| A Massive Change in Precious Metals You Need to See | | By Dr. Steve Sjuggerud | | Friday, October 28, 2016 |

| Wow. I can't believe the sea change that has happened in gold in the last two weeks…

Two weeks ago, my headline here in DailyWealth was "Gold Isn't a Buy Yet… But it's Close."

That day, I said:

Personally, I look forward to getting back into gold and gold stocks with my own money… They have fallen, a lot, and I believe we're at the early stages of a major long-term bull market in gold stocks.

But even after such a fall, and even with my long-term outlook, I personally can't get excited just yet…

Unfortunately, gold is still loved… And it's still in a downtrend. |

|

My, what a difference a couple of weeks makes…

----------Recommended Links---------

---------------------------------

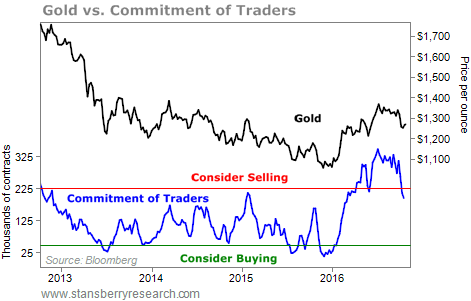

Today, large investors are bailing out of gold – at a frenzied pace. Take a look…

Meanwhile, the bleeding might have stopped in the price of gold. It's hard to call it an "uptrend" right now… But gold has moved sideways for weeks. The downtrend might be nearing its end.

And it's not just gold…

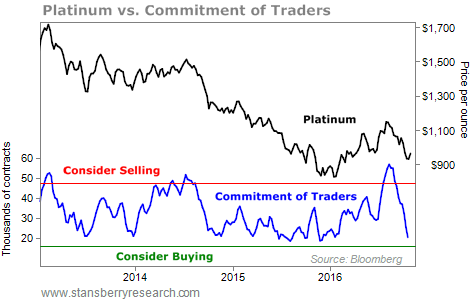

We've seen similar extreme moves by big traders in other precious metals.

Platinum has been the most extreme. Take a look…

You can see from the chart that you don't want to own platinum when investors have piled up big bets on the metal. That's where we were over the summer. But as you can see in the bottom right of the chart, big investors have bailed out of platinum today.

So the big question is… What do we do now?

Is this moment a buying opportunity for gold and precious metals?

Personally, I'm still not buying just yet…

I want to see even more large investors get out. And I want to see more of an uptrend in prices.

I want to be clear here: The story for gold and precious metals has improved dramatically in the last two to three weeks. The change has been more dramatic than we've seen in a long time.

Now is a much better time to enter gold or precious metals than it was two or three weeks ago.

But it's still not "optimal" – yet.

Based on these charts, platinum is closer to a "buy" now than gold…

More investors have given up on platinum. That's means platinum is closer to the bottom, in my book.

Summing up, investors have massively changed their opinions on gold and other precious metals in just the last couple weeks. And big investors have started to throw in the towel.

I didn't think it would happen this quickly, or to this degree. But it's true. Gold is quickly moving from "loved" toward "hated" again.

I love to see this… This makes gold and other precious metals much more attractive than they were just a couple weeks ago.

The "red light" in gold has changed to yellow… We're just not all the way to green, yet. I'll let you know when we get there.

Good investing,

Steve

Editor's note: Although precious metals aren't a "buy" today, Steve has become super-bullish on another area of the resource market. In fact, he's so bullish that he's offering a free look at the research behind his latest True Wealth Systems recommendation. Get the details here. |

Further Reading:

The picture in precious metals has changed drastically in the past two weeks as they move closer to being "hated"... And Steve is following this trend closely. Check out his original article investigating the moves to come in gold and silver: Gold Isn't a Buy Yet... But It's Close. Steve recently outlined exactly what he looks for in a trade. If you're still waiting for the "green light" in precious metals, or in any other investment, you can read about Steve's thought process in his two-part series here and here. |

|

THE LATEST 'BAD TO LESS BAD' WINNER

Today's chart highlights one of our favorite strategies at work... Regular readers know that Steve coined the term "bad to less bad trading" several years ago. It involves buying assets that have gotten crushed and are making massive profits as the market starts to return to normal – or when things simply get "less bad." Right now, we can see a "bad to less bad" move in shares of iron-ore giant Vale (VALE). As Steve wrote in June, the story in commodities has been bad. The sector had fallen in half from its peak in 2012 through the start of 2016. Investors gave up on the biggest commodity firms. VALE shares fell from around $36 per share to around $2. But as things have gotten "less bad" in commodities, VALE has exploded higher... Shares are up more than 220% since January and hit a new 52-week high yesterday. It's a perfect example of the power of "bad to less bad" trading... |

|

| Own this gold and silver miner during the next precious metals boom... "We believe we're on the cusp of a historical bull market in precious metals," Porter writes in a recent Stansberry Gold & Silver Investor report. |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Surprisingly, both Trump and the Clintons share a fascinating income secret – a way to generate tens of thousands in extra income without much extra work. You can and should get in on this idea, too. Details here |

| There Is 100% Chance of a Recession Next Year | | By Porter Stansberry | | Thursday, October 27, 2016 |

| | I've been writing about the warning signs for a long time – falling industrial production, declining trade, falling corporate profits, and rising corporate defaults... |

| | The U.S. Government Is Digging Our Financial Grave | | By Porter Stansberry | | Wednesday, October 26, 2016 |

| | Investors who don't understand this concept are going to get wiped out. What's the concept? It's the answer to the following questions... |

| | The Only Thing That's Worse Than Being Hated | | By Dr. Steve Sjuggerud | | Tuesday, October 25, 2016 |

| | It appears – with very little fanfare from the media – that the major decline in oil prices is behind us... |

| | The Best Christmas Present You Can Give Yourself | | By Dr. Steve Sjuggerud | | Monday, October 24, 2016 |

| | Let's make some changes. Together. Starting right now... |

| | The Fed Don't Mean a Thing | | By Dr. David Eifrig | | Friday, October 21, 2016 |

| | This letter is the only thing you need to read about the Federal Reserve... |

|

|

|

|