| 99% of Investors Don't Do This... Here's How to Be the 1% | | By Dr. Steve Sjuggerud | | Thursday, December 7, 2017 |

| The setup was perfect for one particular trade last month – so we pulled the trigger in my True Wealth newsletter.

So far, we're up 6%. And our potential upside is 30%. But that's not what's important today...

What's important is knowing what to look for in a trade.

Today, I'll start by explaining what I look for in a trade setup. Then, I'll use our True Wealth trade as an example, so you can see for yourself how it works.

Let me explain...

----------Recommended Links---------

---------------------------------

First off, you want to put the odds in your favor from the start.

This is not hard to do, but many people skip this step entirely...

Ideally, I want my potential gain to be at least three times my downside risk. For example, if I believe my upside potential on a trade is 30%, then I often set a hard stop loss at 10%.

That means if a stock is at $50, and you believe it has 30% upside (to $65), then you would plan to sell if it falls to $45 – no questions asked.

What? You think that's too tight? You're afraid you are going to get stopped out?

Then maybe your big idea isn't good enough.

I hate to break it to you. But that might be the case. If you want to use a wider stop, then you'd better find a stock with more upside potential.

Why do I do this? The main reason, as I said, is that it puts the odds in my favor... If I lose 10% on two trades but make 30% on one trade, then I still come out ahead.

Beyond putting the odds in my favor, the second thing I look for is this: Ideally, I want to buy what's 1) hated, and 2) trending "up."

In short, you want to buy when no one else is interested so the trade has room to move higher. But this isn't enough by itself... You need to know that the stock won't just keep falling. That's why I wait for the start of an uptrend. I wait for the market to confirm my idea... Then, I get in.

Now, let me show you what we did in our True Wealth trade...

Last month, I recommended buying the ProShares UltraShort Australian Dollar Fund (CROC).

This fund works as a leveraged bet AGAINST the Australian dollar. So in this case, we turned our second idea around... The Aussie dollar was overly loved, and the trend was down. That's what we wanted to see.

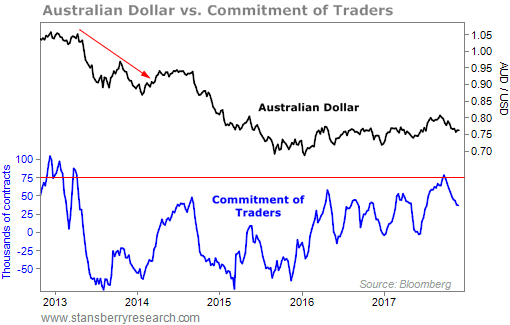

The easiest way to tell when an asset is overly loved or hated is to look at the Commitment of Traders (COT) report. It shows the real-money bets of futures traders.

As you can see below, based on the COT report, the Australian dollar recently hit its most loved level in more than four years. The last time we saw the Aussie dollar at these levels, it fell dramatically over the next six months. Take a look...

We also put the odds hugely in our favor on this trade... I told subscribers to take all profits once they're up 30%. But we entered the trade with seven or eight times the potential reward relative to our risk (around 4%).

We saw the Aussie dollar was overly loved... We saw the trend start to move in our favor... And we saw that we could set up a trade with good odds. So we bought.

The trade setup is still good today. Your downside risk is still about 4%.

But the point today isn't about making a bet against the Aussie dollar. Instead, I wanted you to see how I think about a trade...

Set your odds. Set your stop. Then, wait for trend to move in your favor before you act.

I would bet that 99% of investors don't do these basic things. I urge you to be part of the 1% that does...

Good investing,

Steve |

Further Reading:

In this classic series, Steve digs deeper into what he looks for in a trade. "Within two minutes, I knew everything I needed to know," he writes... Check out his step-by-step rundown here and here. "The reward-to-risk ratio should be the first thing that pops into your mind when you think about successful trades," Ben Morris says. Learn how to plan great trades with a better understanding of risk right here: How to Do Even Better Than 'Dazzling' Gains. |

|

THIS ENTERTAINMENT COMPANY RIDES A NEAR-MONOPOLY

Today, we visit a popular entertainment company dominating its niche... Companies with iconic brands can charge premium prices because they enjoy tremendous customer loyalty. Consumers trust well-known brands to deliver quality goods. This even holds true in the entertainment industry... Popular media franchises are known for their die-hard fans. Not only that, but they're able to sell licensed products under their brands that folks can't buy anywhere else. Sports-media company World Wrestling Entertainment (WWE) is the world's largest professional-wrestling promoter. It holds hundreds of events each year. The WWE Network has around 1.5 million subscribers worldwide... but the company also earns money from video games, collectibles, merchandise, live events, and licensing. The broad reach of this brand has paid off... In its last quarterly earnings report in October, revenue grew 14% year over year to $186 million. As you can see in the chart below, the stock has skyrocketed after its earnings announcement. Shares are up more than 52% over the past year, and have reached new 52-week highs. It's more proof that iconic brands can bring in excellent returns for investors... |

|

| Buy Japanese stocks without the currency risk... One currency I'm watching closely today is the Japanese yen. A falling yen is likely... And it gives us a great opportunity in Japan's stock market... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Ever since Steve Sjuggerud predicted "Dow 50,000," stocks have soared 64%. But it turns out, most of Steve's money is NOT in stocks. He's put the bulk of his cash into something else, which could soar even higher in the months ahead. For the full story, click here. |

| You'll Want to Own This When Today's Bubble Implodes | | By Porter Stansberry | | Wednesday, December 6, 2017 |

| | It's a familiar story to anyone who knows much about financial history... |

| | 'Melt Up' Update: ALL CLEAR Again | | By Dr. Steve Sjuggerud | | Tuesday, December 5, 2017 |

| | I'm watching five specific early warning indicators for the "Melt Up" – the last explosive stage of this bull market. These indicators will let me know in advance when the Melt Up is on its last legs... |

| | Join Me at the Stansberry Winter Conference | | By Dr. Steve Sjuggerud | | Monday, December 4, 2017 |

| | I can't wait... We'll meet the world's best investing minds... and we'll have a ton of fun together. |

| | Forget a Bear Market... The U.S. Financial System Is About to Be 'Reset' | | By Porter Stansberry | | Saturday, December 2, 2017 |

| | Let me show you why what happens to your portfolio over the next few years should be the least of your worries. Protecting your portfolio is easy. Protecting everything else won't be... |

| | How to Be Wrong Half the Time... And Still Make Money | | By Ben Morris | | Friday, December 1, 2017 |

| | "Don't ignore trading ideas that have enormous upside potential just because the chances of success aren't great..." |

|

|

|

|