Editor's note: Cracks are showing in the U.S. economy. And according to Joel Litman – founder of our corporate affiliate Altimetry – it all comes back to credit. In this piece, adapted from a December issue of the free Altimetry Daily Authority e-letter, Joel explains why U.S. companies are in worse trouble than you might think...

Bankruptcy Is Only One Piece of the Puzzle By Joel Litman, chief investment strategist, Altimetry

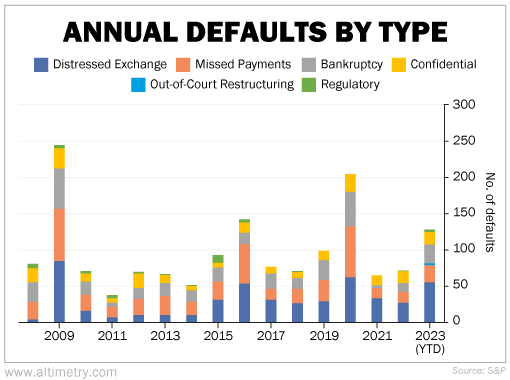

Bankruptcy is just about the worst-case scenario for a company... It probably sounds obvious when I put it like that. But it's also an important reminder – because when measuring economic health, folks often get way too caught up with bankruptcies. They're certainly a factor, and they're not looking good today. Last year is projected to be the worst for U.S. bankruptcies since the Great Recession. However, when companies are under stress, they have more options than simply declaring bankruptcy. Most companies will try their best to restructure first. Or they might get as close to default as possible without actually entering default. If you're only paying attention to bankruptcies, you're missing the bigger picture. So today, I'll examine other overlooked categories that measure the health of corporate America.

| Recommended Links: |  '2024's Market Is a Trap' If you're holding stocks, you can't afford NOT to see this urgent warning from Joel Litman. He famously predicted the financial crisis in 2008 and is now sounding the alarm on a similar crisis unfolding on Wall Street – one that'll have dire implications for investors over the next three years. It's time to move your money. |  |

|---|

|

Bankruptcies weren't even the biggest form of default last year... That title goes to the "distressed exchange." A distressed exchange happens when a company is struggling with its debt and wants to avoid bankruptcy. The company has the option to try negotiating with its lenders. It might offer to buy back the debt at a steep discount. Or it might exchange it for a much smaller debt. For instance, the company may offer to buy back its bonds at a lower price... like 15 cents for each dollar of the bond's value. The key point is it's not like normal refinancing – the lender is taking a discount. This move helps the company avoid bankruptcy and lets creditors get back some of their money. This is what Swedish real estate company SBB attempted early last year. SBB wanted to buy back some of its bonds for an 85% discount. Credit-ratings agency S&P warned it would be labeled as a "selective default." If you've only been paying attention to bankruptcies, you know the U.S. economy is struggling. But when we zoom out our view of corporate health... we can see just how many companies are struggling. Last year, even more companies underwent distressed exchanges than went bankrupt. And plenty missed interest payments, entered out-of-court restructuring, or started confidential restructuring procedures that don't show up in the bankruptcy numbers. Only three years have looked worse since 2008... the height of the Great Recession in 2009, the midst of the energy-price rout in 2016... and the start of the pandemic in 2020. Take a look...

Corporate stress is building... and more companies are on the brink of bankruptcy than many folks realize. They're missing it because they're only paying attention to companies that have already gone bankrupt. Today, distressed exchanges are nearly matching the tough times of 2020. The numbers make for a grim outlook. No matter where you look, pretty much every credit metric is going south... Bankruptcy data is important. However, it's better for seeing how bad the economy is... rather than how bad it might get. Distressed exchanges and overall corporate stress point to a recession on the horizon. Many of these companies skirted bankruptcy last year. That doesn't guarantee they'll stay solvent forever. It's a good reminder of just how much worse the outlook could get in the coming months. Regards, Joel Litman

Editor's note: Joel famously predicted the financial crisis in 2008. Now, he believes a similar crisis is unfolding on Wall Street... It's far worse than anyone realizes. And it could have dire implications for investors over the next three years. But Joel has a way to stay ahead of this market trap. With the help of his "backdoor" strategy, prepared investors could see double- or triple-digit gains through this crisis... Click here for the full details. Further Reading "The next credit crisis is already underway," Mike DiBiase writes. Banks are lending out less money today. It's yet another sign of trouble for U.S. companies. But with one proven bond strategy, you can protect yourself – and even profit – from what's happening... Learn more here. One famed investor has historically gone against the grain. Recently, he defied the consensus bet again... and called a big shift in the bond market. Here's why his current outlook could be a warning sign for investors this year... Read more here. |

|