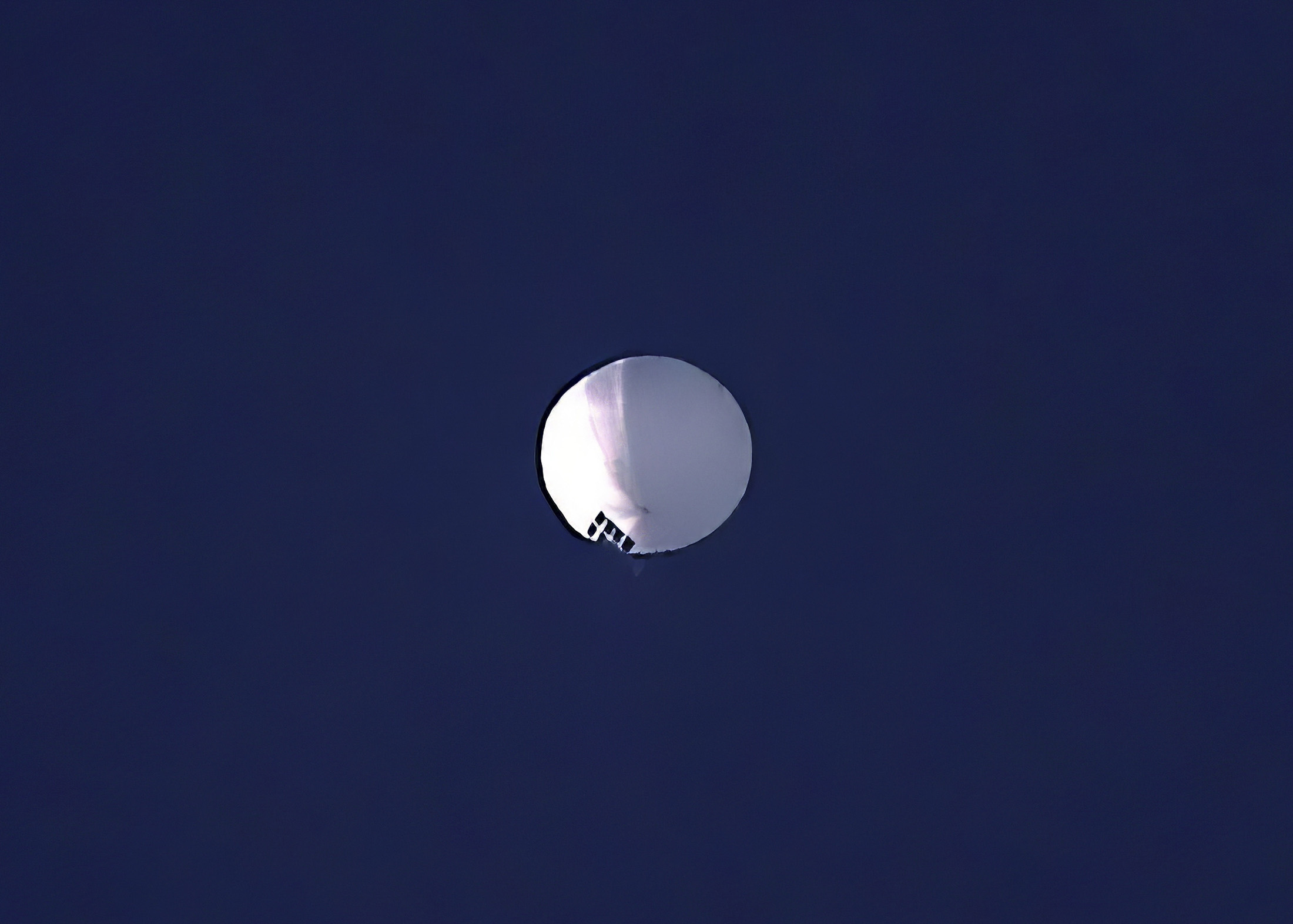

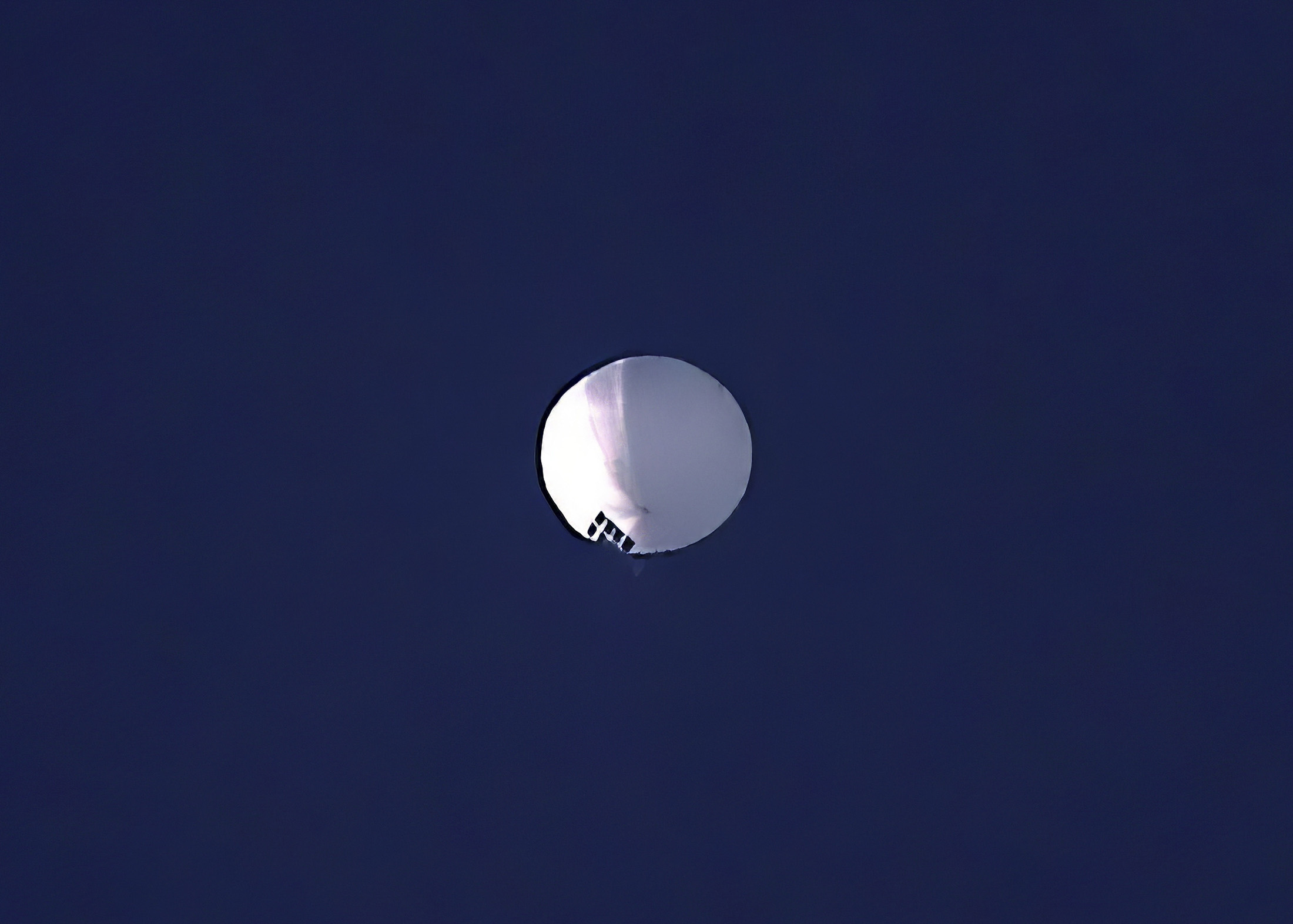

| Forget all that talk of falling inflation, moderating wages, record-low unemployment and possible soft landings. Wall Street says 2023 will likely turn ugly. What was a beautiful January for investors was only a mirage—a stock rally that’s already gone too far. This is the warning from strategists at Bank of America, who said investors could face brutal declines if economic growth crumbles in the second half of the year. The risk is that inflation flares up again over the next few months, and that the US economy faces a deeper recession (than that initially predicted) after staying resilient in the first six months of 2023, they wrote. But with more experts seeing potential success for the Fed after a year of panicky recession calls, it may be a warning that’s hard for some to heed. The “most painful trade,” the bank’s strategists wrote, is always the “apocalypse postponed.” —David E. Rovella US Secretary of State Antony Blinken put off his upcoming trip to Beijing after the US detected what it said was a Chinese surveillance balloon lingering at high altitude over Montana, where scores of America’s strategic nuclear missiles are siloed. Blinken was set to have meetings in Beijing next week, the first such visit by a top US diplomat in five years.  A high altitude balloon the US said is a Chinese surveillance platform floats over Montana on Wednesday. Photographer: Larry Mayer/The Billings Gazette Global food costs capped their longest run of monthly declines in at least three decades. So why are supermarket prices still sky high, crushing household budgets? And why are food giants saying they’re going to charge even more? More bad news for accused fraudster Sam Bankman-Fried. His Emergent Fidelity Technologies, an offshore entity that owns 55 million shares of Robinhood Markets, filed for bankruptcy amid a fight over who should get the stock following the collapse of FTX Group. A blockbuster US jobs report Friday triggered a morning stock slump as Wall Street worries the Fed will keep rates higher for longer to fight inflation. But President Joe Biden seized on the report as unabashedly good news for American workers and job seekers, and for his agenda ahead of an expected re-election bid. With an unemployment rate that’s at a 53-year-low, the Democrat hailed data showing the US economy added 517,000 new jobs in January, blowing out estimates. Referring to the total number of new jobs since he took office early in the pandemic, Biden said “there’s now 12 million more Americans who can look at their kid and say, ‘it’s going to be okay.’”  President Joe Biden spoke in Washington on Friday, touting strong new US jobs numbers. Photographer: Yuri Gripas/Abaca Malaysia’s richest man, a powerful shipping tycoon and the world’s two wealthiest families are just a few of the high-profile names caught up in the unraveling of Gautam Adani’s empire. Billionaires from Hong Kong to Arkansas are exposed to the crash caused by short-seller Hindenburg. Big tech’s results this week may have been disappointing, but the industry—which has been busy firing tens of thousands of its employees—is about to splurge on artificial intelligence. Companies from Microsoft to Meta are telling investors AI is a “huge opportunity” for growth—and are pledging hefty investments to outpace rivals. The Biden administration will allow more crossover SUVs to qualify for the newly-revamped electric vehicle tax credit. The change announced Friday effectively expands the number of buyers who can take advantage of a lucrative $7,500 consumer tax credit by broadening the definition of how a sport-utility vehicle is defined. The tweak matters because under Biden’s Inflation Reduction Act, SUVs costing up to $80,000 can receive the tax credits.  The Ford Mustang Mach-E GT Photographer: Michael Nagle/Bloomberg Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. When Michelin published its 2023 guide for Tokyo, the city got good news: it held on to its title as dining capital of the world. Tokyo has 200 Michelin-starred restaurants, the most of any city, including a dozen with three stars. The latest list contains several high-end sushi restaurants where meals can easily cost up to 50,000 yen, or about $384 per person. That’s not unusual. What’s notable is the inclusion of places that offer sushi in unconventional, reasonably priced ways.  A chef at Touryumon Sushii Ginza Onodera. The restaurant serves as a training ground for the company’s younger chefs. Source: Onodera Group/Ginza Onodera Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. On the Deadly Cure podcast, Bloomberg explores the rise and fall of a church that peddled bleach as a cure and a sacrament to people around the world. We tell the story of the Grenons, the family behind the Genesis II Church of Health and Healing—and the band of keyboard warriors who sought to take them down. Listen on Apple, Spotify or wherever you get your podcasts. |