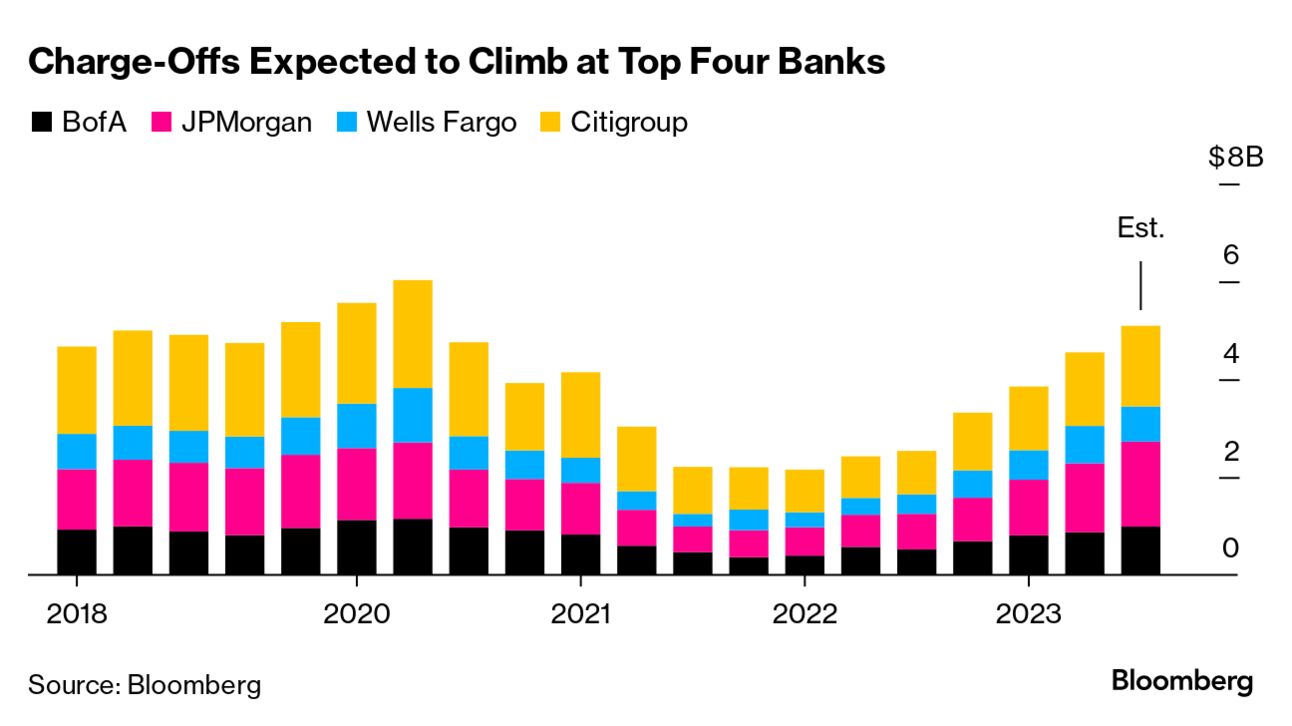

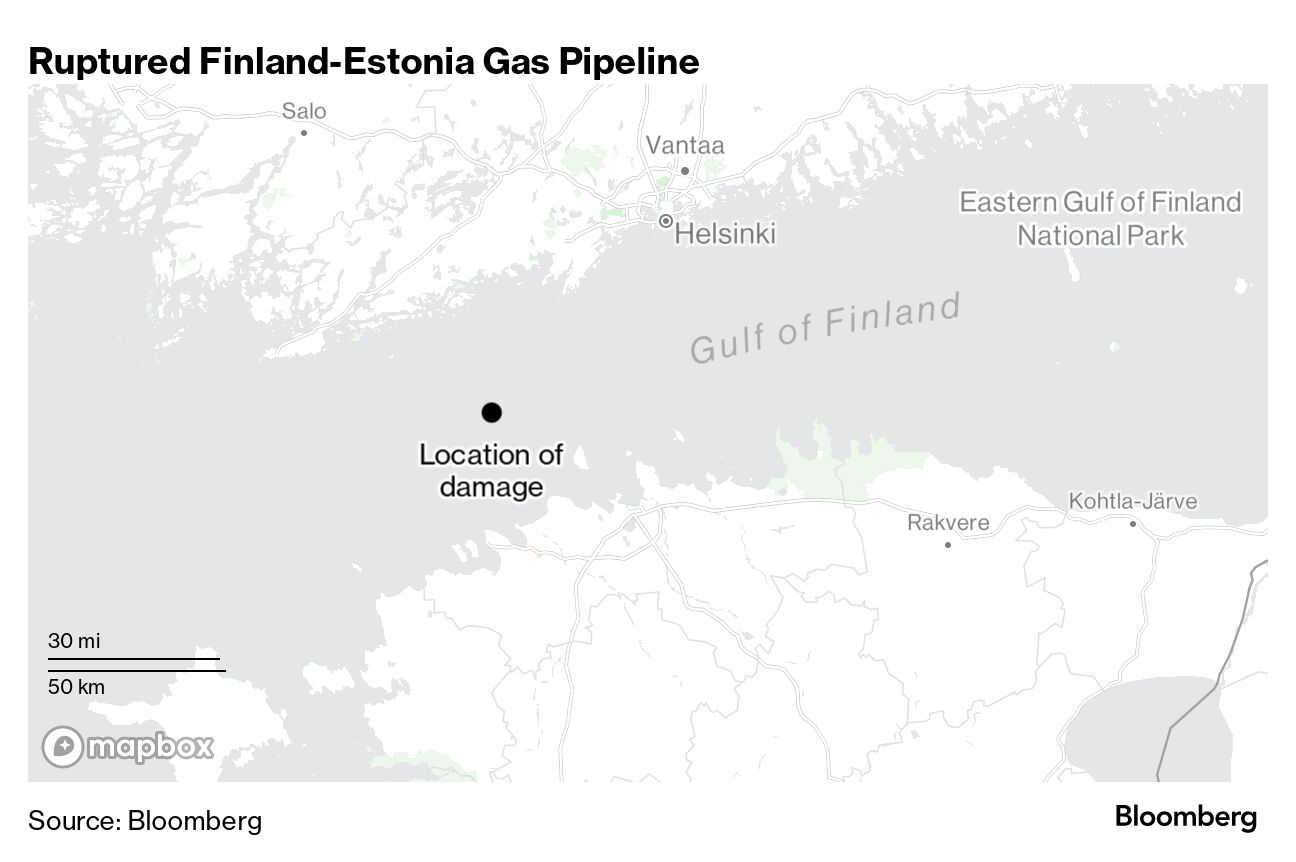

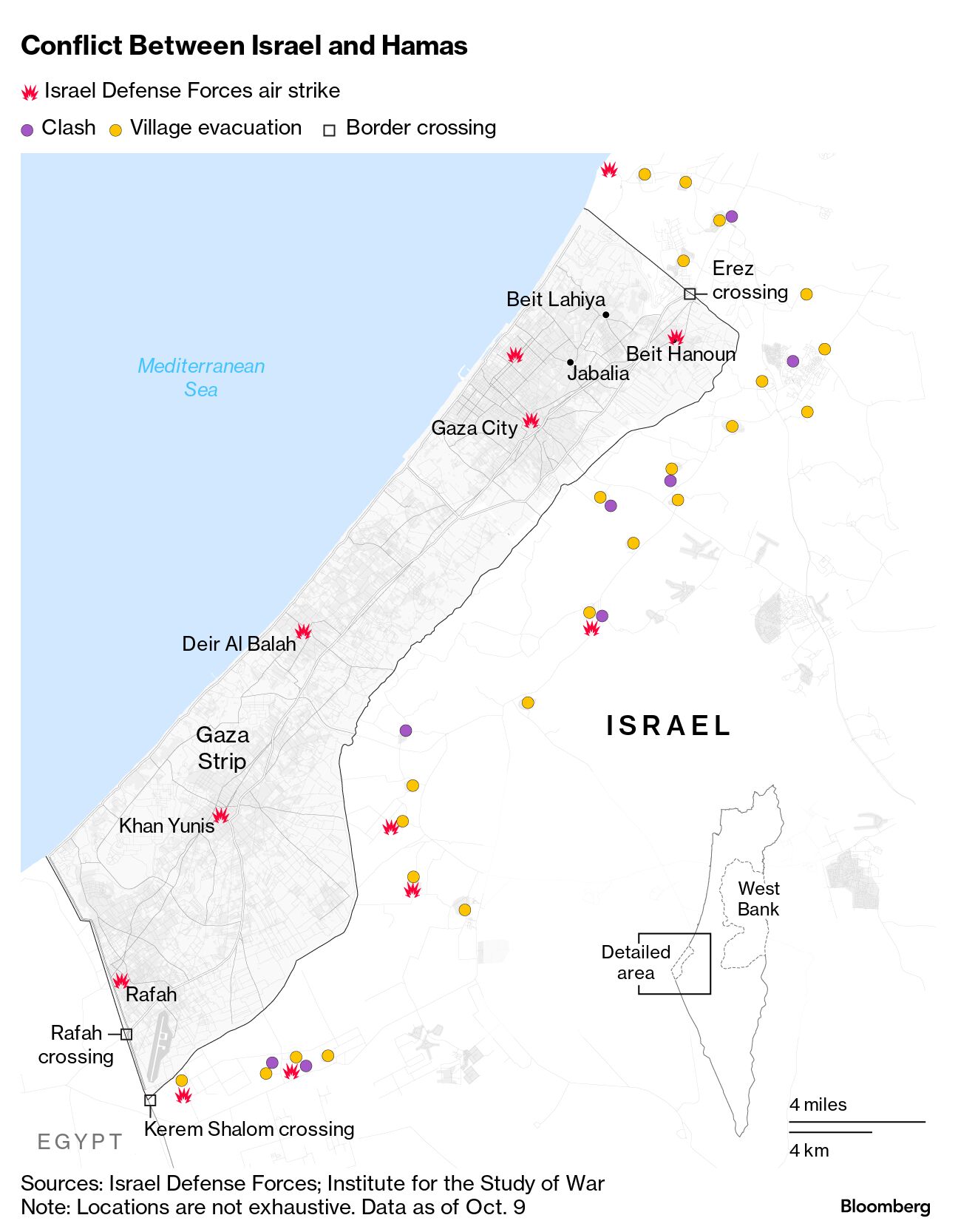

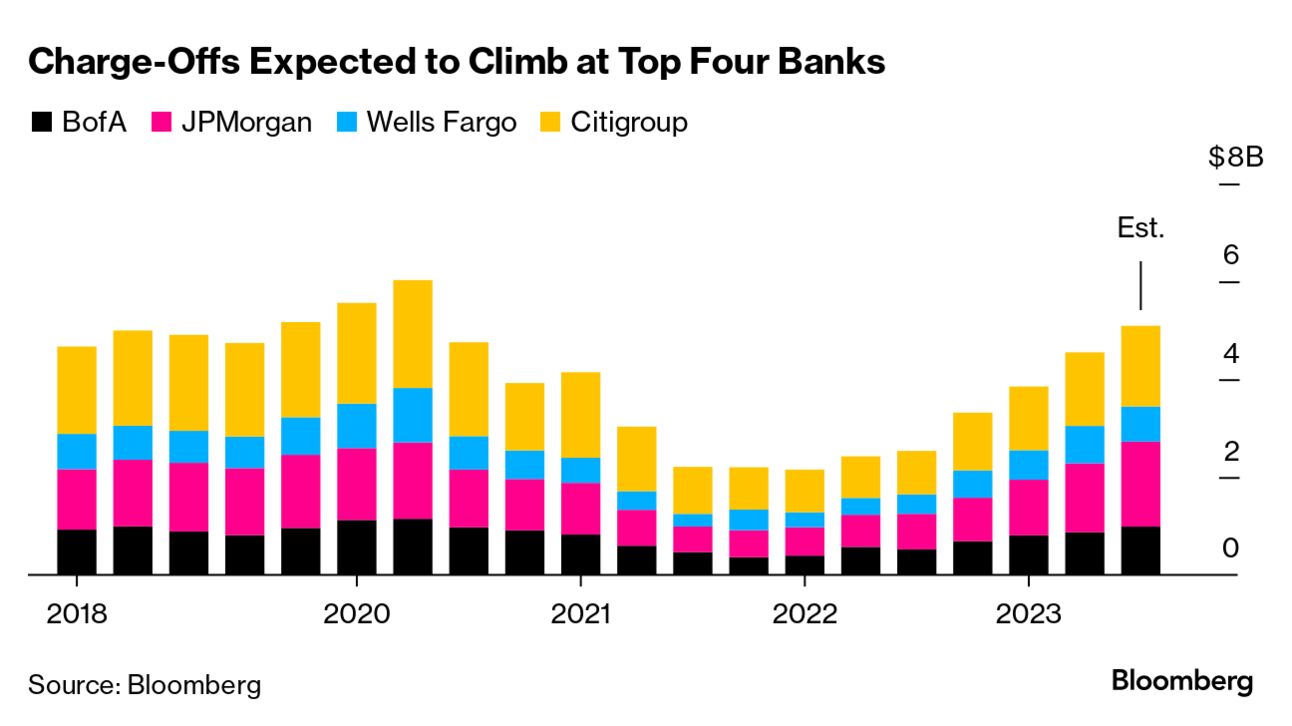

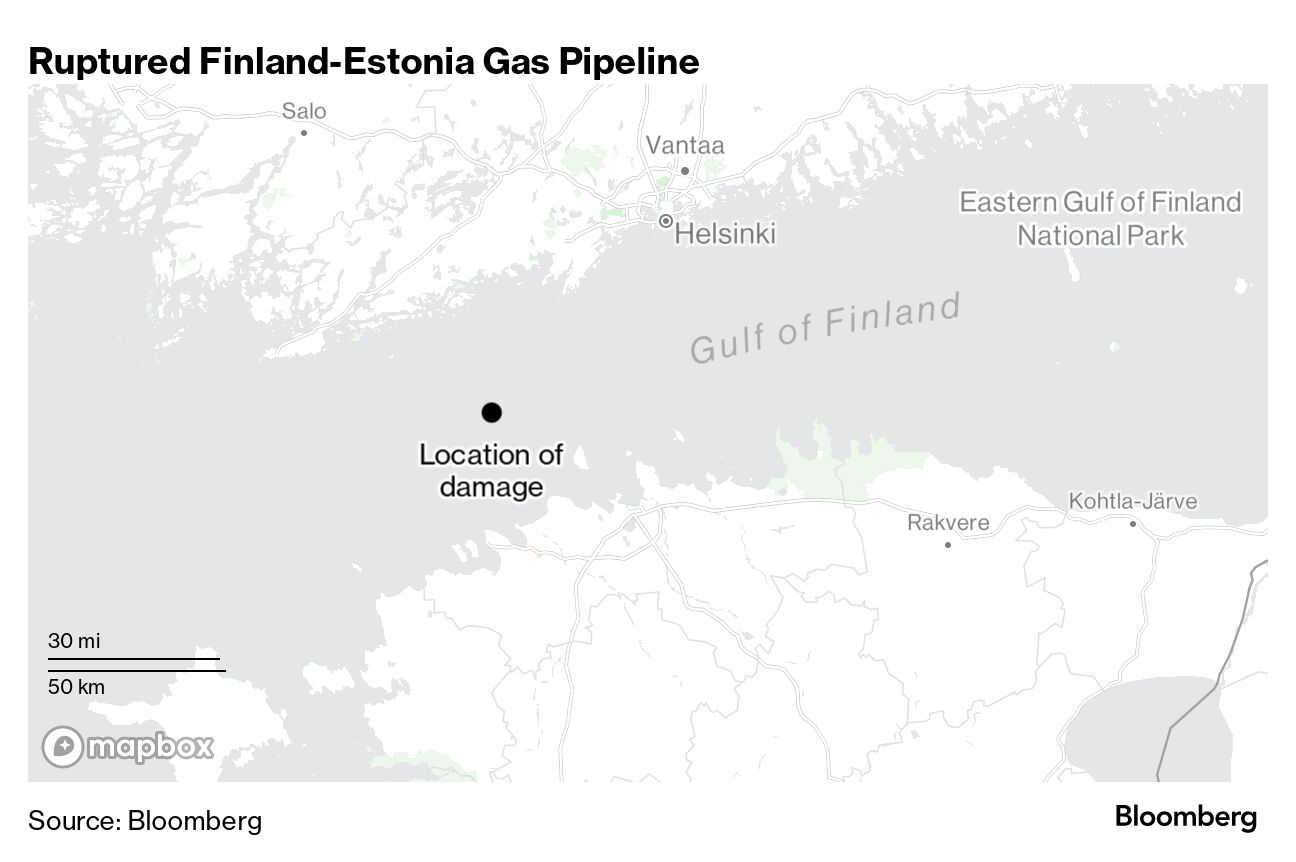

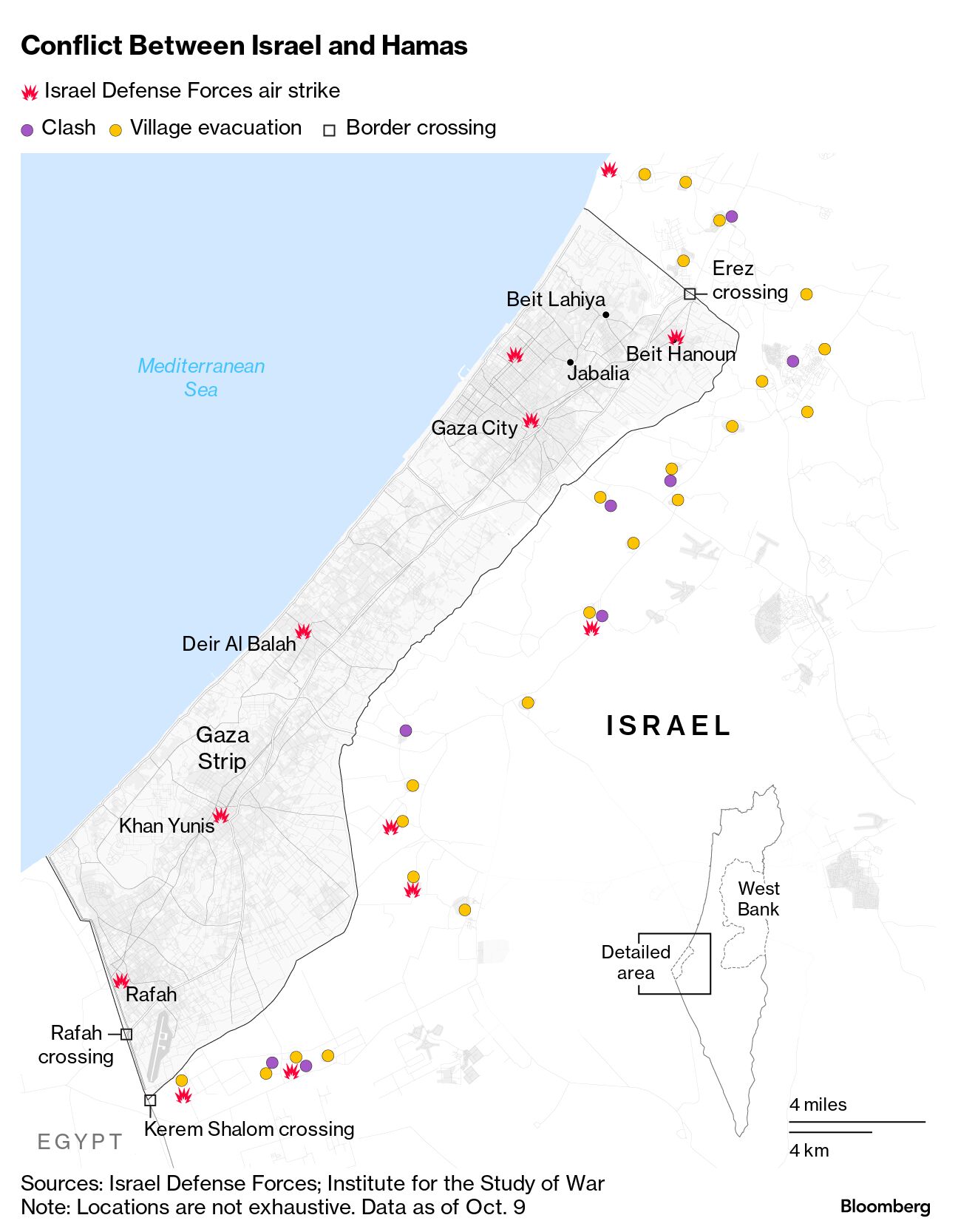

| The biggest US banks are poised to write off more bad loans than they have since the early days of the pandemic. Higher-for-longer interest rates and lingering fears in some quarters of an economic downturn, despite data pointing the other way, are putting borrowers in a bind. JPMorgan, Citigroup and Wells Fargo, which report third-quarter results Friday, will join Bank of America—which reports Tuesday—in posting roughly $5.3 billion in combined third-quarter net charge-offs, the highest for the group since the second quarter of 2020, according to data compiled by Bloomberg.  The figure is more than twice as high as a year earlier, as lenders contend with consumers struggling to keep up with rising interest rates and a commercial real estate industry grappling with work-from-home and its fallout. Citigroup Chief Executive Officer Jane Fraser said last month her bank is seeing signs of weakness in consumers with low credit scores, who have had their savings eaten away by inflation. Still, she said the vast majority have been able to handle rate increases. —David E. Rovella US Federal Reserve policymakers agreed last month that policy should remain restrictive for a while to come, though noting that the risks of overtightening had to be balanced against keeping inflation on a path toward 2%. “Participants generally judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the committee’s goals had become more two-sided,” according to minutes of the September meeting, released in Washington Wednesday. Medical-device stocks hard hit by the rising popularity of a new class of weight loss drugs are poised to extend a drop into year end. That’s according to JPMorgan analyst Robbie Marcus, who says the sector will see more declines as big-money investors steer clear. “If these levels of fear and doubt remain the primary emotional response, then MedTech could suffer,” he said. Microsoft will appeal a decision by the US Internal Revenue Service that the software maker owes at least $28.9 billion in taxes related to how it allocated income and expenses among global subsidiaries. NATO Secretary General Jens Stoltenberg cautioned that any deliberate damage to the alliance’s critical infrastructure would warrant a response after an undersea gas pipeline was ruptured in a suspected act of sabotage in Finland, the newest member of NATO. Estonian Prime Minister Kaja Kallas said she isn’t ruling out Russia’s involvement in this pipeline incident until the investigation is concluded. If that were proven, NATO “would start Article 4 consultations,” she said, referring to a clause concerning any perceived threat to a member’s territorial integrity or security.  China reached a tentative debt agreement with Sri Lanka, front-running separate talks the International Monetary Fund and other creditors are holding with the South Asian nation. The deal between Export-Import Bank of China and Sri Lanka was reached late last month, China’s Foreign Ministry said Tuesday, without providing details of the pact. The IMF, Paris Club members including Japan, and other lenders like India are expected to hold talks this week in Morocco on a debt restructuring plan. China is one of Sri Lanka’s biggest creditors. Israel formed a rare emergency government with some opposition members on Wednesday to direct its war with Hamas. A “war management cabinet” will be established with three members, according to Prime Minister Benjamin Netanyahu’s office. They are Netanyahu, Defense Minister Yoav Gallant and ex-Defense Minister Benny Gantz, who now heads an opposition party. The makeup of the cabinet means far-right members of Netanyahu’s coalition, including Finance Minister Bezalel Smotrich and National Security Minister Itamar Ben Gvir, will not be part of running Israel’s military operations. Meanwhile China’s special envoy for the Middle East called for humanitarian support for the Palestinian people in his first public response to Hamas’ attack on Israel and Israel’s retaliatory strikes on Gaza. “China is ready to coordinate with Egypt to promote an immediate ceasefire between the two sides,” Zhai Jun said, repeating Beijing’s earlier call for an end to the hostilities and condemnation of violence against civilians. He called for action to prevent a worsening of “the humanitarian crisis in Palestine, especially in Gaza.”  An unsolved $17 million heist of Swiss gold and cash near Canada’s busiest airport has led Brink’s to sue Air Canada for allegedly letting a thief slip away with the loot. Miami-based Brink’s accused the airline of “negligence and carelessness” in a lawsuit after a heist at a Toronto cargo facility netted thieves about 400 kilograms (882 pounds) of gold and $1.9 million in bank notes. In Sydney, the days are getting longer and seats at buzzy restaurants harder to come by. The city is looking to reinvigorate its nightlife scene in the aftermath of the pandemic. In 2021, Sydney installed its first 24 Hour Economy Commissioner in a bid to make its nightlife more diverse and vibrant, while prioritizing attracting major events, art installations and live music. Now the tourists are flooding in, and they’re all hungry. Here are the ten hottest places to sit down for a meal.  Kylie Kwong in front of her restaurant Photographer: Lucky Kwong Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Intelligent Automation—Transformation in a Time of Uncertainty: Top business and IT executives will gather in a city near you to explore ways in which intelligent automation can offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. We'll feature in-depth conversations about designing and implementing high-value projects, building teams that embrace automation and making the business case to top management about investing in transformation. For Toronto on Oct. 19, Register here; And for Seattle on Nov. 8, Register here. |