| At times this week, not even a crystal ball could have foretold which way the stock market would go. Red-hot consumer prices? Stocks weirdly rallied, adding 5% in a flash. But in the end, the direction was all too predictable: down. A sky full of inflationary clouds blotted out any moments of bullish sunlight. As has been true all year, the week turned on a Friday, with concerns that price pressures are getting entrenched leaving the S&P 500 down 1.6% over five days, bringing losses on the year to a crushing 25%. Violent reversals point up the challenge of assessing what investors might do when obsessions with inflation data and the Fed fuel unpredictable reactions. “We have to realize that this is going to stick around a little bit longer,” said Brian Belski, chief investment strategist at BMO. “But I do believe a year from now stocks will be higher, and I think a year from now inflation will be lower.” —David E. Rovella An escalating public dispute between the Biden administration and Saudi Arabia over the latter’s oil production cuts may risk irreparable harm to US relations with the kingdom. Dueling statements from Washington and Riyadh in recent days over the OPEC+ decision to cut flows underscore how badly the US-Saudi relationship has deteriorated. Embattled UK Prime Minister Liz Truss, boxed in by a mutinous Tory party and market turmoil triggered by her widely panned tax-cut policy, tried to save herself by doing a 180 while firing her finance minister. It may have made things worse for markets, and for Truss. The new Chancellor of the Exchequer could end up taking her job. Others may be lining up, too.  Jeremy Hunt, UK chancellor of the exchequer, departs 10 Downing Street on Friday. Prime Minister Liz Truss scrapped her plan to freeze corporation taxes next year hours after firing ally Kwasi Kwarteng. Photographer: Carlos Jasso/Bloomberg Xi Jinping seems set to cement his role as China’s paramount leader, but not everyone is happy with him and his authoritarian government. A rare sign of protest emerged as the Communist Party meets to anoint Xi for an unprecedented third term. Beijing reacted to the display of dissent with a massive censorship effort. Even before sanctions cut off access to vital components and technologies for Vladimir Putin’s defense industry, an internal Russian government review found years of attempts to reduce reliance on imports had largely failed. Now his military is paying the price. The Russian leader said Friday he has no regrets about his eight-month war on Ukraine, in which Russian forces have killed potentially tens of thousands and are accused of widespread torture and mass executions of civilians.  A destroyed Russian-made Uragan MLRS rocket launcher in southern Ukraine. Photographer: Dimitar Dilkoff/AFP/Getty Images Elon Musk may be making his Putin problem worse. After creating a furor by parroting Kremlin talking points on terms for peace negotiations, the Tesla CEO made a joking threat to cut off Ukrainian access to his Starlink communication network—critical to Kyiv’s war effort—after an official there criticized his foray into diplomacy. Musk has said he can’t keep bearing the cost—but now the Pentagon says there are other options. Japan is set to change a 19th-century law deciding the paternity of a child born after divorce. It’s part of an effort to reduce the number of Japanese children who face difficulty accessing healthcare and education. Winter is coming in the northern hemisphere, and with it will come a new wave of coronavirus infections. But this time things will be very different—and not necessarily for the better. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - More bad news for Musk: Tesla drops 50% from a November record.

- Star hedge fund calls China stocks bottom—says it’s time to buy.

- Another Fed official may be in hot water over financial ethics rules.

- Cathie Wood’s main ETF closes at five-year low—a 78% drop.

- Nikola founder Trevor Milton found guilty of defrauding investors.

- Harry Potter and Cracker actor Robbie Coltrane dies. He was 72.

- K-Pop sensation BTS to give what could be last concert for years.

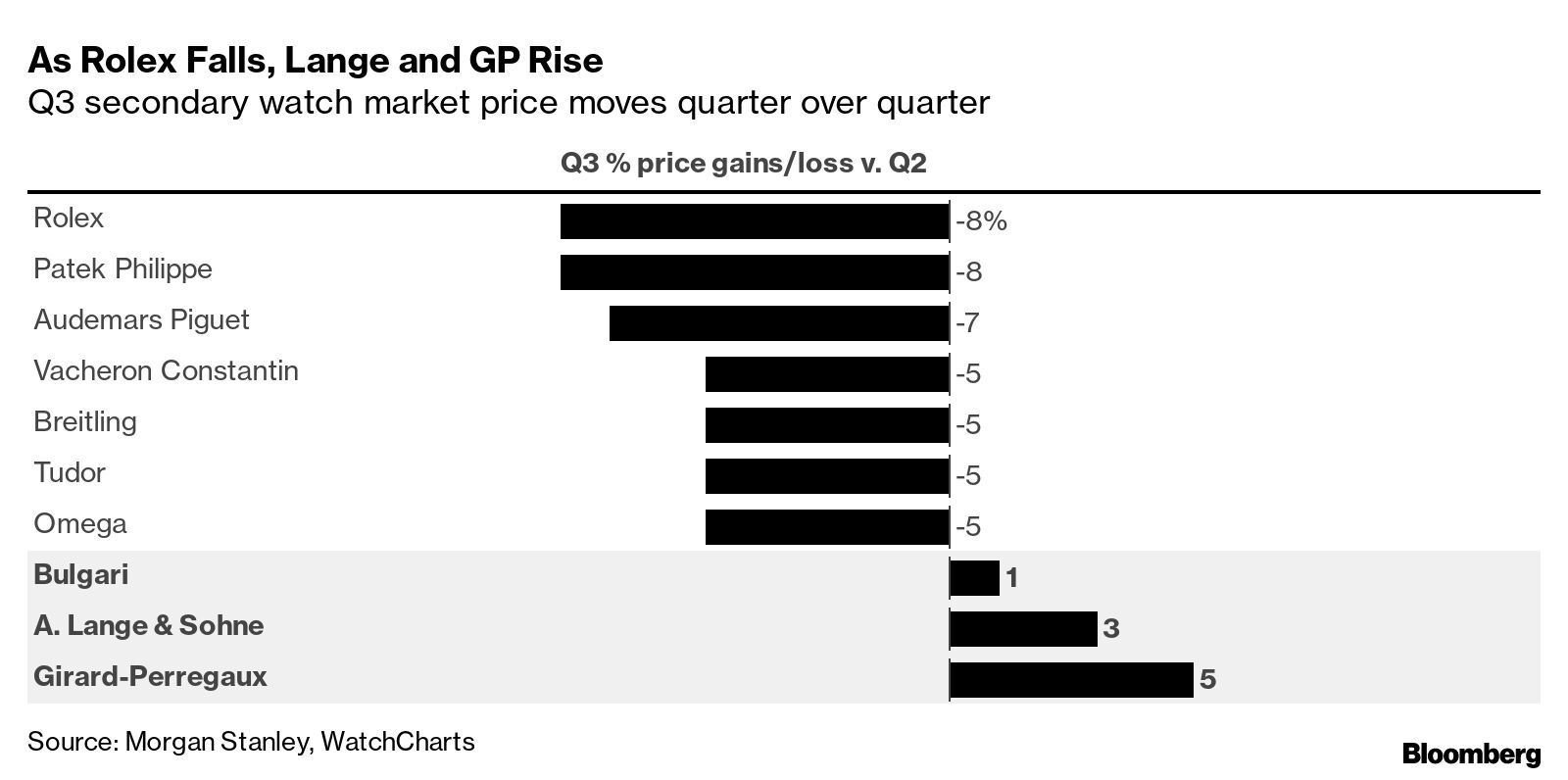

Prices for the most popular pre-owned Rolex, Patek Philippe and Audemars Piguet watches will fall further as the market has been flooded with supply, analysts at Morgan Stanley said. After surging in 2021 and during the first quarter of 2022, an index of the most popular models has fallen by 21% since the market peak in April. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Chief Future Officer Briefing: The role of the chief financial officer continues to evolve as conditions warrant hyper responsiveness to changes in the business environment and economy overall. Join us for the Chief Future Officer Briefing: The Next Generation CFO in New York or virtually on Oct. 25, where we will examine how companies and financial leaders are adapting to economic volatility and technological innovation. Register here. |