*The U.S. January Employment Report is all-round strong: employment increased by 225k, the unemployment rate remained low, the labor force participation rate increased to a 6.5-year high, and average hourly earnings growth increased. This ongoing strength in labor markets combined with high consumer confidence and improving business confidence indicates a solid beginning to 2020 for U.S. economic performance:

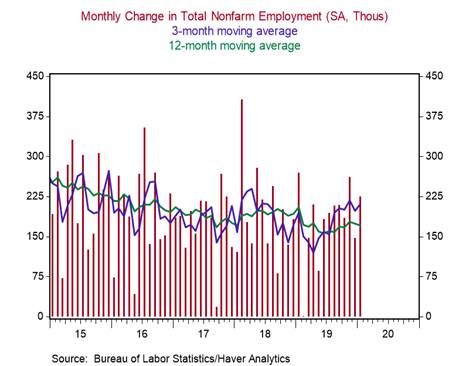

- U.S. establishments added a net new 225k jobs in January, well-above expectations (consensus: 165k), after adding 147k and 261k jobs in December and November, respectively, bringing the three-month and six-month moving averages to 211k and 206k, respectively (Chart 1).

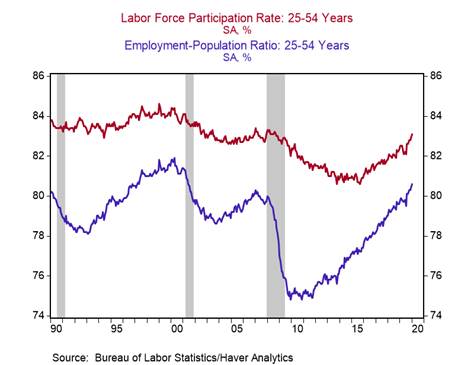

- The unemployment rate ticked up to 3.6% from 3.5% reflecting the positive news that the labor force participation rate (LFPR) increased to 63.4% from 63.2% (Charts 2 and 3). The LFPR has been on a defined uptrend since last Spring. The healthy increases in the LFPR and employment-to-population ratio indicate that the supply of labor is fairly elastic and employment has room to grow. These trends are lifting confidence in labor market conditions.

- Average hourly earnings (AHE) increased by 0.2% m/m in January, lifting its yr/yr change to 3.1% from 3.0% (Chart 4). With inflation low, real (inflation-adjusted) AHE are rising around 1%, a healthy trend we expect will continue. Combined with solid job gains, the rising real wages are boosting real disposable incomes and supporting consumer spending.

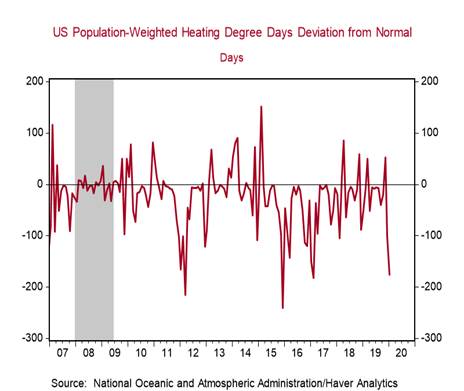

The unseasonably warm weather in January likely boosted payroll growth as suggested by the outsized 44k increase in jobs in the weather-sensitive construction sector (Chart 5). Regardless, the sustained rapid job growth (112 consecutive months) is truly remarkable and reflects the resilience and durability of the economic expansion. These trends are distinct positives for consumption and housing activity that are offsetting weaknesses in industrial production and business investment.

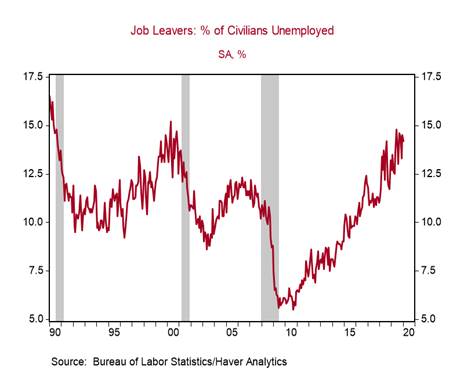

The Household Survey was also strong, most notably the rise in the labor force participation rate of prime working-age (25-54 yrs.) cohort increased to 83.1% in January, its highest since September 2008 (Chart 6). We expect further increases in 2020. The associated rise in the employment-population ratio for the prime working-age cohort to 80.6% from 80.4%, the highest since June 2001, is expected to support higher nominal wage gains. The LFPR for the >55 yrs cohort has remained steady around 40%, defying the government’s earlier projections of a declining trend. The share of voluntary job quits remained elevated in January, reflecting the confidence in job-finding prospects (Chart 7).

The goods sector added 32k jobs in January as the strong increase in construction employment (+44k) offset declines in manufacturing (-12k) employment and mining employment (-1k). The mining sector has cut 34k jobs since May 2019 because of the idiosyncratic issues plaguing the oil and gas sector and low energy prices. U.S. regional and national manufacturing surveys were broadly positive in January and if sustained would bode well for stronger hiring in manufacturing in coming months.

The service sector added 174k jobs in January. The transportation and warehousing (+28k), education and health services (+72k) and leisure and hospitality (+36k) sectors reported solid job growth, and the retail (-8k) and financial (-1k) sectors cut jobs.

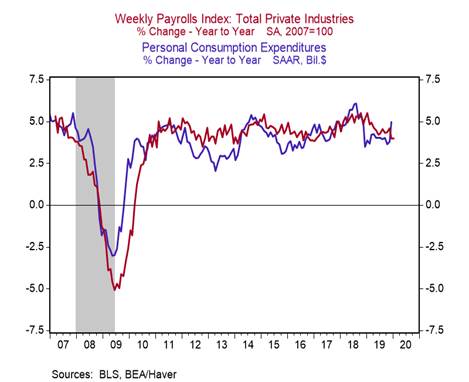

Aggregate hours worked increased by 0.2% m/m, the strongest since September. Aggregate weekly payrolls that combines employment, average weekly hours worked and average hourly earnings, increased by 4% yr/yr, the lowest since January 2017, but it points to continued consumption growth (Chart 8).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com