August ISM Manufacturing Index highlights continued strength of recovery in manufacturing

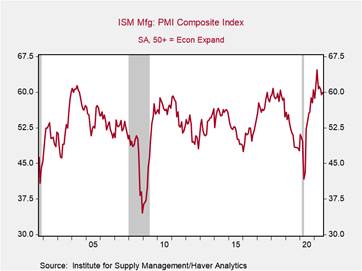

*The ISM Manufacturing survey ticked up to 59.9 in August from 59.5 in July (Chart 1), bolstered by gains in new orders, production, and inventories despite a contraction in employment. The increase in August marks the 15th consecutive month of growth in the index and highlights the strength of the recovery in the manufacturing sector. The new orders index rose to 66.7 in August accompanied by an increase in the production index to 60, signaling strong demand.

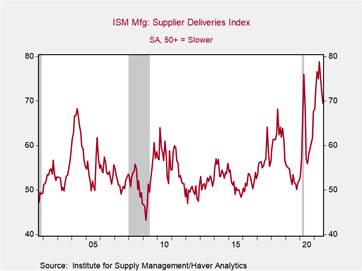

*Supply chain bottlenecks continued to weigh on the manufacturing industry in August, although the supplier deliveries index fell a touch from 72.5 in July to 69.5 in August (Chart 2). The supplier deliveries index has been above 60 for the last 11 months, while the percentage of respondents who experienced faster supplier deliveries increased slightly from 3.1% in July to 3.6% in August. This highlights the substantial supply chain constraints manufacturers face. Backlogs of orders expanded for the 14th straight month, indicating production cannot keep up with strong levels of new orders. Backlogs are also increasing at an accelerated rate, up 68.2 from 65.0 and 64.5 in the past two months (Chart 3). No industry reported lower backlogs this month, highlighting the continued supply constraints.

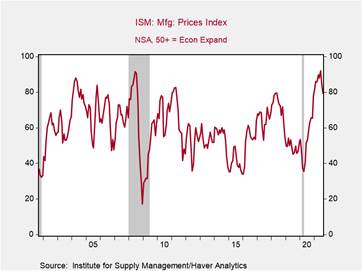

*The Price index fell from 85.7 in July to 79.4; however, it remains at a high level, with 62.8% of respondents reporting higher prices in August (Chart 4). This reflects the pressure exerted on prices by elevated demand and supply constraints. Moreover, these price increases have been broad based, with 16 out of 18 industries paying higher prices for raw materials in August.

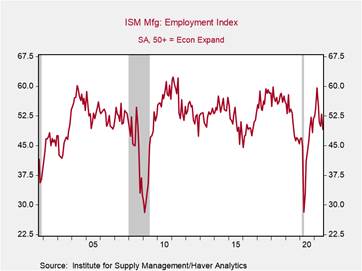

*The employment index declined from 52.9 in July to 49.0 in August, signaling a contraction period after a one-month expansion in the previous month (Chart 5). According to the report, an overwhelming majority of respondents are attempting to hire, with 35% experiencing difficulties in filling positions. The Institute of Supply Management reported that notable sectors experiencing employment growth include Computer & Electronic Products; Fabricated Metal Products; and Transportation Equipment.

*Interesting anecdotal evidence from ISM respondents:

- “The chip shortage is impacting supply lines. So far, we’ve been able to manage it without impacting clients." [Computer & Electronic Products]

- “Bookings/sales continue to be strong. Persistent supply issues — including availability of materials, freight/logistics/containers, and allocation of key commodities — continue to hamper production ramp to meet demand. Also struggling with lack of labor in several factories. Commodities are still inflationary, but price increases have leveled.” [Furniture & Related Products]

- “Business is going strong, but raw material prices still under increasing price pressure. Labor is still an issue.” [Plastics & Rubber Products]

- “Customer order backlog continues to climb because we are unable to raise production rates due to supplier parts and manpower challenges. Continue to see price increases with key commodities, and logistics is an ongoing challenge that has no end in sight.” [Machinery]

Chart 1: ISM Manufacturing Composite Index

Chart 2: ISM Manufacturing Supplier Deliveries Index

Chart 3: ISM Manufacturing Backlog of Orders Index

Chart 4: ISM Manufacturing Prices Index

Chart 5: ISM Manufacturing Employment Index

Mickey Levy, mickey.levy@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.