| A Huge 113,000% Rise in Seven Years – And Plenty of Upside Ahead | | By Dr. Steve Sjuggerud | | Monday, November 13, 2017 |

| About seven years ago, the Japanese government apparently decided to buy up the Japanese stock market.

I'm not kidding...

This situation could eventually lead to a bubble. But today, it's creating a huge opportunity for investors. Let me explain...

----------Recommended Links---------

---------------------------------

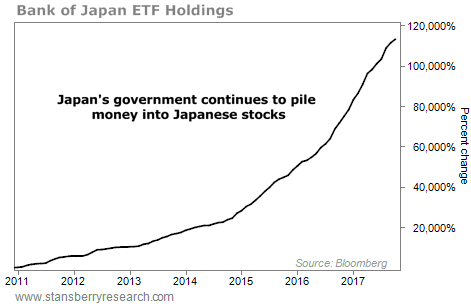

Since the end of 2010, Japan's central bank has increased its holdings of Japanese exchange-traded funds (ETFs) by 113,000%.

You can see it on the chart below...

The numbers are just staggering... The Japanese central bank now owns more than 16 trillion yen worth of Japanese ETFs. (That works out to about $140 billion in U.S. dollars.)

For a frame of reference, more than half of the total assets in Japanese ETFs are owned by the Japanese central bank.

And the pace isn't slowing down. Instead, it's speeding up... This year alone, the Japanese government has added $46 billion in ETFs to its portfolio – and we still have two months of data left to report for the year.

I told my subscribers about this story exactly one year ago in my True Wealth newsletter...

The headline to my story was "Little-Known 'Mr. K' Just Set Up the Best Trade of Our Lives."

Here's the deal.

"Mr. K" is Haruhiko Kuroda – the head of Japan's central bank. He's afraid Japan will backslide into deflation... And he has the power to prevent it from happening.

He's committed to buying Japanese stocks. And he's also committed to keeping interest rates at zero for an EXTREMELY long period of time.

So this gives us an incredible tailwind in Japan... zero-percent interest rates for the long run, AND a government that is committed to buying stocks. That is a recipe for an eventual stock market bubble.

Subscribers who followed my advice a year ago and bought the WisdomTree Japan Hedged Equity Fund (DXJ) are up 26%.

But you haven't missed it yet...

U.S.-traded Japan ETFs actually had a net OUTFLOW of cash in 2016. And this year, the net flow in Japan is basically flat. In short, Americans don't care... yet.

That means this trade has more upside ahead.

Long story short – this Japan setup is as good as it gets. Interest rates are at zero for the long run, and you have a multibillion-dollar tailwind in the stock market.

Don't miss it!

Good investing,

Steve |

Further Reading:

"'Abe's revenge' will create a massive bubble in Japan's stock market," Steve writes. Japan's economic policies are setting up a huge opportunity for investors... And now is a great time to take advantage of it. Learn more here: Investors Just Bailed on These Stocks – We're In! |

|

NEW HIGHS OF NOTE LAST WEEK BP (BP)... oil and gas ConocoPhillips (COP)... oil and gas Royal Dutch Shell (RDS-A)... oil and gas CF Industries (CF)... fertilizer Weyerhaeuser (WY)... timberland Deere (DE)... tractors and farming equipment Stanley Black & Decker (SWK)... tools and storage PulteGroup (PHM)... homebuilder Marriott (MAR)... hotels Wynn Resorts (WYNN)... gambling Royal Caribbean Cruises (RCL)... cruises Visa (V)... credit cards Amazon (AMZN)... online-retail juggernaut Apple (AAPL)... iPhones, iPads, and more Corning (GLW)... smartphone screens Yum Brands (YUM)... Pizza Hut, Taco Bell, KFC Becton Dickinson (BDX)... needles and syringes

NEW LOWS OF NOTE LAST WEEK Sprint (S)... telecom AT&T (T)... telecom Fossil (FOSL)... watches Macy's (M)... retail "old guard" |

|

| A one-click way to own hundreds of Japanese stocks... Peter Churchouse has lived and invested in Asia for more than three decades. Today, he agrees with me that the environment is good for Japanese stocks... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Markets have gone mad – hitting new highs every month. How much longer could it last? Steve Sjuggerud says, "Hold on to your hat – a lot longer than you think." To watch his updated presentation on the "Melt Up," click here. |

| Is This Common Mistake Leading You to Financial Ruin? | | By Dan Ferris | | Friday, November 10, 2017 |

| | Karl Hill turned $2.9 million into $54 million in seven years... |

| | This 'Boring' Energy Investment Could Soar 53% in Two Years | | By Brian Weepie | | Thursday, November 9, 2017 |

| | This is the kind of stock market "divergence" that I like to see... |

| | Investment Protection No One Is Talking About | | By Dr. David Eifrig | | Wednesday, November 8, 2017 |

| | I'll bet you've made this mistake. And I'll also bet that your kids... and grandkids... are making it right now. |

| | A Major Ominous Sign for Stocks | | By Dr. Steve Sjuggerud | | Tuesday, November 7, 2017 |

| | Rejoice, my friend – almost everyone who wants a job has one today! This is good news, right? |

| | Biotech Is a Screaming 'Melt Up' Buy Today | | By Dr. Steve Sjuggerud | | Monday, November 6, 2017 |

| | The biotech sector recently fell by 8% in three weeks. I believe the bust is overdone. And now is a great moment to swoop in and buy... |

|

|

|

|