A Skeptic's Look at One of the Biggest Investments of the Year

Earlier this week, I was in Philadelphia with some of the best and brightest from our publisher...

We talked about the biggest themes we anticipate seeing in the markets this year. I can't reveal much about what was said (although you'll probably be reading plenty about it from us throughout the year). But the one overall theme was how much – and how quickly – technology is changing our lives... especially technology that people weren't talking about just a few years ago. We also discussed what these big changes mean for our portfolios.

Take bitcoin, for example...

Last month, bitcoin marked a major milestone when it hit $100,000...

More than a decade ago, I was skeptical that bitcoin would go far. But plenty of folks came into my office telling me how excited they were to be an early investor. This was back when the value of a single bitcoin was around $0.10.

It hasn't been an easy road for cryptocurrency investors. Bitcoin has had massive moves higher. But it has also fallen in half over just a few months several times.

No matter its ups and downs, bitcoin has remained a popular investment, and it's becoming a part of everyday life. You can use it with PayPal, Cash App, and to withdraw cash in certain cities around the U.S. (And that's just some of what you can do with cryptos.)

Despite my earlier uncertainty, it's clear that cryptos aren't going anywhere anytime soon.

Our publisher, Stansberry Research, is fortunate to have its very own expert in the blockchain and cryptocurrency spaces – Eric Wade.

Eric knows all the biggest players in the industry, and he understands the scientific technicalities in a way that only angel investors, computer programmers, and software engineers know about.

Eric believes that right now is the last time you can get in "early" to crypto... thanks to President-elect Donald Trump. Eric says that Trump's outspoken support of crypto will be the catalyst for the next boom. Once Trump is inaugurated and the crypto world has U.S. government support, prices will never go back down to what they are now.

If you've considered investing in cryptos, Eric believes right now – before January 20 – is the best opportunity you'll ever get.

That's why he has arranged something extraordinary and completely unprecedented for folks who are interested.

See what Eric has to say here... and accept his offer by January 20.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 18, 2025

| Recommended Link: |

The BEST-PERFORMING Investment Asset on Earth If you'd put money in this asset any time over the past 13 years, you'd have outperformed every other investable asset on the planet. Now, you have the chance to see potential gains of 384 times on a single opportunity and five more offering 500% to 1,000% upside each. The analyst who has produced more 10-baggers than anyone else in Stansberry Research's 25-year history says this is the most important message he'll ever deliver. But you must act by January 20. Get access right here. |  |

|---|

|

Reader question of the week...

Q: I believe I have my emotions out of the picture by using adviser-recommended trailing stops to avoid holding onto anything I'm attached to or like too much to sell when I should. Is this the best strategy in your opinion? Thanks. – M.T.

A: Thanks for your question, M.T. If you're following any stop, you're already a step ahead of most folks. It's the best way to protect yourself against huge losses because it removes your emotions from the equation and keeps you from clinging to a loser.

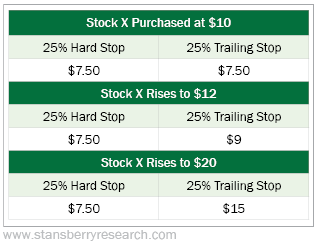

Stops come in two varieties: hard and trailing. Here's a look at how the stop types differ:

As stock X's price rises, the trailing stop follows it up, but the hard stop stays the same... no matter how high the share price rises. (Of course, the trailing stop doesn't follow the stock down. So if shares fall to $8 right after you buy them, your hard stop and your trailing stop both remain at $7.50.)

The kind of stop you should use depends on what you're investing in and what your goals are. Here at Stansberry Research, our editors will recommend different stops for different portfolio holdings – based on a given strategy or risk profile.

For example, I often recommend a 25% hard stop in my Retirement Millionaire newsletter, because our strategy is to let our winners ride for the long term, without needing to sell during a period of ordinary market volatility.

However, I recently switched some of my long-held winners to trailing stops to protect our gains. And sometimes I'll recommend a wider 35% stop to give a volatile stock more room to bounce around.

Meanwhile, our corporate affiliate TradeSmith goes even further and calculates a custom trailing stop for each stock based on its own volatility.

The further your stop loss is from the stock's current price or your entry point, the less likely you are to stop out... but the more you'll lose if the stock does reach that point. This all comes down to your own risk profile.

Now, I'm not entirely sure what you mean by an "adviser-recommended trailing stop"... But whether you're listening to a Stansberry editor, TradeSmith, or someone else's stop-loss recommendation, the most important thing is to stand by your choice.

Whichever stop you pick, sell when your stop is triggered... no questions asked.

Keep sending your questions, comments, and suggestions our way. We read every e-mail... feedback@healthandwealthbulletin.com.

| Profiting From Wall Street's Toxic Sludge Leave it up to Wall Street to ruin one of the safest strategies for generating a steady stream of income... |

|---|

| The Secret I Learned From a Mathematical Economist When I first started my career at Goldman Sachs, few people cared about the massive profits I generating for the bank... |

|---|

| How Every Winter Road Warrior Should Be Armed Kris Kerr never imagined she'd be trapped on a bus, dining on Rice Krispies Treats and wine... |

|---|

| Two Ways 'Old Man Winter' Is Out to Get You Last week, millions of folks along the East Coast had a foot or more of snow dumped on them... |

|---|

| Dear Mr. President Every Friday, we're following in the footsteps of President Franklin D. Roosevelt... |

|---|