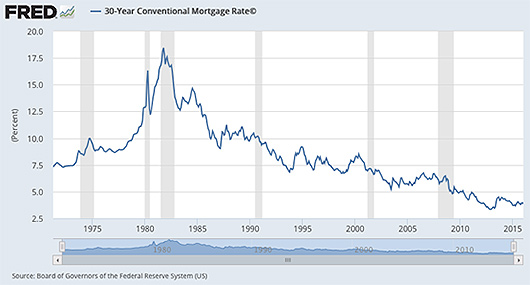

If those numbers sound dire and depressing to you, remember, I’m not just warning people—I also show them how to make money from these turbulent markets, economic downturns, and incompetently run companies. And the opportunity I want to present you today is one few investors are seeing yet... Ultra-Low Mortgage Rates... and STILL No Takers What the current situation in the housing sector looks like to me is, to quote my friend John Mauldin, “a bug in search of a windshield.” According to the Census Bureau, the US homeownership rate dropped to 63.7% in 2015—that’s a whopping 5.3% fall from the 2004 peak of 69%. The rate fell for EVERY age group except householders under age 25, whose numbers climbed by a barely noticeable 0.1%. At the same time, the renter rate has increased in every one of the 50 largest US cities since 2006, according to American Community Survey. Here’s what should shock you most about this:

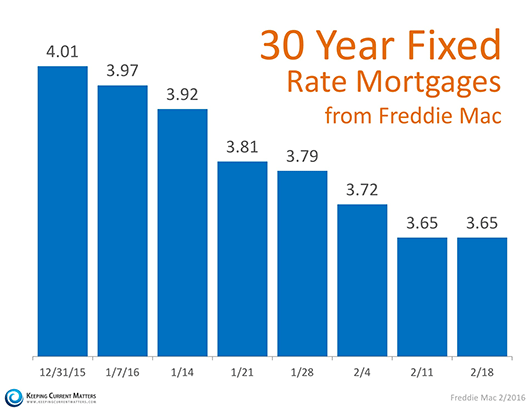

Since the start of 2016, the average rate on a 30-year fixed mortgage has dropped from 4.01% to 3.62%—and lower mortgage rates are supposed to be a big positive for the real estate market.

What has all that near-free money done for the real estate market? Not much, according to the most recent statistics. 4 Warning Signs That the Lights May Go Out Soon As the housing bubble nears its popping point, these warning signs will increase in number and become more pronounced. But if you keep your eyes open, you’ll already see... Lights-Out Sign #1: Pending home sales are down. Pending home sales are a good barometer of future real estate sales. However, there is a lag of one or two months between a contract and a completed sale.

According to the National Association of Realtors, pending home sales fell 2.5% from December to January. The “good news”: On a year-over-year basis, there’s a gain—of a truly pathetic 1.4%. Lights-Out Sign #2: New-home sales are slow. The “lag” I’ve talked about is already here because the January numbers for new-home sales showed a big slowdown.

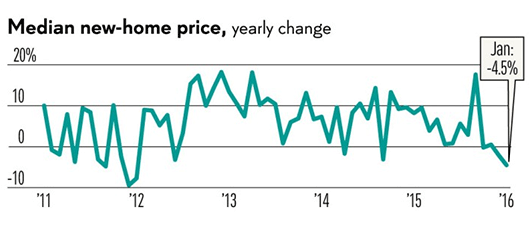

The Wall Street crowd had anticipated 520,000 new-home sales, but the actual number came in at 494,000—a 9.2% month-over-month drop from 544,000 in December. Lights-Out Sign #3: The price of new homes is falling. The median sales price for a new home dropped by 4.5% to $278,800, the biggest one-year decline since January 2012.

And if you think January was an anomaly, think again: the median sales price fell by 3.7% in December and by 0.3% in November. Lights-Out Sign #4: Creative mortgage-financing tricks are back. At the height of the real estate bubble, people bought homes with no to low down payments and without financial documentation (aka “liar’s loans”).

According to the Equifax National Consumer Credit Trends Report, the number of mortgage originations for subprime borrowers with credit scores of 620 and below is on the rise again. From January to October 2015, Americans took out more than 312,000 subprime mortgages worth $50.7 billion—that’s a 28% increase in the number of mortgage originations and a 45% increase in dollar value. Seven Years of Near-Free Money and This Is the Result? It’s pretty obvious that the problem is lack of demand... which tells me that the real estate rally has run out of steam and the next major move is going to be downward. And I’ve found a great way to play the coming housing-bubble burst that I’d like to show you today. The best and easiest way to profit from a downturn in US real estate is through an inverse fund that, I believe, will make my Rational Bear subscribers a nice chunk of money. I can’t just tell you the name, out of respect for my paying subscribers. What I can tell you, though, is that the knuckleheads on Wall Street have priced the stocks that make up this fund as if they are going to the moon. Case in point: The average P/E of the fund’s portfolio is a nosebleed 31.5 times earnings, 12.1 times cash flow, and 5.7 times sales. A perfect scenario for us to jump in and cash out when the time is ready. And you’ll know instantly when that time has come. All you have to do to get in position to benefit from the deflating housing bubble is read the current monthly issue of my Rational Bear service. I think this play could get as big as our recent success with a special exchange-traded note... How to Make Volatility Your Friend In the past two years, we’ve repeatedly invested in the iPath S&P 500 VIX ST Futures ETN (VXX)... and won every time. You see, the VXX is designed to mirror the performance of the VIX, the Chicago Board Options Exchange’s Volatility Index. It isn’t a direct bet on the stock market going down—it’s more like a bet that the stock market will become more volatile. The VIX is calculated from the volume of call and put options trading. It’s a widely used measure of market risk and is often referred to as the “investor fear” index. And let me tell you, there has been a lot of fear and uncertainty in the market. We made our first VXX bet on December 4, 2014 and cashed out with a 5.06% gain only five days later... followed by a quick 8.70% gain in four days... and 7.03% in seven days.

And these VXX trades were not our only recent successes: In the last few months, my subscribers made 70% and 152.14% on two different trades involving the flailing transportation sector… 56.60% on a dramatically overvalued clothing company... and more. In a market like this, it can pay well to be a bear. Of course, I can’t guarantee that we’ll see similarly great results with the US housing bubble trade you can get in on now. But having closely watched the housing market before and since 2008, it again looks pretty frothy to me. For the sake of completeness, I should mention that my housing play isn’t the only one you can partake in. We currently have quite a few promising trades in our Rational Bear portfolio—including five you can still buy into right now. Among them are bearish bets on...

Plus, I recommend more great trades almost every week, so there’ll be no lack of opportunities to take advantage of. And right now, you can do so at an exceptionally low price... Pay 60% Less If You Try Rational Bear Today Bottom line is, in today’s choppy markets and unstable economic conditions, you need a powerful investment strategy.  In my premium alert service, Rational Bear, I typically focus on three kinds of market scenarios to provide you with a perfect portfolio hedge: Reverse-Momentum Plays. These are the stocks that are already headed down and are likely to continue lower for some time. Because trends in motion tend to keep moving until they’ve run their course... and that often takes longer than most people think. Overblown and Overvalued. These are companies with inherent flaws that have been so hyped up by Wall Street that they’re trading at multiples unsupported by any rational data. The True Titanics. It’s not that hard to find balance-sheet anomalies in certain corporations, if you know what to look for. In this category, I look for the next Enron or WorldCom—and let you know who they are. The tools I use on behalf of my Rational Bear subscribers range from short-term put options to longer-dated LEAP puts, short sector ETFs, and the occasional outright shorting of stocks. Don’t worry if you’re not familiar with these concepts. My team and I will give you everything you need to know so you can use the above tools with confidence. Rational Bear is geared toward giving you the utmost flexibility to act. To immediately alert you to fast-moving opportunities, I send buy-and-sell email alerts straight to your inbox (usually several times a week). On top of the alerts, you’ll also receive a monthly newsletter with more in-depth analysis, a new bearish stock or fund recommendation, and a portfolio update. Normally, Rational Bear sells for $2,495 per year. But to make it even easier for you to get all the details of my current recommendation...

It’s not cheap, but worth every penny. If you don’t think so, feel free to cancel within the first 90 days of your subscription—for a complete, prompt, and courteous refund of every penny you paid. The best part: If you subscribe today, your annual fee will never rise, as long as you remain a subscriber. Your subscription will always renew at the same low price. As a thank-you for subscribing, you’ll also get instant access to two valuable reports that will prepare you for our special brand of investing:

This offer expires on March 11, 2016, so I hope you decide to take me up on it today and give Rational Bear a risk-free try at 60% off. All you have to do is click here to complete the order fields » I look forward to welcoming you to the world of bearish bets with great potential. Let’s make some money together! Sincerely,

Copyright © 2016 Mauldin Economics, LLC |