|

| - | - | - | - | - |

|

|

| ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

|

More options in our savings section, incl Premium Bonds, a 50% bonus if you're on a low income and kids' accounts. Plus see Martin's Help to Buy Isa/Lifetime ISA help immediately below. |

| Martin: 'URGENT: Should you move your Help to Buy ISA to a Lifetime ISA?' His new Is a LISA better than H2B ISA? blog takes you through who should and shouldn't move it over. If you should, do it ASAP, before the tax year ends (in a few days). New. Top balance transfer credit card - shift debt to 29mths at 0%, 2.75% fee. If you pay credit or store card interest, a balance transfer helps you slash costs. First check which cards you're most likely to get, though this new M&S Bank* card now offers accepted new cardholders the longest 0%, for 29mths, with a one-off 2.75% fee (min £5). If you apply by 11.59pm today (Wed) and go paperless by 23 Apr, you also get 1,000 M&S pts - worth £10. Golden rules: 1) Pay at least the monthly min. 2) Pay it off in the 0% period or transfer again, or it's 21.9% rep APR. 3) Don't spend/withdraw cash. More help & deals, incl 18mths 0% NO FEE (+ £20 Amzn vch), in Top Balance Transfers (APR Examples). B&Q £5 off £30 spend. For newbies to its free loyalty scheme. See how to get £5 off at B&Q . Last chance. Green Homes Grant closes to applicants at 5pm TODAY (Wed). We've criticised this Govt scheme for being overcomplex and cumbersome, but it gives up to £5k for green improvements in Eng. Yet after a surprise announcement on Sat you now only have hours to apply, so if you've begun the application process and have a quote for the work from an installer (which you need in order to apply), then move quickly. If you've not begun the process it's probably too late, although you may get lucky. Full info in our Green Homes Grant guide. Free £50 Govt bicycle repair vchs in Eng - can you get one? 150,000 originally avail, but they tend to go wheely quick, so see it as a bonus if you're successful. Free £50 bike vchs FREE Easter choc for 3m Clubcard holders (eg, Creme Egg, Mini Eggs etc). Check if you can get free choc. Ends today (Wed). EXTRA 30% off secret Amazon discounts on returned (often unused) items. Eg, £250 off an HP laptop, £30 off a Nespresso machine. Get 30% more off 40,000+ items that are already discounted at the little-known Amazon Warehouse. |

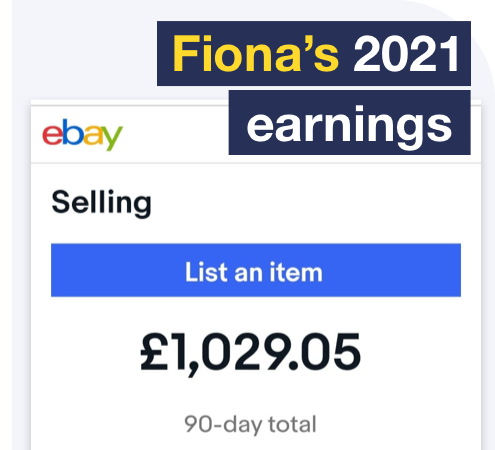

| If you've spare time this long weekend, why not do a personal stock clearance? With what you find, ask yourself: "Have I used it since last Easter?" Our usual rule is to consider flogging anything unused in a year, but now, given the restrictions, you get a pass on stuff such as suitcases, ball gowns or fancy china. However, we bet most can still make cash from their attic - here's how you could make £100s...

|

| M&S to close current accounts, but ALL its custs can now apply for £100+ switch bonuses. They're closing in Aug, but when the news broke earlier this month, anyone who'd opened an M&S current account since 2018 couldn't grab bribes to switch to sister brands First Direct and HSBC (the market's standouts). But that restriction's been lifted, subject to normal eligibility criteria. The most similar account to M&S is First Direct, which offers newbies a free £100* to switch, a 1% savings account, while some get a £250 0% overdraft. For more deals, see Best Bank Accounts. Also see M&S to close bank accounts news. Martin's 17 urgent pre-Apr checks, incl work-from-home rebate and marriage tax allowance. Plus beat council tax & prescription hikes, and last chance Covid payment hols. 17 urgent pre-Apr checks Ends 11.59pm today (Wed). Cheapest 8GB Sim we've seen - '£5.09/mth' from Three. MSE Blagged. With this 1yr deal, newbies to Three* (via reseller Fonehouse) get 8GB/mth of data + unlimited calls & texts. It's £8/mth, but you get £35 automatic cashback, so it's equiv to £5.09/mth. For more Sim-only deals, see our Cheap Mobile Finder. COUNCIL TAX RECLAIM SUCCESS OF THE WEEK: Warning. Renewing or signing a new O2 deal? It's planning inflation-busting price hikes. Affects pay-monthly & Sim-only contracts. See full O2 hike help. Free or cheap Easter kids' activities at home. Incl cheap baking recipes, free colour-in pages and kids' movies on Freeview. Easter fun at home |

| AT A GLANCE BEST BUYS

|

| THIS WEEK'S POLL What TV do you pay for? The pandemic has led to a surge in TV viewing, and streaming services continue to grow in popularity too. But with more choice than ever, this week we want to know what TV you pay for. MoneySavers are keenest on buying books and cars second-hand. Last week, we asked what you'd be happy to buy second-hand - over 7,400 voted. More than three quarters were happy to give a second home to books, cars and furniture. Meanwhile, bicycles and DVDs were also popular choices. But just 13% would buy second-hand bedding and just 11% a second-hand carpet, while not surprisingly, very few were keen on the idea of pre-owned underwear. See the full second-hand poll results. |

|

|---|

| MONEY MORAL DILEMMA Is it 'morally wrong' to use student discounts aged 55? I'm a 55-year-old mature student doing a continuing education course at a university, which is about two hours a week, plus reading, studying etc. As such, I have a university email address, which means I'm eligible for all manner of student discounts. My 20-year-old son, who is also a student, is appalled that I can do this and says it's "morally wrong" as I'm "not a proper student". Is it wrong for me to take advantage of these offers? Enter the Money Moral Maze: Is it 'morally wrong' to use student discounts aged 55? | Suggest an MMD | View past MMDs |

| MSE TEAM APPEARANCES (SUBJECTS TBC) Sat 3 Apr - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am |

| £99,999 TO RENEW BIKE INSURANCE... WHAT'S YOUR MOST OUTRAGEOUS INSURANCE QUOTE? That's all for this week, but before we go... one MoneySaver got a shock recently when he was quoted a whopping £99,999 to renew his bike insurance, and while something strange has obviously happened, it turns out he's far from alone in getting an outrageous quote. You've been sharing the most ridiculous quotes you've had, including £17,000 for travel insurance. See the full list and let us know if you can beat 'em on our outrageous quotes Facebook post. We hope you save some money, stay safe, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin Lewis What is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email marcus.co.uk, sagasavings.co.uk, bank.marksandspencer.com, firstdirect.com, fonehouse.co.uk, santander.co.uk, moneysupermarket.com, confused.com, comparethemarket.com, gocompare.com, ratesetter.com, cahoot.com, mbna.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |