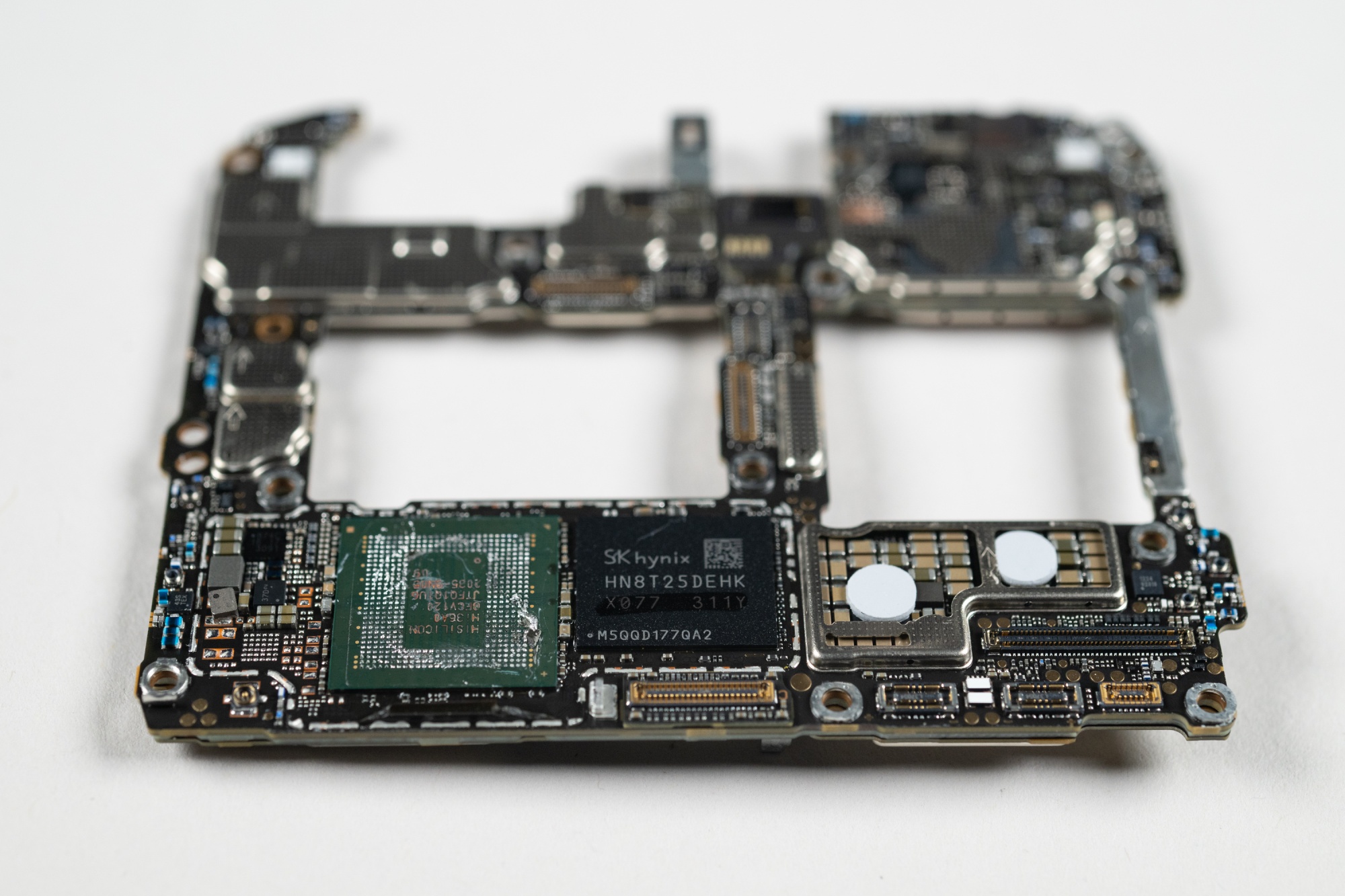

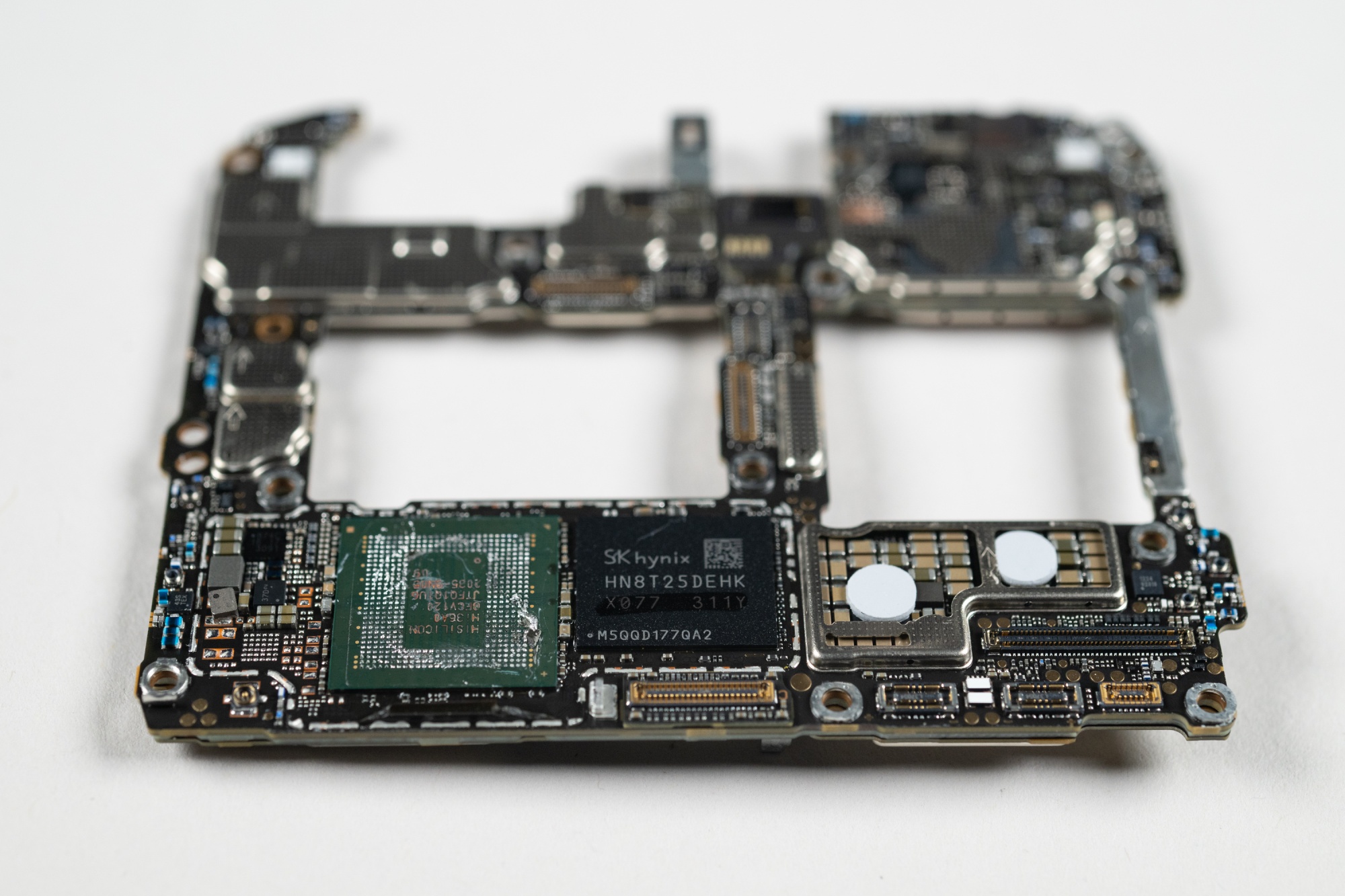

| One of Wall Street’s biggest stock-market pessimists dialed back his gloomy forecast for the S&P 500 Index. Greg Boutle, head of US equity and derivative strategy at BNP Paribas, had predicted that the benchmark would end the year at 3,400, an 11% drop from where it finished in 2022. But this week, he capitulated. Boutle raised his target to 4,150—a revised projection that seems to reflect the growing expectation that the US economy will thread the needle of a soft landing, or at the very least avoid any downturn this year. Instead, Boutle said he expects stocks will drift down as growth cools and analysts lower forecasts for corporate earnings. —David E. Rovella China is looking to expand a ban on the use of iPhones in sensitive departments, government-backed agencies and state companies. In addition, Beijing intends to extend that restriction far more broadly to state-owned enterprises and other government-controlled organizations. If Beijing goes ahead, the unprecedented blockade will be the culmination of a yearslong effort to root out foreign technology use in sensitive environments. In markets Thursday, it wasn’t just Apple that took a hit on the news. Here’s your markets wrap. SK Hynix has opened an investigation into the use of its chips in the latest phone from Huawei after a teardown of the device revealed its memory and flash storage inside. China-based Huawei’s Mate 60 Pro uses Hynix’s LPDDR5 and NAND flash memory, said TechInsights, who conducted the teardown of the device for Bloomberg News. Icheon-based Hynix “no longer does business with Huawei since the introduction of the US restrictions against the company and, with regard to the issue, we started an investigation to find out more details,” a company spokeswoman said on Thursday.  Components of the Huawei Mate 60 Pro smartphone. Photographer: James Park/Bloomberg JPMorgan is said to be in the early stages of exploring a blockchain-based digital deposit token for speeding up cross-border payments and settlement. Deposit tokens are transferable digital coins that represent a deposit claim against a commercial bank—a digital version of the deposits customers hold in their accounts. The US’s biggest bank by assets has developed most of the underlying infrastructure needed to run the new form of payment, but doesn’t plan to create the token unless the project is approved by US regulators. Mortgage rates in the US decreased for a second week in a row. The average for a 30-year, fixed loan fell to 7.12% from 7.18% a week earlier, Freddie Mac said in a statement Thursday. Mortgage rates have been above 7% for the past four weeks and have more than doubled since the start of 2022. The surge in borrowing costs has stifled home sales and sidelined many buyers, squeezing affordability. Former Goldman Sachs partners Tom Connolly and Mike Koester are betting on one of the hottest corners on Wall Street for their next act. The New York-based duo have co-founded a new firm, 5C Investment Partners, that aims to capture a slice of the burgeoning private credit market, where alternative asset managers are increasingly displacing banks by providing multi-billion financings to companies. “Direct lending is playing a very important role during a market dislocation that is persistent,” Koester said in an interview Thursday, referring to regulation that has curbed bank lending since 2008. “There are credit-worthy companies that need financing.”  Tom Connolly, left, and Mike Koester Source: 5C Investment Partners The Lone Star State’s uniquely delicate power grid is in trouble again. Texas declared its first power emergency since a deadly winter storm two years ago and came close to rolling blackouts as soaring temperatures roasted the southern state. The declaration of a so-called Level 2 emergency late Wednesday came in response to shrinking supplies of available power and meant the Electric Reliability Council of Texas, the state’s grid operator, had to draw on reserves while pushing consumers to curb usage. What if there were a country where politics had yet to be polarized by social media? One where most people not only choose to vote online, but freely provide their personal information to the government? A country that serves as a possible model for how digitalization can be used for something other than misinformation and cyberattacks? Such a place arguably exists—and its name is Estonia. From government services to taxes and education, the Baltic nation set about transforming itself into a 21st century model for digital democracy soon after the fall of the Soviet Union. On the first episode of the Bloomberg Originals series Exponentially, investor and author Azeem Azhar sits down with Estonia Prime Minister Kaja Kallas, who shares how her government has sought to strengthen democracy by embracing technology.  Prime Minister Kaja Kallas spoke with Azeem Azhar about how Estonian democracy is being made more resilient with the embrace of technology, on the premiere of the Bloomberg Originals series, Exponentially With Azeem Azhar. Even for Star Island, the most exclusive enclave in Miami, the bill is a shocker: $622,000. That’s per year—for homeowners insurance. Granted, that was a recent quote for a policy on one of the ultraluxe mansions on the island, where people like Rick Ross, Ken Griffin and Alex Rodriguez own homes. But only last year, the same policy cost $200,000. Across the nation in the rarefied playgrounds of the rich, both the costs and risks posed by the climate crisis, it would seem, are no object.  Star Island Photographer: Jeff Greenberg/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Intelligent Automation—Transformation in a Time of Uncertainty: Top business and IT executives will gather in a city near you to explore ways in which intelligent automation can offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. We'll feature in-depth conversations about designing and implementing high-value projects, building teams that embrace automation and making the business case to top management about investing in transformation. For London on Sept. 19, Register here; For Toronto on Oct. 19, Register here; And for Seattle on Nov. 8, Register here. |