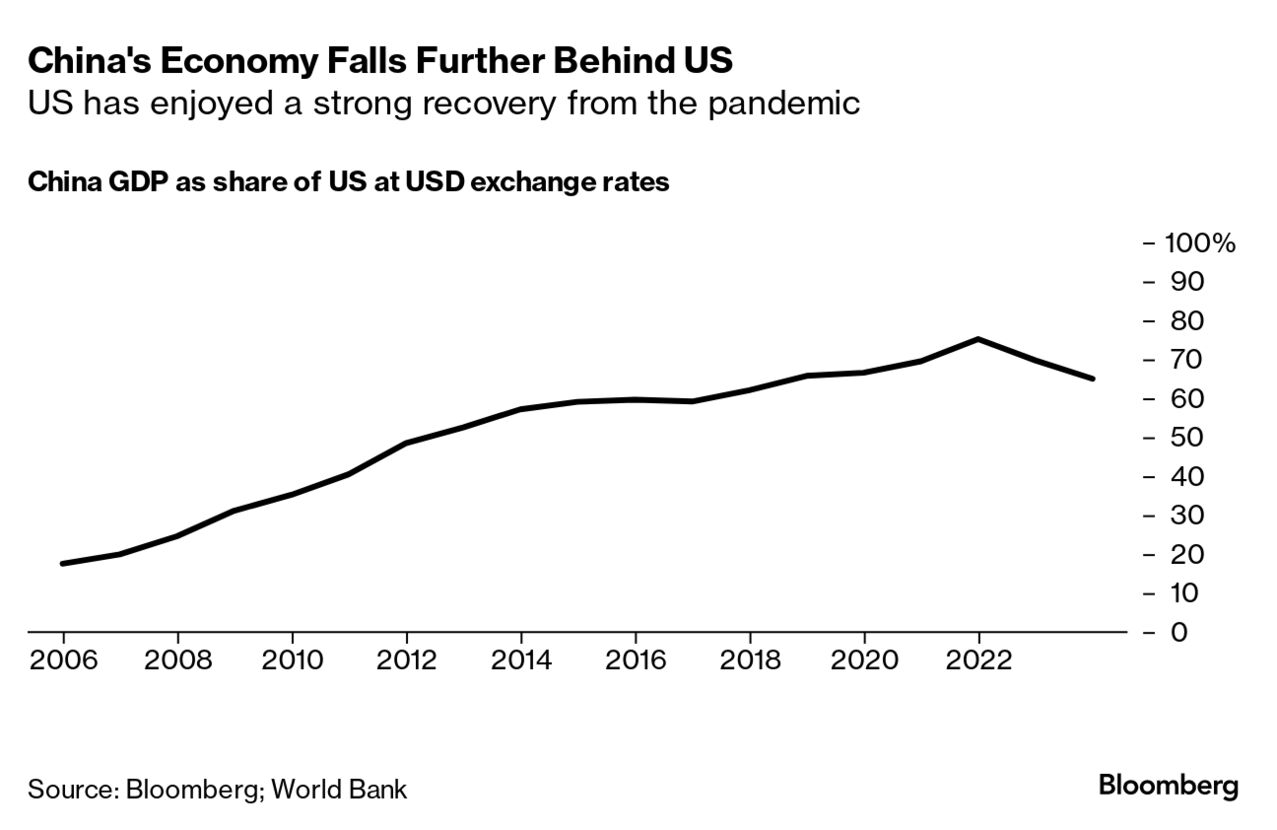

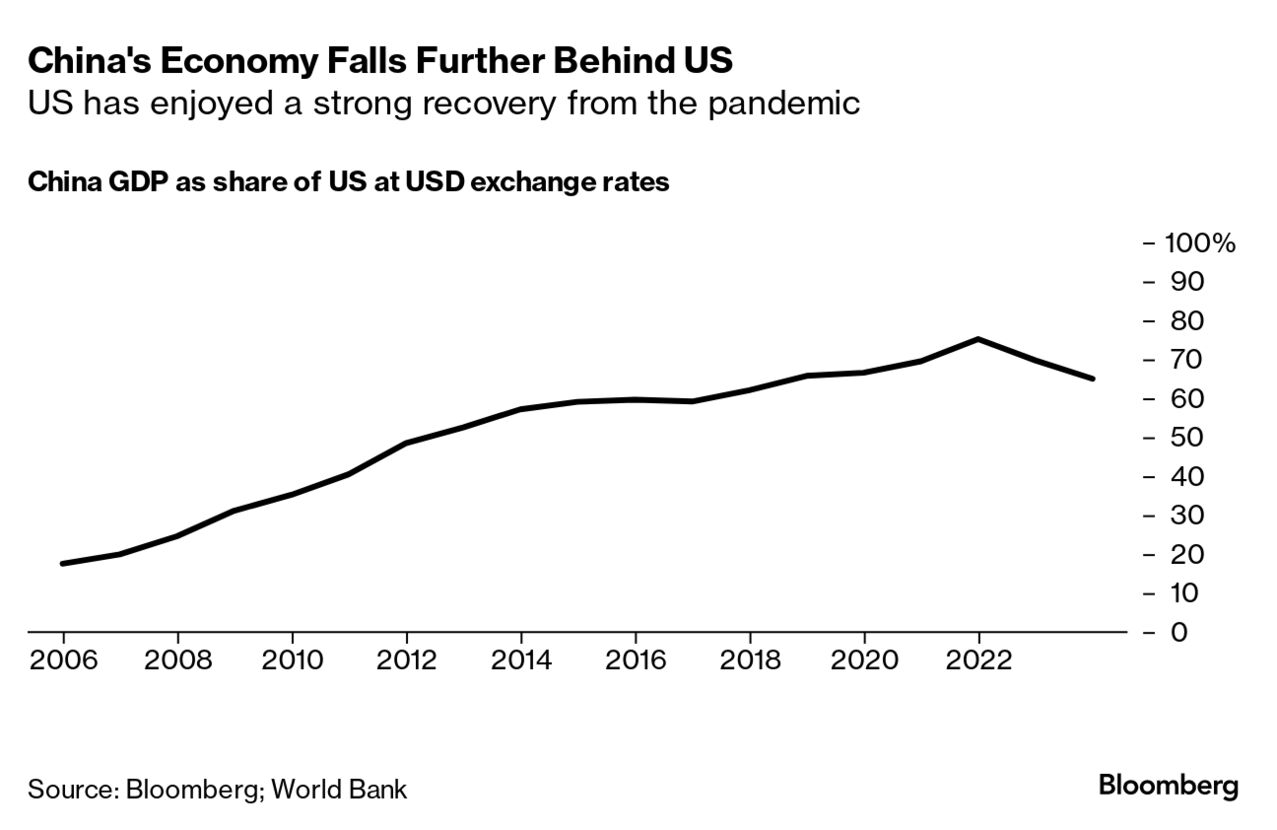

| The US economy continued its seemingly unstoppable ascent out of the pandemic recession and its inflationary aftermath, further burying wrong calls of recession by posting fourth-quarter growth numbers that crushed forecasts. Cooling inflation has fueled consumer spending amid continued, near-record low unemployment and rising wages. The economy’s main growth engine—personal spending—rose at a 2.8% rate while business investment and housing also helped fuel the larger-than-expected advance. A closely watched measure of underlying inflation rose only 2% for a second straight quarter, in line with the Federal Reserve’s target and its plan for a soft landing. Meanwhile, Americans who have voiced negativity in the face of an economy that’s been firing on all thrusters may be finally coming around, as consumer sentiment begins to rise. Wall Street cheered. Here’s your markets wrap.  Meanwhile, the US has pulled further ahead of China as the world’s biggest economy, thanks in part to those big-spending American consumers. “It is a striking turn of fortunes,” said Eswar Prasad, who once led the International Monetary Fund’s China team and is now at Cornell University. “The strong performance of the US economy, in tandem with all the short-term and long-term headwinds the Chinese economy is facing, renders it a less obvious proposition that China’s GDP will someday overtake that of the US.” —David E. Rovella Financial firms usually grumble in private after getting punished by regulators. Now, Chatham Asset Management is dragging its advisers into a very public $100 million legal battle. The $6 billion hedge fund is demanding that Adviser Compliance Associates not only cover Chatham’s costs for settling a US probe last year, but also damage to its business. In the unusual lawsuit, Chatham claims the outside consultant—founded by former regulators—failed to prevent trading practices that ran afoul of authorities. JPMorgan Chief Executive Officer Jamie Dimon moved a handful of his top lieutenants into new senior roles, positioning them for more experience running the firm’s operations as he prepares potential successors. It’s a high-stakes maneuver: JPMorgan just achieved the largest annual profit of any bank in US history. But as Bloomberg reported in December, insiders have been predicting it would need to rotate bosses to give them new challenges.  Jamie Dimon, chief executive of JPMorgan, at the World Economic Forum in Davos, Switzerland, on Jan. 17 Photographer: Hollie Adams/Bloomberg Stand For America Fund, the super political action committee backing former South Carolina Governor Nikki Haley, is said to have raised $50.1 million in the last six months of 2023, a haul fueled by Wall Street and corporate executives seeking to stop Donald Trump’s bid for the GOP presidential nomination. That’s also about $5 million more than the super PAC backing the twice-impeached former president raked in over the same period. Russia imported more than $1 billion of advanced US and European chips last year, despite restrictions intended to stop Kremlin leader Vladimir Putin’s military from getting hold of technology to fuel his war on Ukraine. Classified Russian customs service data obtained by Bloomberg show that more than half of imported semi-conductors and integrated circuits in the first nine months of 2023 were manufactured by US and European companies.  People kneel as soldiers carry the coffin of Ukrainian serviceman and famous Ukrainian poet Maksym Kryvtsov in Kyiv on Jan. 11. Photographer: Efrem Lukatsky/AP Apple is embarking on a historic overhaul of its iOS, Safari and App Store offerings in the European Union, aiming to placate regulators set to impose tough new antitrust rules. The revamp will allow customers to download software from outside the App Store for the first time. They’ll also be able to use alternative payment systems and more easily choose a new default web browser—addressing two frequent complaints of developers and lawmakers. Intel tumbled in late trading after giving a disappointing forecast, signaling that it continues to struggle to defend its once-dominant position in data center chips. Nvidia and Advanced Micro Devices have remained the stock-market darlings of the chip sector, largely because investors expect them to benefit the most from a surge in spending on artificial intelligence-related infrastructure. Video-game maker Blizzard Entertainment canceled one of its biggest projects on Thursday as part of a reorganization under new owner Microsoft, leading to the mass termination of 1,900 people, or 8% of the gaming division’s total staff. It wasn’t long ago that spending $1,000 a night on a hotel room was considered a wild extravagance, even among ultrahigh-net worth travelers. But lately that figure merely gets you in the door at luxury properties in major markets. More than 20 Paris hotels now charge at least $1,000 for entry-level rooms; in London, 13 hotels reached that threshold. There were a dozen in New York.  Sky Terrace suite at Atlantis the Royal in Dubai. Source: Atlantis the Royal Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Green Festival: The world needs radical solutions to address global warming and climate change. Join us in Seattle July 10-13 for the inaugural Bloomberg Green Festival, a groundbreaking celebration of thinkers, doers and innovators leading the way into a new climate era. The festival will immerse attendees in solutions-driven experiences with world-renowned experts to inspire climate action. Get 40% off if you secure your tickets by Jan. 31. |