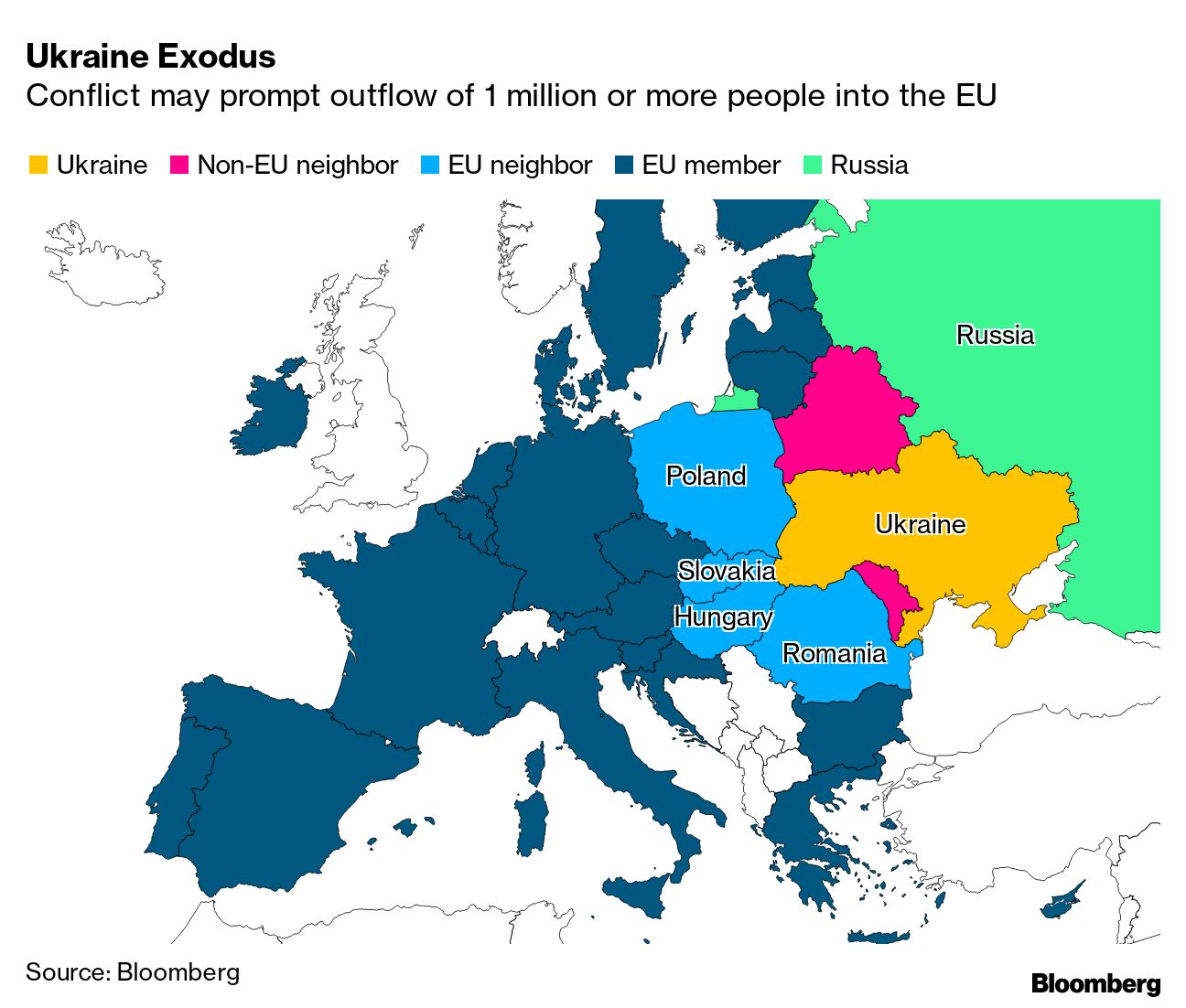

| Capping months of repeated denials and alleged attempts at false-flag provocations and propaganda, all eerily predicted by U.S. intelligence, Russia on Thursday launched a full-scale attack on its neighbor of a kind not seen in Europe since World War II. Kremlin forces moved swiftly to take control of major cities, effectively eliminating Ukraine’s air defenses with missile volleys landing all across the country. European Commission President Ursula von der Leyen called the Russian war a “barbaric attack” while European nations backed an unprecedented sanctions package, though omitting key components some see as most effective in punishing Moscow. Later, U.S. President Joe Biden imposed more sanctions on Russia, its banks and industries. But he too held back on measures where the collateral damage to European economies could be high. In Ukraine, officials reported almost 60 killed and about 170 wounded by Russian attacks as of late Thursday. People raced to the West to escape Putin’s forces while Ukraine’s overmatched military sought to delay their march. Western intelligence officials said Kyiv could fall in a matter of hours. But taking over the capital is unlikely to be the end of Putin’s war, or the fight by Ukrainians to beat him back.  Ukrainian tanks on the move following Russia’s attack on Ukraine near Chuhuiv. Photographer: Anadolu Agency/Anadolu In Moscow and other Russian cities, hundreds of protesters against the war were rounded up by state security. Russian ally China meanwhile refused to condemn Putin’s attack, instead urging restraint by “all parties” and repeating its criticism of the U.S. for publicly predicting what, as it turned out, Putin ended up doing. Beyond the economic pain in store for Putin, Russian oligarchs and the country as a whole, Biden announced the start of a process with NATO allies that may bring about the kind of geopolitical restructuring Putin wants least. At the height of the Cold War, America had hundreds of thousands of troops (along with tanks, jets and missiles) all across Europe. With more troops from allied nations now heading to NATO members along Russia’s border, what was old may be new again. “The U.S.,” Biden intoned from the White House, “will defend every inch of NATO territory with the full force of American power.” —David E. Rovella Europe is bracing for an exodus of refugees from Ukraine, as officials say any initial strain will be borne by member states on the bloc’s eastern frontier. More than a million may be displaced. International banks are talking publicly about how the business impact of Russia’s Ukraine invasion will be limited. In private, they’re debating the chances of nuclear conflict. Russian stocks cratered as global outrage and a rising tide of sanctions took aim at its economy. U.S. stocks closed higher. Fears that oil prices would skyrocket eased, due in part to Biden’s pledge to release more crude from strategic reserves as needed—and because sanctions have yet to broadly target Russian supply. Here’s your markets wrap. UBS Group triggered margin calls on some wealth management clients that use Russian bonds as collateral for their portfolios after marking down the value of debt issued by the country and its corporations. U.S. Federal Reserve officials signaled they remain on track to raise interest rates next month despite uncertainty posed to the global economy by Russia’s invasion. Putin has fallen into the autocrats’ trap, Clara Ferreira Marques writes in Bloomberg Opinion. He is starting a war Russians do not want for which they will pay the cost. Hong Kong may see thousands of restaurants shut down as the city ramps up its Covid-19 eradication campaign with some of the world’s toughest curbs. Cases continue to rise in China and Singapore delayed its easing. The United Arab Emirates, Ireland and Saudi Arabia topped Bloomberg’s Covid Resilience Ranking in February, as the three nations are leading examples of a shift taking place in much of the world toward living with the virus. Here’s the latest on the pandemic. Wall Street managers are rushing to price in the immediate fallout from the Russian invasion of Ukraine and figure out how exactly the geopolitical fallout will hit cross-asset trades in the weeks to come. Bloomberg asked some of them what they see coming.  Photographer: Michael Nagle/Bloomberg Photographer: Michael Nagle/Bloomberg Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Bloomberg Deals: Get the inside scoop on tomorrow’s deals today, from M&A and IPOs to SPACs, LBOs, PE, VC and more. All in our Deals newsletter. Exclusive to our Bloomberg.com subscribers. Subscribe here. |