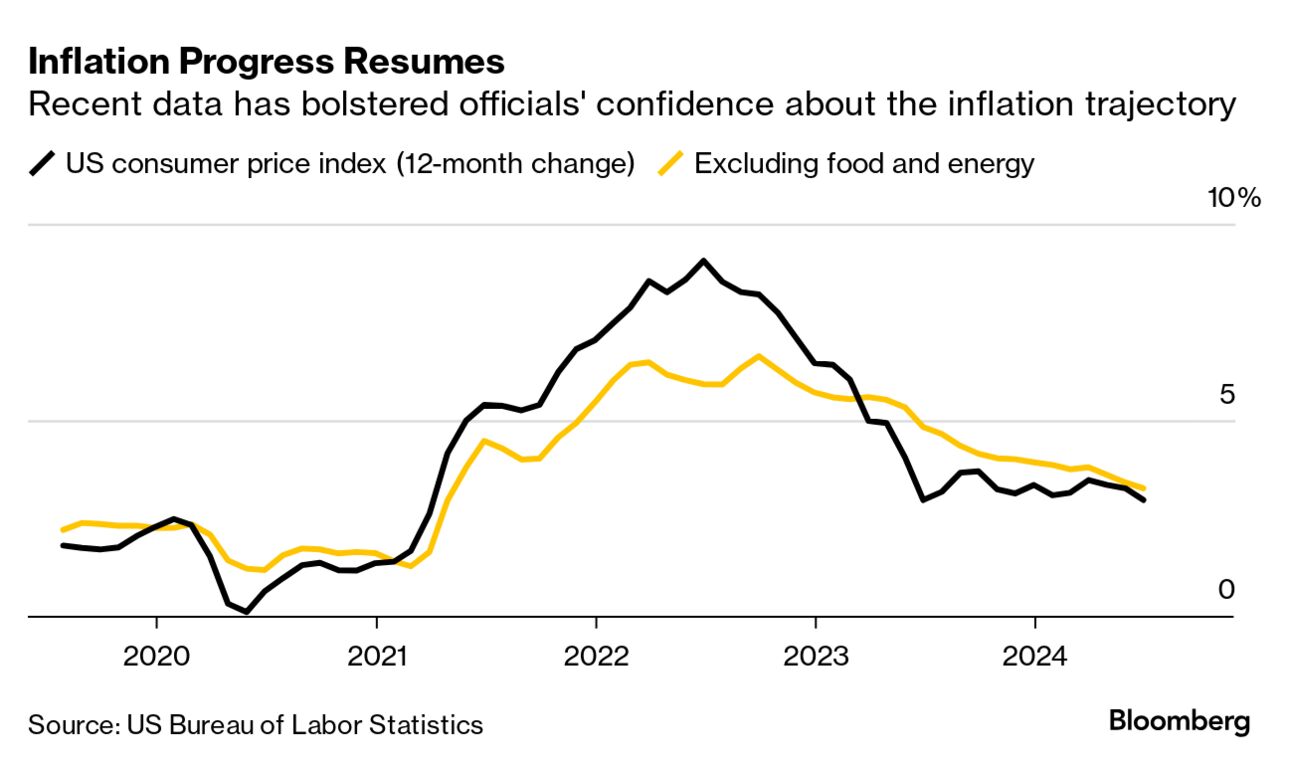

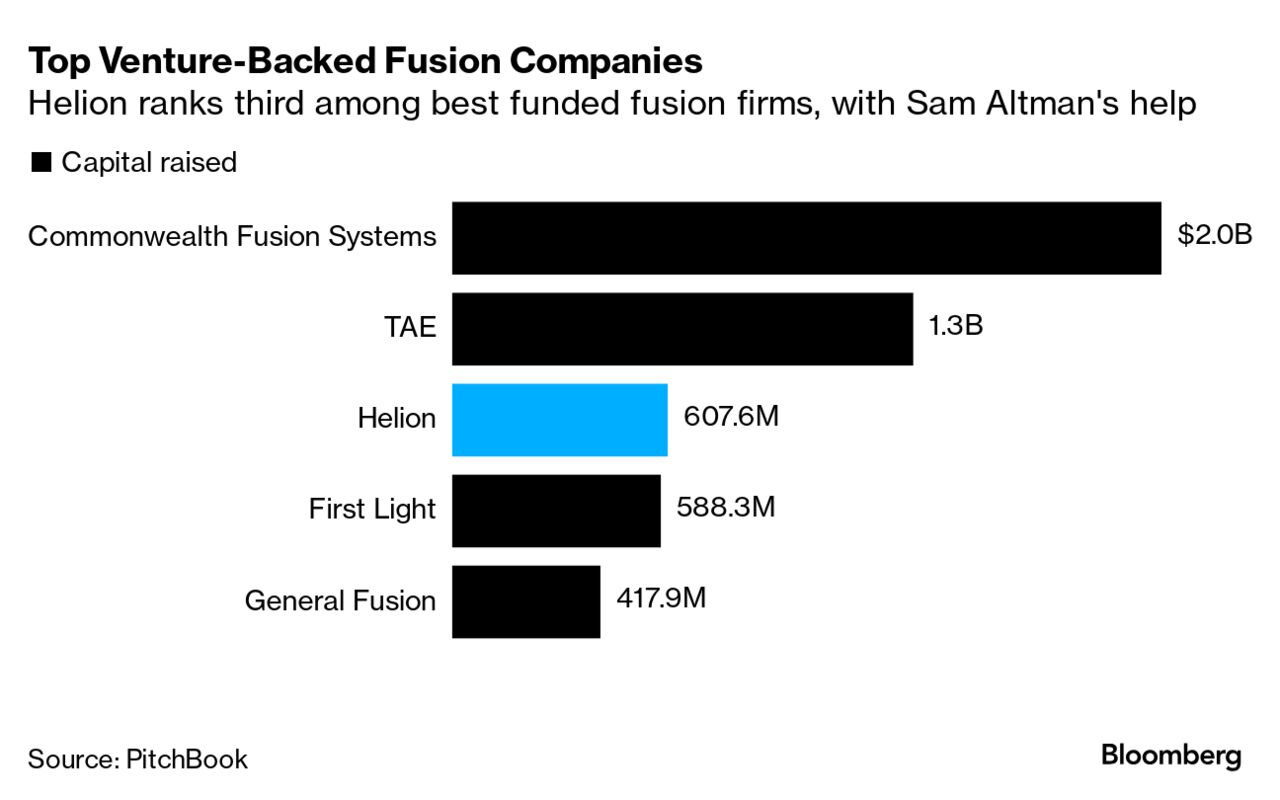

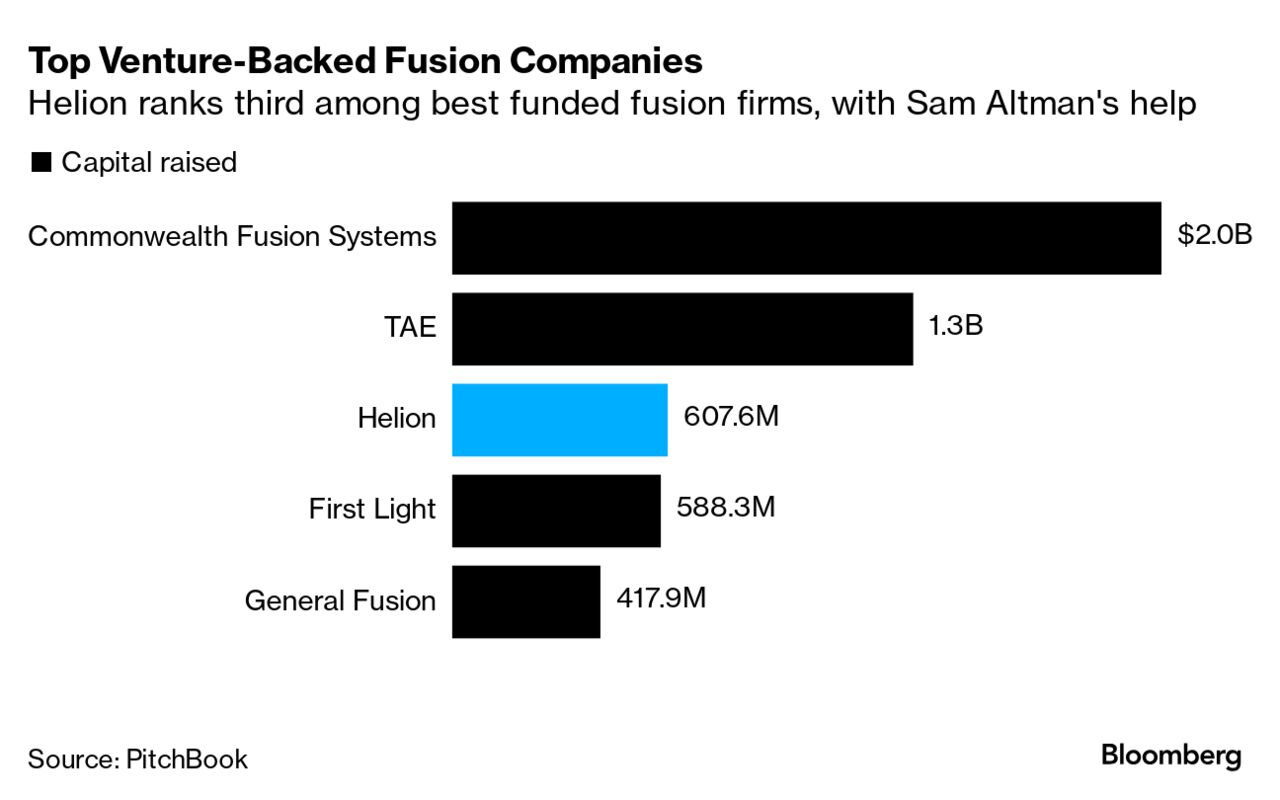

| For more than two years, inflation has eclipsed everything else at the US Federal Reserve. In a shift eagerly awaited by global markets, that’s poised to change. US central bankers appear ready to cut interest rates in September amid growing confidence that price stability is within sight— while risks to the labor market have grown. They’ve laid the groundwork for the coming move in speeches over recent weeks, and Chair Jerome Powell will likely flag it more explicitly after a policy meeting at the end of July. It’s not quite a done deal, mind you. But almost. Fed officials still want to see monthly price numbers continuing to trend down toward their 2% annual inflation goal before they commit to lowering borrowing costs from a two-decade high. But Powell and his colleagues are also determined not to squander the chance of sticking a soft landing for the US economy, which is showing at least a few signs of losing steam. —David E. Rovella President Joe Biden canceled an additional $1.2 billion in student debt for public servants on Thursday, the latest effort to provide loan relief and deliver on one of his signature initiatives. The assistance will affect 35,000 public service workers enrolled in the government’s loan forgiveness program, including nurses, firefighters and teachers. The Education Department has now forgiven $168.5 billion in student debt for 4.76 million Americans. Biden’s more ambitious plan to help Americans increasingly buried for decades under massive educational debt, a $400 billion plan for broad student debt relief, was blocked by the US Supreme Court. Biden, who the White House said is doing “fine” a day after testing positive for Covid-19, has faced more calls this week to end his re-election bid amid questions about his age. Former President Barack Obama has reportedly urged Biden to consider the possibility of an exit following his disjointed debate performance last month and the unceasing maelstrom that’s followed. The deepening crisis for the 81-year-old Democrat comes as 78-year-old Donald Trump—impeached twice, indicted four times and convicted of dozens of felonies—is to accept the presidential nomination of the Republican Party.  US President Joe Biden Photographer: Hannah Beier/Bloomberg The giants of Wall Street are smiling, Paul J. Davies writes in Bloomberg Opinion. Morgan Stanley and Goldman Sachs are confident that their most important clients are about to get off the sidelines and help power a long-awaited revival in investment banking fees. The private equity deal machine has been mostly jammed up for the past two years, Davies writes, leaving many investment bankers waiting for supposed green shoots to actually grow. Davies says one sign of this cash-laden horizon is the wave of debt refinancing that’s led this year’s revenue recovery for banks: It’s been helping to fix the prospects of many companies owned by private equity firms. NATO may soon have a rival, James Stavridis writes in Bloomberg Opinion. While the Western defensive alliance just held an important gathering in Washington, another—the Shanghai Cooperation Organization—recently met in Astana, the capital of Kazakhstan, an energy giant and founding member of the SCO. In the West, many don’t pay much attention to the SCO, which was established three decades ago by China, Kazakhstan, Kyrgyzstan, Russia and Tajikistan. But the West should, Stavridis writes. Among others, India and Pakistan became members in 2017. Iran joined in 2023 and Belarus, a puppet of Vladimir Putin’s Russia, just signed on. There are also 14 “dialogue partners” across Asia and the Middle East—including Turkey, a NATO member. The Philippines is developing an airport on an island in the South China Sea on Thitu Island, also known locally as Pag-asa Island, as the Southeast Asian nation asserts its claims amid tensions with Beijing. The Philippines has been seeking to project resolve in the face of aggressive tactics by Chinese vessels across the region. Manila has also been sending vessels into the disputed sea, leading to clashes. A military runway on the island of Balabac in Palawan province near the South China Sea is also nearing completion. Balabac is one of the four new sites that the US military can access under a defense agreement that was expanded last year.  Pag-asa Island Photographer: Jam Sta Rosa/AFP/Getty Images Taiwan Semiconductor Manufacturing lifted projections for 2024 revenue growth after quarterly results beat estimates, reflecting its confidence in the longevity of the global artificial intelligence spending boom. The chipmaker for Apple and Nvidia now expects sales to grow more than the maximum mid-20% it had guided toward previously. The revisions underscore TSMC’s view that AI spending will remain elevated despite growing US-Chinese trade tensions. In both countries, startups and tech firms are splurging on AI infrastructure, largely powered by Nvidia accelerators. Billionaire OpenAI CEO Sam Altman is—as with so many billionaires these days—staking a sizable chunk of his personal wealth on nuclear fusion—the elusive, always-just-a-few-decades-away limitless clean-energy source that could solve all our problems. Oh, and Altman notes it can help him build our AI-enabled future. But while others in his uber-wealthy neighborhood (Jeff Bezos, Bill Gates etc.) have backed fusion ventures, Altman has made his largest personal investment in Helion Energy, which stands out for its audacious timeline. It plans to open the world’s first fusion power plant by 2028 and to supply Microsoft with energy from it soon after. But Helion offers little to persuade doubters or skeptics: Though it’s among the best-funded fusion companies, it doesn’t publish experimental results or engage in peer review the way large rival startups do, raising some pretty big red flags.  Any discussion of the Chinese economy in the past few years is likely to have touched on its property sector implosion, the catastrophic loss of life following its “Covid zero” reopening, crackdowns on the tech sector and a general failure to launch. But amid all his struggles, President Xi Jinping has been pursuing a long-term plan to turbocharge China’s new engines of economic success—with an eye toward catching and surpassing the world’s tech behemoths. In the Bloomberg Originals mini-documentary How China Is Rewiring Its Faltering Economy, we explain how Beijing has directed massive resources toward transforming its famous “factory floor” industrial economy into one dominated by, among other things, the clean technology that will eventually power a post-fossil fuel world.  Watch How China Is Rewiring Its Faltering Economy Big Take Asia: Every Tuesday on the new Big Take Asia podcast, Bloomberg reports on the critical stories at the heart of the world’s most dynamic economies, delivering insight into markets, tycoons and businesses driving growth across the region. You can also listen daily to powerful Bloomberg deep-dives on the original Big Take podcast and hear fresh takes on what’s going on in Washington every Thursday on the Big Take DC podcast. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |