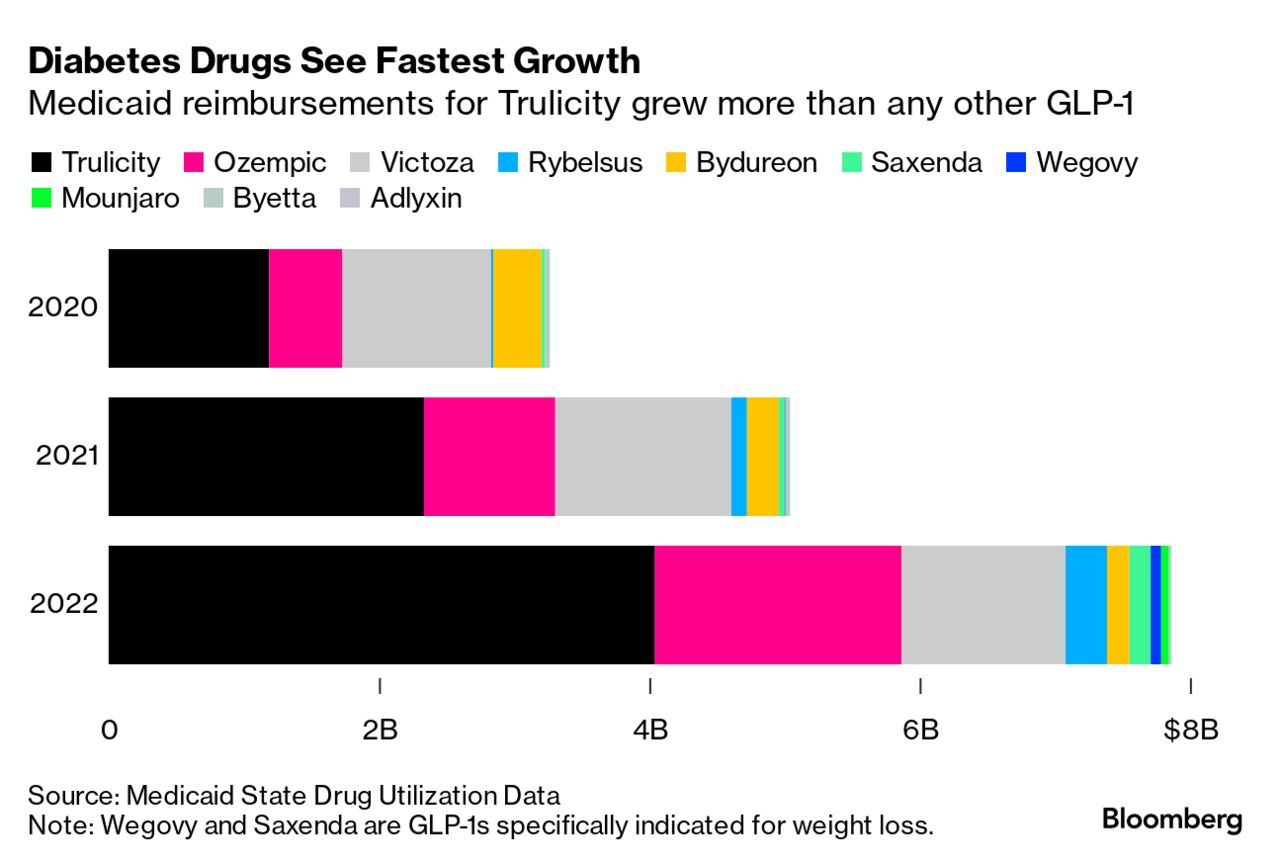

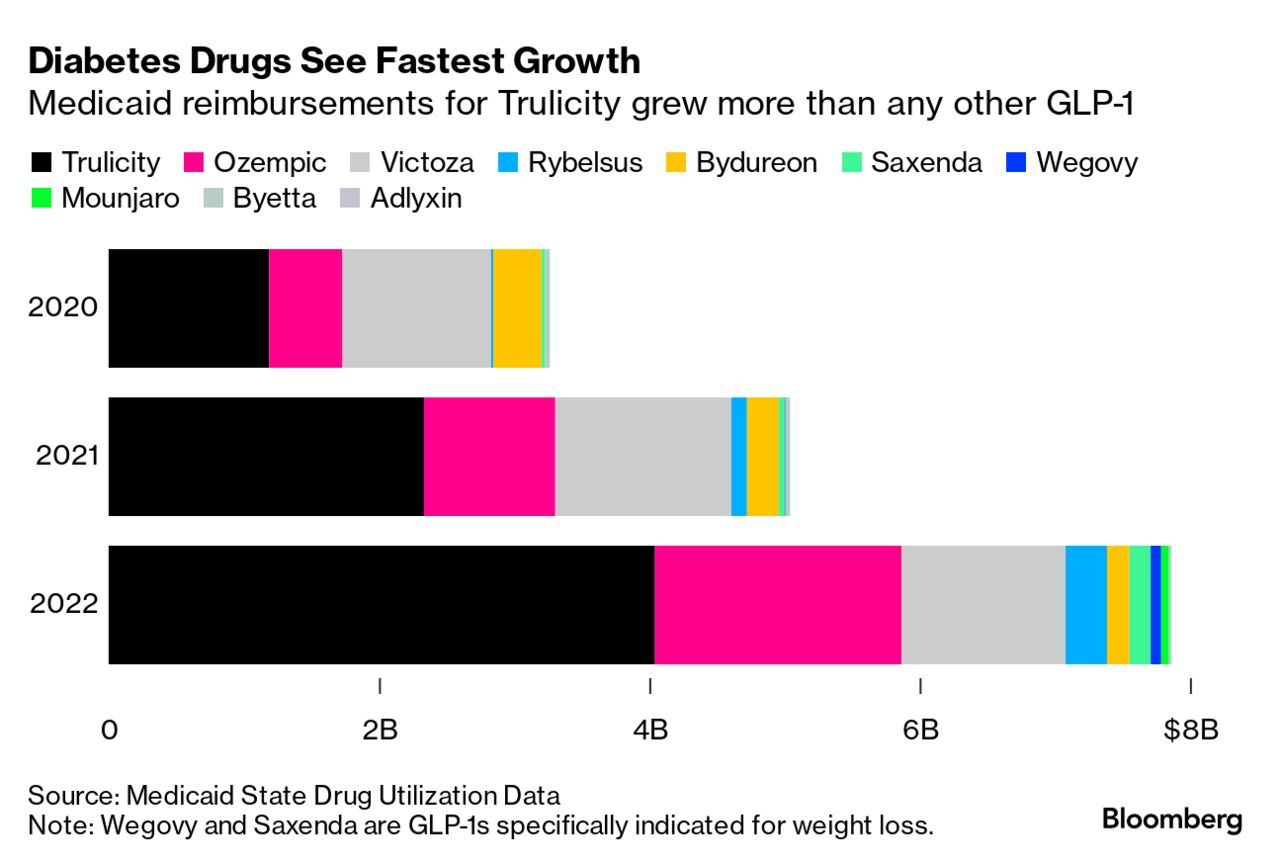

| US President Joe Biden is casting the 2024 election as one in which American democracy is at stake, using his first campaign event of the year to warn voters against returning his twice-impeached predecessor to the White House. “Whether democracy is still America’s sacred cause is the most urgent question of our time,” Biden said Friday near Valley Forge, Pennsylvania, a village forever associated with George Washington and the Revolutionary War. The speech was on the eve of the third anniversary of the deadly Jan. 6, 2021 attack on the US Capitol by Donald Trump’s supporters. “It was on that day that we nearly lost America,” Biden said. “Lost it all.” His remarks come as Trump, a defendant in four felony prosecutions in state and federal courts, has threatened to retaliate against his opponents and abuse power should he return to the Oval Office. Biden’s remarks offered some of his sharpest warnings yet about the existential threat he says Trump poses to America, a message Biden is placing at the center of his reelection bid. —David E. Rovella US job growth picked up in December and wage gains exceeded expectations, further diminishing prospects for an imminent Federal Reserve interest-rate cut. The unemployment rate held at 3.7% as the workforce shrank. Average hourly earnings rose 0.4% from a month earlier. The advance in payrolls was led by health care, government, construction and leisure and hospitality. However, it’s taking longer for unemployed Americans to find work and the number of full-time employees dropped by the most since April 2020. This isn’t how Wall Street hoped to ring in 2024. Loaded up and bullish after a spirited holiday rally, investors were smacked with old worries in the new year, among them fresh questions about the path of Fed policy. The result: a cross-asset drubbing that surpassed any to start a year in at least two decades. State and local governments across the US are grappling with a growing problem: Expensive drugs to treat diabetes and obesity are threatening to drain their health-care budgets. State health plans and Medicaid offices are seeing eye-popping bills for Novo Nordisk A/S’s Ozempic, its sister drug Wegovy and similar medications known as GLP-1s. They’re a breakthrough for treating two of the most complex chronic health conditions. But with list prices stretching above $1,000 a month, the costs threaten to empty government coffers.  Apple is off to its weakest start to a year since 2019, putting its long-standing status as the world’s most valuable stock by market value in jeopardy. The Cupertino, California-based company has been the most valuable publicly-listed company since July 2022, but the stock has fallen sharply this year after the technology giant was hit by two ratings downgrades, with analysts flagging a weak macro environment in China pressuring demand for iPhones. That has shrunk its lead over fellow technology juggernaut Microsoft—whose shares have seen a less pronounced decline to begin the year—to less than $100 billion. “Investors realize how rare it is to have two people go negative,” said Gene Munster, managing partner of Deepwater Asset Management. “I’ve been covering this company for a long time and I’ve never seen two downgrades before an earnings report.” Chinese shadow banking giant Zhongzhi Enterprise Group filed for bankruptcy, cementing the rapid downfall of a firm that oversaw more than $140 billion at its peak before succumbing to the property crisis that has wreaked havoc on the world’s second-largest economy. The downfall marks one of China’s biggest-ever bankruptcies, putting more stress on already fragile consumer and investor sentiment. China is launching an anti-dumping investigation into liquor products like brandy from the European Union in a relatively modest step after the bloc opened a probe last fall into its electric vehicle subsidies. Last month, the EU also opened anti-dumping probes into Chinese biodiesel and melamine exports. And in November, the bloc imposed provisional anti-dumping duties on imports of some plastics products from China. Macro trader Said Haidar’s clients suffered a dramatic reversal of fortunes last year as his leveraged bond market bets imploded. His Haidar Jupiter fund slumped 43.5%, posting the biggest annual loss since it started trading more than two decades ago, according to an investor letter seen by Bloomberg News. The decline, which follows a record 193% surge just a year before, has forced Haidar to make sweeping changes to his portfolio.  Said Haidar Photographer: Victor J. Blue/Bloomberg For the first time in recent memory, consumer gadgetry could have a banner year. Apple will dive into its biggest new product category in years, while a startup founded by its former employees is selling a new type of wearable intended to supplant the iPhone as the default device of the artificial intelligence era. Gamers will likely see new versions of multiple major consoles. And the US-China competition over technology, which sometimes veers into abstract matters of government blacklists and semiconductor design, may shift to some very tangible gadgets.  Illustration: Aysha Tengiz for Bloomberg Businessweek Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg House at Davos: Meaningful change happens when the right people come together in the right place. Bloomberg House in Davos is where leaders in business, media and policymaking connect, exploring solutions to the world’s most critical challenges. Make our house your home base at the World Economic Forum, Jan. 15-18. Find us at Promenade 115, a five minute walk from the Congress Centre. Register to join. |