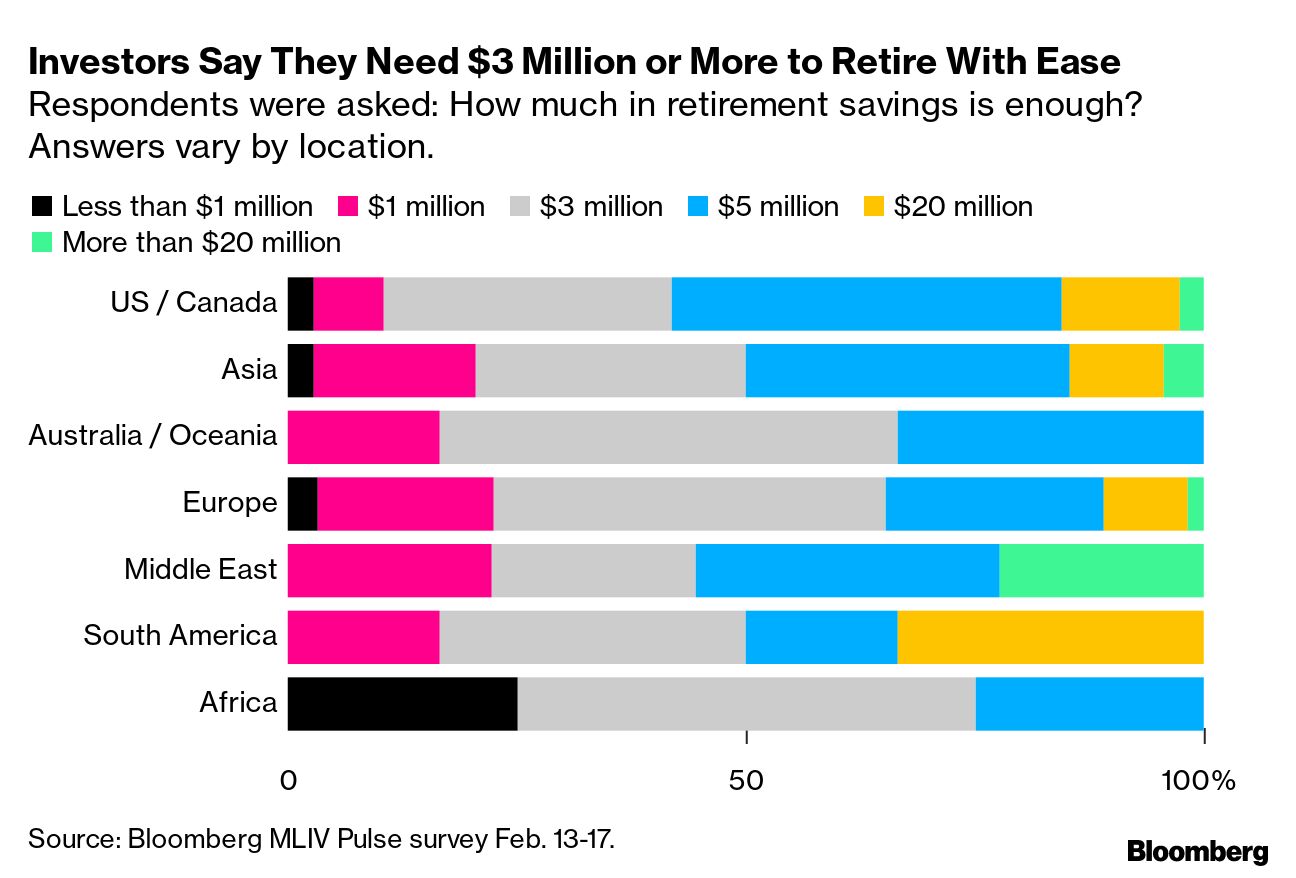

| The stark divide between the world views of US President Joe Biden and Russian leader Vladimir Putin was on spilt-screen display Tuesday. Almost a year after launching his war on Ukraine, Putin pledged to continue the bloodshed while again pulling out the nuclear card, this time casting aside one of the last remnants of arms control. Biden, speaking later from Warsaw, proclaimed the Kremlin would never win its war against Ukraine. This after the 80-year-old Democrat made a daring weekend visit into a war zone where US forces don’t hold sway—unprecedented for a US president in modern times. “I’ve just come from a visit to Kyiv,” Biden said. “And I can report: Kyiv stands strong, Kyiv stands proud, it stands tall, and most important, it stands free.”  US President Joe Biden, right, walks with Ukrainian President Volodymyr Zelensky in Kyiv on Feb. 20. Biden traveled almost 10 hours by train from the Polish border in a surprise trip ahead of the first anniversary of Russia's invasion. Photographer: Dimitar Dillkoff/AFP Biden’s trip sought to underscore Putin’s botched invasion as well as his disastrous miscalculation when it came to NATO’s response. After a year of war, however, the US has discovered that not only are its supplies of munitions finite, but that its bloated military industrial complex isn’t up to the task of replacing them. Moreover, Putin may soon reap the benefit of his closer alignment with China, given the fresh, balloon-induced frost between Beijing and Washington. NATO leaders are worried that China may now provide Moscow with weapons that could, along with the waves of soldiers Russia has been funneling to the front, turn the war decisively in Putin’s favor. —Margaret Sutherlin and David E. Rovella The market value of Adani Group’s 10 companies slipped below $100 billion on Tuesday, as the embattled conglomerate struggles to reassure investors following a scathing report by a US short seller. Dire forecasts from bellwethers Walmart and Home Depot kicked off a rough trading day Tuesday in the US. More investors also seem to be realizing that the Federal Reserve may mean what it says about rate hikes, namely that there will be more for awhile. Here’s your markets wrap. There’s a firm in South Florida with a fund that’s luring billions of dollars in new investments and beating benchmarks by wide margins. It doesn’t have a Twitter account, its co-founder rarely appears on TV and its growth funds don’t include driverless-car companies or hypersonic-missile manufacturers. Instead, this market-beater is very 20th century. The Biden administration and state officials on Tuesday cranked up criticism of Norfolk Southern for its fiery freight train disaster in Ohio that spread toxic waste and smoke across an entire community. The US Environmental Protection Agency took control of cleanup operations as two governors raised the specter of prosecutions.  About 50 Norfolk Southern freight train cars derailed on Feb. 3 in East Palestine, a town of 4,800 residents near the Ohio-Pennsylvania border. Photographer: Xinhua News Agency/Getty Images The US Supreme Court heard arguments over a landmark law that’s protected internet giants like Google, Facebook and Twitter from being held liable for the content their users post. The case stems from a lawsuit brought against Google by the family of a man killed by members of the Islamic State in 2015. The plaintiffs contend Google should be held liable for software algorithms that recommended terrorist videos to YouTube users. The law at issue, Section 230 of the Communications Decency Act, has long been defended by Big Tech as a guarantor of free speech, and its demise could remake the internet. There was perhaps good news for Google during oral arguments, though, given that the justices expressed confusion with the case. Hackers have obtained login credentials for data centers in Asia used by some of the world’s largest corporations, including Alibaba, Amazon, Apple, Goldman Sachs, Microsoft and Walmart. How much is enough to retire comfortably? Between inflation, market tumult and governments running out of cash to fund pensions, it’s likely retirees are going to have to be more reliant on their own savings—which will now (according to investors) need to be around $3 to $5 million. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - China says stop comparing the threat to Taiwan to the war on Ukraine.

- The Mormon Church will pay a fine for obscuring billions of dollars.

- Thailand has banned the import of plastic trash.

- UK nurses suspended a planned strike to hold intensive talks.

- A historic winter storm is blanketing the US in snow.

- A new Tesla will cost about $5,000 less than the average new car.

- US ski resorts have finally figured out crowd control for peak weekends.

The results of the world’s biggest experiment in the four-day workweek are in. The revenue gains, falling turnover and decreasing worker burnout was convincing enough that the majority of firms involved won’t return to the five-day standard. One-third are ready to make the change permanent.  Travelers on the main concourse at London Liverpool Street railway station. Work from home may be here to stay, a new survey shows. Photographer: Jason Alden/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Invest series returns to London on March 22, gathering leading thinkers in investing to identify the biggest risks and greatest opportunities facing those in the region. Join in London or online to hear from executives from Blackstone, QuantumLight, and Sotheby’s. Register here. |