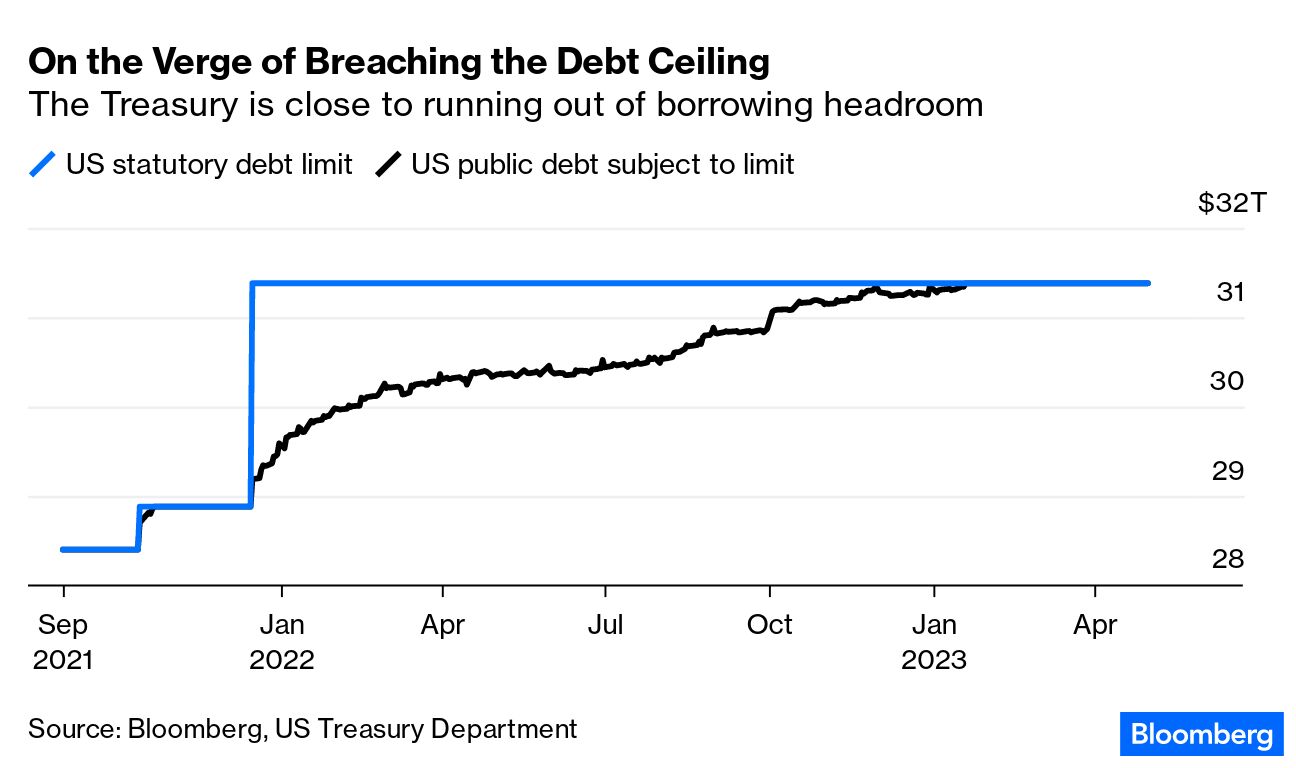

| Deutsche Bank is using artificial intelligence to scan wealthy client portfolios. ING Group is screening for potential defaulters. JPMorgan is advertising for more AI roles than rivals. Morgan Stanley bankers are, well, “experimenting.” Unsurprisingly, the AI revolution is unfolding rapidly on Wall Street as wider interest grows in the evolving technology and its likely impact on business. Given the fears of mass unemployment (if not extinction) at the robot hands of this new tech, it may be surprising to some that the nascent industry is actually creating jobs—for now anyway. At the most enthusiastic banks, about 40% of all open roles are for AI-related hires, such as data engineers and quants (as well as ethics and governance roles). Says Kirsten-Anne Bremke, global lead on data solutions at Deutsche Bank’s international private bank: “I’m a big fan of combining artificial and human intelligence.” —David E. Rovella It’s not over yet. US Senators scrambled Thursday to agree on a plan for swift consideration of the debt-limit deal forged by President Joe Biden and House Speaker Kevin McCarthy ahead of a June 5 deadline. Senators in each party met separately behind closed doors to sort through which amendments could be considered, and how best to pacify some last minute demands, including those by two Republicans who threatened maneuvers that could push a vote past the point where the government would default. The tightening cash situation and dwindling headroom under the statutory borrowing limit is forcing the Treasury to engage in fresh contortions almost daily. The department said Thursday that while it’s “tentatively” planning to proceed with its regular auctions of three- and six-month bills on Monday, it may have to postpone them if Congress hasn’t passed debt-cap legislation in time. It also plans to sell a rare one-day cash management bill on Friday and auctioned a three-day instrument earlier on Thursday as it seeks to preserve its position under the borrowing ceiling. Is an MBA from what is widely seen as the most prestigious business school in the US truly recession-proof? That claim—often implied, if not fully articulated—has been put to the test this spring at Harvard Business School. There’s “a lot of anxiety and trepidation about the job market,” says Albert Choi, a second-year student now planning his own business. And with good reason. When Iqbal Khan joined UBS from rival Credit Suisse in 2019, the crosstown move sparked a tabloid scandal over a cloak-and-dagger surveillance operation on the star banker. But in this year’s forced marriage of Switzerland’s two biggest lenders, he’s been conspicuously low-key. Seen by many insiders as a future UBS chief executive, Khan retained his pivotal role as head of global wealth management. But after a management reshuffle aimed at helping the combined entity meld its sprawling operations, other potential contenders have emerged to succeed CEO Sergio Ermotti, who returned to UBS to lead the integration.  Iqbal Khan Photographer: Arnd Wiegmann/Reuters A lopsided trade relationship with India is forcing Russia to accumulate up to $1 billion each month in rupee assets that remain stranded outside the country, swelling the stockpile of capital it’s amassed abroad since its invasion of Ukraine. Saudi Aramco met with an army of Turkish contractors this week to discuss $50 billion of potential projects in the Gulf kingdom, underlining improving trade ties between the two countries after they ended a diplomatic fight over the brutal murder of Washington Post journalist Jamal Khashoggi. The US resident was killed in Istanbul by agents of the Saudi government. Turkey transferred the case to Saudi Arabia in 2022. On the first day of 2023, a Washington-area parent woke up to an alarming message in her group chat of local moms: “Now that it’s January, what are you all thinking for summer camps this year?” The mother, whose oldest child is 4, was bewildered. Was Jan. 1 really the time to start thinking about summer camp? For parents like these, summer planning starts in winter, and the logistics can rival a military operation. In early May, another mom pulled up a spreadsheet to describe her kid’s summer: seven camps to cover the nine weeks for which they need child care. Not only was this program painful to map out—laboriously chosen for cost, location, and what she thought her child would enjoy—but it was incredibly expensive. And the price is only rising.  Mealtime at Falling Creek Camp in Tuxedo, North Carolina Photographer: David Burnett/Contact Press Images Bursting from retirement villages into the national conciousness, Pickleball is arguably the hottest sport in America. Fueled by celebrity enthusiasm, the paddle sport has gone pro, guided by a former Goldman Sachs partner and an A-list investor roster. In the premiere episode of the Bloomberg Originals series “Next in Sports,” we meet the world’s top players and get into the business of Pickle to assess whether this craze can survive—and thrive.  Photographer: Ronald Martinez/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Technology Summit, in San Francisco and virtually on June 22, will bring together innovators and decisionmakers to discuss the road ahead for Silicon Valley. The day-long event will focus on generative AI, the changing world of social media and the intersection of technology, finance and the global economy. Register now to secure your spot. |