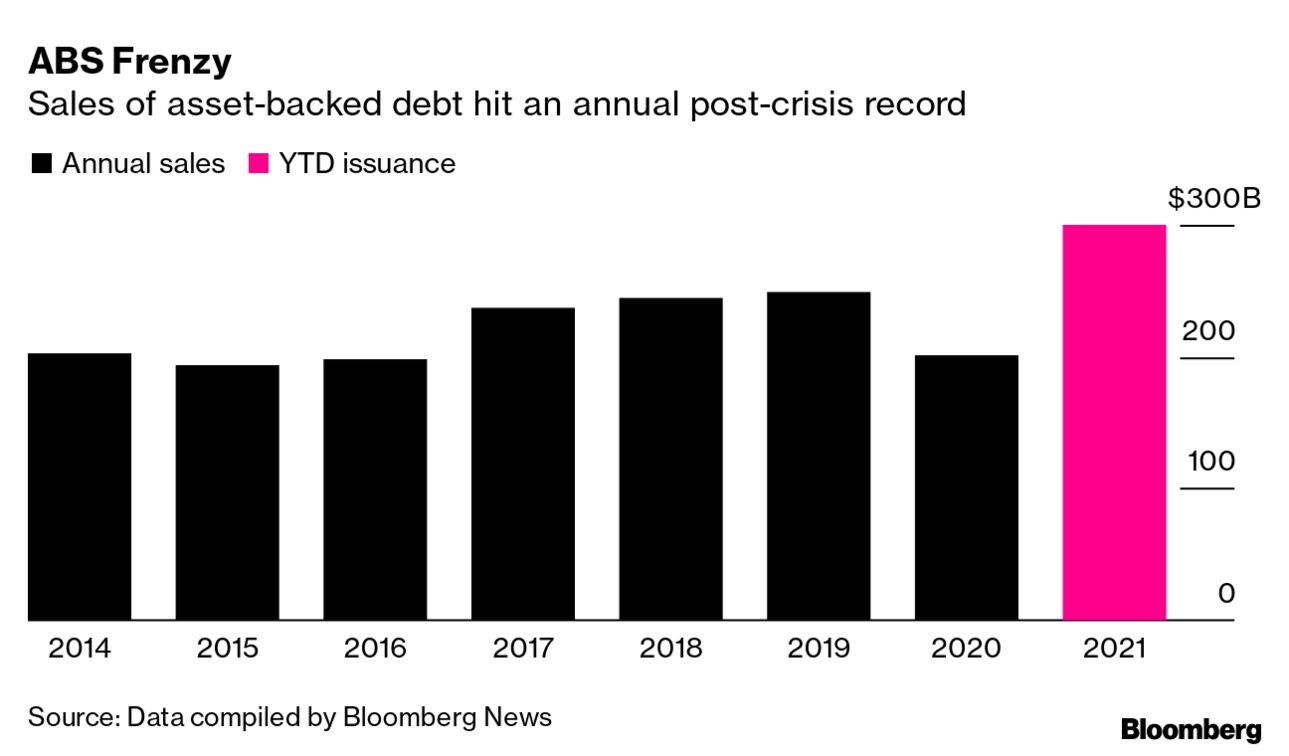

| The vast majority of those who need intensive care and ventilators are unvaccinated. That’s the common refrain across America and much of the world as a new wave of Covid-19 infection sweeps the globe—something that in the past has been followed by surging hospitalizations and deaths. In Europe, lives lost to the coronavirus will reach 2.2 million by March based on current trends, the World Health Organization warned. In the U.S., which has led the world in infections and fatalities since shortly after the pandemic began, a sixth wave is forming up as the delta variant rips through populations of vaccine refusers. Michigan, the latest U.S. hot spot, had a seven-day case rate of more than 600 per 100,000—triple the national average. Here’s the latest on the pandemic. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. BlackRock is reducing its investment in Indian stocks while displaying increased optimism on China, citing attractive valuations and an expectation that come 2022, President Xi Jinping will dial back his domestic economic crackdown. Bond traders cut projections on U.S. inflation for a fifth-straight day as President Joe Biden’s decision to renominate Fed Chair Jerome Powell reinforced belief that the central bank will move aggressively to slow rising consumer prices. Here’s your markets wrap. Remember 2008? Bankers are repackaging everything from fast food franchises to fitness-center fees into bonds at the fastest clip since the global financial crisis. This year’s sales of U.S. asset-backed securities have already surpassed $300 billion, and more is expected by year-end. Post-crisis issuance records have also been set in private-label commercial mortgage bonds and, yes, collateralized loan obligations. The Turkish lira’s freefall is shattering all kinds of records as President Recep Tayyip Erdogan’s intensifying campaign for lower interest rates plunges the country deeper into crisis. Best Buy tumbled the most since the start of the pandemic as increased robberies by organized groups of thieves add to an array of profit pressures, including a holiday outlook that’s worrying Wall Street. The top military officers of the U.S. and Russia spoke Tuesday as tensions remain high over Moscow’s deployment of about 100,000 troops on the border with Ukraine. American intelligence agencies see Vladimir Putin preparing to invade his neighbor for a second time in seven years. The twin ports of Los Angeles and Long Beach in California became the most essential gateways for the U.S. economy as the nation’s economic focus turned more toward Asia. But recently, these neighboring hubs—accounting for almost 40% of the country’s imported goods—have suffered every supply chain freeze-up you can think of. Bloomberg’s Visual Data team shows you exactly how.  The Ever Leader docked at the Port of Los Angeles on Nov. 16 as ships wait for weeks at anchor. The historic traffic jam has eased slightly as ocean carriers face fines for letting cargo linger and “sweeper ships” arrive to haul off empty containers. Photographer: Bing Guan/Bloomberg New York’s recovery from the Covid-19 pandemic is lagging behind that of other major U.S. metropolitan areas as the nation’s biggest city continues to suffer from a loss of tourism jobs. The Big Apple has regained little more than half of the jobs it lost during the worst of the pandemic in 2020.  Times Square in Manhattan Photographer: Michael Nagle/Bloomberg Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Reinvigorating Corporate Purpose: Covid-19 has radically changed the way business is done. Over the last two years, companies have focused on digital transformation and sustainability amid heightened scrutiny from stakeholders, media and increasingly ethically conscious consumers. Join us Nov. 30 as global leaders share their experiences using decisive, actionable strategies to lead with purpose. Sponsored by Kearney. Register here. |