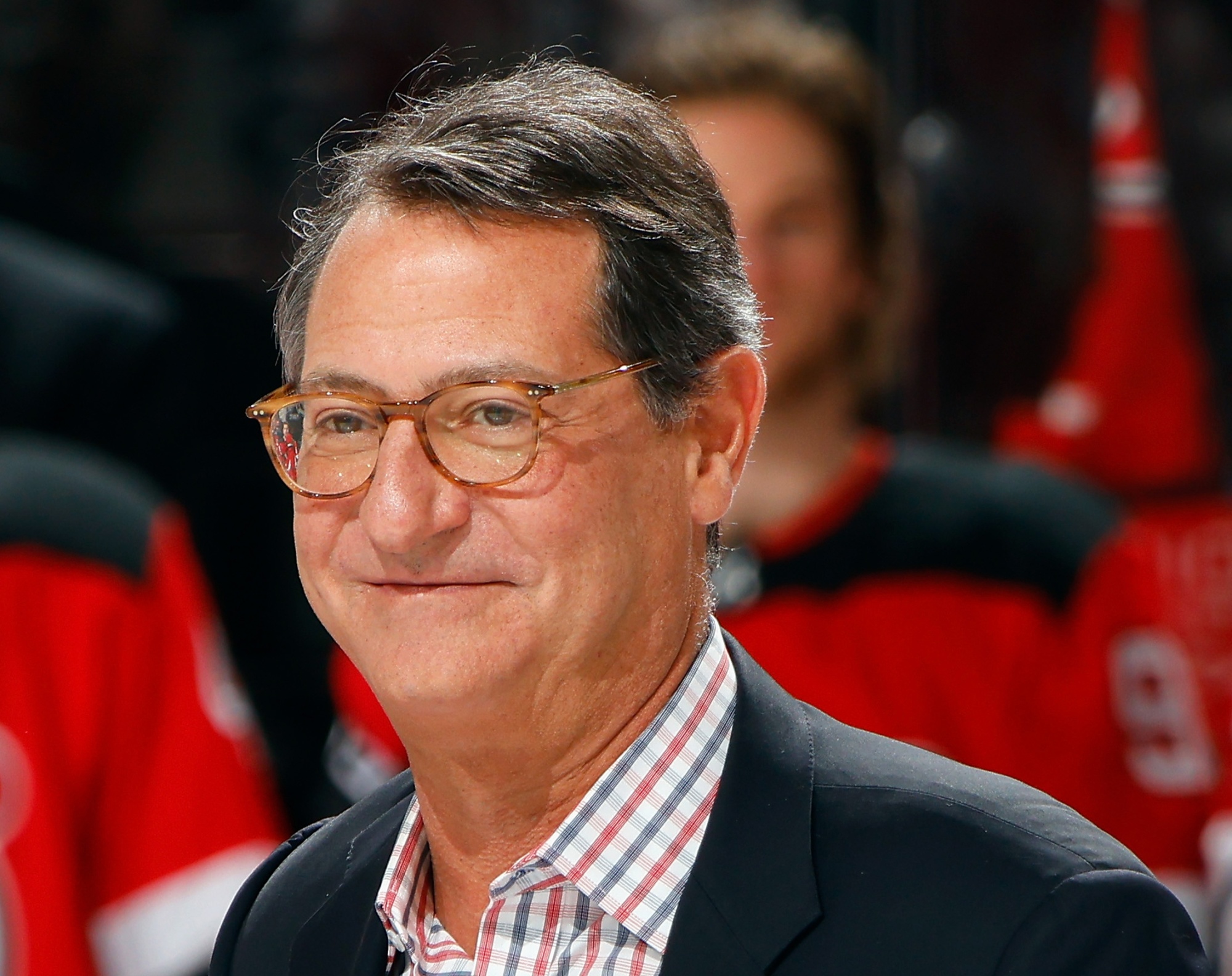

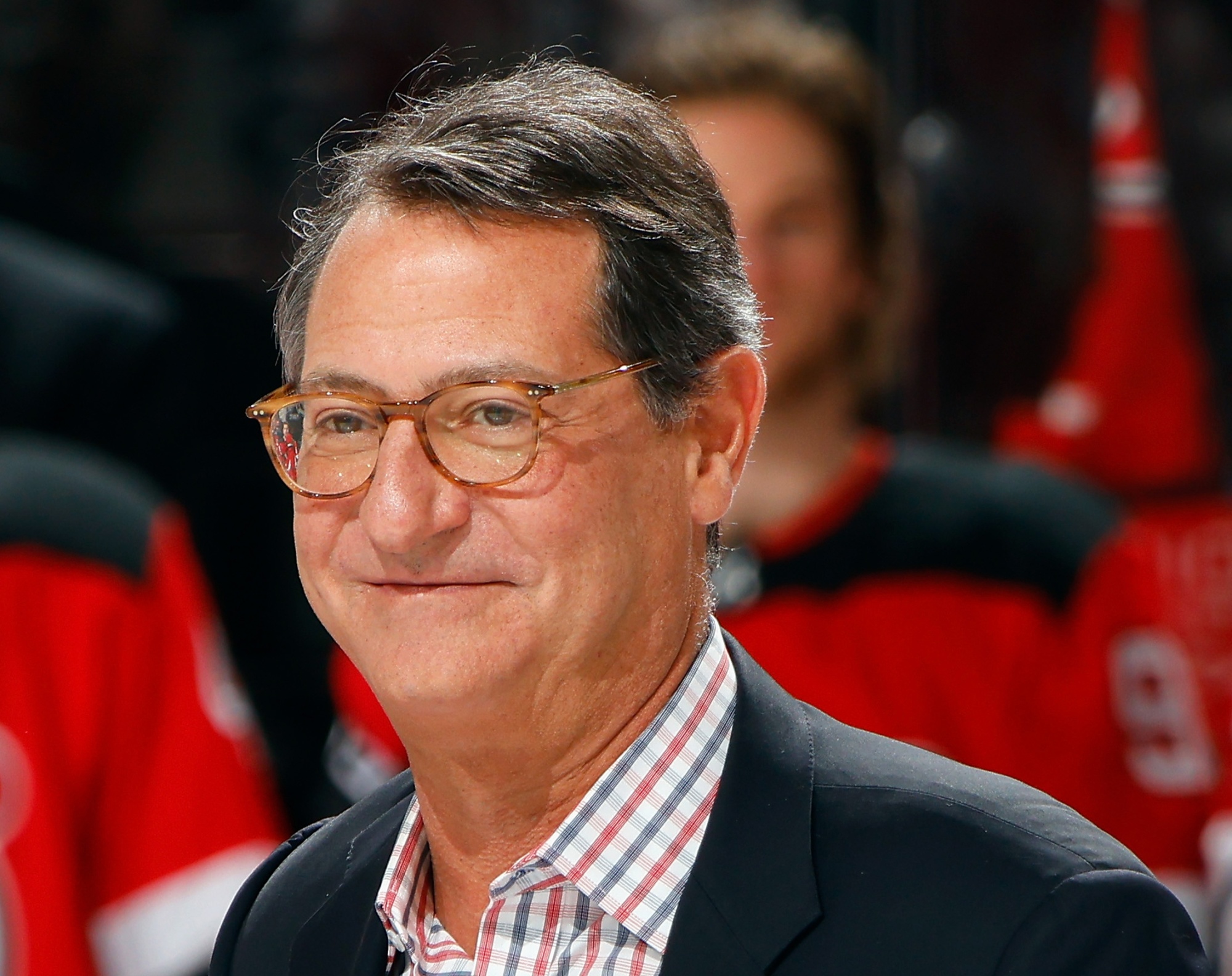

| The biggest US bank stocks have been trouncing the broader market this year. But their rally got a brake-check from earnings results that underwhelmed investors. Wells Fargo sank 6% for its worst earnings-day drop in more than three years after a net interest income miss. Citigroup slumped 1.8% on expenses even though its markets revenue beat expectations. And JPMorgan fell 1.2% after its results and steady guidance failed to impress. All three were among the 20 biggest decliners in the S&P 500 Index Friday, a session in which more than 400 of the index’s stocks rose, with Wells Fargo coming in as the day’s biggest loser. In short, the results were not enough to keep the momentum going after rallies had sent all the stocks up by more than 20% this year through Thursday’s close, compared with the S&P 500 Index’s 17% gain. The moves were particularly stark given the broader market was rising on Friday, with about 400 S&P stocks in the green. —David E. Rovella It’s true JPMorgan fell short on some key metrics. But it also reported record profit as investment bankers and equities traders at the biggest US bank smashed expectations and the firm took a multibillion-dollar gain tied to a Visa share exchange. Fees from investment banking soared past analysts’ estimates, jumping 50%, while the firm’s equity traders notched a 21% revenue jump. The Visa transaction added $7.9 billion to second-quarter profit. More businesses are doing deals again after a long lull, allowing investment bankers to contribute a larger share of their banks’ bottom lines despite the elevated cost of borrowing, lingering uncertainty posed by the US election and global geopolitical issues. A hubbub on social media over Chipotle’s portion sizes has sent the burrito chain’s shares into their worst tailspin in nearly a year. For Wall Street bulls, the rout that has wiped out roughly $7 billion in market value this week presents a buying opportunity. They argue that the backlash won’t last long enough to justify the extent of the selloff, even as consumers continue to scrutinize price increases and perceived “shrinkflation” at dining establishments. “Clearly, consumers are disgruntled by the value proposition across the industry and are pushing back,” BTIG analyst Peter Saleh wrote in a note to clients. But “any pullback in shares on this dynamic will be short-lived.”  Inside a Chipotle restaurant in New York Photographer: Angus Mordant/Bloomberg US President Joe Biden is forging ahead despite skeptics in his own party. A high-stakes press conference on Thursday evening that began with a major gaffe but went on to highlight his deep policy experience saw the incumbent Democrat state yet again that he would stay in the race. But friendly fire aimed at the 81-year-old and his unswerving re-election bid continued on Friday. Meanwhile, Biden and his supporters say the focus should be on his Republican rival, and what they warn is the threat he poses to American democracy. This summer, Kyiv will finally get the F-16 fighter jets it’s been insisting it needs to repel Russia—but in far fewer numbers than it had hoped. The move to send warplanes has been bedeviled by delays, questions around spare parts and a language barrier between Ukrainian pilots and their foreign trainers. Planners also worry that the country doesn’t have enough runways—and those it does have are vulnerable to Russian attacks.  F-16 military fighter jets Photographer: Petras Malukas/AFP/Getty Images AT&T said on Friday that hackers stole a cache of six months worth of mobile-phone customer data, disclosing for the first time a massive cybersecurity breach that threatens national security. The breach at the telecommunications giant included calls and text information for nearly all of its cellular customers from May 1, 2022 to Oct. 31 of that year, and it included the numbers they were calling. The world’s biggest human resources association dropped “equity” from its main diversity program. The Society for Human Resources Management said it will be adopting the acronym “I&D,” or inclusion and diversity, and removing the “E” from its previous “IE&D” strategy. “By emphasizing inclusion-first, we aim to address the current shortcoming of DE&I [diversity, equity and inclusion] programs, which have led to societal backlash and increasing polarization,” SHRM announced. SHRM’s move is a sign that even hiring managers who’ve encouraged diversity in the workplace are beginning to shy away from DEI. David Blitzer is among the last of the swashbuckling investment personalities at Blackstone. Since joining the firm in 1991, he has gone from starting its European private equity business to leading a $35 billion tactical opportunities unit that epitomizes Blackstone’s shift into all kinds of alternative assets, becoming a billionaire and sports titan in the process. Now Blitzer, 54, is laying the groundwork for his next act.  David Blitzer Photographer: Bruce Bennett/Getty Images Affluent Americans with the flexibility to work remotely have been headed to the French Riviera. In fact, they’re snapping up luxury houses there, sparking a surge in property prices in a region known for its stunning beaches, fancy yachts and the Cannes Film Festival. Prices of homes valued above €15 million ($16 million) along France’s southeastern coast rose between 15% and 20% in the five years through 2023, outperforming the 13% gains in London in the same period.  Pedestrians browse properties in the window of a Sotheby’s real estate office in Saint-Jean-Cap-Ferrat. Photographer: Andrey Rudakov/Bloomberg Bloomberg Power Players: Bringing together leaders at the intersection of sports, business and technology, this half-day experience at Bloomberg headquarters in New York on Sept. 5 will deliver exclusive perspectives on innovations and strategies disrupting the industry landscape. Join us for forward-thinking conversations, forge strategic partnerships and gain insight that will empower you to stay ahead of the game. Get your discounted passes now. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |