|

|

Both stocks and bonds lost ground this week and Danielle DiMartino Booth has provided strong evidence that our economy is about to bite the dust. Private sector job losses are beginning to increase as lower end consumers are having big trouble making ends meet. And finally, corporates are in trouble too as they roll over cheap credit into high-rate debt, not to mention a dramatic rise in home mortgage rates. So, there is reason to think we could be in for a brief period of disinflation. But as Danielle says, there is no way that Powell will start reducing interest rates short of a major financial disaster. He recognizes the need to allow the markets to return to price allocating capital. But even if we have a major recession, Alasdair Macleod thinks both inflation and interest rates are entering a major secular trend that is hugely bullish for gold.

From a longer-term perspective, Alasdair Macleod combines sound free market economic theory with geopolitical realty to provide a guide as to where the U.S. and its allies are heading. It isn’t something we want to look forward to. But it’s always better to face reality than not. Following is a summary and overview of Alasdair’s last three weekly essays published at www.GoldMoney.com.

Inflation Will Return

It is an error to expect inflation to continue to fall in America. All financial market values in the US and elsewhere are predicated on this hope.

The misunderstanding is to assume that the widely expected recession will lead to further falls in consumer price inflation, and that therefore interest rates and bond yields will decline. These hopes are based on Keynes’s rejection of Say’s law, which simply points out there is no such thing as Keynes’s general glut because the unemployed stop producing.

A further point is that banks are increasingly scared of lending risk, which is leading to a credit squeeze. This raises the question, as to how can interest rates fall when there is a growing shortage of credit?

The current economic setup for the US, the Eurozone, and the UK seems set to increase central bank credit replacing commercial bank lending, which will undermine their currencies. Additionally, government funding requirements will increase materially at a time when cross-border investment flows are threatened by financial bear markets.

The timing of a new BRICS gold-backed settlement currency and China’s determination to consolidate the BRICS and Shanghai Cooperation Organization’s sphere of influence have the potential to offer alternatives for capital flows escaping from the collapsing finances of the western alliance led by America.

Above all, we are witnessing the death of fiat, because it is increasingly difficult to see how the current currency regime based on the dollar will survive. July 27, 2023 - Posted here: https://www.goldmoney.com/research/inflation-will-return-july-2023

Gold Is Replacing the Dollar

Financial developments in the Russian and Chinese axis are being generally ignored. The confirmation by Russia that a trade settlement currency for an expanded BRICS is on the agenda at the Johannesburg summit later this month has barely been reported, and even sound money advocates are highly skeptical.

But all will be revealed in three weeks’ time. Meanwhile, this article looks at how gold standards could return in the wake of a new gold-backed trade settlement currency, if that is what emerges, using the currency board model as a template.

This is followed by an explanation of why gold reserves must cover the bank note issue. I assess the cover afforded to both the ruble and the renminbi, incorporating assumed levels of non-reserve gold bullion held by both Russia and China. The conclusion is that both nations have ample cover to implement proper gold standards. And that gives the opportunity for other allied nations to implement currency boards with the renminbi.

The availability of above ground gold stocks to support a global retreat from fiat currencies back to the stability of legal money — gold — is then addressed. The conclusion is that with bullion having migrated in vast quantities from the west to the east in recent decades, there is a deficit for the fiat-committed western alliance and nations in its sphere of influence to back their own currencies. Posted here August 3, 2023: https://www.goldmoney.com/research/gold-is-replacing-the-dollar

Beware the Great Unwind

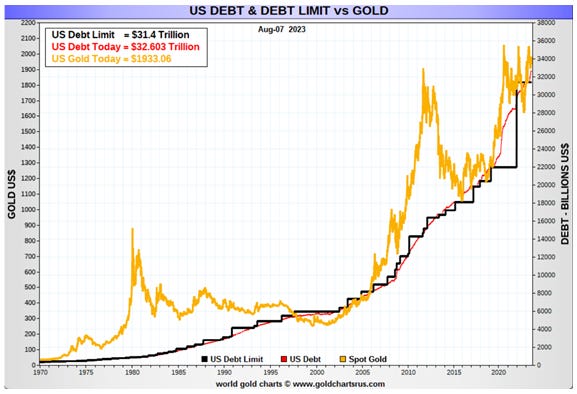

The chart on the prior page strongly suggests that US Treasury bond yields, widely regarded as the risk-free yardstick against which all other credit is measured are going significantly higher, not stabilising close to current levels before going lower as commonly believed. I conclude that US Treasury bond yields could easily double, and the political class will be powerless to stop them going even higher. The implications for interest rates globally are that they will be forced considerably higher as well.

This article concludes that reasoned analysis takes us to this inevitable conclusion. It is consistent with the end of the post Bretton Woods fiat currency era, and the return to credit backed by real values.

The collapse of unbacked credit’s value was only a matter of time, which is now rapidly approaching. The Great Unwind is under way. It is the consequence of monetary and currency distortions which have accumulated since the end of Bretton Woods fifty-two years ago. It will not be a trivial matter.

The trigger will be capital flows leaving the dollar, creating a funding crisis for the US Government. Foreigners, who have accumulated $32 trillion in deposits and other dollar-denominated financial assets will no longer need to maintain dollar balances to the same extent, perhaps even paring them back to a minimum. Furthermore, economic factors are turning sharply negative with energy prices rising ahead of the Northern Hemisphere winter, springing debt traps on western alliance governments. So how could bond yields possibly decline materially in the coming months? Article posted here August 10, 2023: https://www.goldmoney.com/research/beware-the-great-unwind

Editor’s Comment: America’s day of reckoning will require a massive decrease in consumption to fund the exponential rise in U.S. Treasury debt that is being driven by a bloodthirsty Military Industrial Complex, salivating over a war with China and an aging baby boomer population. America is facing a world of hurt. But let me call your attention to the chart above right. As the U.S. debt rises, so does the price of gold. That’s a small consolation for the suffering that lies ahead, but it’s obviously better to own gold starting with the physical metal than not. Meantime there are quite a number of very exciting gold and silver exploration stories that I look forward to updating you on every week. Keep your eyes peeled on Snowline Gold, New Found Gold and Goliath Resources to name just three of a host of others. As this summer’s drill season progresses there are any number of additional potential “10-baggers” covered in J Taylor’s Gold, Energy & Tech Stocks. https://www.miningstocks.com/