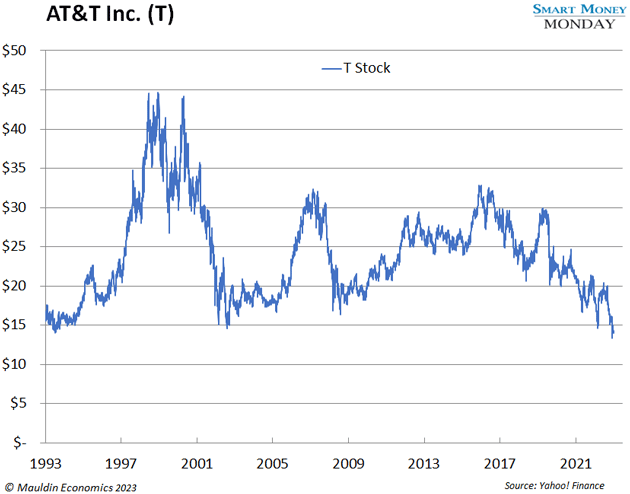

When a mega-cap stock is sitting on a 30-year low, I can’t help but look.

That’s the case today with AT&T (T).

The last time AT&T’s stock was around $14 a share, Bill Clinton was president, the internet was still in its infancy, and Jurassic Park was the most popular film in the country.

AT&T investors have made some money over that time frame—the company has paid out tons of cash in dividends—but the stock itself has been totally flat.

Now, there’s a lot going on in telecom today—from lead cable issues to competition to high debt levels.

So, is this an amazing contrarian buying opportunity sitting right in front of us?

The Setup

AT&T has gone through a dramatic transformation over the past few years. The biggest decision it made was getting out of the media business.

It spun off its Warner Media assets last year in a merger with Discovery Communications. That stock is now Warner Brothers Discovery (WBD).

Prior to that, it sold its DirectTV business to private equity firm Apollo.

The company today is a pure-play communications infrastructure business. It has its mobile business, fiber business, and legacy wireline telephone business.

The narrative with AT&T is that it has a ton of debt… which it objectively does. It has $143 billion of net debt, compared to a market capitalization of $100 billion.

However, AT&T is a profitable company—it generates a lot of free cash flow. There is, however, a substantial “call” on that cash: the common stock dividend.

After the Warner Media spinoff, AT&T slashed its dividend to $1.12 per share on an annual basis. That pencils out to about $8 billion per year.

AT&T is guiding to $16 billion in free cash flow this year, and 50% of that goes to the dividend—a really big chunk of it.

As for its debt, AT&T has stated its goal of paying it down. Throwing that extra $8 billion per year in free cash flow after dividends isn’t terribly meaningful. But at least it’s something.

Then there’s the latest “blow” to AT&T…

Lead Cables

The Wall Street Journal published a handful of excellent investigative pieces a few months back on the presence of lead cables throughout the United States. Lead is toxic and is a major health hazard.

The stocks of AT&T, Verizon, and other legacy telecom companies sold off hard on the announcement. They own these cables and were responsible for laying them in the 1950s.

The perception in the market was the lead cable “issue” would be akin to asbestos or some other major class action issue. Fortunately, for the telecom companies, it doesn’t seem to be that severe.

For context, asbestos was in every building product (i.e., every home) in the country. That exposed 300 million people to this carcinogen.

In the case of lead cables, the exposure is likely limited to line workers and other contractors who have, in the past, worked on lead cables.

Some analysts are estimating the exposure is limited to around $5 billion, specifically for AT&T. And that $5 billion will likely be paid out over several years.

The lead issue isn’t fatal to AT&T, but it is a concern.

Back to the Stock

All this bad news is in the open. As the saying goes: If it’s in the news, it’s in the stock.

So, is AT&T a buy here?

The stock today has around an 8% dividend yield. That’s compelling.

Plus, it has $16 billion of free cash flow. On a $100 billion market cap, that’s an attractive 16% free cash flow yield. Or, inverting it, AT&T currently trades for less than 7X free cash flow.

Despite all the bad news, all the debt, and the 30-year low, that’s an attractive valuation and an attractive entry price.

You still have to manage your expectations for future returns. It seems highly unlikely that AT&T is in any shape, financially, to begin increasing the dividend. So don’t count on that.

And is 8% really that attractive when you can get over 5% risk-free in short-duration US Treasuries?

The bet you’d have to make with AT&T is that the market revalues the company. That is, it gets past the lead cable issues, it keeps paying down debt, and it shows a little growth in free cash flow over time.

If those things happen, the market should rerate the stock higher than 7X free cash flow.

I wrote up AT&T as one of my favorite ideas in 2022. I also wrote it up favorably in 2021 here. I’ve been wrong the whole way down.

I think the market has oversold this one, though. At these levels, AT&T is still a buy.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...