|

|

| A reversal, at last—oil-price gains push the MPI higher |

The gains have spread across the MPI subindices, finally propelling the main index higher

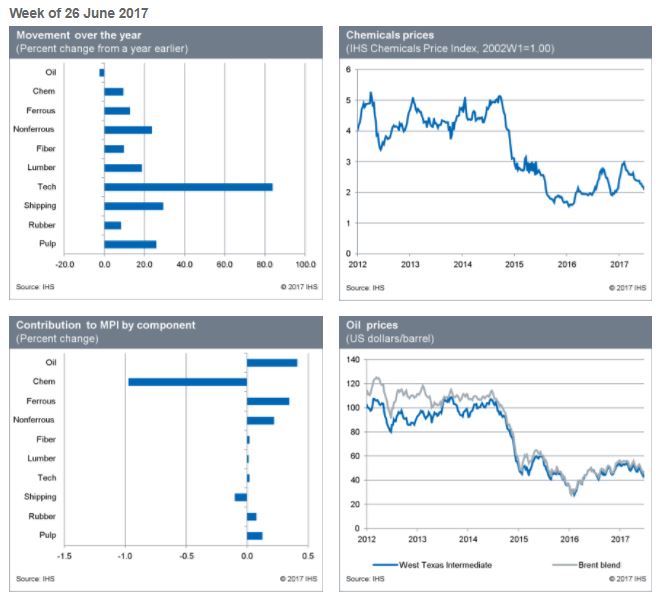

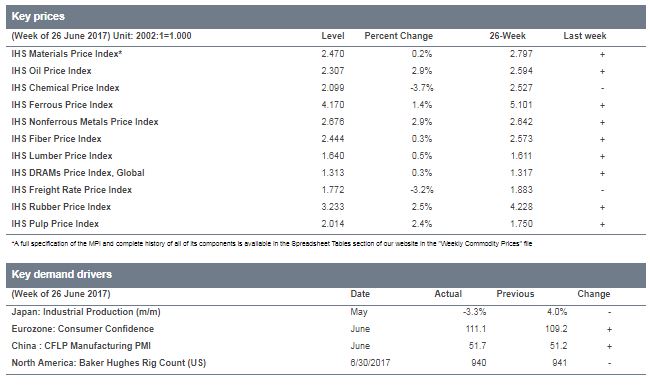

The IHS Materials Price Index (MPI) rose for the first time in just over a month last week, gaining 0.2%. Oil and metals markets drove the index higher. The oil subindex gained 2.9%, with nonferrous metals up 2.9% as well. The broad-based gains across the MPI's subcomponents continue to spread. Only chemicals and freight fell last week, both heavily influenced by oil-price declines in early June.

Oil prices moved higher each day last week, as US drilling activity moderated for the first time since January, while US crude output fell in April for the first time this year. Metal prices also posted solid increases—aluminum, copper, and nickel all registered good gains, while iron ore partially reversed the steep declines seen over the last few months.

Last week there were several positive macroeconomic announcements that helped buoy commodity markets. In the Eurozone, economic sentiment recovered in June, up 2 full points at 111.1, further highlighting the growing strength of the currency bloc. In China, the Federation of Logistics and Purchasing Managers' manufacturing purchasing managers' index (PMI) came in at 51.7, a slight improvement from May. Finally, the US dollar also continued to slide, providing general support to commodity markets. We have felt for some time that a slow improvement in fundamentals would "soon" end the four-month slide in commodity prices. While one week does not a trend make, we feel the increasing number of MPI subcomponents posting increases across June at the very least highlights the limited downside now present in markets. More particularly, we feel July and August will provide definitive signs that the global expansion continues to roll forward. |

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Materials and Equipment Cost Escalation Hit Lowest Level This Year

|

Construction costs rose again in June, according to IHS Markit and the Procurement Executives Group (PEG). |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 51.5, down from 54.0 in May, indicating less broad price increases across the industry. Both the material/equipment and labor categories continue to record higher prices. The materials/equipment price index came in at 51.3 in June, its lowest level in seven months. Price increases were uneven with only six of the 12 categories tracked in the materials sub-index showing higher prices, three categories registered flat pricing, and three had falling prices. Although structural steel and steel pipe prices have backed off from this spring’s peaks, anxiety about the pending Section 232 trade case decision continues. “Steel pipe prices have peaked for the time being and prices for certain products have started to fall,” said Amanda Eglinton, senior economist at IHS Markit. “However, there is still tightness in products such as oil country tubular goods (OCTG) and line pipe, where demand remains elevated. There is high potential for further tightening pending the outcome of the Section 232 trade case. If pipe is included in the scope of this case and imports are restricted, prices will spike again and supply will be very tight. If pipe is not included, steel pipe prices will continue to soften with lower steel input costs.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|