Morgan Stanley strategist Mike Wilson finally capitulated and apologized for getting the market wrong the last nine months. He was everyone’s favorite analyst in 2022. King of the Bears. I haven’t seen that much drooling over a strategist since Abby Joseph Cohen in 1999.

We all live long enough to see our reputations ruined.

Ruined? Yes, ruined. If you’re bearish from 3,500 to 4,400 in the SPX (a 25% move), then you’re dead-balls wrong. Not only that, but he was also noisy and wrong. So much bravado. He’s got the big L stapled to his forehead.

Over the past 50 years, this portfolio has gone up 4,491% and is as set-it-and-forget-it as it comes. Jared Dillian's Awesome Portfolio is designed to outperform over decades, no matter what happens. If you're looking to take the stress and guesswork out of investing and sleep better at night knowing you have a proven plan for success in the markets, click here to see if the Awesome Portfolio is right for you. |

Now, I don’t know Mike Wilson personally, and I’m sure being wrong on the stock market doesn’t diminish his stature as a human being, but sometimes you can be a little too sure of yourself.

Anyway, the reason I bring up Mike Wilson is: When the Street’s most bearish strategist turns bullish, does that mean the market is due for a correction?

Well, that logic is a little too on-the-nose, but…

Yes.

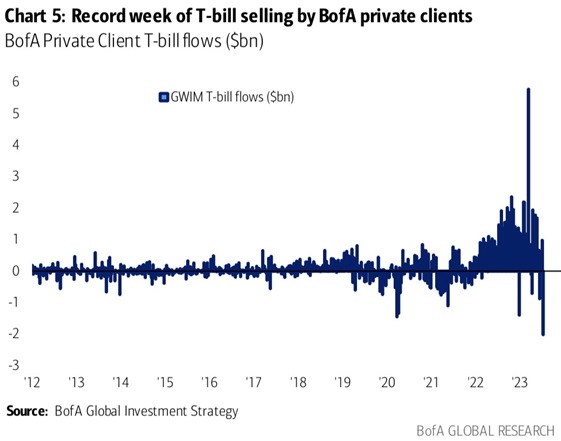

The last bear capitulated. Time to get short. Now, the chart I am about to show you is one of the most incredible charts in the history of charts. And it will give you an idea of how quickly sentiment has shifted from bearish to bullish. Are you ready?

Source: @agnostoxxx

This is a chart of flows into or out of T-bills by Bank of America private clients. You can see that the last year was nothing but risk aversion, with people piling into T-bills, and the last few weeks everyone changed their minds and YOLO’d into tech stocks. Right on the ding-dong highs. You could not have scripted this any better.

I’d put in a chart of the AAII bulls here, but it would be pedantic. It’s back to the levels of where we were doing the second stimulus during the pandemic.

The Market Makes Fools of Us All

Everyone is humiliated by the market at some point. Everyone. Even the great Stan Druckenmiller converted his hedge fund into a family office after picking a fight with the bond market. I can sit here in my air-conditioned living room and criticize people, but I have been there, too.

But there is a big difference between trafficking in opinions and trafficking in positions. If you’re a trader, the market forces discipline on you. You have to admit you’re wrong and close out your trade, or else you run the risk of ruin. People like Mike Wilson don’t have a PnL—all they have is their reputations. The thing with trading reputational capital is that you have to treat it with even more care than actual capital. What do you think Mike Wilson will be remembered for—being right on the way down or wrong on the way up? What is Abby Joseph Cohen remembered for? Exactly.

Mike Wilson falls into a category of people I will call “permas.” There are permabulls and permabears. You can be a permabear, but not if you work at an investment bank. You can’t be an equity strategist and be bearish in a bull market for nine months. If you have a strategist who’s constantly bearish, it makes it difficult to do deals. Banks are more willing to tolerate a bullish strategist in a bear market. The late Jeff Applegate, hyper-bullish strategist at Lehman, didn’t lose his job until 2003. My guess is that Wilson was on a very short leash.

I’m Bearish

Between strategists apologizing and people YOLOing into tech stocks, I think it’s time to book whatever gains we have and move to the sidelines. In The Daily Dirtnap, I have been predicting a correction of about 10%–12%. It may be less. It may be more. Things might get much worse. I don’t know! All I know is that all the conditions are in place for a correction of some magnitude. And it will take a lot of people by surprise, as these things usually do.

In other words, sell when you can, not when you have to.

Since we’re doing market aphorisms, here’s another one: Never confuse brains with a bull market. I’m hearing stories—not many, just a few—of plumbers quitting their jobs and getting into day trading… again. They made a lot of money off TSLA and think that is a repeatable strategy. Here we go again.

It’s no use arguing fundamentals. I could sit here and talk about how interest rates are over 5%, how there is a war in Europe, how there is the persistent threat of inflation, how richly valued the stock market is—none of it matters. These are the sorts of dumb things that people talk about at idea dinners on Wall Street.

You want to know where the market is going? Don’t follow the smart money; follow the dumb money.

Jared Dillian, MFA

P.S. My Bond Masterclass is now accredited! It has been granted 3.5 Certified Financial Planner (CFP) and 3 Investments & Wealth Institute (IWI) credits. If you hold either of these professional credentials and would like to take advantage of the continuing education credits, we’ll walk you through the process once you sign up.

The best part? It’s easy to get started. It doesn’t matter if you don’t have much time right now. My Bond Masterclass is designed so you can jump straight into the clearly marked takeaways, build the portfolio every investor should have, and learn the rest at your leisure. Join today and save 25%.

Suggested Reading...