| Another Reason Why the 'Melt Up' Can Move Much Higher From Here | | By Dr. Steve Sjuggerud | | Friday, August 25, 2017 |

| When does it all end?

When will the "Melt Up" be over... and the meltdown begin?

I know you're worried about this question. I am, too.

My team and I have worked long and hard finding the answer. And today, I'll share one simple reason why the Melt Up isn't over yet... and why stocks can still move much higher.

Last month, I showed you one simple way to see a dying bull market. The advance/decline line – a measure that shows if more stocks are going up than down – was a warning sign at the end of the 1990s boom.

The advance/decline line is signaling "all clear" for now. And another similar measure also says the market is healthy today. Here are the details...

----------Recommended Links---------

---------------------------------

Today's indicator is the S&P 500 Equal Weight Index. You see, the regular S&P 500 is "market-cap weighted." That means the largest companies get a larger weighting.

Consumer-electronics titan Apple (AAPL), for example, has a nearly 4% weighting in the S&P 500, even though the index typically holds 500 companies.

Those kinds of outsized weightings mean that, at times, the overall market can rise while most stocks in the S&P 500 are falling.

So in addition to monitoring the regular index, we can confirm the overall market's movements with this equal-weight index. Every stock is equally weighted, regardless of size. This equal-weight index should mirror the S&P 500 when we're in a healthy bull market.

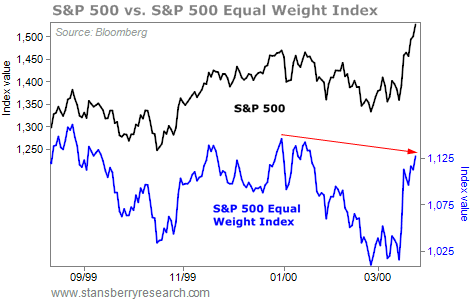

And again, this indicator told us the market wasn't healthy at the end of the tech boom. Take a look...

The S&P 500 Equal Weight Index was hitting "lower highs" when the overall market peaked in 2000. It was 6% below its 1999 high as the overall market hit new highs.

That was a major warning sign for the market. And the same thing happened in 2007...

The index hit a lower high as stocks peaked. The majority of stocks had stopped moving higher. And the final Melt Up gains all happened in what was overall a weak market.

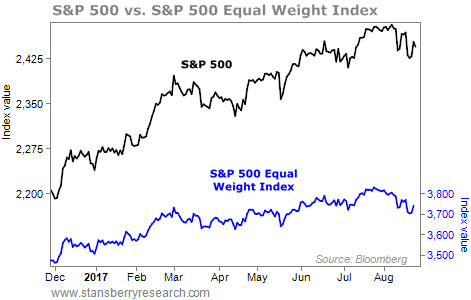

This isn't happening today... yet. Take a look...

The chart shows that the S&P 500 and the S&P 500 Equal Weight Index are moving together today. They're both coming off all-time highs.

It will be a warning sign if the overall market hits a new high and the S&P 500 Equal Weight Index doesn't. But that's not happening today.

Stocks are still broadly moving higher. The bull market remains healthy.

The Melt Up is still intact... So my advice is simple: Stay long.

Good investing,

Steve

P.S. If you're one of the millions of Americans who missed out on the massive bull market over the last eight years, don't worry... I just released a presentation detailing how to potentially double your money over the next 12 months. And I made a unique guarantee unlike any other in Stansberry Research's 18-year history. Get the details here. |

RETAIL TURMOIL WEIGHS HEAVILY ON THIS MALL OWNER

Today's chart highlights the next victim in the retail bust... As regular readers know, the brick-and-mortar retail sector has been struggling as more consumers turn to online shopping. Retailers are seeing major foot-traffic declines and are regularly reporting sinking sales. Many are filing for bankruptcy. With 127 properties in 40 states, GGP (GGP) is one of the largest mall real estate investment trusts in the U.S. But the company is highly dependent on failing tenants like Macy's (M), JC Penney (JCP), and Sears (SHLD). This year, those department stores are closing nearly 600 stores combined. That means lots of vacant space and no rent for GGP... As you can see below, GGP shares are breaking down. They just hit a three-year low. Last September, Porter's team recommended shorting the stock in Stansberry's Investment Advisory. Readers who followed that advice are sitting on gains of more than 20%. Congratulations to Porter on another great call... |

|

| It's time to buy the big winners of the 'Global Melt Up'... It appears that one specific sector is leading in the U.S. And – in a bit of a Melt Up plot twist – this sector is also starting to melt up around the globe. |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Reserve your "Online All-Access Pass" to see Stansberry Las Vegas 2017 live, on your home computer. You'll see two full days of fantastic speakers... action-packed presentations... and of course, tons of great ideas that really could change your life. Get your Online Access Pass here. |

| This 'Safe' Asset Could Fall 15%-Plus This Year | | By Brett Eversole | | Thursday, August 24, 2017 |

| | Former Fed Chairman Alan Greenspan is worried... Greenspan believes that the bond market is about to begin a dramatic correction. And current sentiment says he could be right... |

| | Three Things I Wish I Had Understood About Money Long Ago | | By Kim Iskyan | | Wednesday, August 23, 2017 |

| | Although experience may be the best teacher, it's also the most expensive – especially in matters of money... |

| | Speculators Are Borrowing More Than Ever... Here's What It Means | | By Dr. Steve Sjuggerud | | Tuesday, August 22, 2017 |

| | It's official – investors have borrowed more cash than ever to buy stocks... |

| | 'This Time It's Different' | | By Dr. David Eifrig | | Monday, August 21, 2017 |

| | At the height of the dot-com bubble, tech stocks soared... Bulls argued, "This time it's different." Of course, we know it wasn't.

|

| | A New Type of Crime Will Cause This Industry to Soar | | By Jeff Brown | | Saturday, August 19, 2017 |

| | A new crime wave is sweeping across the country... Unlike crimes of the past, this one can't be stopped with more locks, security cameras, or guards... |

|

|

|

|