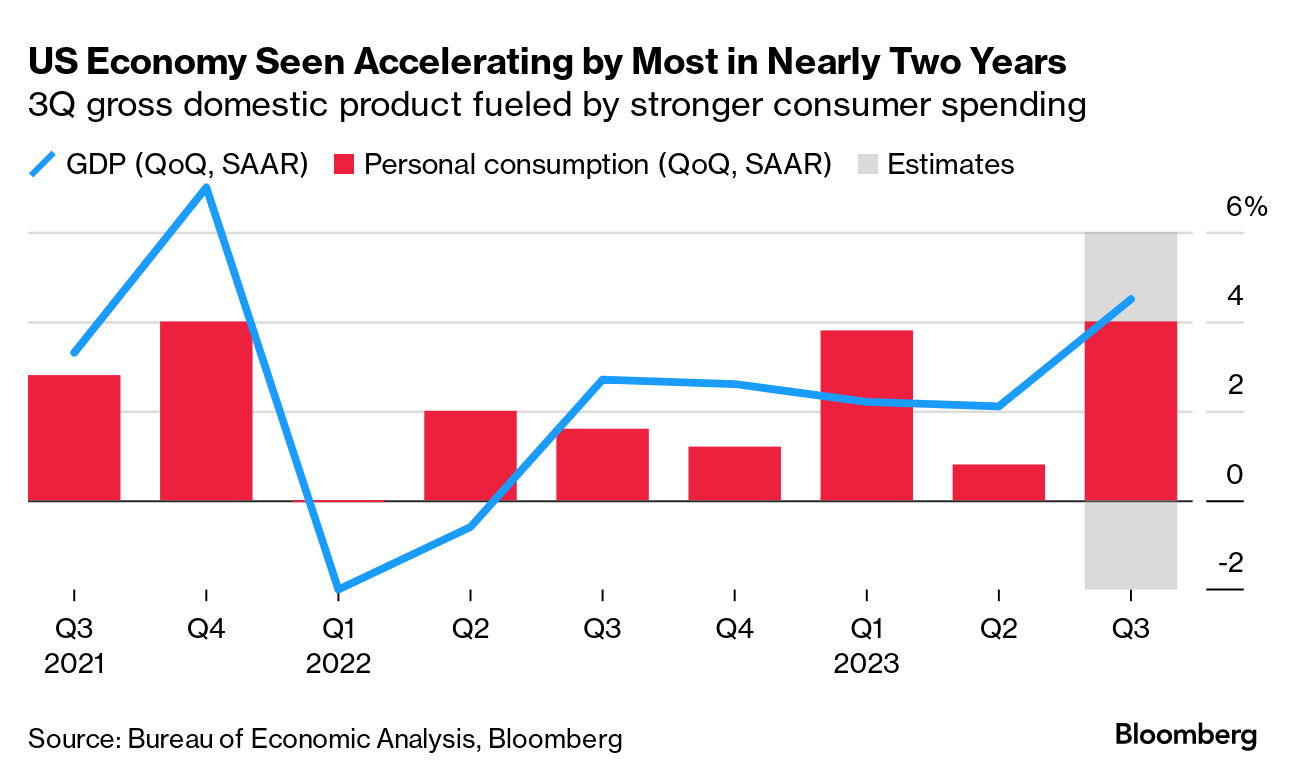

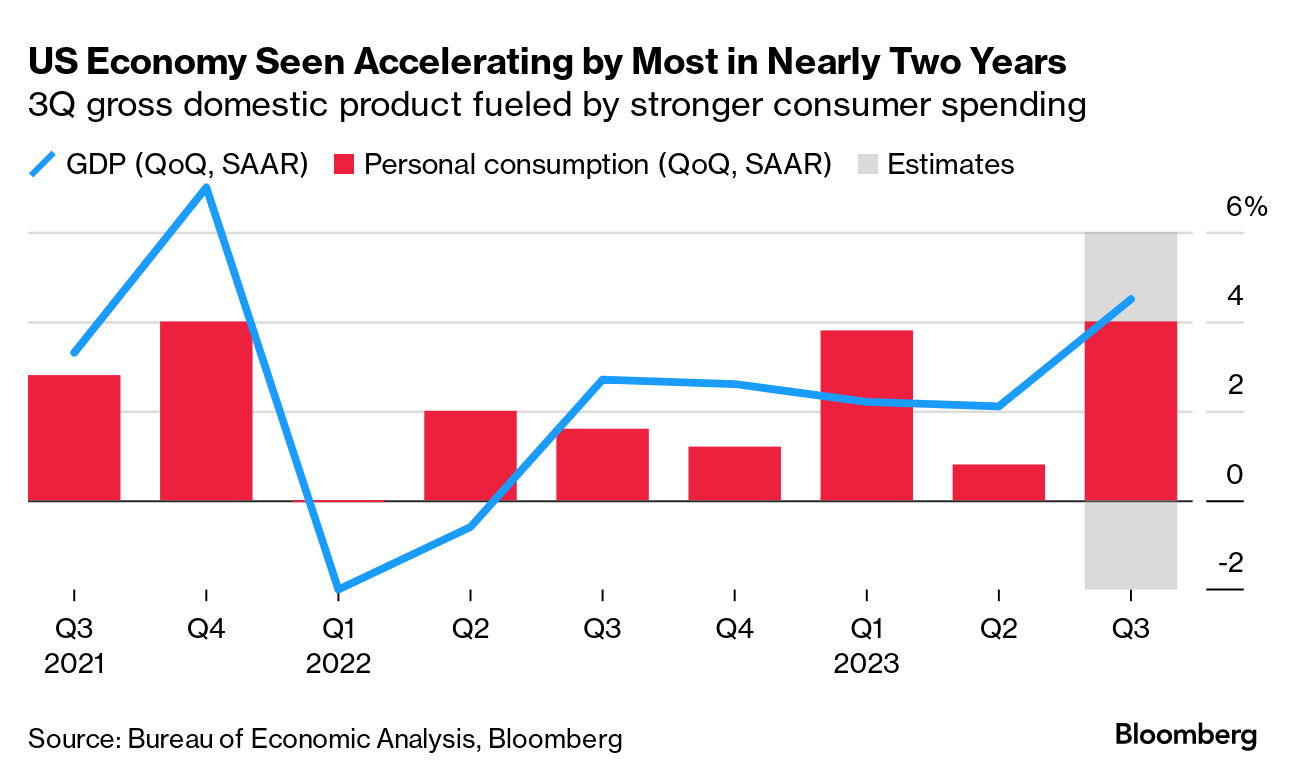

| Chinese leader Xi Jinping appears to be redoubling his efforts to combat an economic slowdown, with his government unveiling a sovereign debt package amid a persistent housing downturn. But Xi has refrained from the kind of stimulus “bazooka” many economists have called for. The unusual budget change is “a firm signal from policymakers that they intend to support growth,” said Peiqian Liu, Asia economist at Fidelity International. “Raising funds by central government leveraging is a strong sign that the government will not hesitate to expand its balance sheet when needed.” Still, things are going from bad to worse in China’s ongoing real estate meltdown. Developer Country Garden Holdings was deemed to be in default on a dollar bond for the first time, underscoring its fall into distress amid the broader property debt crisis. Country Garden’s failure to pay interest on a note within a grace period that ended last week “constitutes an event of default,” according to a notice to holders from trustee Citicorp International. That means the trustee must declare principal and interest due immediately if holders of at least 25% in aggregate principal amount of the notes outstanding demand it. There is no indication that creditors have made any such demand—yet. Nevertheless, the company is likely headed for what would be one of the biggest restructurings in China’s history. —David E. Rovella How did China make the advanced Huawei smartphone that has the Biden administration so worried? It turns out they used equipment from Netherlands-based ASML Holding. In a suggestion that export restrictions on Europe’s most valuable tech company may have come too late to stem China’s advances in chipmaking, ASML’s so-called immersion deep ultraviolet machines were used in combination with tools from other companies to make the the phone’s advanced chip. The US economy likely expanded in the third quarter at the fastest clip in almost two years, as a historically strong jobs market powers consumer spending. The Biden administration has been touting its strategy in extracting America from the pandemic as part of the Democrat’s broader “Bidenomics” agenda. US gross domestic product is projected to have grown at an annual rate of 4.5% last quarter, more than double the pace in the prior period, according to a Bloomberg survey of economists ahead of the release of government data on Thursday. But of course too much of a good thing may be a bad thing as far as the central bank is concerned.  UBS is extending a $9 billion credit line to one of the Middle East’s most influential investors, former Qatari prime minister Sheikh Hamad bin Jassim bin Jaber Al Thani. UBS Chief Executive Officer Sergio Ermotti seeks to retain the region’s ultra wealthy following the takeover of Credit Suisse. The credit facility is at least 50% more than the total of existing lines from UBS and Credit Suisse that it replaces. Ford and the United Auto Workers are said to be hashing out the final details for a new contract that would bring an end to a nearly six-week strike. UAW President Shawn Fain and Chuck Browning, the union’s top Ford negotiator, were both at the bargaining table Wednesday at the automaker’s headquarters in Dearborn, Michigan. The presence of the union’s top two negotiators is significant. A Donald Trump-approved far-right Republican from Louisiana is now second in line to the presidency. Representative Mike Johnson, an opponent of reproductive rights and same-sex marriage who helped lead members of his party in seeking to reverse the election of President Joe Biden, was elected by the razor-thin GOP majority to be Speaker of the House. His job new job could give him even more power over Congress’ role in certifying the results of the 2024 contest. Johnson’s western Louisiana district is largely rural and among the poorest in the nation. Here’s what you need to know.  Representative Mike Johnson Photographer: Al Drago/Bloomberg Silver Lake Management, the private equity group, is considering making a takeover bid for Endeavor Group Holdings, the talent agency and entertainment company behind World Wrestling and Ultimate Fighting Championship. Led by Hollywood super-agent Ari Emanuel, Endeavor, said it won’t consider options for its publicly traded TKO Group Holdings, which owns the UFC and WWE combat-sports businesses. 23andMe Holding, the genetic-testing company best known for helping people discover their ancestral roots and inherited food aversions, is rolling out a new product to help customers better understand and manage health risks hidden in their DNA. The service—available in November for $1,188 a year—allows people to sequence their entire exome, the tiny portion of DNA that researchers estimate is responsible for the vast majority of disease-causing genetic variants. It seems private equity firms are coming for your nest egg. Amid the roster of banks and brokerages helping KKR raise money for some of its newest infrastructure investments, two names stand out: Fidelity and Charles Schwab. Both are known for serving individuals, not the pension funds and endowments that typically invest in multibillion-dollar investment partnerships such as KKR’s. But that kind of money is drying up. Individual investors, by contrast, represent a deep reservoir of untapped riches. “The amount of money that is in IRAs is the largest pool of liquid capital on Earth,” said David Himmelreich, a senior vice president at Wealth Enhancement Group. “It is getting more and more important” to private equity firms, he said.  Photographer: Chandan Khanna/AFP Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg’s Technology Transformation & the Strategic C-Suite:Join us in New York on Nov. 2 as CFOs and other senior leaders in corporate finance and operations gather for a special evening briefing on the ways they can transform and amplify the impact of their departments. New York: Register here. |