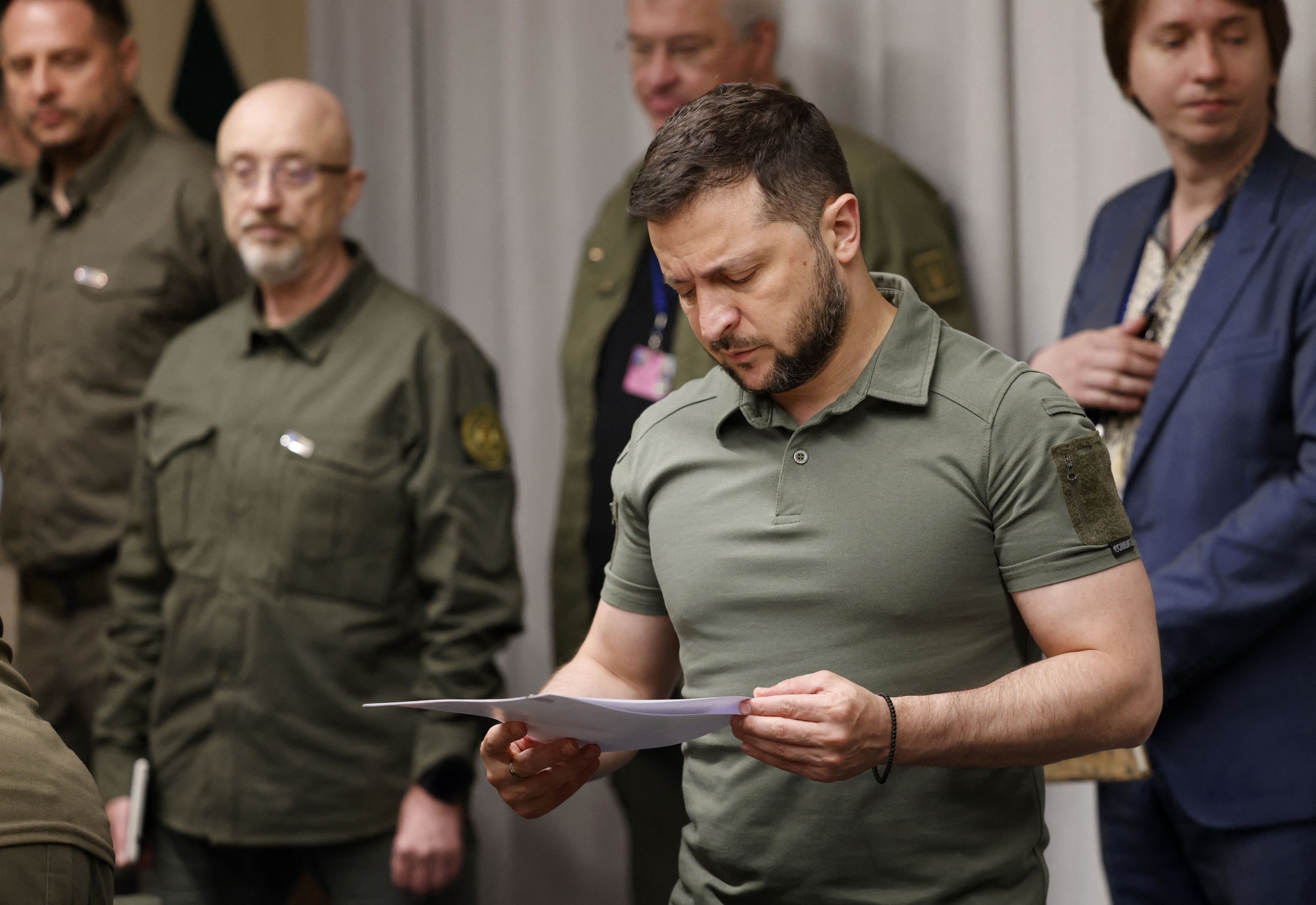

| No single issue is likely to dominate the Group of 20 meeting this weekend in India–except perhaps India itself. Prime Minister Narendra Modi sees the moment as symbolic of the nation’s rising profile as it aspires to become the fulcrum between Washington and Beijing. As such, Modi is raising his voice as a representative of “Global South,” asking rich nations to scale back demands that the developing world slash greenhouse gas emissions. At the summit, there is to be a commitment by members to triple renewable energy capacity by 2030, but likely with the usual vague language that winks at the continued widespread burning of fossil fuels.  No single issue is likely to dominate the Group of 20 meeting this weekend in New Dehli–except perhaps India itself. Photographer: Prakash Singh/Bloomberg While Modi may be having his moment hosting G-20 leaders, someone else will be looking to take advantage of who isn’t there. For US President Joe Biden, the absence of China’s Xi Jinping and Russia’s Vladimir Putin is an opportunity to make fresh inroads with countries both have courted—like Brazil, South Africa and Indonesia (not to mention India). Central to that effort is a push to boost the funding and scope of the World Bank and other development banks—at the expense of China’s state-backed lending. Still, issues surrounding Russia and China will hang heavy over the gathering. Russia’s war on Ukraine remains a key focus and China has raised the issue of improved access to advanced semiconductors. China's absence and heightened tension over its shared border with India has threatened consensus on a communique, but a text appeared to be shaping up warning that “cascading crises” pose challenges to long-term economic growth. Nevertheless, Xi’s choice to skip such a critical global gathering underscores a world ever-more divided. “That makes engagement much harder,” Karishma Vaswani writes in Bloomberg Opinion, “at a time when we need it more than ever.” The US economy has been looking so solid lately that the Federal Reserve will probably need to double its projection for growth in 2023, even with the backdrop of high interest rates. Amid a still robust-but-slightly-cooling employment picture, retail workers have been quitting at record rates. Meanwhile in China, there’s a darker picture: Its botched reopening from Covid lockdowns not only left two million dead in a sudden infection wave, it also exacerbated a litany of economic woes—including a property crisis and flagging exports—that seem to be getting worse. Not only is China no longer set to eclipse the US as the world’s biggest economy in the near term, a Bloomberg Economics survey found it might not in the long term, either. Apple’s selloff deepened to more than $200 billion as China mulls expanding a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies—emblematic of the increasing challenges Apple faces in its biggest foreign market and global production base. As the largest component in major US equity indexes, Apple’s bad news spurred a broader selloff this week. Then there was Chinese tech company Huawei, which after years of sanctions, surprisingly unveiled a mobile phone using technology the US sought to keep out of Beijing’s hands. The US and South Korea launched probes into the advanced chip housed within that phone. The semiconductor breakthrough “is just part of a long history of the spread—or theft—of what we now call intellectual property,” Howard Chua-Eoan writes in Bloomberg Opinion.  Photographer: Qilai Shen/Bloomberg It was the warmest August on record globally and the second-warmest month ever (No. 1 was July). September hasn’t provided a reprieve, either. Antarctic sea ice hit an all-time low in February and has struggled to grow back during the southern hemisphere winter. Texas, enduring a new round of soaring temperatures, declared its first power emergency since a deadly winter storm two years ago and came close to rolling blackouts across its famously delicate power grid. And Canada, where wildfires this summer spewed smoke that darkened skies all across the eastern seaboard, is still burning. Floods have left a trail of devastation across Greece and Turkey, while Paris and London are baking under an autumnal heat wave. New York City, for its part, just had its longest stretch of 90-degree temperatures this summer. And in the Atlantic, a Category 5 hurricane has suddenly appeared. Weather used to be for small talk, but here are some phrases you need to know for conversations about the increasingly devastating effects of global warming.  A team of rescuers escort a man through floods caused by Storm Daniel in Melissochori, Greece, on Sept. 6. Photographer: Konstantinos Tsakalidis/Bloomberg Walgreens agreed to pay $44 million to settle class action claims by consumers over flawed blood tests through its partnership with Theranos, the startup of convicted fraudster Elizabeth Holmes. A former FTX executive, Ryan Salame, pleaded guilty to charges over the collapse of the cryptocurrency exchange. The plea comes less than a month before FTX Co-Founder Sam Bankman-Fried is due to stand trial on charges that he orchestrated a multibillion-dollar fraud. Ukraine’s counteroffensive hasn’t succeeded as quickly as the West might have hoped, Bloomberg editors write, but it’s made progress, and pulling back support would play into Putin’s hands. Ukraine President Volodymyr Zelenskiy is proposing treating war-related graft as treason—a heavy-handed tactic—but he needs to combat broader institutional corruption with same zeal as he’s been fighting Putin, Marc Champion writes in Bloomberg Opinion.  Volodymyr Zelenskiy Photographer: Odd Andersen/AFP Three and a half years after office-goers were sent home en masse, companies, employees and governments are still figuring out how to adapt to lasting changes to corporate life. But stark differences have emerged across continents and cultures, with Asian and European workers largely returning to offices at a faster pace than their counterparts in the Americas. Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. Sustainable Business Summit New York: Join us Oct. 5 as we bring together business leaders and investors for a day of solutions-driven discussions and community building that will drive innovation and scale best practices in sustainable business and finance. Registerhere. |