| A Simple Reason Why the U.S. Dollar Can Soar | | By Dr. Steve Sjuggerud | | Monday, November 27, 2017 |

| Every night in 1995, I would deposit money overnight in a different currency...

Sounds strange, I realize.

But back then, as the vice president of a global mutual fund, one of my jobs was to execute our fund's trades.

Once our U.S. trading day was done, we wanted our money to work for us overnight as well. We might put our money into French francs, German marks, or somewhere else – just for the night.

We would find the safest country that was paying the highest interest rate. And we would put our money there overnight. No kidding.

As I'll explain today, what we were doing wasn't anything special...

----------Recommended Links---------

| 500% Gains in 82 Days... Here?

From our friends at Stansberry Churchouse Research: This isn't about chasing safe 5%-10% gains. It's not about dividend investing. And it's not about trading options. Simply put, this is about seeking mega-gains of 500% to 1,000% or more – sometimes in as little as a few months – where few people dare to go. Details here... |

|---|

---------------------------------

Big companies like German automaker Volkswagen and Japanese automaker Honda (and thousands of other companies) have cash-management departments that do basically the same thing – on a much larger scale.

I'm sure that hundreds of billions of dollars move this way (if not trillions)... every day.

This money is all looking for the same thing... "Where am I going to get treated best tonight? Where is the safest, highest-yielding place to spend the night?"

The simple investing lesson you need to learn is that money flows to where it's treated best.

It always has. It always will.

Importantly, this simple truism leads us to an investment conclusion that you might find hard to believe: The U.S. dollar could move dramatically higher in the coming months and years.

Take a look at this table of safe countries to park your money in overnight. Tell me, where will money be treated best going forward?

We ask the simple question, "Where will money be treated best?" The answer is obvious: in the U.S. dollar.

The interest-rate difference between the U.S. and the other major "safe haven" countries is downright massive right now.

You know my investing strategy by now... Ideally, I like to buy when three things come together. I want to buy when an investment is cheap, hated, and starting an uptrend.

This investing strategy works for basically every asset class – you just have to figure out how to define these three terms.

When it comes to currencies like the U.S. dollar, we define "cheap" as the best value. The first place I look for value is in interest rates. When you have a difference in rates as large as we have today, it's time to pay attention.

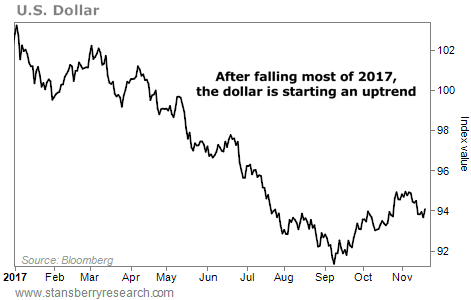

For most of this year, the dollar hadn't been hated enough or in enough of an uptrend to expect a big move. But that changed recently.

After being in a downtrend for most of this year, the U.S. dollar has finally started an uptrend...

This is a new development. It tells me that a major move in the dollar could be starting now.

I know this might sound a little too simple... and maybe a little crazy. But hear me out...

Money flows where it's treated best. And right now, the U.S. dollar treats money better than any other major global currency.

With the uptrend back in place, we could be at the beginning of a major move higher. That makes now the time to position yourself for a stronger dollar.

Good investing,

Steve |

Further Reading:

The dollar is just one of several high-upside opportunities Steve sees for investors today. Catch up on some of his latest DailyWealth essays here... |

|

NEW HIGHS OF NOTE LAST WEEK Square (SQ)... mobile payments Garmin (GRMN)... GPS devices and smartwatches VMware (VMW)... cloud software Box (BOX)... cloud storage GoDaddy (GDDY)... domain names Verisign (VRSN)... domain names Groupon (GRPN)... e-commerce Overstock.com (OSTK)... betting on bitcoin Dolby Laboratories (DLB)... audio technologies Home Depot (HD)... home improvement Owens Corning (OC)... roofing and insulation Armstrong World Industries (AWI)... walls and ceilings Honeywell (HON)... manufacturing Dollar General (DG)... discount retailer Dollar Tree (DLTR)... discount retailer VF Corporation (VFC)... The North Face, Victoria's Secret, Wrangler Marriott (MAR)... hotels Winnebago Industries (WGO)... road trips Becton Dickinson (BDX)... needles and syringes MSCI (MSCI)... index provider

NEW LOWS OF NOTE LAST WEEK |

|

| How to bet on a higher U.S. dollar – with leverage... The dollar tends to move against other major currencies. So betting against this overly loved currency is a smart way to bet on a stronger dollar today... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Something strange is going on in the financial system. And it's causing some investors to move massive amounts of money out of banks. For the full story, click here. |

| Three Ways to Invest If 'This Time Is Different'... or Even If It's Not | | By Ben Morris | | Wednesday, November 22, 2017 |

| | Today, we'll look at three current "this time is different" scenarios. Our goal isn't to get to the bottom of each idea... Instead, we just need the appropriate investing or trading strategies for each situation. |

| | The Danger (and Promise) of 'This Time Is Different' | | By Ben Morris | | Tuesday, November 21, 2017 |

| | Today, we'll look at why folks are so tempted to believe this time is different. We'll look at examples from the past... how they turned out... and what we can learn from them. |

| | This Simple Phrase Could Be Costing You Money | | By Ben Morris | | Monday, November 20, 2017 |

| | It's one of the funniest phrases in the markets... No matter how many times it's proven false, people will always believe... |

| | This Technology Could Change Our Lives... And Much Sooner Than You Might Think | | By Justin Brill | | Saturday, November 18, 2017 |

| | The remarkable rally continues for one Stansberry Venture Technology holding... |

| | Stick It to the Taxman and Avoid the 'Death Tax' | | By Dr. David Eifrig | | Friday, November 17, 2017 |

| | No matter what happens with the death tax, we have a way to shield nearly $11 million from the IRS' death tax right now... |

|

|

|

|