Up until February, you would have done well to be overweight banks. “Banks do well in a rising interest rate environment” was the simple thesis. And that’s true if the banks have competent risk management.

We know now that competency is not a given across the industry. The story du jour is about some banks getting caught on the wrong side of interest rates.

Banks are a bellwether for the economy. It’s worth looking past today’s headlines and asking, “What else is on a bank’s balance sheet that could cause trouble?”

Turns out, a lot. There are several concerning trends.

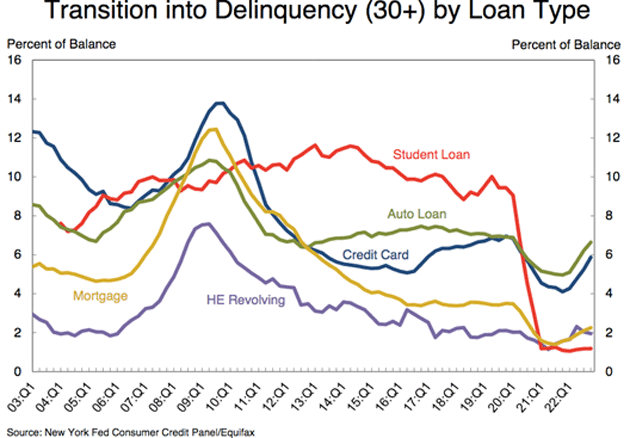

Stimulus checks combined with lax lending standards seduced a lot of Americans into buying a car or truck they really couldn’t afford. Auto loans 60+ days past due climbed to nearly 2% in January, up 20% from the year-ago period. That is the highest rate since 2006. The past-due figure for subprime borrowers is about triple that rate.

A snapshot of delinquent single-family residential mortgages looks better than autos, which makes sense. The first bill you are going to pay each month is the mortgage. Still, homeowners falling behind on their mortgages has taken a definite turn higher over the past year.

The delinquency rate for credit cards shows a similar trend. The New York Fed reported that card users making payments that were at least 30 days late rose last quarter to 5.9%, up from 5.2% in the prior quarter. Those numbers are 4% and 3.7%, respectively, for users that are 90 or more days late.

The New York Fed said it is “worrying that the delinquency rates keep on increasing.”

And let’s not forget the catalyst of the 2008–2010 financial crisis: MBS (mortgage-backed securities). Back then, it was the crash in residential home prices that led to a financial meltdown. Today, we should be watching office space.

Many of you agree. Last week’s issue drew our highest number of reader comments.

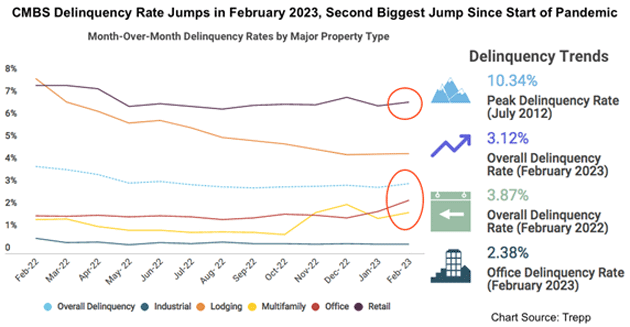

The first step on the path to default is delinquency, and the commercial mortgage-backed securities (CMBS) office delinquency rate has turned higher this year.

Although the office CMBS delinquency rate is nowhere near its 10.32% pandemic high, it turned sharply higher in February, up 55 basis points to 2.38%.

Note the much higher delinquency rate in retail. If “office is the new retail,” we are going to see default rates in office CMBS explode higher.

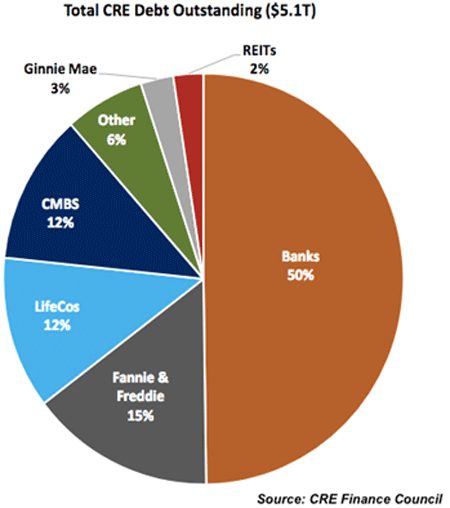

One factor that could mitigate any potential fallout in office CMBS is its scale. When measured by value, office represents about 16% of the total commercial real estate (CRE) market. And CMBS account for 12% of the $5.1 trillion in CRE debt outstanding (as of May 2022). Here’s a breakdown of the sources of that debt:

That scale might be relatively small, but trouble with office loans will have big negative consequences on small- and mid-sized banks.

Last week, Goldman Sachs warned that smaller US lenders have outsized exposure to office loans. At the end of 2022, 80% of the pool of CRE loans was held by lenders with less than $250 billion in assets.

Fitch Ratings expressed similar concerns, noting that “the office sector faces asset quality deterioration, putting smaller banks at risk due to their relatively larger exposure as a percentage of their assets.”

Before its collapse, Signature Bank had the tenth-largest CRE loan book in the US. Another bank in the news, First Republic, has the ninth-largest loan portfolio in the same market.

The troubles on display from these two banks could alter the behavior of other lenders, leading to a pullback in lending across the entire sector. A move like that would only aggravate an already deteriorating situation.

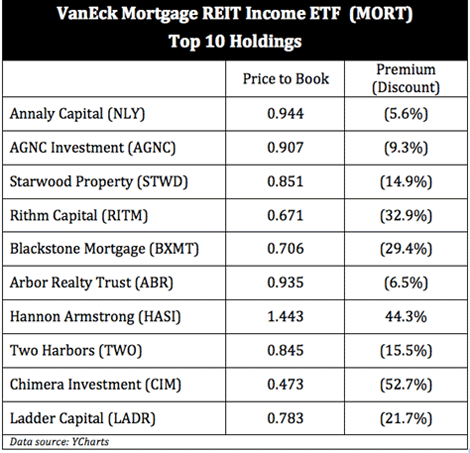

Heightened fears about the health of the CRE market are dealing a blow to mortgage REITs. The VanEck Mortgage REIT—the second largest such fund with $154 million in assets—is down roughly 40% from its 52-week high.

Some of the industry’s biggest names are now selling for substantially less than book value.

I suspect we have not yet seen the last of markdowns like these.

To keep all of this in perspective, new commercial development and the operation of existing commercial buildings added $2.3 trillion to US GDP and supported 15 million jobs last year, according to industry association NAIOP.

Individually, auto loan, home mortgage, credit card, and office CMBS delinquency stats may not be significant enough to cause a system-wide problem. But all of them are trending in the wrong direction.

These trends are early economic indicators to be watched.

Best regards,

Ed D’Agostino

Publisher & COO