|

Today’s letter is brought to you by Sidebar!

Ready to take your career to the next level? Make your transition successful by leveraging a Personal Board of Directors. A trusted peer group, with battle-tested perspective, and proven playbooks, to have real, tactical discussions with to propel you forward.

With Sidebar, senior leaders are matched with a small group of highly-vetted, private, and supportive peers to lean on for unbiased opinions, diverse perspectives, and raw feedback. Everyone has their own zone of genius. Together, we’re better prepared to navigate professional pitfalls and push each other to do more, do it better, and do it faster.

“Providing and receiving support from others who play a similar role to you is one of the best ways to grow your capabilities and succeed.” - Vice President, Roku

“You’re the average of the people you keep closest; Sidebar helps you raise that bar.” - Global Director, Reddit

“Tap into a new level of coaching support, professional development, and peer-driven accountability.” - Senior Director, Credit Karma

Why spend a decade finding your people – join Sidebar today. Join the growing waitlist of over 5,000 top senior leaders, and apply to become a founding member.

To investors,

It has become obvious to me that American manufacturing is an essential component of our national security strategy moving forward. We need American companies building American technologies, including semiconductors.

As I researched this topic more, I was introduced to the team at Auradine. They are tackling two things I am interested in — American manufacturing and bitcoin mining. The founders are highly successful Silicon Valley entrepreneurs who are dedicating their time and resources to tackle a very difficult problem.

I asked Viswesh Ananthakrishnan, Head of Product Management, at Auradine to write a guest post on why it is critical to have US suppliers design & manufacture advanced semiconductors and systems for Bitcoin mining. Here are Viswesh’s thoughts:

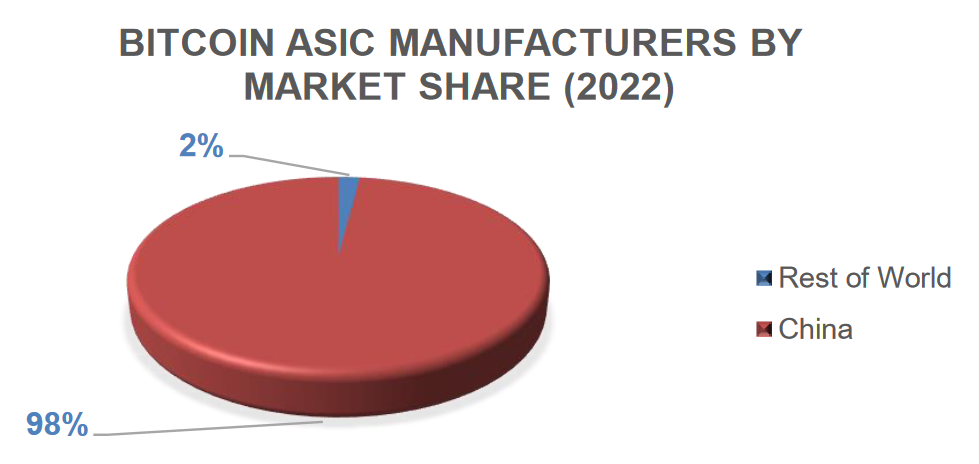

Advanced semiconductors are crucial components in Bitcoin mining solutions, providing the computational power necessary to solve complex mathematical problems and earn mining rewards in the form of Bitcoins. At present, China has a manufacturing monopoly on ASICs used in Bitcoin mining. However, the size of the Bitcoin mining industry (by market capitalization) outside China is disproportionately much larger.

This lopsided distribution shows that even though China may have a stronghold on the manufacturing front, other countries and regions are contributing significantly to the overall growth, development, and profitability of Bitcoin mining. The decentralized nature of Bitcoin allows participants from around the world to engage in mining activities, resulting in a diverse and widespread ecosystem beyond the borders of any single country. It only makes sense that the design and manufacturing of Bitcoin mining ASICs should follow suit.

Unfortunately, the US semiconductor industry’s share in global semiconductor production capacity has seen a sharp decline over the last 30 years, falling from 37% to just 12%. This decline has been driven by increased competition from other countries and a lack of investment in domestic manufacturing capabilities. Recent events have demonstrated how vulnerable US businesses are to supply from overseas ASIC manufacturers. The COVID-19 pandemic had a significant impact on the semiconductor supply chain, causing disruptions and shortages that have affected a wide range of US industries.

Indeed, it has become crucial for the US to invest in and support its domestic semiconductor industry to ensure long-term growth and stability, in general for the broader economy and also specifically for the Bitcoin mining industry.

“Making more semiconductors in the United States […] will strengthen our national security by making us less dependent on foreign sources”

– Joe Biden, 46th President of the United States, July 2022

In response to these challenges, the Biden-Harris Administration has launched efforts to bring semiconductor manufacturing back to America through the CHIPS and Science Act. While these efforts represent important steps forward, there is still much work to be done to rebuild the U.S. semiconductor industry and ensure its long-term competitiveness.

Meanwhile, the economic significance of the Bitcoin mining industry in the US cannot be overstated, with a projected compound annual growth rate (CAGR) of 9.3% between 2023 and 2029, starting at $9 billion in 2022. The maturation of capital markets and the development of financial instruments have played a key role in the quick ascent of the Bitcoin mining industry in the U.S. In recent years, there has been a surge of interest in Bitcoin and other cryptocurrencies from institutional investors. Recently, several asset management firms, including BlackRock and Fidelity, have filed applications with the SEC to launch Bitcoin ETFs.

“The role of crypto is digitizing gold. […] Let’s be clear, bitcoin is an international asset, it’s not based on any one currency and so it can represent an asset that people can play as an alternative.”

– Larry Fink (CEO of Blackrock), in an interview with Fox News, July 2023

The development of Bitcoin ETFs could further accelerate the growth of the Bitcoin mining industry in the U.S. If approved, these ETFs would make it easier for investors to gain exposure to Bitcoin through existing financial infrastructure and eliminate the need to hold the cryptocurrency themselves. This could lead to a surge in demand for Bitcoin from US investors and further growth of the mining industry in the U.S.

Local governments can play a crucial role in supporting their local Bitcoin mining industry by providing regulatory clarity, investing in infrastructure, offering tax incentives, promoting education and research, collaborating with industry associations, and supporting entrepreneurial initiatives. This support can foster economic growth, technological innovation, and job creation within the cryptocurrency mining sector. Examples from around the world, such as Crypto Valley in Switzerland, Inner Mongolia in China, Texas in the US, Alberta in Canada, Iceland, and Kazakhstan, demonstrate the different approaches governments can take to support their local mining industry. By providing a supportive environment for Bitcoin mining, local governments can attract and retain mining operations, contributing to the local economy and promoting the growth of the broader cryptocurrency industry.

In conclusion, recent developments in the geopolitical landscape and the strained relationship between the US and China in the advanced semiconductor and related technologies sectors portend a serious threat to the growth of several US industries. Specifically, US-based Bitcoin miners face significant challenges with the unpredictable supply of cutting-edge ASICs, potential security issues, and continued profitability.

It is critical for the United States to invest in designing and manufacturing advanced semiconductors for Bitcoin mining. This will help ensure a resilient supply chain, promote economic vitality, and maintain technology leadership in this rapidly growing industry. Continued investment and support for the domestic semiconductor industry is essential to achieving these goals and ensuring the long-term competitiveness of the U.S. in the global market for advanced semiconductors and systems.

Hope you enjoyed this guest post from Viswesh Ananthakrishnan, Head of Product Management at Auradine, on why it is critical to have US suppliers design & manufacture advanced semiconductors and systems for Bitcoin mining. Have a great day and I’ll talk to members tomorrow.

-Pomp

Peter Johnson is the Co-Head of Venture Investments at Brevean Howard Digital.

In this conversation we talk about the epic rise of stablecoins, how they have become the killer app of blockchain technology, where stablecoins are being used, why they are being used, and who is using stablecoins.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Pomp’s Appearance on Fox Business with Liz Claman Yesterday

Podcast Sponsors

Velo Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem.

Range - Get started today with code POMP15 for 15% off any quarterly plan for your first year.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.