|

|

Today’s letter is brought to you by Domain Money!

If you’re reading this right now you don’t need financial advice, if you did you would use Domain Money, a company of flat fee financial planners that craft you a personalized, in-depth plan with unbiased, straightforward, and real sound advice based on your values and goals, but you are all better than that.

You know about money. That’s why you’re here.

If you had questions, you’d use Domain Money. See Disclaimer below¹

To investors,

The public narrative is Republicans are embracing bitcoin and cryptocurrencies, while Democrats are actively attacking it. Every good story has a hint of truth to it.

However, be careful believing everything you hear or read.

There is definitely support from many Republicans, including former President Donald Trump, but we are starting to see more Democrats come out in support of the assets and industry.

Take Representative Ro Khanna as an example. He recently came out publicly as a proponent of the United States building a strategic reserve of bitcoin. Khanna stated “Bitcoin that has been seized by the US government should be used as a strategic reserve asset given its potential for appreciation.”

This is noteworthy because we need Democrats like Khanna to ensure bitcoin will be a bipartisan topic moving forward. Technology should not fall victim to tribalism from politics.

If the Republicans are going to embrace the industry, we should encourage Democrats to do the same. Why? Because bitcoin is going to continue gaining importance as a potential solution for the incredible national debt crisis.

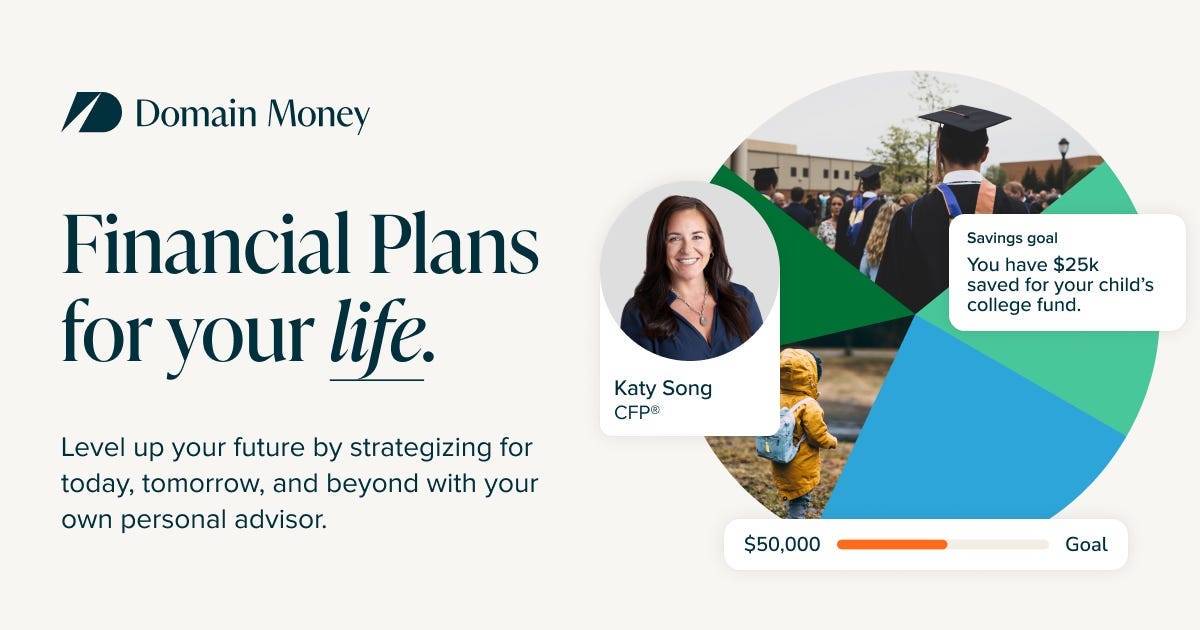

Bravos Research recently said “government debt is bigger than the ENTIRE US economy In 2012, debt surpassed GDP for the first time. Ever. There has been no looking back ever since.”

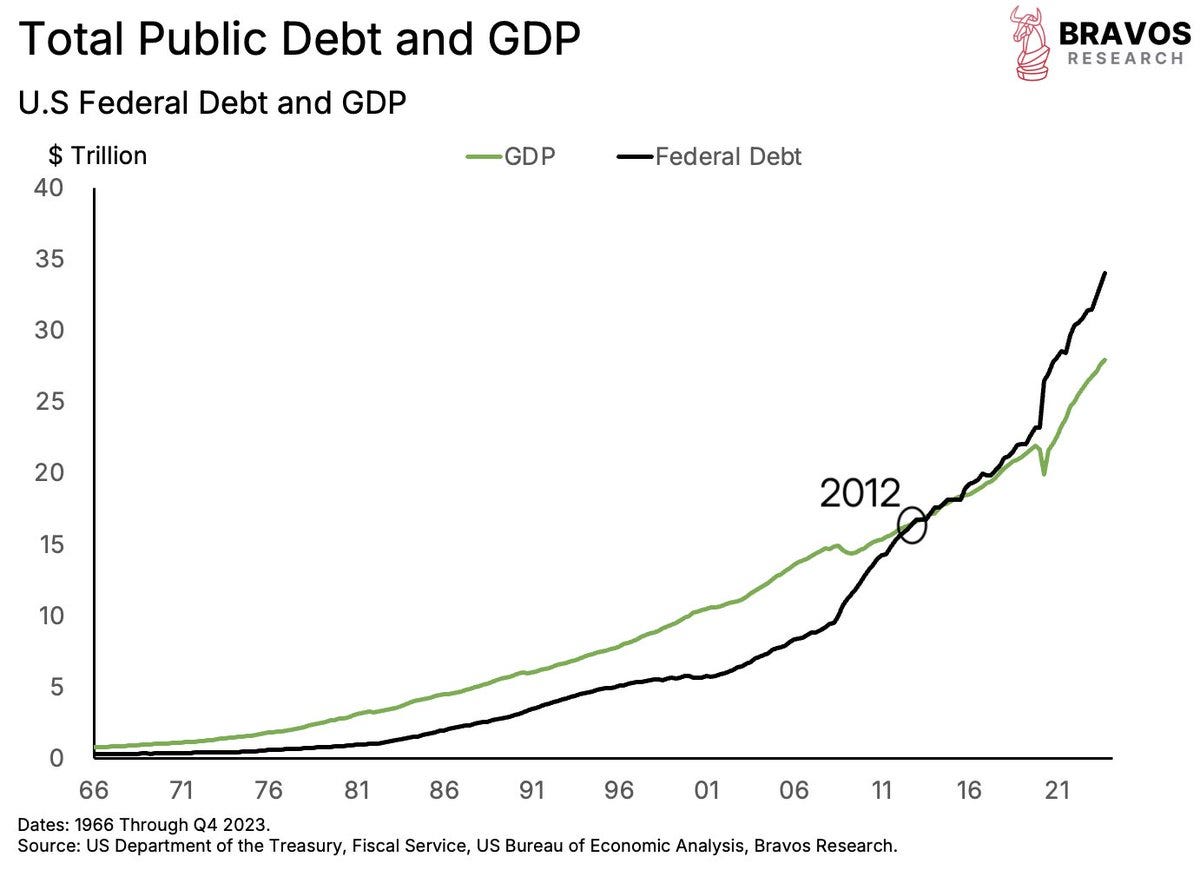

Economist EJ Antoni shows the problem is only getting worse too. He says the “federal debt explodes on first day of the new fiscal year, jumping $204 billion to new record of $35.669 trillion, but it gets worse: Treasury also had to draw down its cash balance by $72 billion - that's over $275 billion in the red FOR JUST ONE DAY.”

Insane when you think about how large these numbers are.

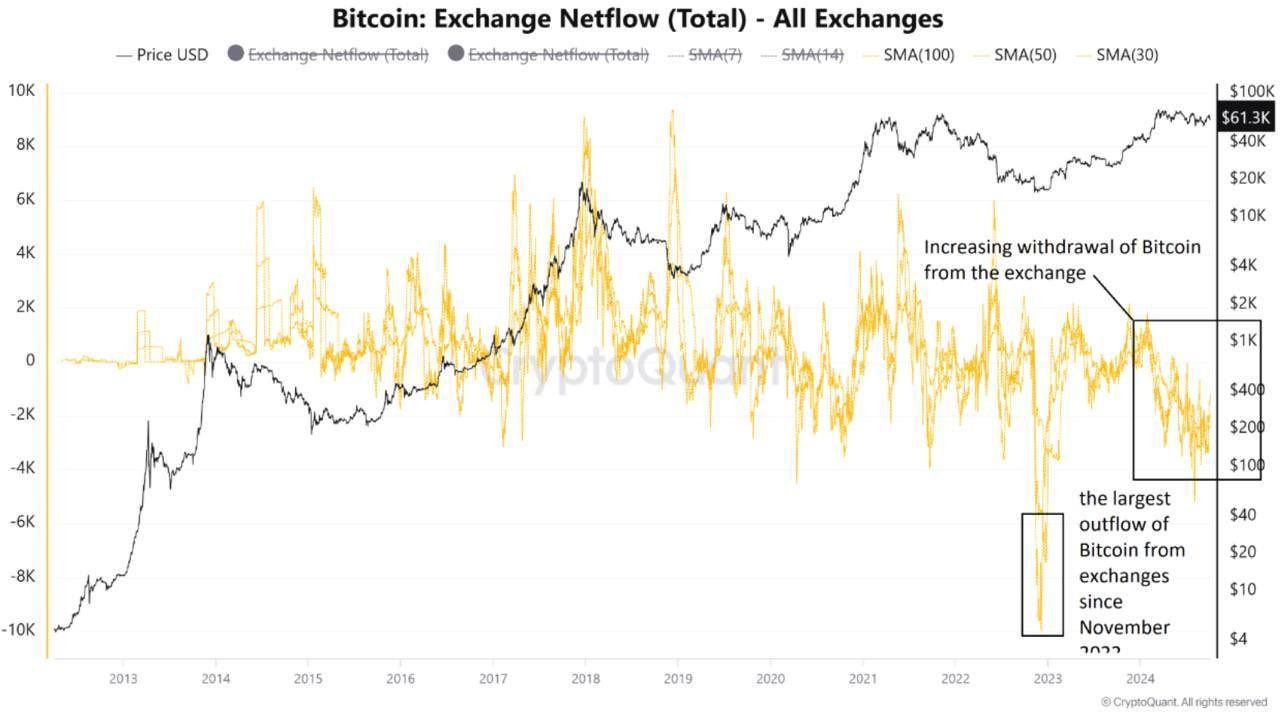

Bitcoiners seem to be preparing for bitcoin to become a lot more valuable too. Crypto commentator Marty Party pointed out yesterday that crypto exchanges are seeing the largest withdrawals of bitcoin since the big crash in November 2022.

So to recap — national debt is growing to the moon, the Fed is cutting interest rates, bitcoiners are withdrawing their coins into self-custody, and Republicans and Democrats are finding common ground with a decentralized, finite supply asset.

Seems bullish to me. Let’s see what the rest of the year has in store for us.

Hope you all have a great weekend. I’ll talk to everyone on Monday.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 Talk or Hang Out With Anthony Pompliano 🚨

I want to meet you.

In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

Buy 25 Books: We will have a 30 minute video call to discuss anything you want.

Buy 100+ Books: I will speak virtually at your event or company meeting.

Buy 500+ Books: I will speak in-person at your event or come to your office.

Buy 1000+ Books: You get to spend an entire day with me in-person, including breakfast, lunch, and dinner. I will also speak at your event or to your team.

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books.

Here is how it works:

You reply to this email with the receipt or screenshot.

I will send you potential days/times for the call, meeting, or visit.

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well.

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss why Jerome Powell can’t stop cutting interest rates, all-time high number of US citizens dependent on government aid, using bitcoin to pay your taxes, and what will happen when cheap capital floods the market.

Listen on iTunes: Click here

Listen on Spotify: Click here

The Fed Is Easing & Asset Prices Are Starting To Increase

Podcast Sponsors

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Domain Money makes financial planning straightforward and accessible.They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

CrossFi isthe Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

1While I am not a financial advisor and can’t give financial advice, Domain Money has board-certified CPAs who can give you financial advice and keep you on track to reach your goals.

As always, doing your own research before purchasing any product/service is important. View this important disclaimer so you know exactly what to expect.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.