| Week ending July 27, 2017 |

Another increase in MPI indicates the correction in commodity markets is over

|

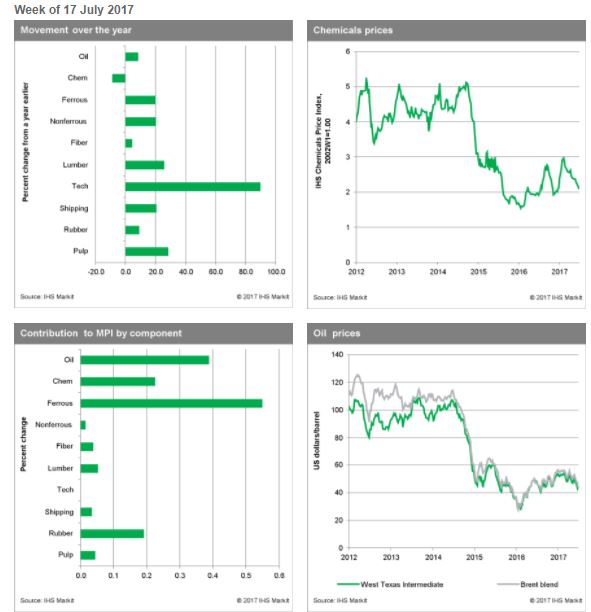

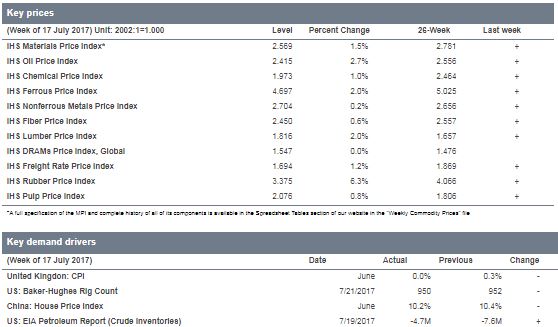

The IHS Materials Price Index (MPI) increased by 1.5% last week, its third gain in four weeks. Nine of the ten subindexes rose, marking a broadly based increase. Strength in oil and rubber, which rose 2.7% and 6.3%, respectively, helped lead the MPI higher. Weakness in the US dollar also provided support for the commodity complex as a whole.

The direction of the MPI once again followed oil prices, which showed strength early in the week. US crude oil inventories fell by 4.7 million barrels, more than expected, while demand edged up slightly. The Baker Hughes US rig count fell by 2, although the total North American rig count increased by 13 as producers in Canada continue to come back online.

The recent rise in commodity prices will soon be evident downstream in supply chains and help end the recent softness in goods price inflation. Looking ahead, however, several factors argue for a relatively stable pricing environment. First, oil production gains are expected to at least keep pace with demand growth over the rest of 2017, keeping oil prices soft. Second, Chinese growth is projected to continue slowing over the near term. This slowdown will also act as a restraining influence on prices, given China's footprint in markets. Finally, tightening monetary policy will undercut investor demand, acting as an additional headwind on commodity prices.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Materials and Equipment Cost Escalation Hit Lowest Level This Year

|

Construction costs rose again in June, according to IHS Markit and the Procurement Executives Group (PEG). |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 51.5, down from 54.0 in May, indicating less broad price increases across the industry. Both the material/equipment and labor categories continue to record higher prices. The materials/equipment price index came in at 51.3 in June, its lowest level in seven months. Price increases were uneven with only six of the 12 categories tracked in the materials sub-index showing higher prices, three categories registered flat pricing, and three had falling prices. Although structural steel and steel pipe prices have backed off from this spring’s peaks, anxiety about the pending Section 232 trade case decision continues. “Steel pipe prices have peaked for the time being and prices for certain products have started to fall,” said Amanda Eglinton, senior economist at IHS Markit. “However, there is still tightness in products such as oil country tubular goods (OCTG) and line pipe, where demand remains elevated. There is high potential for further tightening pending the outcome of the Section 232 trade case. If pipe is included in the scope of this case and imports are restricted, prices will spike again and supply will be very tight. If pipe is not included, steel pipe prices will continue to soften with lower steel input costs.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|