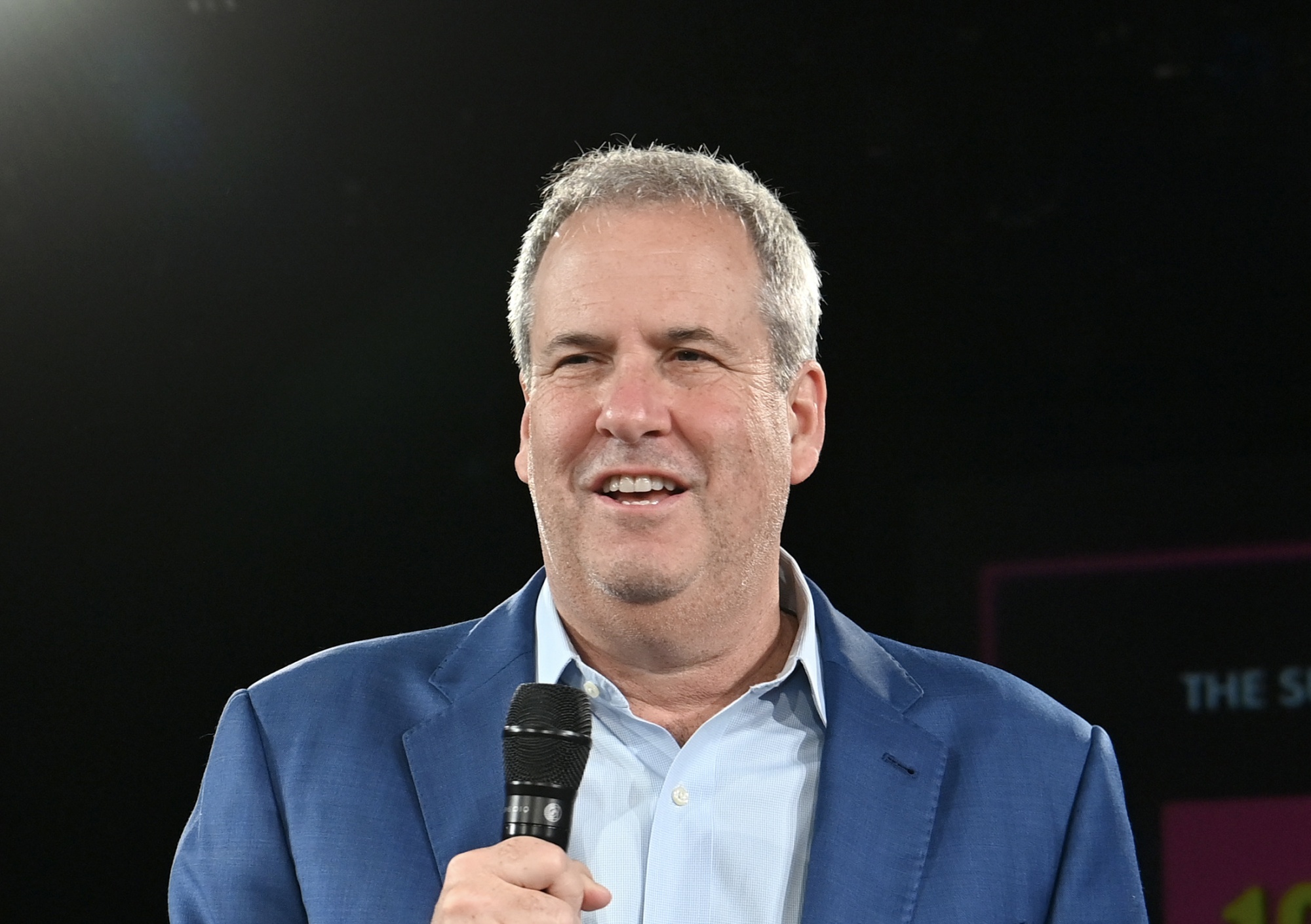

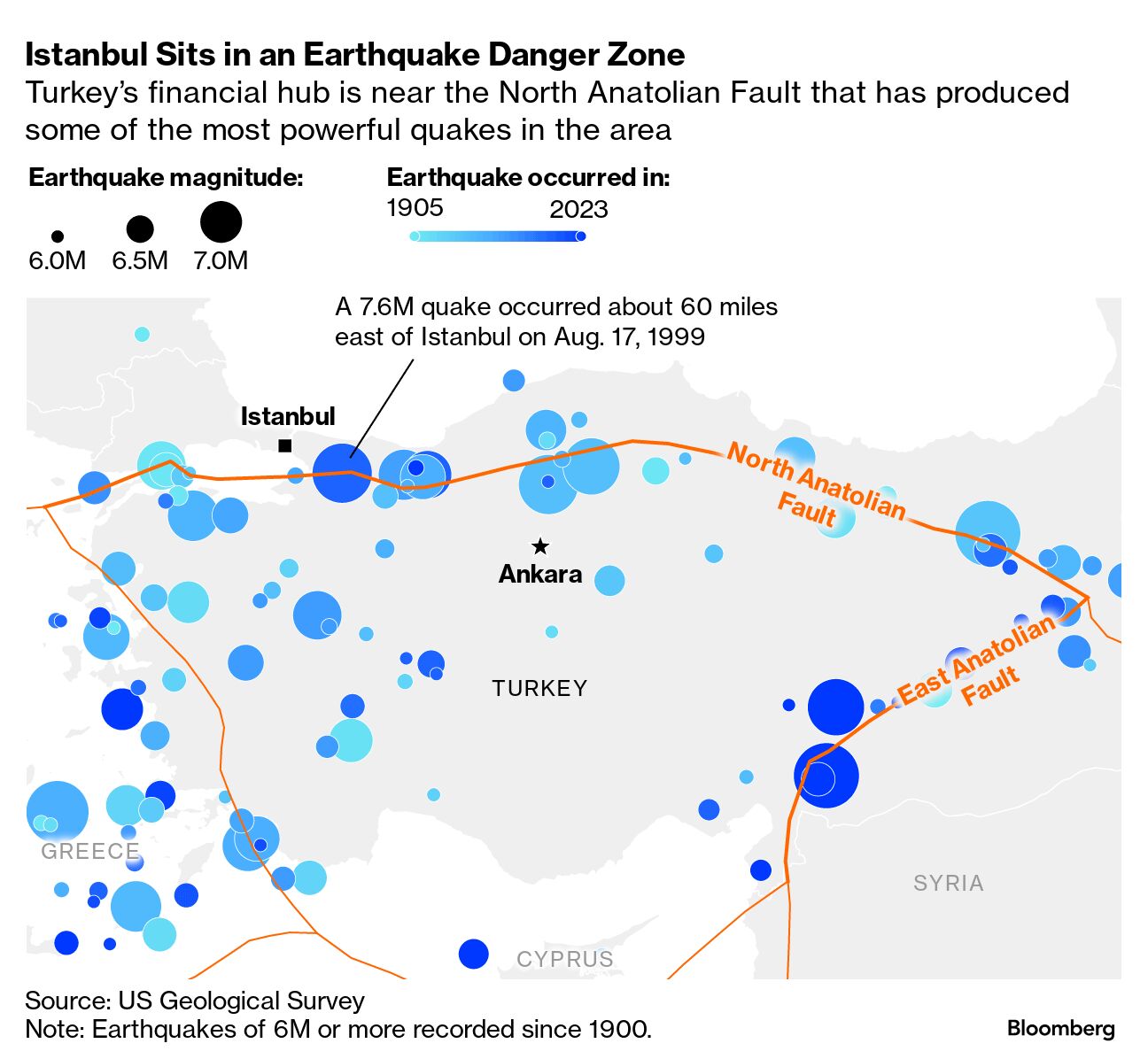

| A flurry of data affirming US economic resilience has driven stocks to their best week this year, with dip buyers stepping in after a recent rout. Equities rose on Friday with the S&P 500 extending a seven-day rally to 6.8%—the best performance in such a span since October 2022. The stock market halted a streak of four weeks of losses that had been partially driven by concern the Federal Reserve wouldn’t reduce borrowing costs fast enough to keep from overshooting the economic runway. But new data this week put frightened investors to shame, showing ebbing inflation and a resilient consumer—hallmarks of the central bank’s goal of a soft landing. Here’s your markets wrap. —David E. Rovella Bryant Riley, the co-founder and largest shareholder of B. Riley Financial, informally offered to buy the shares of the embattled investment firm he doesn’t already own. Riley is willing to buy the stock at $7 a share, according to a regulatory filing Friday, far from the roughly $50 the Los Angeles-based brokerage and investment firm was trading at a year ago. The move comes just days after the company suspended its dividend, disclosed its biggest-ever quarterly loss and confirmed the Securities and Exchange Commission is investigating the business. That sent B. Riley’s shares into a tailspin this week.  Bryant Riley Photographer: Jon Kopaloff/Getty Images North America Jerome Powell recently attended a closed-door meeting with a group of big-bank chief executives, encouraging them to work with the Fed to avoid a long legal battle over the Biden administration’s landmark bank capital proposal. Powell is said to have told the bank chiefs, including JPMorgan’s Jamie Dimon and Citigroup’s Jane Fraser, that the public would have the chance to weigh in on key changes to the plan. The discussion is the latest sign that he’s using his influence to try to get consensus and push the package across the finish line. The effort, a response to the 2008 global financial crisis triggered in large part by Wall Street, has been in the works for more than a decade, but it has faced fierce opposition from the industry. And in some ways, the Fed has already retreated, having floated a dramatically weaker version of the bank-capital overhaul. That’s prompted some observers to question whether the Fed will give too much ground. On Thursday, President Joe Biden and Vice President Kamala Harris announced that the US government’s historic drug price negotiations will save Americans $7.5 billion in its inaugural year, a first step toward driving down its world-leading pharmaceutical bill. On Friday, Harris vowed to build “an opportunity economy” if elected to replace Biden, unveiling an economic agenda seeking to tackle residual inflation with sweeping new subsidies and tax benefits for poor and middle class Americans. The plan represented the first major policy rollout of her weeks-old campaign, and included aggressive and costly initiatives that—if passed into law by Congress—would provide a $25,000 subsidy to first-time home buyers, significantly expand tax credits for parents and cap on out-of-pocket prescription drug prices. Lawyers for hedge fund founder George Weiss allege Jefferies Financial Group threatened to ruin his reputation in the investing industry if he and his namesake firm didn’t agree to a deal that added protections to $100 million in debt owed to Jefferies. Lawyers for George Weiss made the claim in a Thursday court filing as part of a broader effort to knock-out the key legal claim in Jefferies’ lawsuit over the debt. Jefferies has alleged the founder agreed to personally backstop the obligations of Weiss Multi-Strategy Advisers before the firm filed bankruptcy, which he has denied. Kyiv’s allies are largely withholding judgment over the stunning Ukrainian offensive into Russian territory amid uncertainty over the ultimate goal of an operation that’s sought to redraw the map of the Kremlin’s 2 1/2-year war. Several NATO allies have backed Ukraine’s decision to send troops into the western Kursk region and called the operation a legitimate form of self-defense against Moscow’s war of aggression, in which Russia has killed tens of thousands of Ukrainians and is accused of a wide array of war crimes including mass killings of civilians. But some Ukrainian allies have voiced misgivings, citing the risk that the escalation could divert badly needed troops from a fragile front line.  A building damaged by Ukrainian strikes in the Kursk region of Russia on Aug. 16. Photographer: Tatyana Makeyeva/AFP South Africa’s rand is on a winning streak not seen in 13 years. The ninth consecutive day of gains in the currency, often seen as a bellwether for the outlook of emerging markets, marks its longest streak since January 2011 as well as a five-week high on a closing basis. As of Friday morning, it was the best-performing currency against the dollar among the 150-or-so global currencies tracked by Bloomberg. South African assets have won investors’ favor since a business-friendly coalition took power two months ago and the country’s economic data began improving. When Turkish lender Denizbank paid more than $350 million for the building that houses its headquarters in April, the purchase cemented the bank’s place in Istanbul’s most expensive commercial district. Yet, almost as soon as the ink had dried on the deal for the imposing 34-story tower, the same institution was quietly scouting for alternative premises in another city. The reason was the prospect of seismic activity beneath the building. Earthquakes are unpredictable but also inevitable, and experts say Istanbul might be due one. After the devastation last year in the southeast of the country and criticism that the government was woefully unprepared, banks are now getting ahead on contingency planning.  It’s not just that the $10 billion sports betting industry has saturated sports media. It’s that the sports betting industry is, in a sense, the sports media. ESPN has a sportsbook in its name. Sports Illustrated has one, too, though it’s already being wound down. Everyone in sports media, it seems, is in a partnership with either DraftKings or FanDuel, and anyone who isn’t is trying to figure out how to be. How sports gambling came to be such a hulking, clanging presence in our life is the ultimate sports media story—which is ironic, given there’s not a lot of sports media left to tell it.  Damon Runyon at the Kentucky Derby in 1938. Photographer: Bettmann Archive/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. Bloomberg Power Players: Join us in New York on Sept. 5 during the US Open Tennis Championships and hear from leaders working to identify the next wave of disruption that could hit the multibillion-dollar global sports industry. With us will be A-Rod Corp founder Alex Rodriguez, Boston Celtics co-owner Steve Pagliuca, Carlyle Executive Chairman and Baltimore Orioles owner David Rubenstein and US Women's National Team forward Midge Purce. Learn more. |