|

|

To investors,

Satoshi Nakamoto published the bitcoin whitepaper on October 31, 2008. The paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” In the abstract, Nakamoto writes this as his first sentence:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

The promise of bitcoin has been that it will replace fiat currencies for store-of-value AND medium-of-exchange. It is obvious that hundreds of millions of people are using bitcoin as a store-of-value, but the medium-of-exchange vision is becoming harder to see with each passing day.

On the store-of-value front, bitcoin is a trillion dollar asset that has approximately 80% of the circulating supply which has not moved in the last 6 months. If you expand the timeline out to 1 year, the percentage of coins being held for the long-term is approximately 70%.

Why would you sell an asset that is likely to appreciate in price in the future? You wouldn’t. This is the same reason that people hold real estate or gold. The assets appreciate as the dollar, which the asset is priced in, gets devalued.

In order for any asset to become electronic cash (translation: medium-of-exchange), it must first become a store-of-value. So bitcoin has checked that box.

The next step is to get users of bitcoin to transact with it to purchase goods and services. This happens in certain situations, but it has not become the dominant use case for bitcoin. In fact, other digital assets have become the de-facto asset for peer-to-peer transactions.

Let me explain.

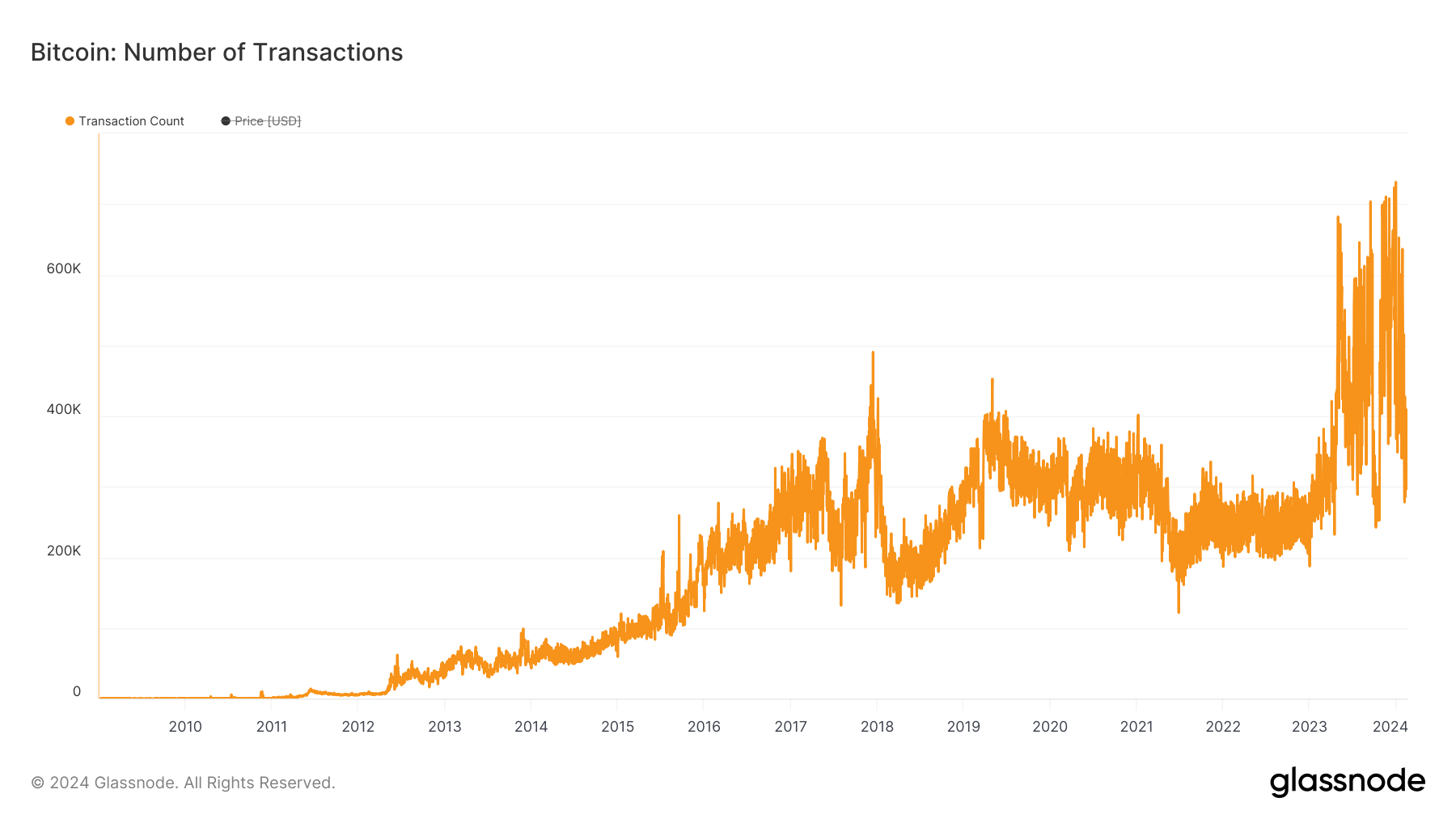

It is true that the total number of transactions on bitcoin’s layer one blockchain have continued to increase over time. Today the number hovers per day between 300,000 transactions and 600,000 transactions.

This means that the transaction rate — the number of transactions per second — has also been increasing at a similar pace.

To put these numbers in context, Visa does 750+ million transactions per day and 8,750 transactions per second. Paypal does ~ 74 million transactions per day and 850 transactions per second. The Paypal comparison is probably better because it was founded within 10 years of bitcoin’s launch (1999) and has about the same number of users as bitcoin (less than 500 million people globally), yet Paypal’s transaction volume is almost 150x higher on a daily basis.

Bitcoin’s challenge was historically thought to be the slow and expensive experience to send transactions. Enter the Lightning Network. This peer-to-peer layer two allows people to send transactions directly between each other without waiting for the layer one.

But this technical improvement has not yielded the transaction volume explosion that many predicted. It is not that the technology can’t handle the transaction volume (it can handle millions of transactions per second), but rather the consumer preference is to transact using a different asset.

I have long told people not to spend their bitcoin. Many people have given me a hard time about this over the years. We don’t accept bitcoin for almost any of the products and services that we have built over the years. I don’t want people to spend a currency that is going to appreciate in the future. It makes no sense to spend bitcoin for goods and services if you can avoid it.

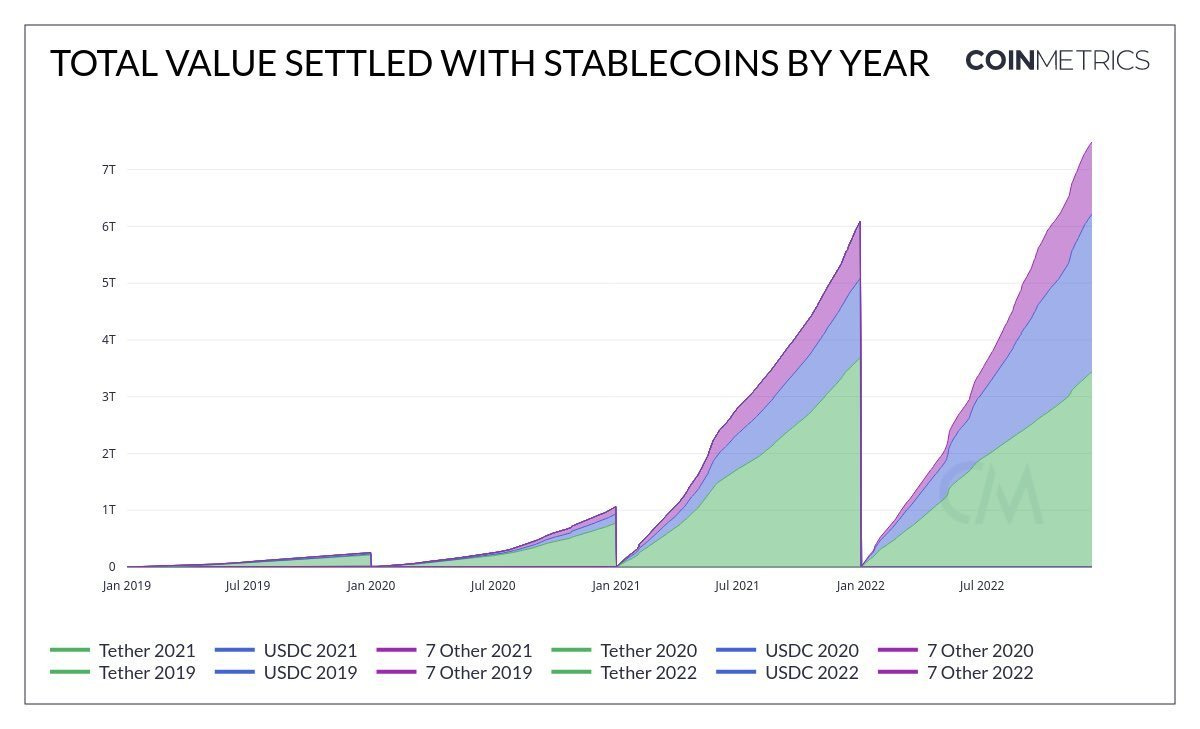

The majority of bitcoiners appear to agree. Not only are they holding their bitcoin and driving the circulating supply highly illiquid, but stablecoins have become the asset of choice for people in the crypto community. You can see the increasing usage every year from launch through 2022 (note: the trend continues into 2024 but I was having difficulty creating the right chart to show it):

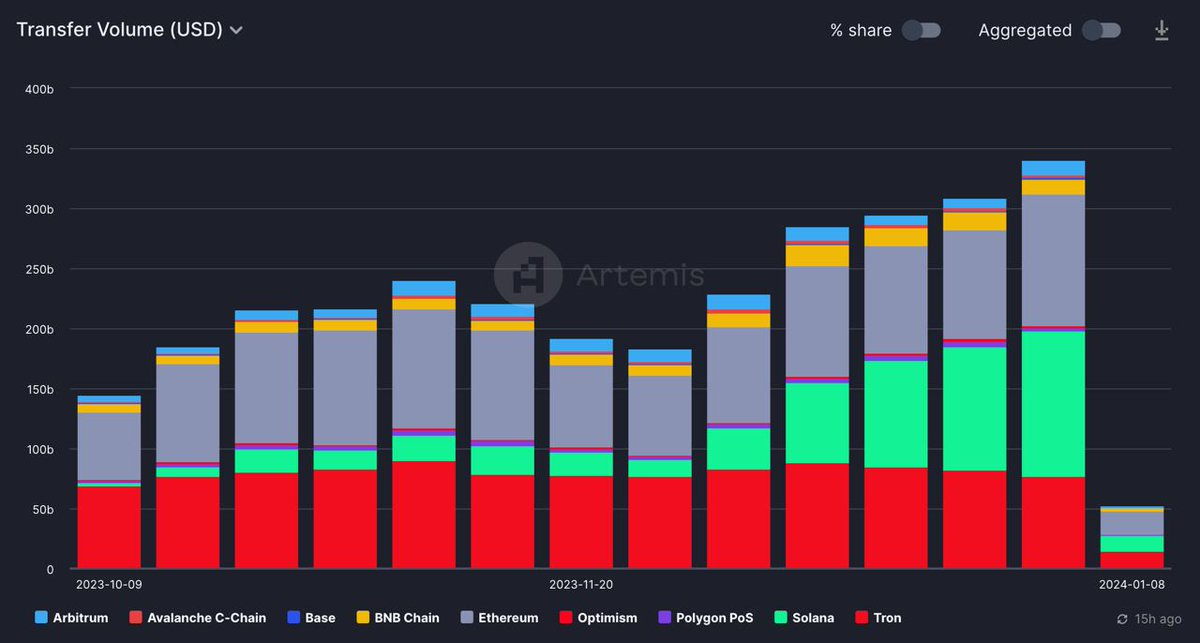

Stablecoins are doing more than $300 billion in weekly transaction volume, which puts it on a more than $15 trillion annual transaction run-rate.

Why is this number important? Because Visa does $15 trillion in annual transaction volume. So while everyone was expecting bitcoin to become the electronic peer-to-peer cash, stablecoins were able to seize that opportunity so far.

Now you may wonder if this is just a first-world development. Maybe people in the developing world prefer bitcoin over stablecoins? Former NFL star and successful entrepreneur/investor Russell Okung tweeted over the weekend:

“Used to advocate weekly for merchants to accept Bitcoin as payment and utilize the Lightning Network, now I find myself questioning whether the Lightning Network is truly the only solution…During my time in Africa, while advocating for the Lightning Network, I faced a cold, hard realization. Despite my efforts, I found that more people were interested in dealing with USDT rather than Bitcoin. They desired USD, even if they were synthetic versions.”

Castle Island’s Nic Carter followed this commentary up with what he calls the Orange Man’s Burden:

“The mistaken belief that the global south requires bitcoin, despite their clear revealed preference for stablecoins, and privileged westerners must impose it on them == Orange Man's Burden”

Stablecoins are the winners in the peer-to-peer electronic cash competition. This does not mean that the situation will stay this way. While unlikely, bitcoin could catch up and surpass stablecoins in the future. But right now, the global market is suggesting that bitcoin is a great store-of-value in the world and stablecoins are the more popular medium-of-exchange.

This nuance is important to understand because only independent thinkers will be able to change their mind when presented with these new facts. Don’t fall into the rigidity of the bitcoin religion imposed by the loudest hardcore maximalist. Although their intentions are commendable in an effort to bring bitcoin to the world, it spells disaster when they ignore the realities of the market.

Bitcoin doesn’t need to become the most popular medium-of-exchange asset in order to drive more economic value in the future. Bitcoin is likely 10x better than gold in terms of portability, divisibility, transparency, predictability, security, etc. This should lead to at least a 2x higher market cap over a few decades, so being the digital gold would still have about 20x more upside available to bitcoin holders if that outcome comes to fruition.

Economic actors do not spend a currency that will appreciate hundreds or thousands of percent in the future. The limitations for bitcoin as a medium-of-exchange are not technical, but rather a game theory that highlights bitcoin’s future success in price could be it’s worst enemy as a spendable currency.

I’m not selling my bitcoin, but I am also not spending it. Spending bitcoin is a form of selling. So if the hardcore maximalists truly believe bitcoiners don’t sell bitcoin, we should ask why they are selling their bitcoin for goods and services? :)

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Darius Dale is the Founder & CEO of 42Macro.

In this conversation, we talk about global liquidity, quantitative risk management model, bitcoin, other assets, and macro environment conditions.

Listen on iTunes: Click here

Listen on Spotify: Click here

Will Global Liquidity Push Bitcoin To All-Time Highs?

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.