| A Perfect Track Record for Quick Double-Digit Gains | | By Brett Eversole | | Tuesday, March 20, 2018 |

| Today, I'll share a trade that has a perfect track record in recent years...

More important, it just signaled again.

If you follow this signal, you should be able to pocket double-digit gains in six months on a "boring" asset.

But first, I'll explain why it works. It gets to the core of how we plan some of our best trades at DailyWealth...

----------Recommended Link---------

| One Time-Tested Way to Hedge Risk...

Experts say sooner or later, the debt bubble will burst... Don't let your wealth be caught off guard for the inevitable financial reset. See how this simple way to invest makes it cost-effective and secure to create long-term, stable wealth. Get the full details here. |

|---|

---------------------------------

It's simple, really. If you want to make money in the markets, you need to buy what's cheap. And you need to buy it when no one else wants to.

The opposite is true as well. A good time to sell is when something's expensive and EVERYONE wants it. When everyone wants an asset, there aren't many new buyers left to push prices higher.

This is the basic idea of trading or investing on "sentiment."

We've showed time and again here in DailyWealth that this idea is a great way to figure out the pulse of a market and make contrarian bets at extremes. Today, it's leading us to a bet most investors would never consider...

You see, a certain commodity has boomed in 2018. It rallied double digits from trough to peak. And investors are now extremely bullish.

This commodity crashed the last five times this happened. And the next fall has already begun.

The opportunity is betting against corn.

Corn doesn't sound like a sexy trading idea, I know. It's not Elon Musk putting people on Mars. But hear me out...

After a steady climb higher, futures traders are now extremely bullish on corn, based on the Commitment of Traders (COT) report.

The COT report gives us a gauge of how traders feel about an investment. It tells us what futures traders are doing with their money in real time.

When futures traders all bet in one direction, the opposite often happens. Today, futures traders are all betting on higher corn prices.

We've seen similar bullish levels five times in recent years. And corn prices fell dramatically in each case.

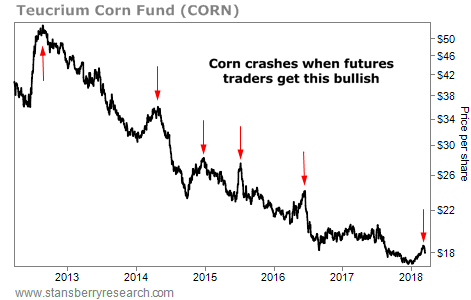

You can see this on the chart below. It shows the corn exchange-traded fund ("ETF") – the Teucrium Corn Fund (CORN). The arrows represent the last five times futures trades were betting on higher corn prices to the same degree as they are right now (and the most recent example as well)...

Prices fell dramatically in every case. In fact, each instance led to a double-digit decline for the corn ETF over the following six months. Take a look...

| Sentiment Peak | 6-Month Return | | 8/21/2012 | -20.2% | | 4/29/2014 | -26.1% | | 12/23/2014 | -15.1% | | 7/21/2015 | -14.1% | | 6/14/2016 | -17.9% |

That's a perfect track record... and an average loss of 19% in six months.

Futures traders haven't been this bullish on corn in nearly two years. And simply put, you really don't want to be long corn when these traders are this bullish.

The commodity is already rolling over. The corn ETF is down 4% in recent days. And history says this is likely the start of a major downtrend... with potential double-digit losses.

Shorting the Teucrium Corn Fund is the simplest way to profit from this idea. But even if you don't make the trade, this is another example of why sentiment is vitally important to investors.

Go out looking for crowded trades... and then make the opposite bet. That's how you earn outsized returns in the market.

Good investing,

Brett Eversole |

Further Reading:

Making trades based on sentiment is one of our key strategies in DailyWealth. But this technique gets even better with two more "secret ingredients." You can read all the details from Steve right here: How to 'Call' the Markets Correctly. "Today, we've found one commodity that could be at the bottom of a bust cycle... and on the verge of its next boom," Brett writes. This contrarian trade could absolutely soar once the trend reverses. Read more here: On the Edge of a 92% Boom. |

|

'BORING' RETURNS COUNT ALL THE SAME

Today's chart highlights a big winner in the utilities sector... Regular readers know we're longtime bulls on utilities. Utility companies provide necessities like water, electricity, and gas to people's homes. They often enjoy monopoly positions in their markets... and guaranteed profits. One utility stock that stands out today is NextEra Energy (NEE). NextEra is the parent company of Florida Power and Light, which serves an estimated 10 million customers in the state. It also owns NextEra Energy Resources, the world's largest generator of wind and solar power. With millions of locked-in customers, it's no wonder this company has a long track record of strong, steady performance in the market... As you can see from the chart below, NextEra has been a fantastic long-term investment. Shares have consistently climbed higher over the past five years. And the stock continues to soar in today's market, hitting an all-time high last week. Utilities stocks may be boring... but they're a great place to earn consistent returns. |

|

Corn declines won't kill this rural America retailer... "Death of retail"? Not according to my colleague Dave Eifrig. One of his favorite opportunities is a retailer that's outside the mainstream, but firmly in the heartland of America. And that's a place we want to invest now... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

At 12:00 a.m. Eastern time, we're closing access to one of the most aggressive, high-return model portfolios in our 19-year history. For the full story, click here. |

| This Is the Ultimate 'Melt Up Millionaire' Stock | | By Dr. Steve Sjuggerud | | Monday, March 19, 2018 |

| | Everyone already knows Apple, Google, and Facebook... Are there any true ecosystems out there that most people don't know about? |

| | The Hidden Force Driving This Historic Bull Market | | By Justin Brill | | Saturday, March 17, 2018 |

| | This is bad enough. However, the Fed has managed to make it even worse... |

| | What I Learned From a $125 Million Investment Lesson | | By Kim Iskyan | | Friday, March 16, 2018 |

| | This was one of the most important investment lessons I ever learned... |

| | On the Edge of a 92% Boom | | By Brett Eversole | | Thursday, March 15, 2018 |

| Investors tend to see boom-and-bust cycles as black swans or once-in-a-generation events. But they happen in the stock market more often than most people realize. And they're downright commonplace in the commodities markets... |

| | Exactly How You Should Trade the Next Market Correction | | By Dr. David Eifrig | | Wednesday, March 14, 2018 |

| | Most people don't want to hear this when the market is in the midst of selling off... |

|

|

|

|