| All-Time Record Bets on Silver... Here's What's Next | | By Dr. Steve Sjuggerud | | Friday, May 19, 2017 |

| Traders are making "extreme bullish bets on higher silver prices. And history says lower silver prices are likely, starting now."

I wrote that exactly one month ago in a Review of Market Extremes update (which is a part of my True Wealth Systems newsletter).

In hindsight, the timing was nearly perfect…

Silver peaked at around $18.50 just a few days before that. And it bottomed out at less than $16.50 over a week ago.

Let me show you what I saw a month ago to signal silver might fall…

----------Recommended Links---------

---------------------------------

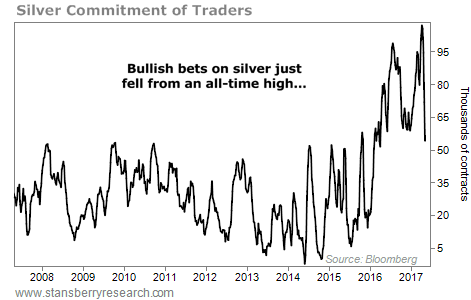

The story was simple. Bullish bets on silver had reached an all-time high. Take a look:

Specifically, silver traders in the futures markets had bought more silver contracts than at any time in history. That told me traders were extremely optimistic on silver.

This data comes from the Commitment of Traders ("COT") report. The COT report tells us exactly what futures traders are doing with their money.

I only use this report to spot extremes. I use it as a contrarian tool… When futures traders are all making the same bet, it signals a crowded trade to me – and the opposite often occurs.

My colleague Brett Eversole shared what happened the last time silver hit this kind of extreme in an April DailyWealth. Looking back at history, the only other time futures traders were close to this optimistic on silver was August 2016. The metal fell 24% over the four months that followed.

Based on that history, we believed a double-digit fall was likely this time… And we were right. Optimism was at an extreme. And a mini-crash followed.

The price of silver peaked for 2017 within days of the peak in optimism from silver traders…

I shared last month's peak in sentiment with my True Wealth Systems subscribers. And silver promptly fell double digits, percentage-wise, from that peak.

As you might guess, the optimism among silver traders has worn off from a month ago. We are no longer near the peak in optimism.

So is now a good time to buy? Not yet…

I am not rushing in to buy… I would rather wait for a moment of greater pessimism before I dive into silver.

We're not there… yet.

Good investing,

Steve

Editor's note: Steve's latest True Wealth Systems recommendation is the perfect setup... When this sector gets going, hundreds-of-percent gains are possible. During its last major boom, this group of stocks soared by 776% in five years. Now, signs point to another big rally... But no one is buying yet. To learn more about True Wealth Systems – and how to access this recommendation – click here. |

Further Reading:

"When an investment idea is truly hated... it has the opportunity to move dramatically higher," Steve writes. He's still waiting for extreme pessimism in silver... But right now, he sees another hated opportunity you can act on today – one with enormous upside. Learn more here: The Most Contrarian Opportunity of My Career. Steve's strategy of buying what's "cheap, hated, and in an uptrend" helps him focus on what matters in the markets. Recently, his colleague Brian Weepie wrote about this kind of advantage – and how to give yourself an edge in both business and investing. Read more here: You Don't Need to Be Rich to Win. You Need This... |

|

A SIMPLE INVESTMENT STRATEGY THAT WORKS...

Today's chart shows that "boring" usually wins in the stock market... Longtime readers know we love simple businesses that sell everyday essentials. Investing in these companies is one of the most powerful ways to build steady, long-term wealth. We're talking about businesses that sell things like booze, packaged foods, and cleaning supplies. Demand for these products never goes away. And right now, we can see this theme at work in another industry... Reynolds American (RAI) is one of the largest tobacco companies in the U.S. The $93 billion giant's operating companies make Camel and Newport cigarettes, as well as Grizzly and Kodiak smokeless tobacco. Last year, the company reported sales of roughly $12.5 billion, up 17% from the year before. In January, Reynolds American announced that it would merge with competitor British American Tobacco (BTI). The deal is expected to close in the third quarter of this year. Since British American's offer was made public last October, shares are up 40%... And the company recently hit a fresh all-time high. It might not be an "exciting" investment, but it's profitable... |

|

| This commodity just hit a new sentiment extreme... I wouldn't rush out to buy silver today – especially when so many better opportunities are hated and in an uptrend right now. I'm talking about opportunities like this commodity... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Urgent public notice for all gold investors. Rare new interview reveals why the number of U.S. Gold Eagle coins sold has plummeted 67% recently – and what gold investors are buying instead. Watch Here. |

| How This Ratio Can Dramatically Increase Your Income Every Year | | By Dr. David Eifrig | | Thursday, May 18, 2017 |

| | Watching the market flip and flop all over the place leads to bad decisions. People buy high and sell low. But there's an easier way... |

| | Think Like a Business Owner, Not Like a Trader | | By Dan Ferris | | Wednesday, May 17, 2017 |

| | "Multibaggers take time. If you can't be patient, you can't get rich in stocks. Period." |

| | How Have You NEVER Heard of This Company? | | By Dr. Steve Sjuggerud | | Tuesday, May 16, 2017 |

| | Have you seen a list of the world's top 10 largest companies recently? It has changed dramatically – in just a few years... |

| | Volatility Won't Cause a Crash in U.S. Stocks | | By Dr. Steve Sjuggerud | | Monday, May 15, 2017 |

| | Fear in U.S. stocks just hit a 24-year low, according to the market's "fear gauge." |

| | These Stocks Are Set to Outperform the S&P 500 | | By Justin Brill | | Saturday, May 13, 2017 |

| | Suddenly, investors are no longer favoring the U.S... Money is now moving out of American stocks – and into European and emerging market stocks – at the fastest rate in years... |

|

|

|

|