What do Italian gas stations, luxury goods, and airports have in common?

Well, they’re all owned, or set to be owned, by one public company.

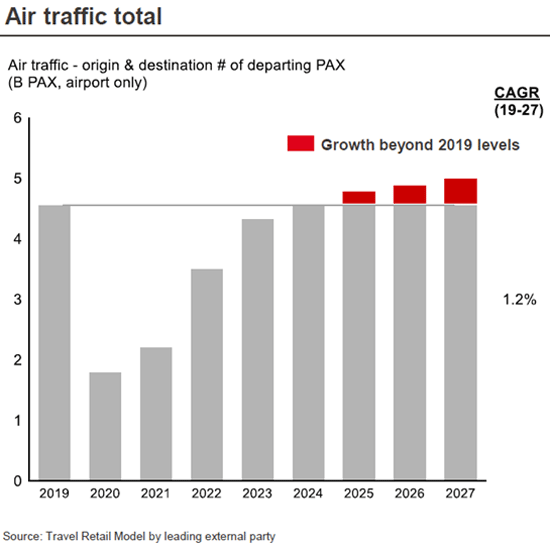

Global travel, despite the COVID pandemic being effectively over, has still not returned to pre-COVID levels.

In 2019, global traveler volume was 4.5 billion people, according to the International Civil Aviation Organization. In 2020, as you can imagine, that number was more than cut in half to less than 2 billion.

Despite all the news about pent-up demand for air travel, the world is still not back to 2019 levels.

Therein lies the opportunity.

Sure, you could play the airlines. But they’re questionable businesses in my view. Look at Southwest Airlines Co. (LUV). Great company, but a recent glitch in its system caused a complete, total meltdown.

You could look at global hotel chains. Not a bad idea, but not my favorite—not when you can invest in travel through airports… or, more specifically, shopping in airports.

A Captive Audience and Limited Competition

In 2019, total dollars spent on travel retail exceeded $115 billion. This is travelers buying food, drinks, and other retail goods sold in airports around the world. It’s a big business.

In 2020, it collapsed. And 2021 was worse. That said, we’re starting to see signs of life in 2022.

Unlike Anything Else Offered by Mauldin Economics: You’re invited to take advantage of first-class research from the most renowned economists, asset managers, and geopolitical experts of our time. Click here to activate your exclusive membership. |

Now, the main player in this space is Swiss-based Dufry AG (DUFRY).

Dufry owns brands common to air travelers around the world. The most popular—at least in the US—is Hudson. World Duty Free is another.

These brands, in turn, have concession agreements with airports. They bid on the concession agreement, which gives them the right to open shops in airports.

Airports typically receive a base level of rent plus variable rent tied to sales at each shop. It’s a great business in “normal” times. Dufry, and its associated brands, has a monopoly on air travelers’ need to spend. It has a captive audience and limited competition.

However, we’re still not back to normal. At least, not yet. Dufry had a tough go of it during COVID. It was forced to issue equity to stay solvent. However, things are starting to turn.

Part of that turn is a transformational acquisition announcement. Dufry recently announced the merger with Italian company Autogrill SpA (ATGSY).

Don’t be confused by the name. Autogrill is a big company. Yes, it owns Italian gas stations of the same name. But more important, it owns HMSHost, another major airport concession operator.

Next time you buy your cup of coffee at Starbucks at the airport, look at your receipt. You’ll see HMSHost there, as pictured on my receipt when I was traveling through the Raleigh-Durham International Airport:

The merger between Dufry and Autogrill is nearly complete. Last week, Dufry announced the transaction was approved by regulators. It should close sometime in the next few months.

There are lots of synergies to extract from the combined companies. And again, the space has yet to rebound.

But most important…

Is It Cheap?

Once the merger is complete, Autogrill shareholders will receive shares of Dufry in the deal.

Looking at the price of Dufry right now, the stock is somewhat cheap. For the combined companies, 2019 free cash flow was 453 million Swiss francs (CHF). At Dufry’s 40 CHF price and adjusted for the new shares to be issued in the deal, this implies a 7.4% free-cash-flow yield to the equity.

That’s not terribly expensive. However, we’re still not back to 2019 levels of travel. Which means free cash flow is materially lower than that today.

The company and industry experts forecast travel retail spending will return to 2019 levels in the 2024–2025 time frame. Will the combined company be even more profitable after that period? I believe so.

Source: Dufry Capital Markets Day 2022 Presentation

Layer on some debt paydown between now and then, and the combined entity could generate quite a bit of free cash flow.

At a 7.4% free-cash-flow yield on 2019 numbers, I’m not sure the stock is cheap enough today. But I like the setup and the story.

It’s a high-torque way to play a rebound in travel. That is, if travel rebounds, it’ll generate substantially greater returns than, say, buying the airlines.

However, if travel retail spending doesn’t rebound… well, the returns will be a lot worse than something like the airlines. That’s what I mean by high-torque.

Consider Dufry AG (DUFRY) another addition to the Smart Money Monday watchlist.

If the situation improves (and the stock gets cheaper), it’ll be time to buy.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...