Last August, Smart Money Monday readers were able to capitalize on Elon Musk’s Twitter (TWTR) takeover. The setup offered attractive upside potential with a high probability of closing.

Fast forward to this week, and we’re talking about another merger arbitrage opportunity. If the deal goes through, we’ll make a nice 20%+ return in just a few months.

And if it doesn’t… well, we’ll be buying a high-quality business at an attractive valuation.

Deals, Deals, Deals

There are lots of ways to make money in the markets…

You can buy high-quality companies and hold. You can buy average companies at depressed valuations and wait for them to trade up. You can short, or bet against, bad companies and profit on their downfall.

Another way to make money is through merger arbitrage. It sounds complicated, but it’s not.

Say Company A wants to buy Company B. It makes an all-cash offer of $20 per share, and Company B trades at $18 per share until the deal closes.

That means buyers of Company B (after the deal is announced) have the opportunity to make $2 in profit. They just have to wait for the deal to close.

Why doesn’t it trade instantly to $20?

One is timing. Deals take time to close after they’re announced. Why buy the stock at $19.99, hold it for six months, then have it get acquired for $20 when you could have instead purchased US government T-bills? There is typically a spread due to timing.

Second is financing risk. Sometimes a deal comes with a “subject to” clause. That is, subject to getting the money to actually close the deal. That creates risk, especially if the buyer is an unproven acquiror of companies.

Third is regulatory risk. We didn’t have that with Twitter—it wasn’t a case of Facebook or Google buying Twitter, which would probably be anticompetitive. Rather, it was a private individual buying a company for personal gain. Regulatory risk, however, is all over the idea I’ll walk you through today.

Now, in my example above, I assumed a 100% purchase price in cash. Not all deals work that way, though. Sometimes it’s part stock, part cash.

Or sometimes it’s cash plus an earnout. This earnout is sometimes called a contingent value right, or CVR. It’s common with biotech companies. If a speculative drug gets approved, for example, the CVR might pay out to its holders. It’s contingent upon a certain event.

CVRs are interesting but are not the subject of today’s idea. With this one, we’re talking about tech behemoths and video games.

| Mark Your Calendar: Debt, interest rates, recession risk, inflation, market mechanics—no issue is out of bounds when Mauldin publisher Ed D’Agostino interviews Keith Fitz-Gerald, principal at Keith Fitz-Gerald Research. During their time together, Keith plans to cover his 2023 thesis, his investing framework, and discuss his approach to the market. He'll also answer questions from the audience during an exclusive Q&A. All will be available for viewing this coming Thursday, February 16, so be sure to watch your inbox for your viewing link. No RSVP required. (From our partners.) |

Activision

We have a big opportunity to take advantage of the all-cash acquisition of video game publisher Activision Blizzard, Inc. (ATVI) by tech giant Microsoft Corp. (MSFT).

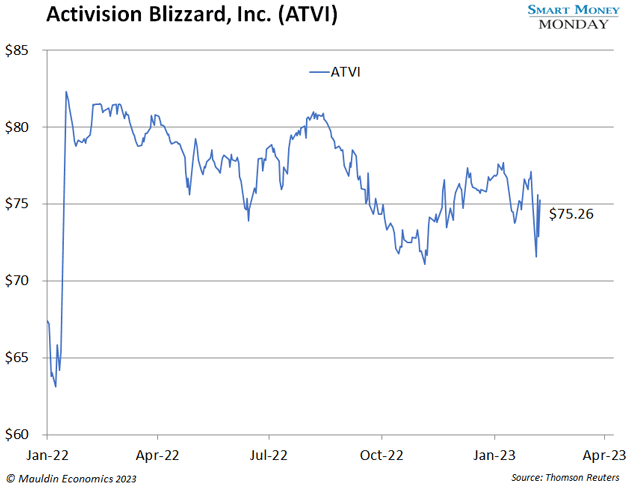

Microsoft announced it would acquire Activision in January 2022 for $95 per share. It’s been over a year, and the deal still hasn’t closed. The main reason appears to be regulatory.

Last week, the UK’s competition regulator, the Competition and Markets Authority, wasn’t particularly thrilled with the deal. Its comments implied it would harm gamers—and therefore, it wouldn’t approve the deal.

It wasn’t a total deal killer, though. It just means Microsoft needs to provide some concessions to appease the regulators.

Activision’s stock is around $75, and the takeout price is $95—about a 27% upside. Despite the regulatory pushback, both companies still expect the deal to close sometime before June 2023.

That’s a nice return in a short period of time… if it closes. But what if it doesn’t?

The Break Fee

If Microsoft can’t get the deal done, it will owe Activision some money. A lot of money—$3 billion, in fact.

Activision currently has $10.75 per share in net cash. And if the deal falls through, it’ll get another $3.84 per share in cash.

So, at $75 per share, assuming the deal breaks, we’re buying ATVI at approximately $60 per share once you back out the net cash.

On the earnings side, analysts are forecasting $4 per share in earnings per share in 2024, which isn’t terribly expensive (just 15 times earnings).

Historically, Activision has traded at 20 times earnings or greater. It’s a high-quality, high-margin business that should command a premium multiple. Twenty times isn’t a stretch.

It’s a straightforward setup. Don’t bet the farm on the idea, of course. But I think it’s worth owning here and has a clear path to market-beating returns.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...