|

| ||

| Feb 7 | |

| Bitcoin Fundamentals Keep Getting Stronger | |

| A breakdown of bitcoin's fundamentals. | |

| |

| Anthony Pompliano | ||||||||

To investors,

Bitcoin is off to a hot start in 2023. The digital currency has increased in price by 38% since January 1st and it continues to lead most risk assets in this latest price rally. As I wrote about last week, most of this appreciation is likely due to the increased liquidity entering the global financial system via expansion of the top 10 central bank balance sheets over the last ~ 60 days.

There are other factors at play as well. Some of the interest in bitcoin is probably coming from investors seeking potential safety from the low likelihood of a US default amid the debt limit crisis. A strong argument could also be made that many investors are trying to front run the Fed’s eventual monetary policy pivot, so they are continuing to deploy capital into risk assets they deem most likely to benefit from a return to loose monetary policy.

The beauty and challenge of financial markets is their complexity. A nearly 40% increase in bitcoin’s price over 35 days is not likely to have a single contributing factor, but rather a multitude of reasons for renewed investor interest. Although this interest is encouraging for the bitcoin community, it is important to call out that bitcoin is still down nearly 50% over the last 12 months and approximately 65% from the all-time high of $69,000 in Q4 2021.

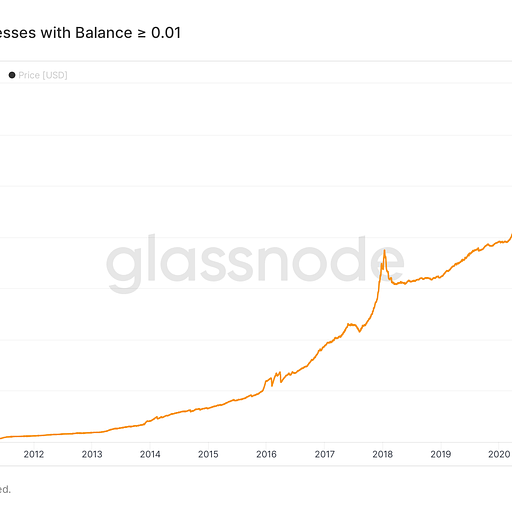

All this volatility begs the question — “what is happening with the fundamentals of bitcoin?”

As many of you know, and as we have discussed at length over the years, bitcoin doesn’t have traditional fundamentals like cash flow, etc. It is a decentralized network that is not owned by any one person or group, so the fundamental data points will be slightly different. That isn’t a black eye on the asset. I see this as a first principles way of evaluating the health of the asset and network.

There are three data points that I immediately check whenever I am evaluating the fundamentals of bitcoin…...

Subscribe to The Pomp Letter to read the rest.

Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content.

A subscription gets you:

| Five subscriber-only letters per week and full archive | |

| Subscriber-only episodes in your podcast app | |

| Post comments and join the community |