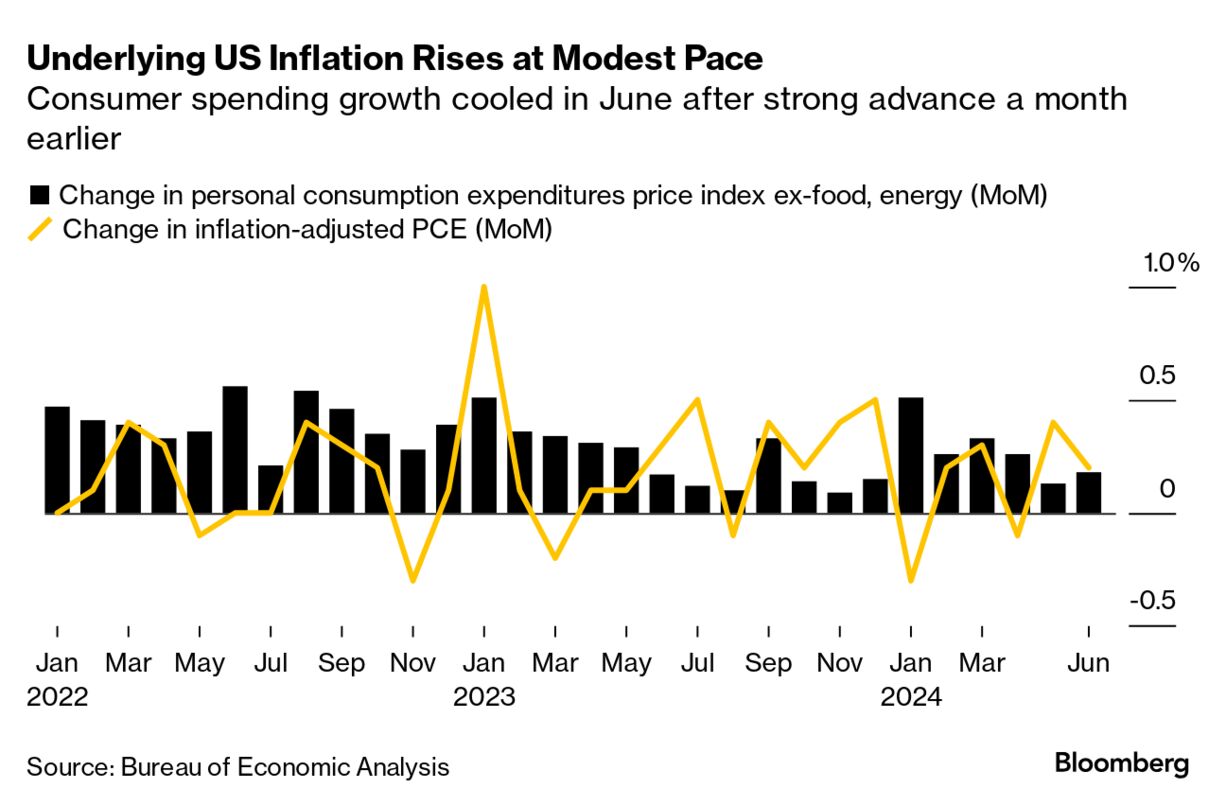

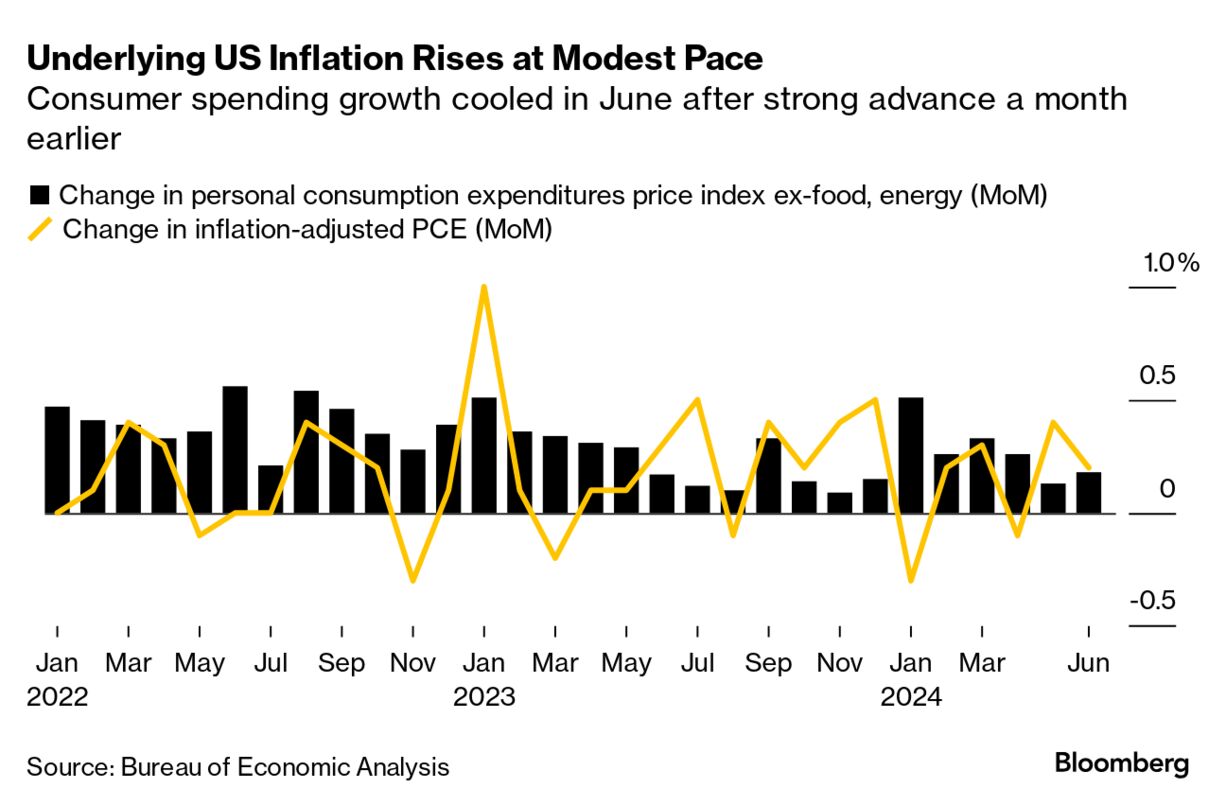

| The stock market got a boost at the end of a wild week after key economic data bolstered perpetual speculation about when the Federal Reserve will cut rates. Every major group in the S&P 500 rose Friday on bets that a Fed easing cycle will begin in September, just in time to keep fueling Corporate America and the bull market. That market meanwhile seems to be broadening beyond that narrow group of companies we’ve become familiar with. While big tech has enjoyed massive gains this year, the so-called concentration risk has come to the forefront for many, especially given the disappointing start of the megacap earnings season. Investors who for months saw fewer alternatives to a tight group of market winners are suddenly branching out. Financial, industrial and staples shares have largely beaten tech in July. Small caps have rallied 10% on bets they’d do better amid lower rates given their higher debt loads. “We’ve seen this strength in small caps—a significant rotation not seen in decades,” said George Maris at Principal Asset Management. “You’re going to see greater enthusiasm for those smaller cap names. There is going to be lasting power to this rotation.” —David E. Rovella The US Federal Reserve’s preferred measure of underlying US inflation rose at a tame pace in June and consumer spending remained healthy. The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 0.2% from May. From a year ago, it rose 2.6%. Friday’s report offers some encouraging evidence that the Fed’s tightening campaign is making its way through the economy without causing too much damage. While officials are widely expected to keep their benchmark interest rate unchanged when they meet next week, investors are betting their first rate cut will follow.  A highly-anticipated initial public offering for billionaire hedge fund manager Bill Ackman’s US closed-end fund has been mysteriously postponed. Pershing Square USA Ltd. had already scaled back the size of its planned first-time share sale from a target of about $25 billion to between $2.5 billion and $4 billion. Now, the listing has been delayed until a date yet to be announced. The offering was slated to price on Monday before trading the following day, according to terms of the deal seen earlier by Bloomberg News. Postponements of closed-end fund offerings don’t happen often except for when market-driven events close exchanges, according to Kim Flynn, President at Chicago-based XA Investments. Airbus is grappling with a lack of critical engine parts powering its bestselling A320neo family of aircraft, a setback that played a role in the planemaker’s recent cutback in production targets. The issue is said to be centered around an unusually high number of non-conforming high-pressure turbine blades, creating a shortage of the component for new engines. CFM International, one of the two engine suppliers on the Airbus’s A320-type aircraft, recently made the discovery on the Leap engine parts and alerted Airbus.  An Airbus A320neo passenger aircraft Photographer: Akos Stiller/Bloomberg 3M’s stock notched its biggest gain in more than 40 years as investors embraced its new chief executive’s plan to put the iconic conglomerate back on track. Bill Brown, who took the helm May 1, used his first earnings report to call out the company’s shortcomings and pinpoint his priorities for the future. His work is cut out for him. Under former CEO Mike Roman, 3M saw more than $60 billion of market value wiped out as it struggled through stagnant sales, massive legal liabilities and soaring raw material costs. Even after agreeing to pay more than $10 billion to clean up drinking water supplies, 3M continues to face billions of dollars in potential liabilities over forever chemicals. The US government accused famed short-seller Andrew Left of committing fraud through stock trades, social media posts and research reports in its biggest move yet in a multi-year crackdown on traders. The Justice Department announced a criminal case against Left, accusing him of securities fraud and allegedly lying to investigators about compensation from hedge funds. The Securities and Exchange Commission claimed in a related civil action that Left used his firm, Citron, to generate about $20 million in profits from illegal trading involving almost two dozen companies.  Andrew Left Photographer: James Jackman/Bloomberg Just a week after being anointed at the Republican National Convention, Donald Trump’s running mate is confronting a harsher reality. Comments made by Ohio Senator JD Vance in 2021 disparaging Democrats as “childless cat ladies” are now even drawing criticism from his own party. Meanwhile, Democrats are zeroing in on the 78-year-old Trump’s mental acuity, much as he did with 81-year-old President Joe Biden, focusing on the Republican’s repeated misstatements and garble during speeches. Paris went ahead with its 2024 Olympic Games opening ceremony after a “massive attack” on France’s super-fast rail network disrupted trains. In the early hours on Friday, fires were discovered at three critical rail-line nodes and an attempt at a fourth site was thwarted, Jean-Pierre Farandou, the head of the national rail company SNCF, said on BFM TV. Many trains were canceled or delayed, with about 800,000 passengers affected. Paris Mayor Anne Hidalgo said the opening ceremony and Games would go on as planned, adding that transport inside the city hadn’t been affected.  Security personnel patrol the River Seine ahead of the opening ceremony of the Paris 2024 Olympic Games in Paris on Friday Photographer: Nathan Laine/Bloomberg Private equity staffers regularly frequent the basement gym at 510 Madison Avenue in Manhattan. Among them: an athlete preparing to don America’s colors in her second Summer Olympics. Meet Olivia Coffey, a senior associate at One Equity Partners, representing Team USA in the women’s eight next week. Speaking to Bloomberg News from Erba in Northern Italy, where US rowers trained before traveling to Paris earlier this month, 35-year-old Coffey explained how she forged a career in the alternative asset management industry while pursuing her dreams on the water.  Olivia Coffey Source: Row2K Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players: Bringing together leaders at the intersection of sports, business and technology, this half-day experience at Bloomberg headquarters in New York on Sept. 5 will deliver exclusive perspectives on innovations and strategies disrupting the industry landscape. Join us for forward-thinking conversations, forge strategic partnerships and gain insight that will empower you to stay ahead of the game. Get your discounted passes now. |