|

Today's edition is brought to you by Clave – the all-in-one mobile smart wallet bridging DeFi and everyday finance. |

Set up your Clave account in a flash! |

|

GM. This is Milk Road – the newsletter where we dox our parents, so you can make better investing decisions! |

Here’s what we got for you today: |

|

|

|

SIGNS OF A RETAIL STORM BREWING 🌩️ |

Who’s Ethan Gibson? |

Don’t worry, I didn’t know at first either. |

Turns out he lived two doors down from me in 2018 (pretty sure I invited him to our Christmas party). |

So why the hell is he texting me? |

To talk crypto. |

And you know what? I get the feeling the Ethans (aka: retail traders) of the world are about to start coming out of the wood work en masse over the next few months. |

‘Cause there are a handful of signs suggesting a retail driven storm is brewing within the crypto space… |

Check this out: |

1/ A spike in Google Search terms for ‘crypto’ |

|

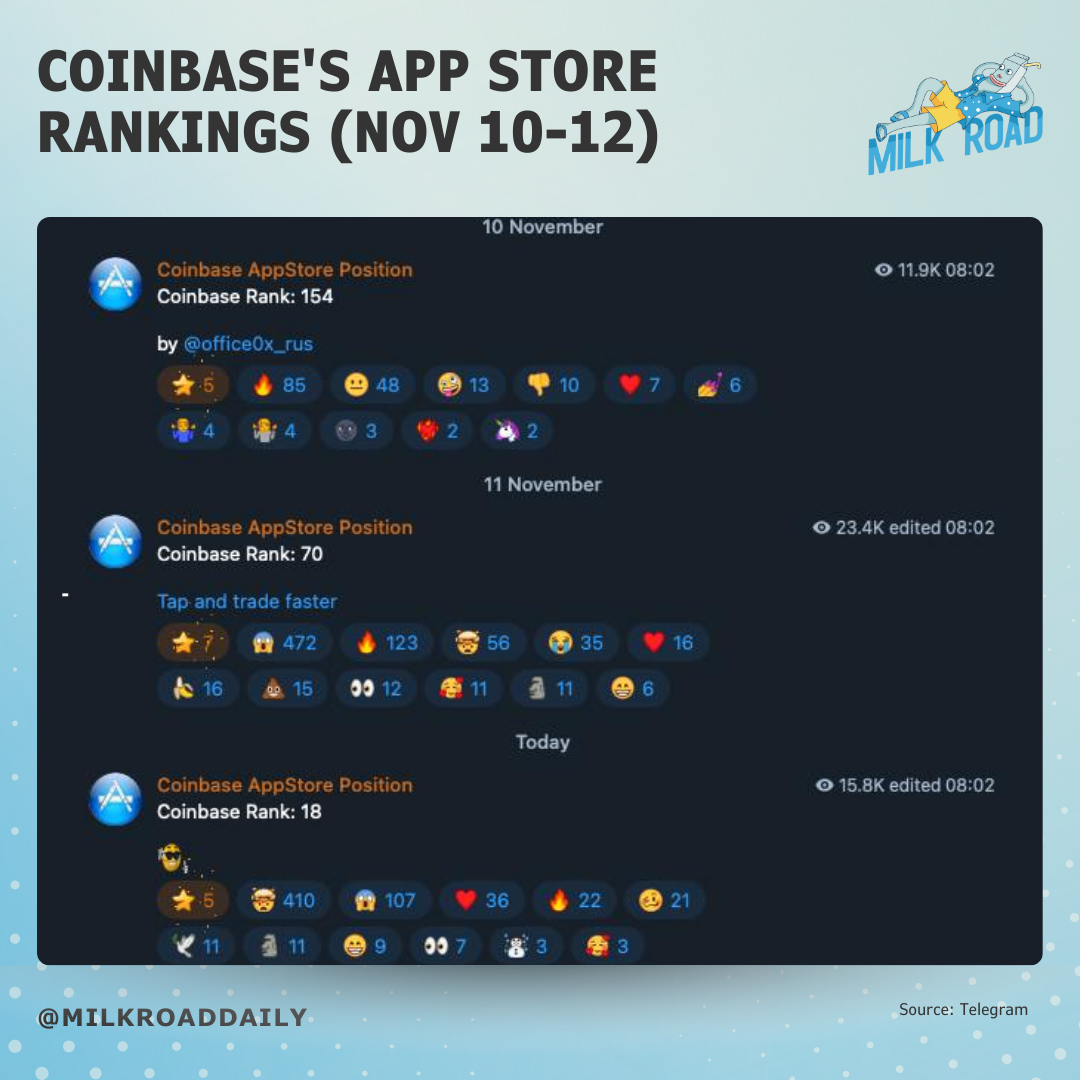

2/ Coinbase App Store Rankings |

The Coinbase app just went from #154 to #18 in two days! |

| Source: Telegram |

|

3/ Doge & Cardano booming |

Retail traders LOVE Doge and Cardano…and guess which of the top 10 coins/tokens pumped most over the last 7 days? |

|

A whooole bunch of retail traders that held $DOGE and $ADA since the last bull run could well be getting push notifications letting them know their investments are bouncing back. |

(Not a bad way to grab their attention). |

4/ Bitcoin on the front page of Bloomberg |

Mainstream news = mainstream eyeballs. |

|

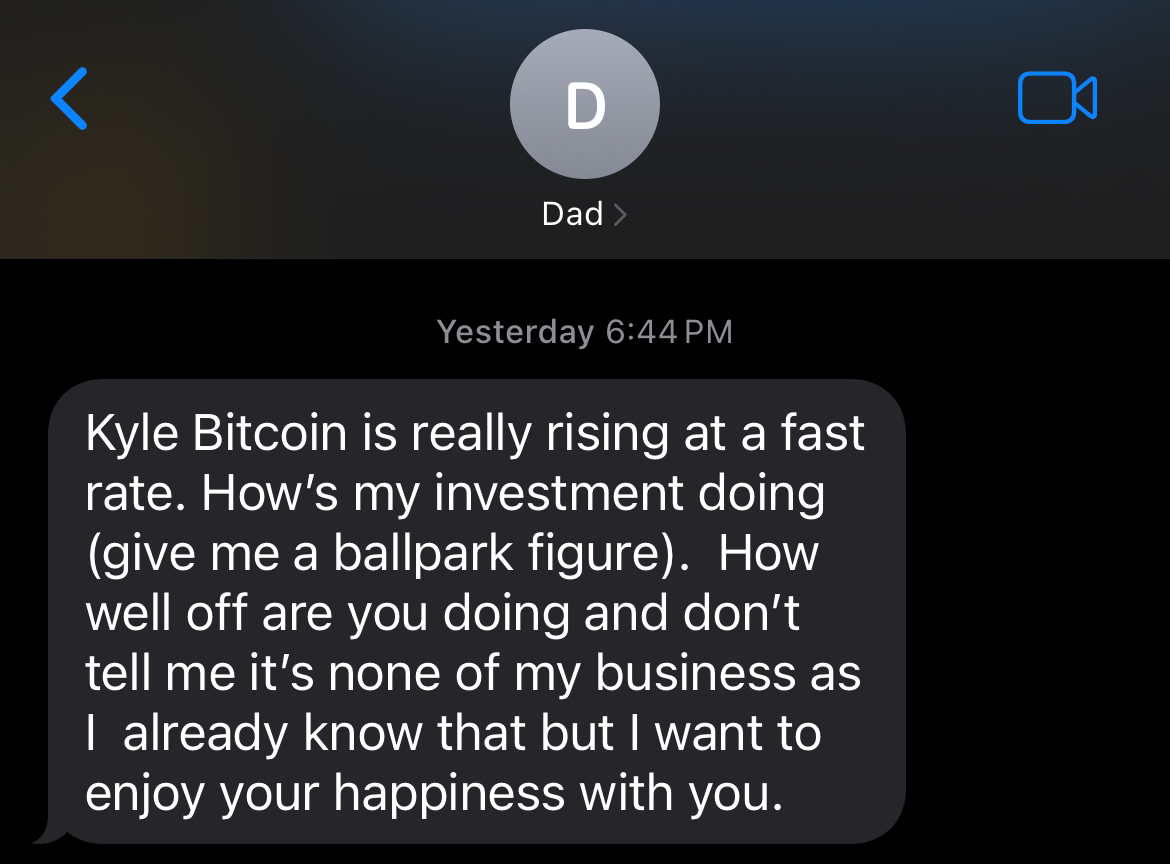

5/ Our parents are texting us |

It started a week ago… |

| Source: Kyle's phone |

|

And the momentum continues to build. |

| Source: Kyle's phone |

|

(The ability to be both sweet and combative at the same time – a magic trick only known to fathers). |

6/ Ronald McDonald has entered the chat… |

McDonald’s just teased an upcoming collaboration with Doodles (The NFT project. Remember those?). |

|

Now, sure – each of these on their own don’t necessarily mean anything… |

But add them all together and it paints a different picture. |

Air pressure dropping, winds picking up, sky darkening… looks like a retail storm could well be brewing. |

Brace yourselves! |

|

| | Meet Clave - the all-in-one mobile smart wallet bridging DeFi and everyday finance. 🌉 | Whether you're a DeFi wizard or just starting your journey, Clave makes crypto management smooth and fun for everyone. | Here’s why Clave is about to change your financial game: | Fort Knox in Your Pocket : Get hardware-level security without seed phrases! 🔒 Your Crypto, Your Rules: Self-custodial wallet for your digital treasures. 🫵 One-Click Access to DeFi: No more complex UX to earn yield. ⚡ Crypto Debit Card: Spend your crypto in the real world! 🔜

| Ready to level up your crypto game? | Create your Clave account in seconds ⏱️✨ | |

|

|

|

COTD: THIS TIME ISN’T DIFFERENT 📊 |

Good news! This time isn’t different. |

See, earlier in the year, there was all this worry about the potential of a ‘left translated cycle.’ |

(Which is just nerd talk for crypto prices spiking earlier/faster than usual). |

Which, at first glance, sounds awesome! (Who doesn’t want to get rich quick – ahead of schedule??). |

Problem is, the shorter the time period in which asset prices peak, the harder it is to navigate safely (because you have days to sell at or around the top, instead of weeks/months). |

And when Bitcoin hit all-time highs before the halving in March (the first time that had ever happened), a bunch of traders started hitting the ‘left translated panic button.’ |

But Benjamin Cowen just dropped a chart that shows us, so far, this time really isn’t all that different. 👇 |

|

See that blue line? |

It tracks the average return of the past three halving years combined (2012, 2016, 2020). |

And while it appears we’re taking a slightly different route this time around, we are now back on track and inline with the average returns of previous halving years… |

The best part? |

If we keep following this trajectory and end up at the same average total returns from the three previous halving years, we’re looking at a ~$126k Bitcoin by the end of the year! |

Let’s hope this time really isn’t different! |

P.S. Want to learn how to spot the Bitcoin cycle top? The Pi Cycle Top Indicator helps you do just that! |

What’s even cooler? We just sat down with the creator of the Pi Cycle Top Indicator, Philip Swift, covering: |

The current market status Philip's strategy for the banana zone Philip's analysis of the upcoming Bitcoin cycle top

|

Click below to listen now! 👇 |

|

YouTube | Spotify | Apple Podcasts |

|

MILK ROAD PRO PORTFOLIO UPDATES 📊 |

You feel it too right? |

That urge to tell your boss where to stick it and ride off into the sunset? |

A portfolio full of unrealized gains can do that! |

We’re not saying you should do it… just enjoy the moment while it’s here! |

(‘Cause these kinds of market moves take four years to cook). |

So how’s the Milk Road PRO Portfolio faring? Glad you asked — let’s get into it… |

Disclosure: We are not a day trading portfolio so don’t expect a high volume of trades. Read our “how to build a crypto portfolio in 2024” report to learn more about our portfolio strategy. |

Portfolio performance 📈 |

The Milk Road PRO Portfolio saw a remarkable increase over the past 7 days. Our portfolio value is at $122.5K, up 37% since last week. |

|

Hell yeah! We’re up 37% since last week, and our portfolio performance is up 22% since inception. |

But this is just the beginning. |

We’re already seeing more interest in crypto, with people asking questions, Coinbase app downloads skyrocketing, funding rates (read: leverage) going through the roof, and Bitcoin/Ethereum ETF inflows ramping up like crazy. |

Yes, we’ve officially entered the banana zone! 🍌 And the best part? It’s likely to last a few months, so buckle up and enjoy the ride. Just don’t blow it by chasing every shiny new narrative or hopping from coin to coin. That’s the fastest way to finish this bull run barely up—or worse, wondering where all your money went. |

Stay focused, stick to your strategy, and make these months count! |

Portfolio changes 👀 |

| The Milk Road PRO Portfolio is available for Milk Road PRO members only. | GO PRO AND UNLOCK: | Full access to the Milk Road PRO Portfolio. 👆 NEW: Our yield strategies 👀 Our weekly reports that help you invest successfully in crypto. 💰 Full access to our weekly bull market peak indicators. 📊 Full access to the Milk Road PRO community. 🫂 50% OFF the Crypto Investing Masterclass 📚️

| | PRO REVIEW OF THE WEEK | |

|

|

|

BITE-SIZED COOKIES FOR THE ROAD 🍪 |

Navigate lets you earn from your data while keeping full control over what you share. With features like DataQuest for gamified tasks and a passive browser extension, you can turn your digital footprint into rewards—all with privacy as the priority. |

Bitcoin flips Silver, becoming the 8th largest asset by market cap. Next few on the list? Amazon & Google. Watch your back boys, we’re coming for you. |

Mt. Gox transfers 2,500 $BTC, part of its 5th transfer this month. Remember when we were all spooked by Mt. Gox’s sell pressure? Yeah. That’s the last thing on people’s mind now. No sell pressure can stop us now babyyyyy (hopefully). |

El Salvador and Bhutan see major gains from their Bitcoin holdings. Kudos to all the countries that doubled down on $BTC. Can’t help but think of the ones that sold off *cough* Germany *cough*. |

US Spot Ether ETFs observe record inflows of $295M. Even though it’s tiny compared to the billions observed by the Bitcoin ETFs, it’s great to see Ethereum finally join the party. |

Milk Road's Bitcoin Price page keeps you up-to-date on Bitcoin ($BTC) with real-time pricing. With $BTC setting all-time-highs after all-time-highs, you might want to keep this page bookmarked. |

|

MILKY MEMES 🤣 |

|

|

|

|

RATE TODAY’S EDITION |

What'd you think of today's edition? |

|

ROADIE REVIEW OF THE DAY 🥛 |

|

VITALIK PIC OF THE DAY |

|

|

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. |