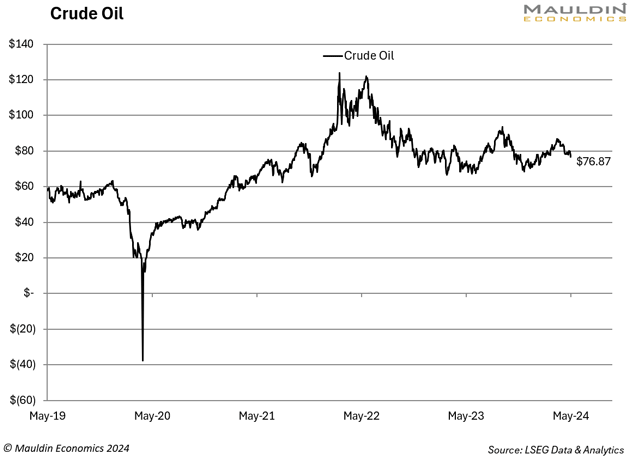

The price of oil is hovering around $76 per barrel, 38% off its 5-year high. With so much geopolitical tension, why isn’t it higher?

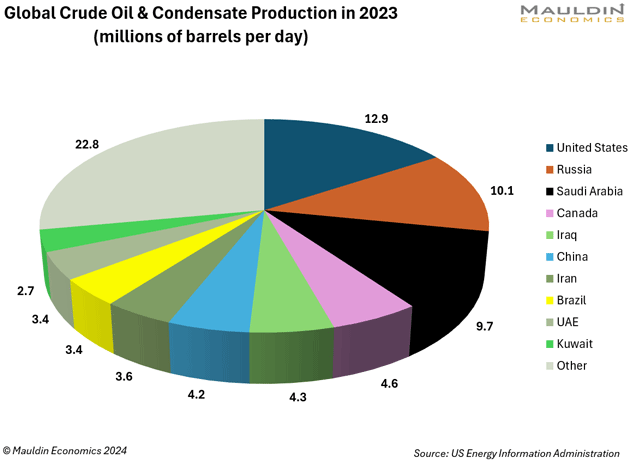

One answer is supply. Last year the United States produced 12.9 million barrels per day, more oil than any nation, ever. And it’s not just the US—total global production is expected to reach a record high of 102.7 million barrels per day this year, with a growing portion coming from non-OPEC nations.

Colombia, for example, aims to boost oil production to over a million barrels per day in the near term. Then there’s Guyana, a relatively new player in oil and gas.

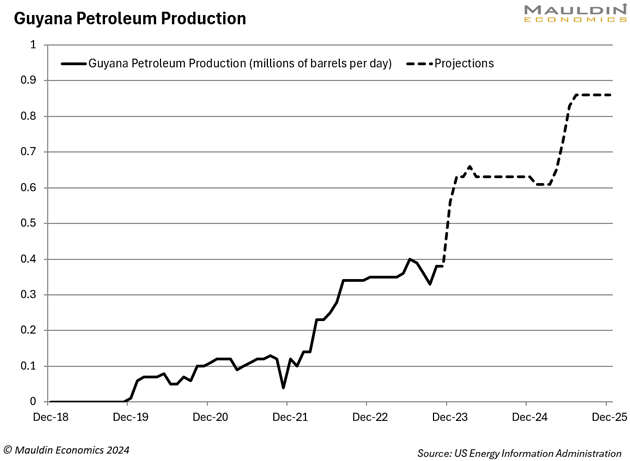

Guyana’s production is set to reach 860,000 barrels per day late next year. ExxonMobil Corp. (XOM), which leads Guyana’s oil block, sees production reaching 1.3 million bpd by 2027.

ExxonMobil made the first major oil discovery there in 2015. It’s since partnered with Hess (HES)—which Chevron (CVX) is trying to buy—and China’s state-owned CNOOC, making 30+ more oil and gas discoveries in the offshore Stabroek Block. Estimates for Guyana’s total recoverable oil and natural gas resources have risen to 11 billion oil-equivalent barrels and counting.

The tiny South American nation now has the world’s fastest-growing economy thanks to oil. But a regional dispute is developing around its lucrative resources. Venezuela’s President Maduro has used a series of legal-ish sounding maneuvers (i.e., voting, redrawing official maps, issuing new passports) to attempt to annex Guyana’s oil-rich Essequibo region, which makes up over half the nation.

Maduro is continuing to build up Venezuela’s military presence in the border region. At the same time, the US has affirmed its commitment to Guyana’s sovereignty, criticizing Venezuela and offering explicit military support.

Russia and China are lurking in the background. Maduro briefed Vladimir Putin prior to talks with Guyana’s president last year. He is employing a Russian-style disinformation campaign around the territorial dispute. China, for its part, would be well positioned to help Venezuela operate Essequibo’s oil and gas resources if it ever took control of the region.

This situation hints at a somewhat coordinated effort to spread US financial and military resources thin. (I’ve noted this before, in an interview with Felix Zulauf last December, where we touched on Guyana.) A regional conflict could compel the US to step in and defend the sizable interests of US companies and their shareholders. Russia, China, and many others wouldn’t mind adding to our list of distractions.

The world is awash in oil, yet an escalation in any of the geopolitical conflicts brewing across the globe could send prices higher.

Thanks for reading.