|

| - | - | - | - | - |

| |

|

|

|---|

Saved cash? Shout it from the rooftops.If this email's ever helped you, please forward it to friends and suggest they get it via moneysavingexpert.com/tips |

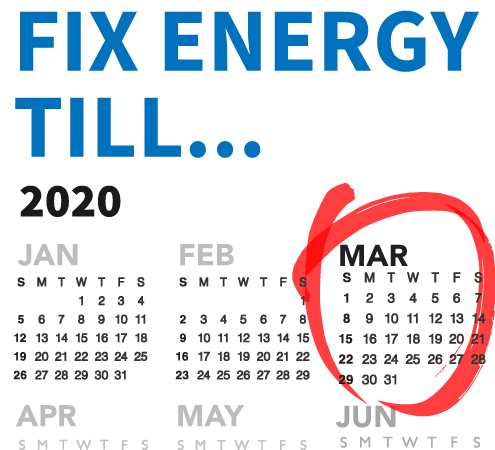

| New. Lock in cheap energy for 2 YEARS from top service Ovo: Save £420 We covered energy last week, but when we saw this tariff from Ovo, we thought it was too good to miss. The deal lasts two winters, so you won't have to switch again till 2020, and it's from Ovo - a top service, big name firm which 80% of its customers rate as 'great'. James got last year's deal: "Was fortunate to catch Ovo's 2yr fix which saved £400/yr thanks to @MartinSLewis." Of course you can go cheaper (do a full market comparison) if you lock in for just one year, but this gives you certainty and hopefu lly it's hassle-free too.

|

| A personal message from Martin 'To those who sent me messages about my interview on losing my mum when I was 11, please read this.' See Martin's blog. _________________ Rare cashback on Amazon purchases - if you have (or know) a kid. Most cashback sites don't work on Amazon, yet there's a way to get Amazon cashback. Get £200 cashback on £1,900+ Nutmeg investment. Investing can be risky but if you're going to put money into one of these much-advertised 'robo-investors', our special link gives a 10%+ head start. Full explanation and pros and cons in Robo-investing cashback. Ends Mon. Free £125 to switch bank to Halifax (or get £200 to switch to HSBC). Apply to switch to Halifax by 11.59pm on Monday and you'll get a free £125 paid before the switch completes. It also pays an ongoing £3/mth. It' s one of many bank switch freebies incl... HSBC up to £200 | First Direct £125 + top service | M&S £125 gift card + £5/mth. Full switching help and eligibility criteria in Best Bank Accounts. Cheapest Samsung S9 - save £550. Not MoneySaving, and early adopters often pay more, but we've crunched the numbers if you're buying now. Cheap Samsung S9 M&S up to 50% off sale. Incl women's, men's and kids' clothing + furniture. In stores and online. M&S sale |

| |

|---|

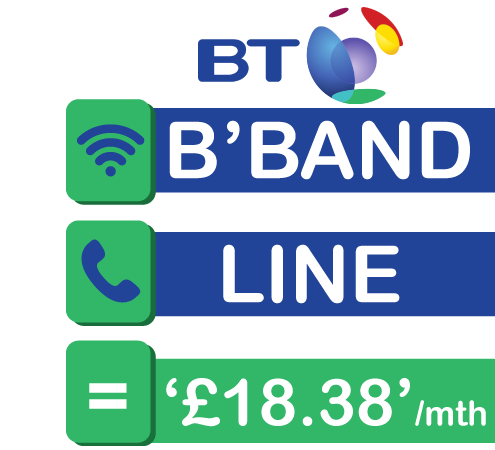

| Ends Thu. BT fibre b'band & line '£18.38/mth' (+ BT Sport discount) This is the cheapest BT fibre broadband deal we've seen this year and undercuts any promo deal for fibre broadband (which is faster than standard speeds) right now, but it's not on for long...

|

| Sky Sports full package £150 for 9mths - and you don't need a Sky box (equiv £16.66/mth). Most pay £27.50/mth on a non-promo deal. Cheap Sky Sports 3m EHICs expired last year and weren't renewed - check yours now. It's free and gets free or discounted medical care if you fall ill in Europe. See how to check and get a free EHIC. New. £8 off Disney Florida tix + more Mickey MoneySavers. Incl cheaper eats, £50 off hotels and hidden freebies. 35+ Disney Orlando tips Virgin Trains up to 52% off West Coast sale, incl Ldn-Birm £10 rtn. For travel 3 Apr-1 Jun. For most, book from Thu (though some can do it now). All aboard Co-op Electrical eBay outlet 20% off code, eg, £269 Dyson cordless vacuum £215. Valid on 1,000 items until Thu. Min £60 spend. Outlet code Let firefighters wash your car - and donate to charity. 'Pay what you like' for a car wash - and they may even use their big hose. Oo-er |

| AT A GLANCE BEST BUYS

|

| 'I found my PPI details down the back of a cupboard - and got £27,764 back' One big barrier to reclaiming Payment Protection Insurance (PPI) is not having the info, yet as Selina's just emailed us, it's worth doing some digging: "I was putting off claiming as I had no account info till I found a carrier bag down the back of a cupboard with it in. I've now had £27,764 back, hoping to hit £30k with two more reclaims. Thanks for making it easy." Selina used our PPI reclaim guide & FREE tool. So if you've ever had a loan, card, mortgage or overdraft, take note...

|

| FLASH Habitat 25% off almost everything code. Online and in stores. Wed-Thu only. Habitat HAGGLING - SUCCESS OF THE WEEK £10 for two Ideal Home Show London tickets (& Martin's there too). For those who missed out on the freebies last month.Ideal Home Show tix. Related: FREE Homebuilding & Renovating Show tickets. |

| THIS WEEK'S POLL Are you part of the cashless society? For some, the days of pockets stuffed with cash are long gone. Contactless cards especially now mean even small transactions can just be done with a 'beep'. So we wanted to test how cashless our society is now, and who's using it. How often do you use cash? |

| MONEY MORAL DILEMMA Should I split my will equally? I'm updating my will, and plan to leave everything to my two daughters. When my younger daughter got married a few years ago, I gave her several thousand pounds towards the wedding. So should my older daughter get more in my will, or is it fairer to split everything equally? Enter the Money Moral Maze: Should I split my will equally? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: What small MSE things will you do? |

|

| MARTIN'S APPEARANCES (WED 14 MAR ONWARDS) Thu 15 Mar - Good Morning Britain, ITV, Deals of the Week, 7.40am MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 14 Mar - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: Can British Gas force me to have a smart meter? Anon, via email.

While you can't be forced to get a smart meter, it's worth noting British Gas and some other firms can and do insist you get a smart meter to qualify for certain tariffs, often including their cheapest. See our Smart Meters guide for more on the pros and cons. Please suggest a question of the week (we can't reply to individual emails). |

| THE 22-YEAR-OLD MOBILE PHONE... WHICH STILL WORKS That's all for this week, but before we go... the relaunch of the classic Nokia 8110 mobile phone has prompted MoneySavers to share pictures of ancient handsets they still own. Favourites include a Motorola with an aerial, a phone with a tiny 32MB storage and a Nokia 1610 from the mid-90s which STILL works (and runs on AA batteries). See the photos and share your own with our Old-school mobile phone Facebook post. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email sainsburysbank.co.uk, uk.virginmoney, zopa.com, admiral.com, bank.marksandspencer.com, secure.ybonline.co.uk, secure.cbonline.co.uk, broadbandgenie.co.uk, mbna.co.uk, halifax.co.uk, confused.com, gocompare.com, moneysupermarket.com, directline.com, aviva.co.uk, admiral.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). The registered office address of both MoneySupermarket.com Group PLC and MoneySupermarket.com Financial Group Limited (registered in England No. 3157344) is MoneySupermarket House, St. David's Park, Ewloe, Chester, CH5 3UZ. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

ingredients, to ensure if you do need to borrow, it's as cheap and safe as possible. First the basics - then, for the icing on the cake, the clever stuff (OK, I think I've overdone the cooking analogy now).

ingredients, to ensure if you do need to borrow, it's as cheap and safe as possible. First the basics - then, for the icing on the cake, the clever stuff (OK, I think I've overdone the cooking analogy now).

MSE

MSE