To investors,

The global financial markets are obsessively watching what the Federal Reserve is going to do with interest rates in the coming months. Based on the most recent FOMC meeting, Fed Chairman Jerome Powell has signaled that the Fed is likely to hike interest rates approximately three times in 2022.

I don’t want to spend our time together this morning debating whether the Fed will actually raise interest rates or not, but rather I want to talk through what is likely to happen if interest rates are increased. The general consensus is that high growth stocks, risk assets, and other recent big performers would sell off when that occurs. As any student of history knows, we have seen this story play out before.

History doesn’t always repeat. It sure does rhyme though. Keith Rabois’ expectations are shared by a large portion of the investing community, particularly those who understand interest rates and their relationship to risk assets.

So if we are operating under the assumption that risk assets will sell off when the Fed raises interest rates, we should expect bitcoin to suffer the same fate, right? Well….no one knows yet.

The prevailing consensus view has been that bitcoin is a risk asset. It has an inverse relationship with interest rates. When central banks and politicians manipulate interest rates lower, and pump trillions of dollars into the market, bitcoin should go higher.

Over the last 18-24 months, we saw interest rates moved lower and trillions of dollars injected into the economy, along with bitcoin’s price going up hundreds of percent. But what if bitcoin’s price increasing has less to do with interest rates and QE? What if bitcoin’s price increasing was more related to the bitcoin halving in May 2020?

Hear me out for a second.

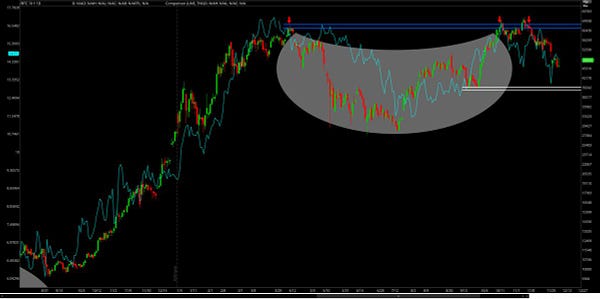

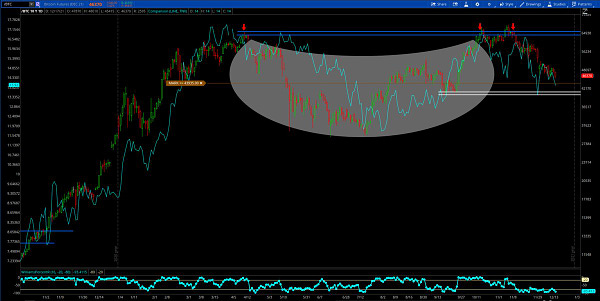

The inverse correlation between tech stocks and treasury yields has been playing out exactly how you would expect. Yields go up and risk assets sell off. Yields go down and risk assets go up.

This inverse relationship is not what we are seeing between bitcoin and Treasury yields though. We are actually seeing the exact opposite. Bitcoin’s price appears to be moving in lockstep with Treasury yields.

So if this short-term trend continues to play out, what would that mean for bitcoin? Again, no one knows for sure. But it would be very interesting if the prevailing consensus view is misplaced and bitcoin would actually benefit from increasing interest rates. That would violate the framework that many people have been viewing the digital currency through.

Caleb Franzen elaborates here:

So why could this idea of bitcoin and yields increasing together potentially be true? Well…one idea is that some people actually deem bitcoin to be their reserve currency. They view cheap capital via low rates as a path to borrowing money and making investments that could earn them more bitcoin. If rates were to rise, risk assets would sell off and these people would go back into their safe haven asset — bitcoin.

This may sound insane to the legacy Wall Street crowd, but there is an increasing number of young people who see the digital currency as that safe haven asset in their portfolio. The entire point of investing in anything outside of bitcoin is to outperform bitcoin and eventually convert back into bitcoin. Obviously, if you’re a good investor than you can pick up more bitcoin. If you’re a bad investor, you end up with less bitcoin. This is the new risk-reward that many young people are evaluating.

Ultimately, none of us know what the Fed is going to do in 2022. We also don’t know how every single asset will react. If we see bitcoin moving in lockstep with interest rates though, my guess is that an entirely new crop of investors are going to start paying attention. Who doesn’t want an asset that moves with interest rates, yet produces a materially higher compound annual growth rate?

Keep your eyes on the relationship between risk assets, bitcoin, and Treasury yields. We are likely to learn a lot over the next 12 months. It will be worth learning, regardless of what occurs. Hope each of you has a great day. I’ll talk to everyone tomorrow.

-Pomp

SPONSORED: This year has seen unbelievable growth of this community and I wanted to pass on a small thank you to all my old and new subscribers alike.

To get your free unique code for a $40 credit at unstoppabledomains.com simply fill in this form.

Unstoppable Domains are the #1 provider of NFT domains, These domains make sending and receiving crypto easy, can be used as your username on Twitter and better yet they don't have any renewal or gas fees.

Don’t forget to fill in this form to get your unique $40 USD voucher.

Thanks,

Pomp.bitcoin

Please see full terms and conditions here

Scot Wingo is the Co-Founder & CEO of Spiffy, an on-demand car cleaning and car servicing app.

In this conversation, we discuss inflation, entrepreneurship, crypto, Web3 and NFTs.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Mode allows you to buy, earn and grow Bitcoin, all in one app. Not only is it an easy and safe way to buy and hold Bitcoin, Mode allows you to pay and receive up to 10% Bitcoin Cashback for FREE from its growing list of online partner brands. Download Mode today and enjoy 0% trading fees on all Bitcoin buys and sells until Dec 31, 2021. Only available in the UK.

Cryptocurrency is the future, so don’t get left in the past, bet with MyBookie and you can get in the game now! The best part is, MyBookie accepts well-known cryptocurrencies like Bitcoin and Ethereum so you can bet and withdraw with Crypto. To get you kickstarted with crypto, use my promo code (POMP) to double your first crypto deposit up to at MyBookie.

Coin Cloud has been serving customers since 2014 and has established itself as the world's leading digital currency machine (DCM) operator. More than just a Bitcoin ATM, Coin Cloud machines make it easy to buy and sell Bitcoin and 30+ other digital assets with cash. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Compass was founded with the goal of making it easy for everyone to mine bitcoin. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in bitcoin and 19 other digital assets inside your IRA. Choice enables you to trade real bitcoin, other crypto, and stocks without having to pay a dime in capital gains. Join me and the 20,000 other bitcoiners who have started their tax-efficient stack, and open your Choice Account today. Search ‘stack sats’ in the app store or visit www.choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy, sell, store, and earn bitcoin, ether, and over 40 other cryptocurrencies. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

CityCoins are programmable tokens that allow citizens to become stakeholders in their favourite cities. MiamiCoin was the first CityCoin launched and within it’s first two months it has already raised over $10 million USD in donations for the City of Miami. Join the CityCoins Discord to become part of the community, and help us build towards a crypto civilization.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user-friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp” when you sign up for one of their metal cards today.

Circle Yield offers qualified businesses superior returns on USDC holdings for terms of up to 12 months. Managed by professional financial institutions, Circle Yield is the best way to earn returns on your USDC. Visit circle.com/pomp today; terms apply.

Nasdaq-listed BTCS was the first US-public company to secure today’s top layer one protocols. Recently, BTCS launched the beta version of its digital asset analytics dashboard! From across multiple exchanges, the BTCS Data Analytics Dashboard lets you evaluate your entire portfolio’s performance with plans to add year-end reports and yield earning on your crypto through linking to staking pools. Test out the BTCS Data Analytics Dashboard today at BTCS.com

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services - offering clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Ethernity.io is the world’s first authenticated and licensed NFT platform, trusted by over 150,000 members. Visit Ethernity.io, where you can buy and sell authenticated NFTs from top notable figures, rights, license, and IP holders you can’t find anywhere else; the start of an entire ecosystem bringing utility to #NFTs.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.