|

| |

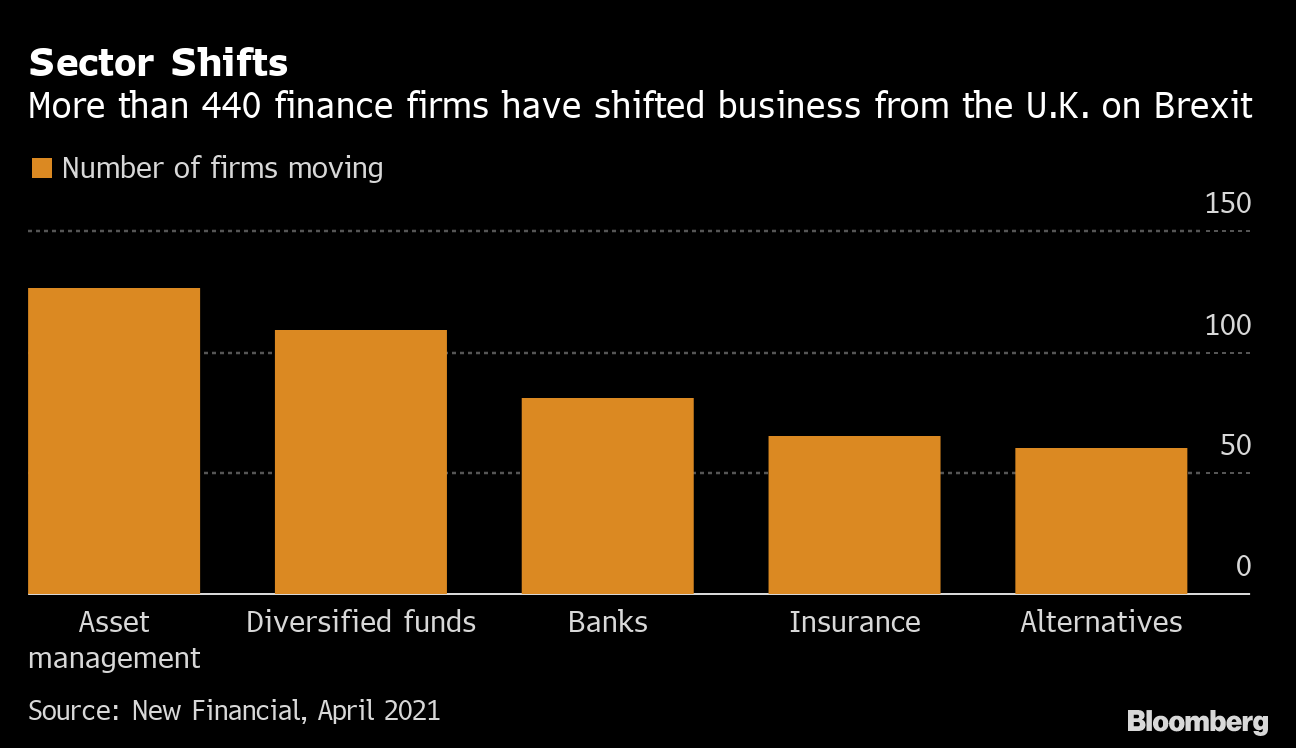

| We know three things about the U.S. economy, Peter Coy writes in Bloomberg Businessweek: The rich are getting richer, everyone else is in debt and interest rates have fallen. The connection between these three facts has implications for fiscal and monetary policy. By forcing interest rates down, extreme wealth inequality is pushing the U.S. economy toward a “debt trap.” —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic worldwide. Here are today’s top storiesGroup of Seven governments are nearing a deal to pursue a minimum corporate tax rate of at least 15% in international negotiations, but remain at odds over how to treat global technology companies. U.S. equities climbed Friday, pushing the S&P 500 close to an all-time high after a pickup in hiring last month bolstered confidence in the economy, though the 559,000 new jobs were less than the average forecast. A strong rise in hourly wages had Wall Street worrying about inflation. Here’s your markets wrap. When JPMorgan asked a team of about 15 London-based equity derivatives traders to move to Paris, it didn’t go down well. Almost half of them chose to quit. And it’s not just JPMorgan: The resistance among some to leave London poses a conundrum for the industry, coming at a time when banks are facing increasing pressure to move staff into the bloc after Brexit.  Novo Nordisk received U.S. approval for its therapy that helped patients lose about 15% of their body weight in trials, an alternative to an existing drug as well as invasive, expensive obesity surgery. Though they have less in the bank than older Americans, millennials and Generation Z are the ones opening their wallets as the U.S. economy recovers. They may be spending even more than they did before the pandemic. U.K. tourists scrambled to return from Portugal before a quarantine requirement kicks in on Tuesday, driving ticket prices up to $1,000 as travelers rearranged flights ahead of the deadline. Coronavirus infection rates in the U.K. are heading in the wrong direction at just the wrong moment for Prime Minister Boris Johnson. Bribery works in a pandemic. U.S. President Joe Biden’s announcement last week that Anheuser-Busch InBev would give away beer was the latest bid to coax hesitant Americans to get vaccinated. Other public officials have dangled empanadas, guns and even cash. Outside the U.S., a shipment of donated shots is headed to South Korea, the first of 25 million stockpiled doses Biden pledged to distribute worldwide. Here’s the latest on the pandemic. What you’ll need to know tomorrow

Onassis Family Is Selling a Painting by ChurchillAfter sitting in storage for decades, a painting by Winston Churchill is coming to auction at Phillips New York with an estimate of $1.5 million to $2 million, Bloomberg Pursuits reports. The landscape, The Moat, Breccles, was painted by Churchill in 1921 and remained in his own collection for 40 years.  Aristotle Onassis and Winston Churchill in 1959 Photographer: Keystone-France/Gamma-Keystone Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. The Bloomberg Deals Summit: Join top CEOs and the biggest dealmakers on June 8 as they share their insights into the historic boom and how long they think it will last. Topics will include how to do a megadeal and choosing between an IPO, direct listing or SPAC. Register for the virtual summit here. |

|

|

|